Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain your reasoning for finding the solution! Zooming in helps to see the information! Thanks in advance! :) On April 1, 2020, Republic Company

Please explain your reasoning for finding the solution! Zooming in helps to see the information! Thanks in advance! :)

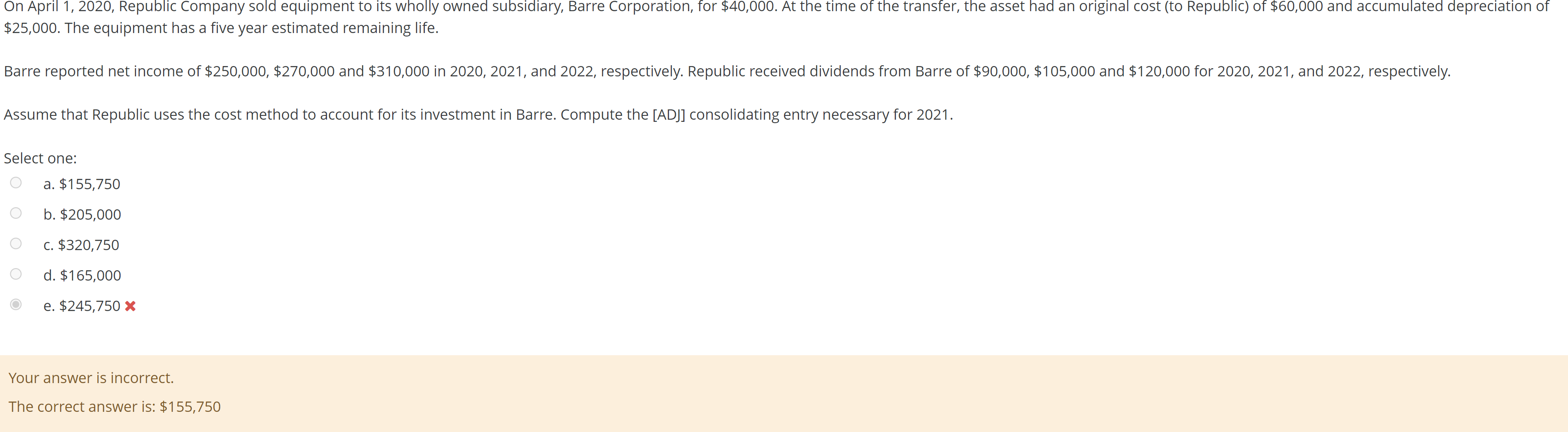

On April 1, 2020, Republic Company sold equipment to its wholly owned subsidiary, Barre corporation, for $40,000. At the time of the transter, the asset had an original cost (to Republic) of $60,000 and accumulated depreciation of $25,000. The equipment has a five year estimated remaining life. Barre reported net income of $250,000,$270,000 and $310,000 in 2020, 2021, and 2022, respectively. Republic received dividends from Barre of $90,000,$105,000 and $120,000 for 2020, 2021, and 2022, respectively. Assume that Republic uses the cost method to account for its investment in Barre. Compute the [ADJ] consolidating entry necessary for 2021. Select one: a. $155,750 b. $205,000 c. $320,750 d. $165,000 e. $245,750X Your answer is incorrect. The correct answer is: $155,750 On April 1, 2020, Republic Company sold equipment to its wholly owned subsidiary, Barre corporation, for $40,000. At the time of the transter, the asset had an original cost (to Republic) of $60,000 and accumulated depreciation of $25,000. The equipment has a five year estimated remaining life. Barre reported net income of $250,000,$270,000 and $310,000 in 2020, 2021, and 2022, respectively. Republic received dividends from Barre of $90,000,$105,000 and $120,000 for 2020, 2021, and 2022, respectively. Assume that Republic uses the cost method to account for its investment in Barre. Compute the [ADJ] consolidating entry necessary for 2021. Select one: a. $155,750 b. $205,000 c. $320,750 d. $165,000 e. $245,750X Your answer is incorrect. The correct answer is: $155,750

On April 1, 2020, Republic Company sold equipment to its wholly owned subsidiary, Barre corporation, for $40,000. At the time of the transter, the asset had an original cost (to Republic) of $60,000 and accumulated depreciation of $25,000. The equipment has a five year estimated remaining life. Barre reported net income of $250,000,$270,000 and $310,000 in 2020, 2021, and 2022, respectively. Republic received dividends from Barre of $90,000,$105,000 and $120,000 for 2020, 2021, and 2022, respectively. Assume that Republic uses the cost method to account for its investment in Barre. Compute the [ADJ] consolidating entry necessary for 2021. Select one: a. $155,750 b. $205,000 c. $320,750 d. $165,000 e. $245,750X Your answer is incorrect. The correct answer is: $155,750 On April 1, 2020, Republic Company sold equipment to its wholly owned subsidiary, Barre corporation, for $40,000. At the time of the transter, the asset had an original cost (to Republic) of $60,000 and accumulated depreciation of $25,000. The equipment has a five year estimated remaining life. Barre reported net income of $250,000,$270,000 and $310,000 in 2020, 2021, and 2022, respectively. Republic received dividends from Barre of $90,000,$105,000 and $120,000 for 2020, 2021, and 2022, respectively. Assume that Republic uses the cost method to account for its investment in Barre. Compute the [ADJ] consolidating entry necessary for 2021. Select one: a. $155,750 b. $205,000 c. $320,750 d. $165,000 e. $245,750X Your answer is incorrect. The correct answer is: $155,750 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started