please expline your answer

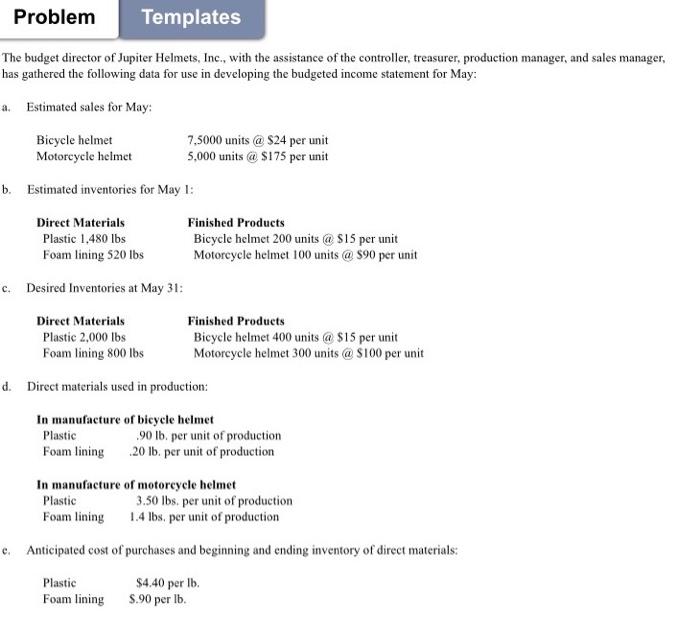

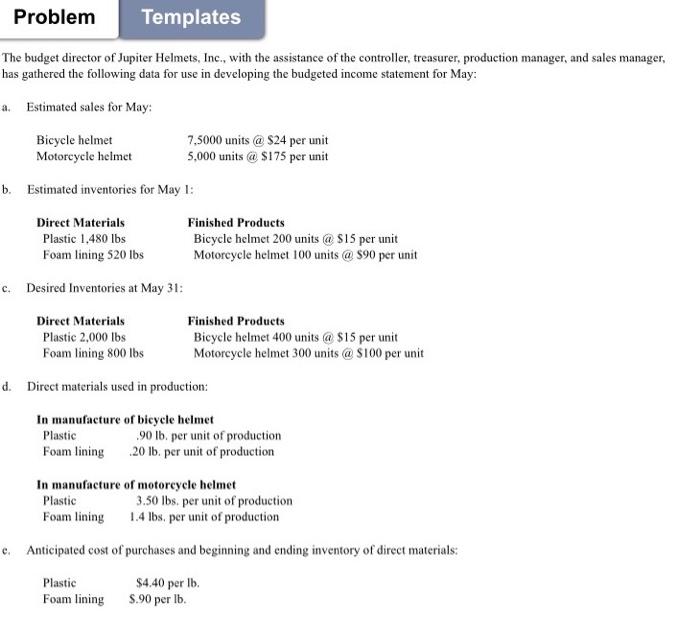

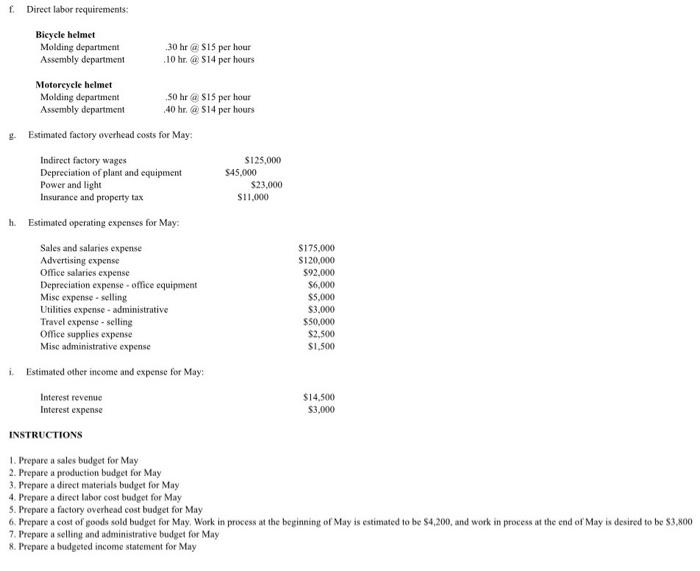

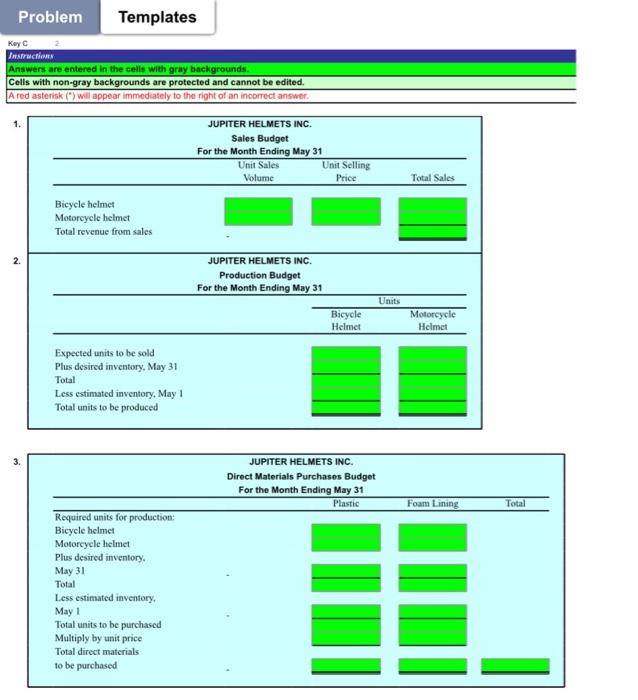

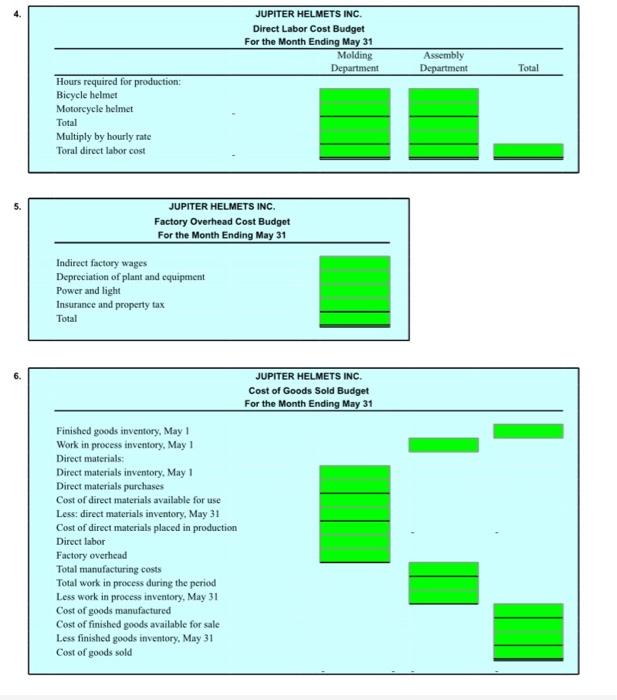

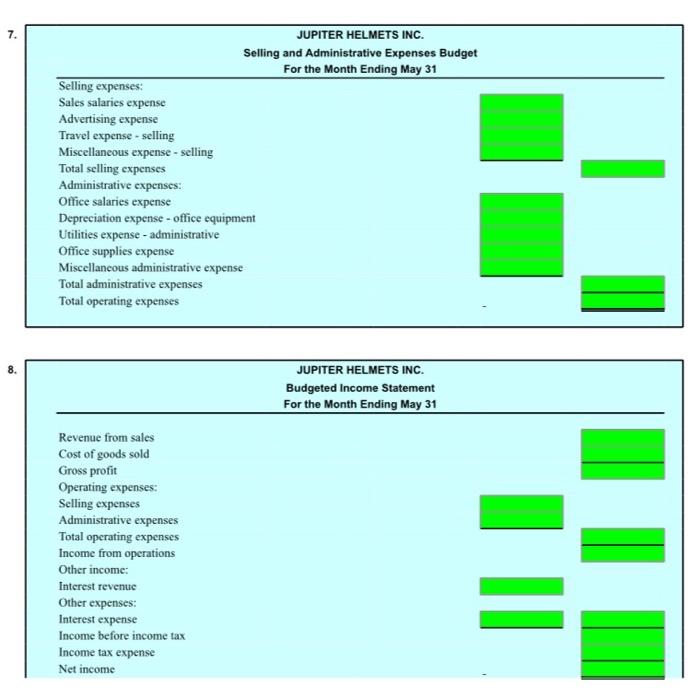

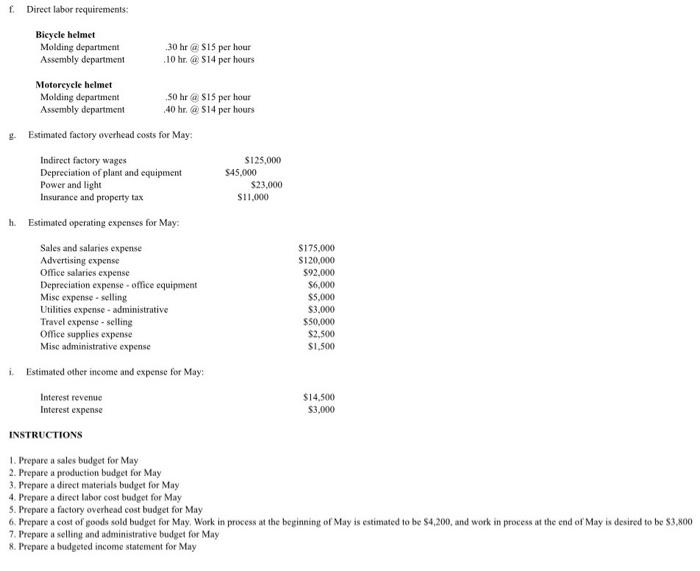

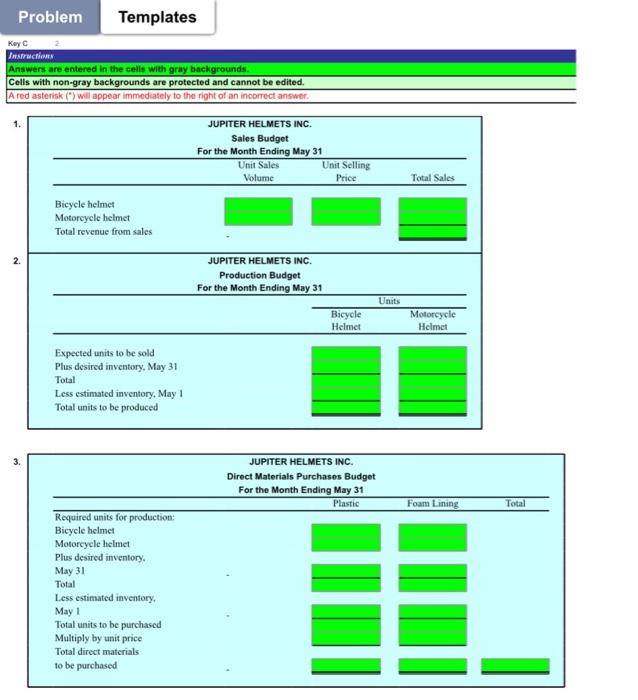

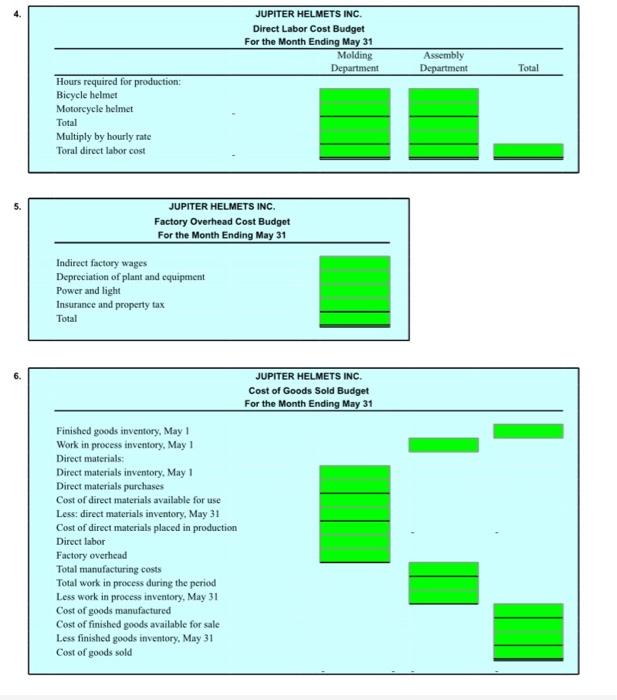

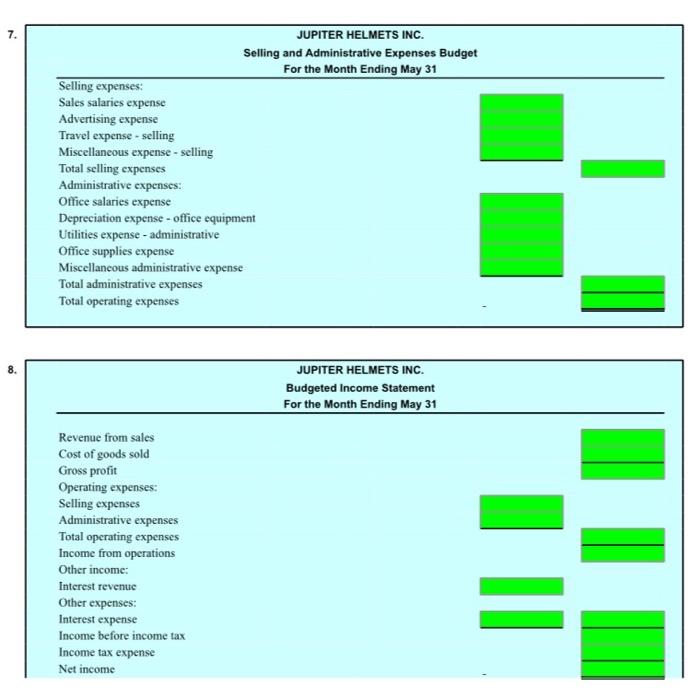

Problem Templates The budget director of Jupiter Helmets, Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for May: a. Estimated sales for May: Bicycle helmet 7,5000 units a $24 per unit Motorcycle helmet 5,000 units @ $175 per unit b. Estimated inventories for May 1: Direct Materials Plastic 1,480 lbs Foam lining 520 lbs Finished Products Bicycle helmet 200 units @ S15 per unit Motorcycle helmet 100 units @ $90 per unit c. Desired Inventories at May 31: Direct Materials Finished Products Plastic 2,000 lbs Bicycle helmet 400 units @ $15 per unit Foam lining 800 lbs Motorcycle helmet 300 units @ $100 per unit d. Direct materials used in production: In manufacture of bicycle helmet Plastic 90 lb, per unit of production Foam lining 20 lb. per unit of production In manufacture of motorcycle helmet Plastic 3.50 lbs, per unit of production Foam lining 1.4 lbs, per unit of production c. Anticipated cost of purchases and beginning and ending inventory of direct materials: $4.40 per lb. Foam lining S.90 per lb. Plastic f Direct labor requirements: Bicycle helmet Molding department .30 hr 15 per hour Assembly department 10 hr. 814 per hours Motoreycle helmet Molding department 50 hr @ S15 per hour Assembly department 40 hr @ 514 per hours Estimated factory overhead costs for May Indirect factory wages S125,000 Depreciation of plant and equipment 545,000 Power and light $23.000 Insurance and property tax $11,000 h Estimated operating expenses for May: Sales and salaries expense Advertising expense Office salaries expense Depreciation expense - office equipment Mise expense selling Utilities expense - administrative Travel expense-selling Office supplies expense Misc administrative expense $175.000 $120,000 $92.000 $6,000 $5,000 $3,000 $50,000 $2,500 $1,500 i Estimated other income and expense for May: Interest revenue $14,500 Interest expense $3,000 INSTRUCTIONS Prepare a sales budget for May 2. Prepare a production budget for May 3. Prepare a direct materials budget for May 4. Prepare a direct labor cost budget for May 5. Prepare a factory overhead cost budget for May 6. Prepare a cost of goods sold budget for May. Work in process at the beginning of May is estimated to be 54,200, and work in process at the end of May is desired to be $3,800 7. Prepare a selling and administrative budget for May 8. Prepare a budgeted income statement for May Problem Templates Keyc Instructions Answers are entered in the cells with gray backgrounds Cells with non-gray backgrounds are protected and cannot be edited. A red asterisk (*) will appear immediately to the right of an incorrect answer JUPITER HELMETS INC. Sales Budget For the Month Ending May 31 Unit Sales Unit Selling Volume Price Total Sales Bicycle helmet Motorcycle helmet Total revenue from sales 2 JUPITER HELMETS INC. Production Budget For the Month Ending May 31 Bicycle Helmet Units Motorcycle Helmet Expected units to be sold Plus desired inventory, May 31 Total Less estimated inventory, May 1 Total units to be produced JUPITER HELMETS INC. Direct Materials Purchases Budget For the Month Ending May 31 Plastic Foam Lining Total Required units for production: Bicycle helmet Motorcycle helmet Plus desired inventory May 31 Total Less estimated inventory May 1 Total units to be purchased Multiply by unit price Total direct materials to be purchased JUPITER HELMETS INC. Direct Labor Cost Budget For the Month Ending May 31 Molding Department Assembly Department Total Hours required for production: Bicycle helmet Motorcycle helmet Total Multiply by hourly rate Toral direct labor cost JUPITER HELMETS INC. Factory Overhead Cost Budget For the Month Ending May 31 Indirect factory wages Depreciation of plant and equipment Power and light Insurance and property tax Total JUPITER HELMETS INC. Cost of Goods Sold Budget For the Month Ending May 31 Finished goods inventory, May 1 Work in process inventory, May 1 Direct materials: Direct materials inventory, May 1 Direct materials purchases Cost of direct materials available for use Less: direct materials inventory, May 31 Cost of direct materials placed in production Direct labor Factory overhead Total manufacturing costs Total work in process during the period Less work in process inventory, May 31 Cost of goods manufactured Cost of finished goods available for sale Less finished goods inventory, May 31 Cost of goods sold JUPITER HELMETS INC. Selling and Administrative Expenses Budget For the Month Ending May 31 Selling expenses: Sales salaries expense Advertising expense Travel expense - selling Miscellaneous expense - selling Total selling expenses Administrative expenses: Office salaries expense Depreciation expense - office equipment Utilities expense - administrative Office supplies expense Miscellaneous administrative expense Total administrative expenses Total operating expenses 8. JUPITER HELMETS INC. Budgeted Income Statement For the Month Ending May 31 Revenue from sales Cost of goods sold Gross profit Operating expenses: Selling expenses Administrative expenses Total operating expenses Income from operations Other income: Interest revenue Other expenses: Interest expense Income before income tax Income tax expense Net income