Answered step by step

Verified Expert Solution

Question

1 Approved Answer

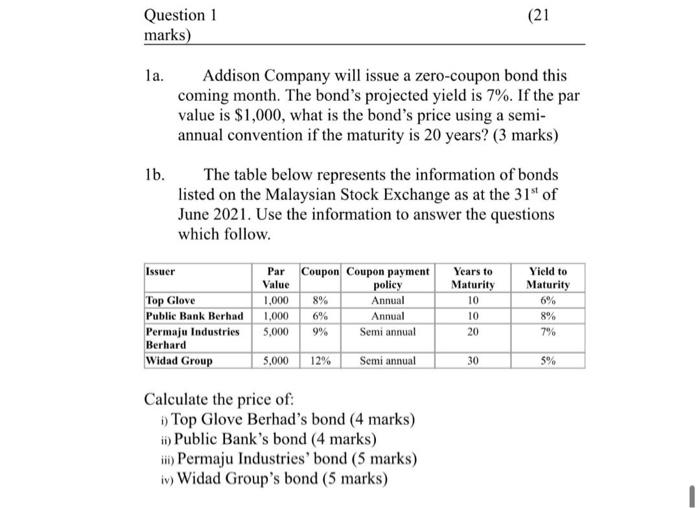

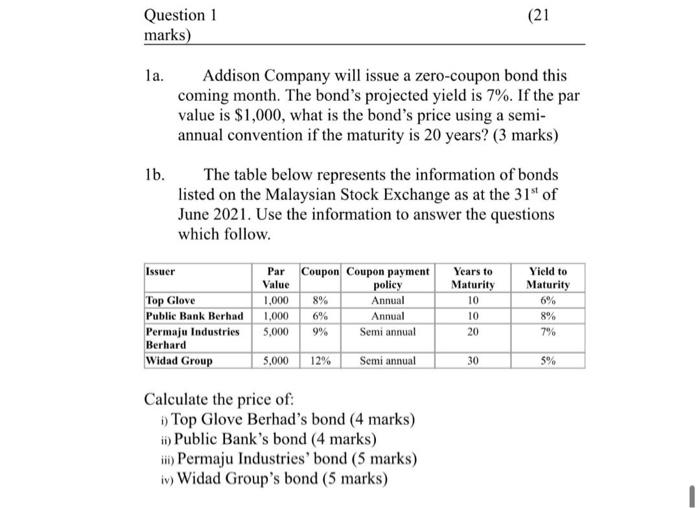

please fast Question 1 marks) la. 1b. Addison Company will issue a zero-coupon bond this coming month. The bond's projected yield is 7%. If the

please fast

Question 1 marks) la. 1b. Addison Company will issue a zero-coupon bond this coming month. The bond's projected yield is 7%. If the par value is $1,000, what is the bond's price using a semi- annual convention if the maturity is 20 years? (3 marks) The table below represents the information of bonds listed on the Malaysian Stock Exchange as at the 31st of June 2021. Use the information to answer the questions which follow. Issuer Top Glove Public Bank Berhad Permaju Industries Berhard Widad Group Par Coupon Coupon payment Value 1,000 8% 1,000 5,000 9% policy Annual Annual Semi annual 5,000 12% Semi annual Calculate the price of: i) Top Glove Berhad's bond (4 marks) ii) Public Bank's bond (4 marks) iii) Permaju Industries' bond (5 marks) iv) Widad Group's bond (5 marks) Years to Maturity 10 (21 10 20 30 Yield to Maturity 6% 8% 7% 5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started