please fast

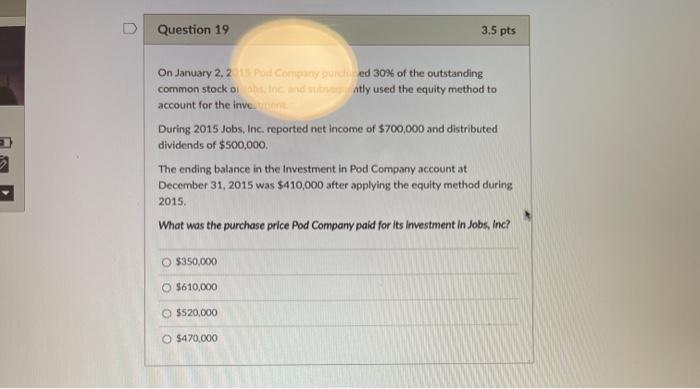

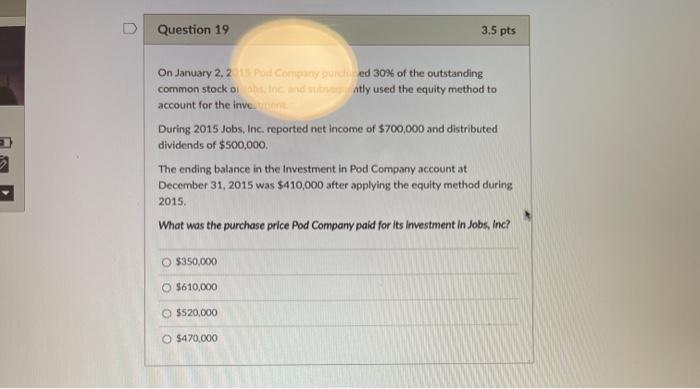

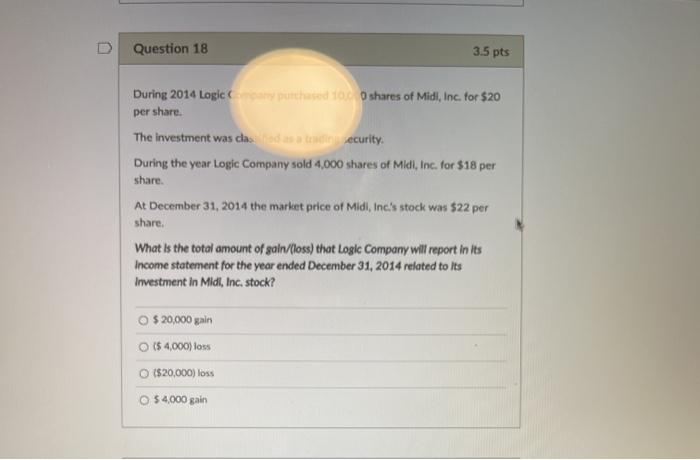

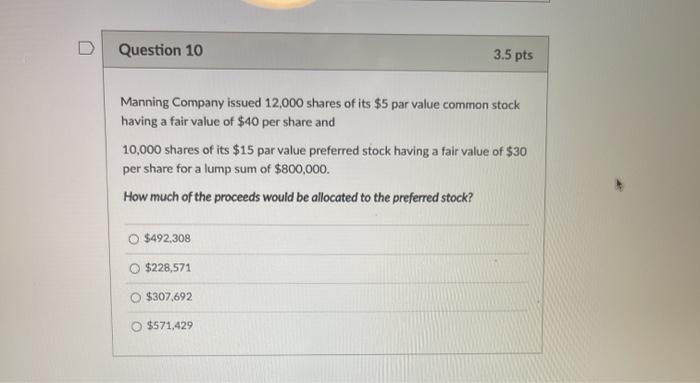

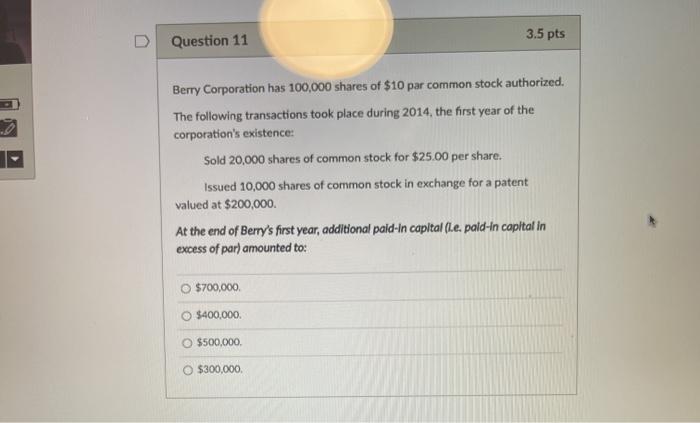

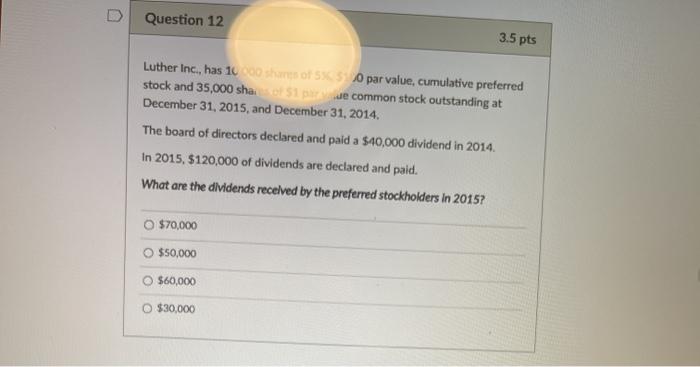

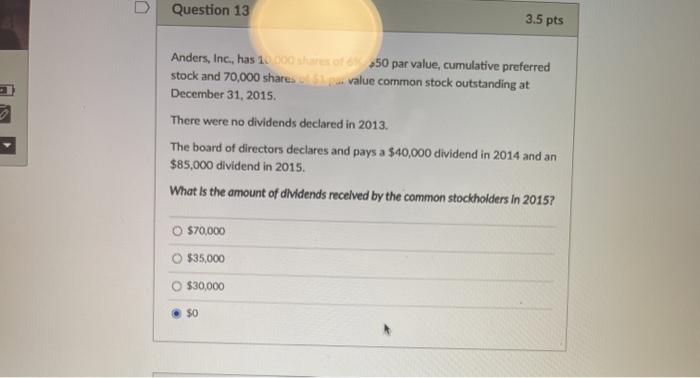

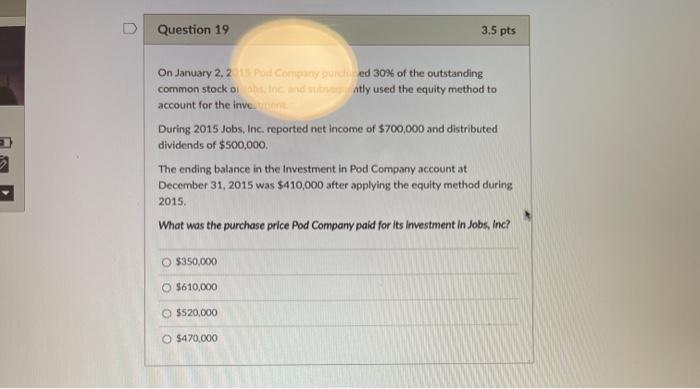

Question 19 3.5 pts On January 2.2 Pod Commergulded 30% of the outstanding common stock och intendently used the equity method to account for the inve During 2015 Jobs, Inc. reported net income of $700,000 and distributed dividends of $500,000 The ending balance in the investment in Pod Company account at December 31, 2015 was $410,000 after applying the equity method during 2015 What was the purchase price Pod Company paid for its investment In Jobs, Inc? O $350,000 O $610,000 $520,000 O $470.000 Question 18 3.5 pts During 2014 Logic purchased to shares of Midi, Inc. for $20 per share. The investment was cladecurity. During the year Logic Company sold 4,000 shares of Midi, Inc. for $18 per share. At December 31, 2014 the market price of Midi, Ine's stock was $22 per share. What is the total amount of gain/floss) that Logic Company will report in its Income statement for the year ended December 31, 2014 related to its Investment in Midl, Inc. stock? $ 20.000 gain ($ 4,000) foss ($20,000) loss O $ 4.000 gain Question 10 3.5 pts Manning Company issued 12,000 shares of its $5 par value common stock having a fair value of $40 per share and 10,000 shares of its $15 par value preferred stock having a fair value of $30 per share for a lump sum of $800,000. How much of the proceeds would be allocated to the preferred stock? $492,308 $228,571 O $307,692 $571,429 Question 11 3.5 pts Berry Corporation has 100,000 shares of $10 par common stock authorized. The following transactions took place during 2014, the first year of the corporation's existence: Sold 20,000 shares of common stock for $25.00 per share. Issued 10,000 shares of common stock in exchange for a patent valued at $200,000 At the end of Berry's first year, additional pald-In capital (Le pald-in capital in excess of par) amounted to: $700,000 $400,000 $500,000 $300,000 Question 12 3.5 pts Luther Inc., has 10h55 par value, cumulative preferred stock and 35,000 share common stock outstanding at December 31, 2015, and December 31, 2014 The board of directors declared and paid a $40,000 dividend in 2014. In 2015, $120,000 of dividends are declared and paid. What are the dividends received by the preferred stockholders in 2015? O $70,000 $50,000 $60,000 O $30,000 Question 13 3.5 pts Anders, Inc., has 10.00 of 50 par value, cumulative preferred stock and 70,000 shares a value common stock outstanding at December 31, 2015 There were no dividends declared in 2013. The board of directors declares and pays a $40,000 dividend in 2014 and an $85,000 dividend in 2015. What is the amount of dividends receved by the common stockholders in 2015? O $70,000 $35,000 $30,000 $0