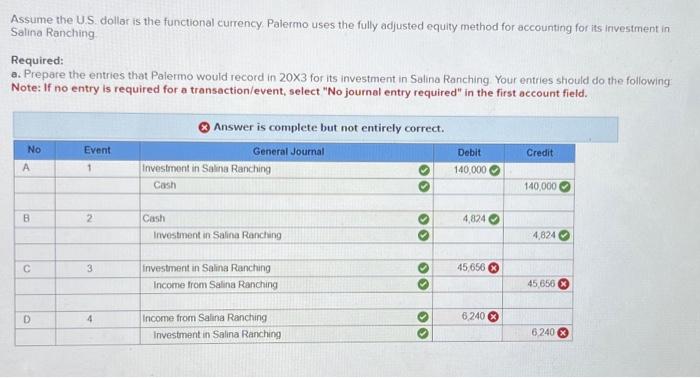

please figure out why i keep getting this wrong thank you

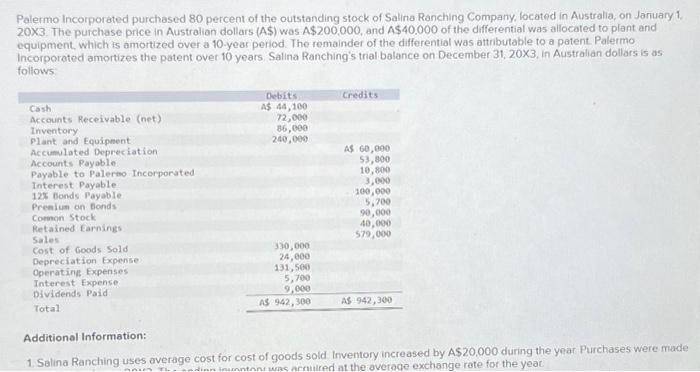

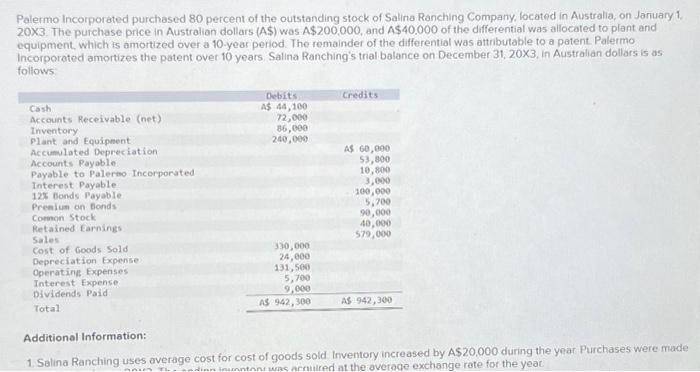

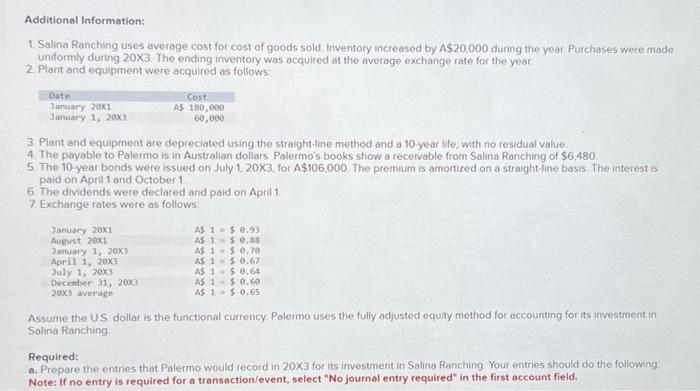

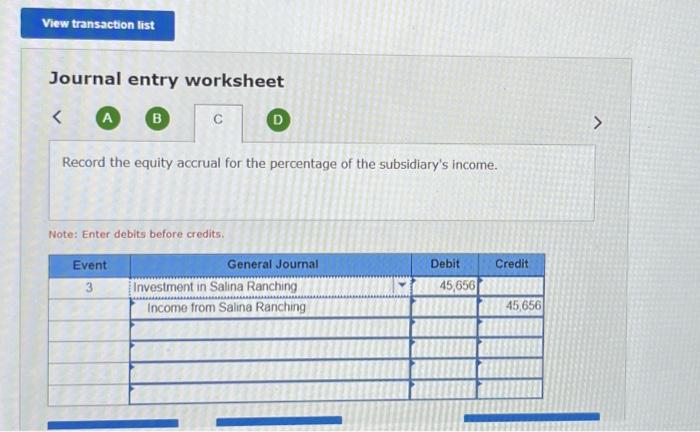

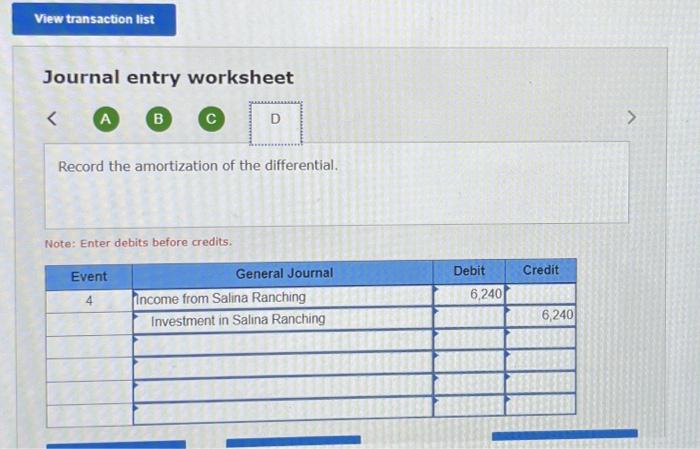

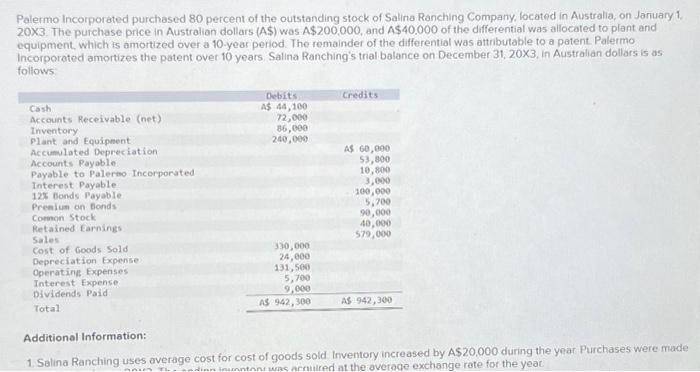

Palermo Incorporated purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on Jariuary 1. 203. The purchase price in Australian dollars (A\$) was A$200,000, and A$40,000 of the differential was allocated to plant and equipment, which is amortized over a 10 -year period. The remainder of the differential was attributable to a patent. Palermo incorporated amortizes the patent over 10 years. Salina Ranching's trial balance on December 31,203, in Australian dollars is as follows: Additional Information: 1. Salina Ranching uses average cost for cost of goods sold Inventory increased by AS20,000 during the year Purchases were made Additional Information: 1. Salina Ranching uses average cost for cost of goods sold Inventory increased by A\$20,000 during the year Purchases were made uniformly during 203. The ending inventory was acquired at the average exchange rate for the yeat 2. Plant and equipment were acquired as follows 3. Plant and equipment are depreciated using the straight-line method and a 10-year life, with no residual value. 4. The payable to Palermo is in Australian doliars. Palermo's books show o recelvable from Salina Ranching of $6,480 5 . The 10-year bonds were issued on July 1,203, for A $106,000. The premium is amortized on a straight-line basis. The interest is paid on April 1 and October 1. 6. The dividends were declared and paid on April 1. 7. Exchange rotes were as follows: Assume the US dollar is the functional currency. Polermo uses the fully odjusted equity method for accounting for its irvestment in Salina Ranching Required: a. Prepare the entries that Palermo would record in 203 for its investment in Salina Ranching Your entries should do the following Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Assume the U.S. dollar is the functional currency Palermo uses the fully adjusted equity method for accounting for its investment in Salina Ranching Required: a. Prepare the entries that Palermo would record in 203 for its investment in Salina Ranching. Your entries should do the following Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the equity accrual for the percentage of the subsidiary's income. Note: Enter debits before credits. Journal entry worksheet A B Record the amortization of the differential. Note: Enter debits before credits