Answered step by step

Verified Expert Solution

Question

1 Approved Answer

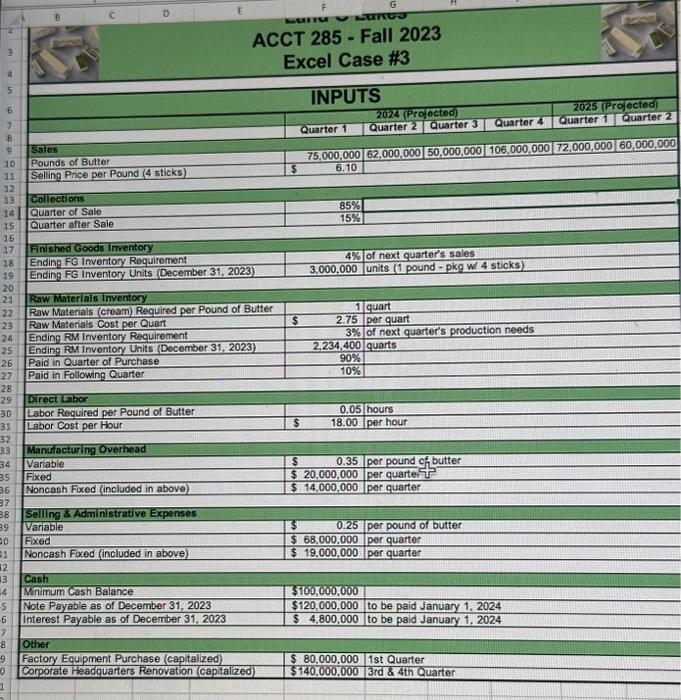

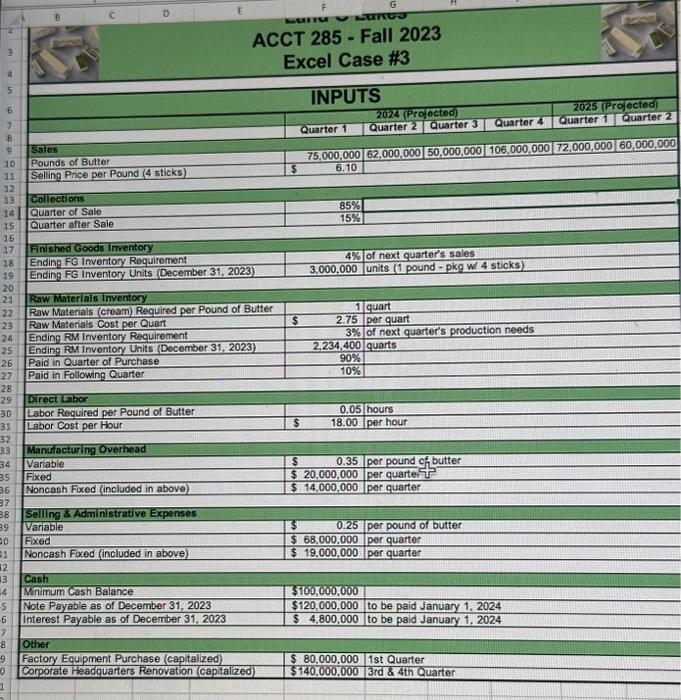

please fill in all blue boxes with correct answers ACCT 285 - Fall 2023 Excel Case #3 begin{tabular}{|l|r|r|} hline Collections & 85% & hline

please fill in all blue boxes with correct answers

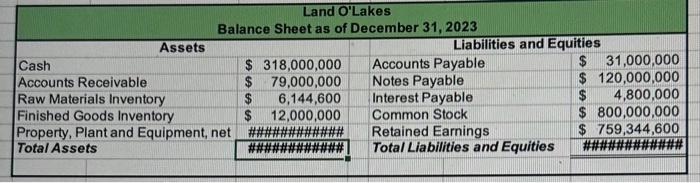

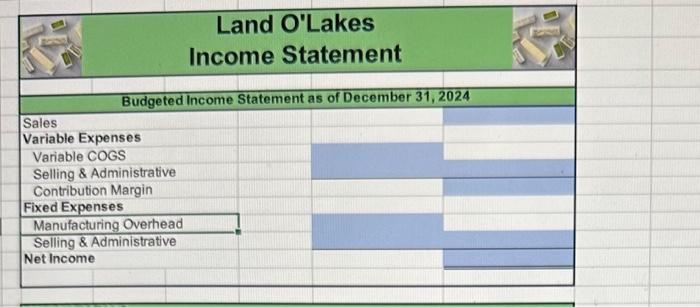

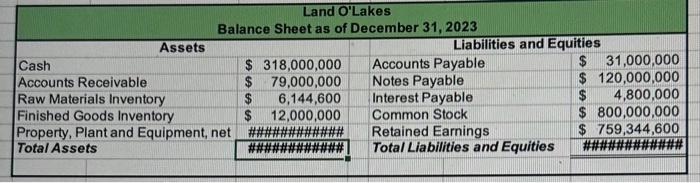

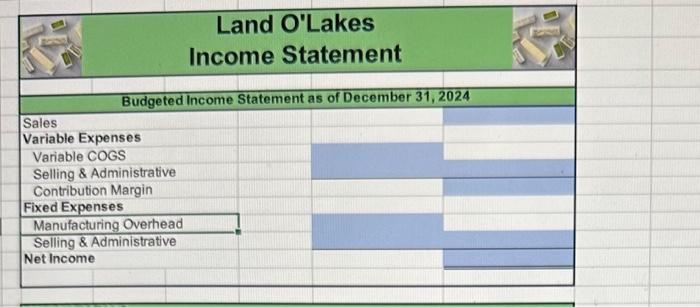

ACCT 285 - Fall 2023 Excel Case \#3 \begin{tabular}{|l|r|r|} \hline Collections & 85% & \\ \hline Quarter of Sale & 15% & \\ \hline Quarter after Sale & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Direct Labor } \\ \hline Labor Required per Pound of Butter & 0.05 & hours \\ \hline Labor Cost per Hour & 18.00 & per hour \\ \hline \multicolumn{3}{|l|}{ Manufacturing Overhead } \\ \hline Variable & 0.35 & per pound of butter. \\ \hline Fixed & $20,000,000 & per quarten \\ \hline Noncash Fixed (included in above) & $14,000,000 & per quarter \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Selling \& Administrative Expenses & & \\ \hline Variable & 0.25 & per pound of butter \\ \hline Fixed & $68,000,000 & per quarter \\ \hline Noncash Fixed (included in above) & $19,000,000 & per quarter \\ \hline Cash & & \\ \hline Mnimum Cash Balance & $100,000,000 & \\ \hline Note Payable as of December 31, 2023 & $120,000,000 & to be paid January 1,2024 \\ \hline Interest Payable as of December 31, 2023 & $4,800,000 & to be paid January 1,2024 \\ \hline Other & & \\ \hline Factory Equipment Purchase (capitalized) & $80,000,000 & 1st Quarter \\ \hline Corporate Headquarters Renovation (capitalized) & $140,000,000 & 3rd \& 4th Quarter \\ \hline \end{tabular} Land O'Lakes Income Statement Budgeted Income Statement as of December 31, 2024 Sales Variable Expenses Variable COGS Selling \& Administrative Contribution Margin Fixed Expenses Manufacturing Overhead Selling \& Administrative Net Income \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{l} Land O'Lakes \\ Balance Sheet as of December 31,2023 \\ \end{tabular}} \\ \hline \multicolumn{2}{|l|}{ Assets } & \multicolumn{2}{|c|}{ Liabilities and Equities } \\ \hline Cash & $318,000,000 & Accounts Payable & $31,000,000 \\ \hline Accounts Receivable & $79,000,000 & Notes Payable & $120,000,000 \\ \hline Raw Materials Inventory & 6,144,600 & Interest Payable & $4,800,000 \\ \hline Finished Goods Inventory & $12,000,000 & Common Stock & $800,000,000 \\ \hline Property, Plant and Equipment, net & \#\#\#\#\#\#\#\#\#\# & Retained Earnings & $759,344,600 \\ \hline Total Assets & & Total Liabilities and Equities & \#\#\#\#\#\#\#\#\#\#\#\# \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started