Please fill in all the sections one by one and explain them to me with their calculations. thank you so much in advanced.

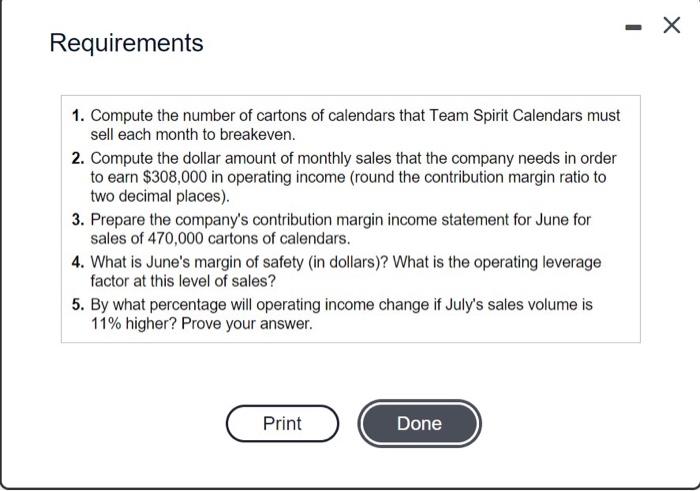

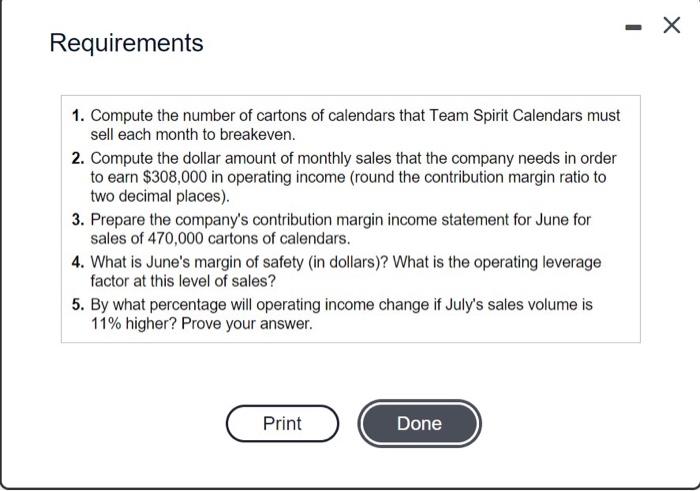

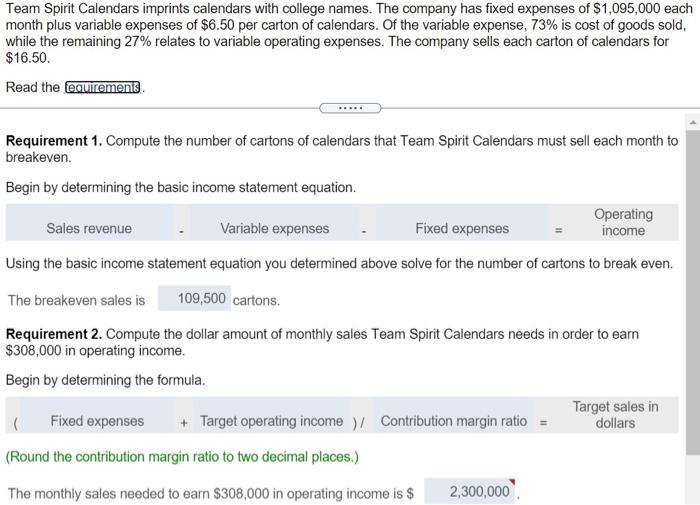

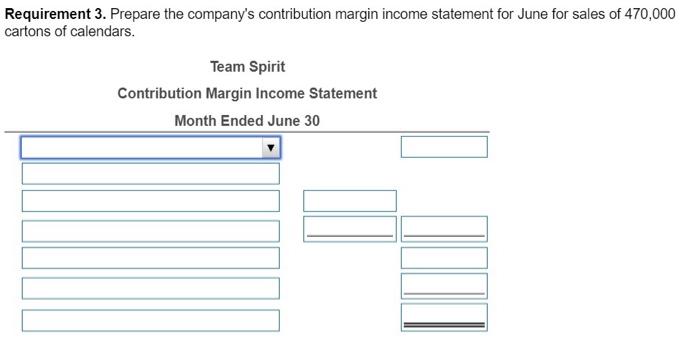

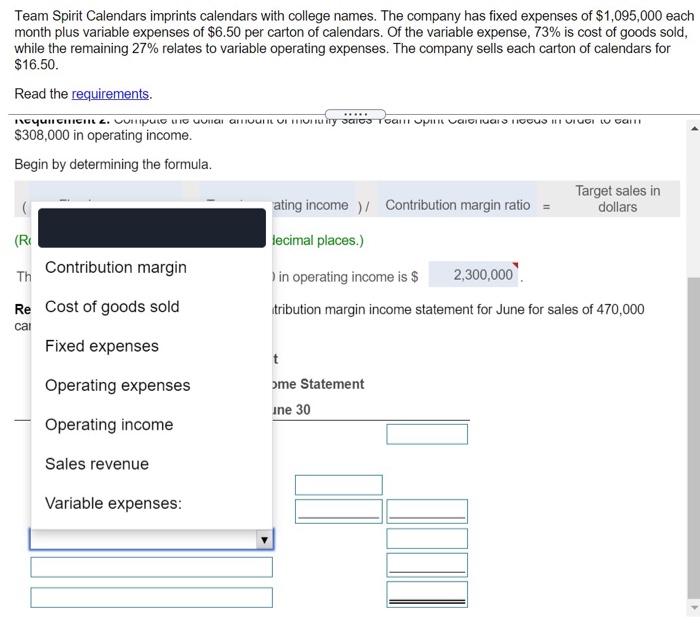

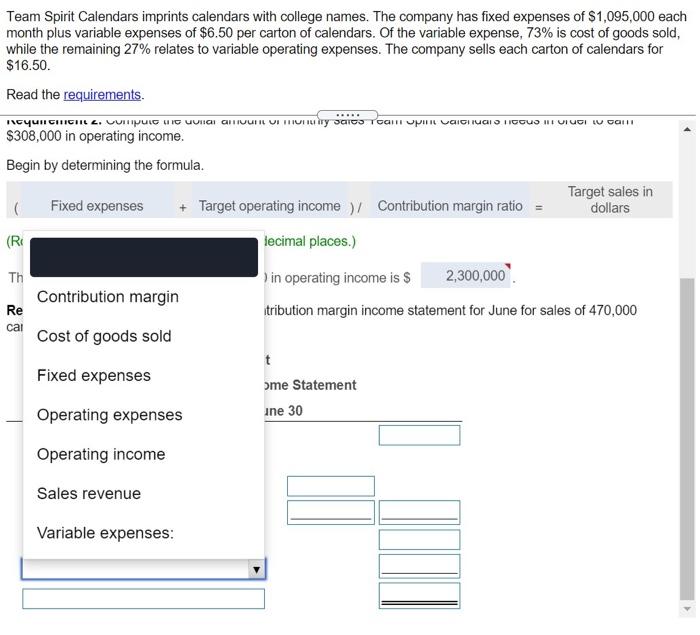

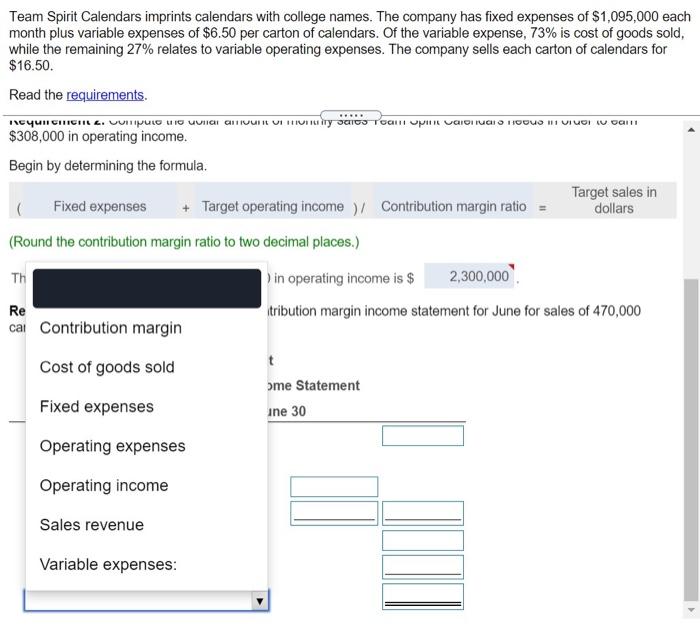

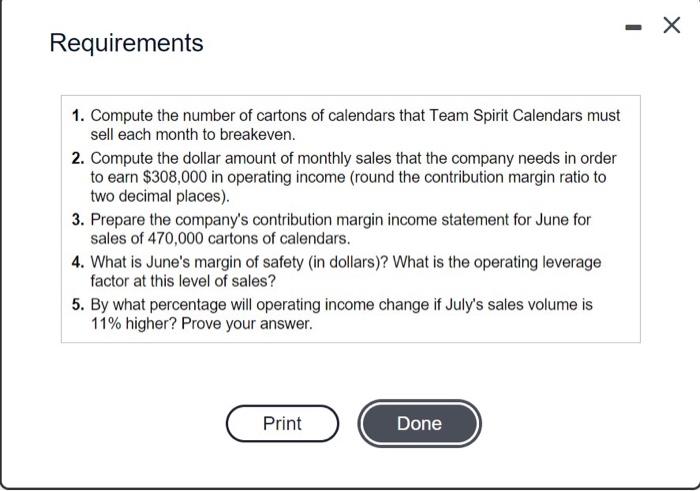

- Requirements 1. Compute the number of cartons of calendars that Team Spirit Calendars must sell each month to breakeven. 2. Compute the dollar amount of monthly sales that the company needs in order to earn $308,000 in operating income (round the contribution margin ratio to two decimal places). 3. Prepare the company's contribution margin income statement for June for sales of 470,000 cartons of calendars. 4. What is June's margin of safety (in dollars)? What is the operating leverage factor at this level of sales? 5. By what percentage will operating income change if July's sales volume is 11% higher? Prove your answer. Print Done Team Spirit Calendars imprints calendars with college names. The company has fixed expenses of $1,095,000 each month plus variable expenses of $6.50 per carton of calendars. Of the variable expense, 73% is cost of goods sold, while the remaining 27% relates to variable operating expenses. The company sells each carton of calendars for $16.50 Read the requirements Requirement 1. Compute the number of cartons of calendars that Team Spirit Calendars must sell each month to breakeven. Begin by determining the basic income statement equation. Operating Sales revenue Variable expenses Fixed expenses income Using the basic income statement equation you determined above solve for the number of cartons to break even. The breakeven sales is 109,500 cartons. Requirement 2. Compute the dollar amount of monthly sales Team Spirit Calendars needs in order to earn $308,000 in operating income. Begin by determining the formula. Target sales in Fixed expenses Target operating income / Contribution margin ratio = dollars (Round the contribution margin ratio to two decimal places.) The monthly sales needed to earn $308,000 in operating income is $ 2,300,000 Requirement 3. Prepare the company's contribution margin income statement for June for sales of 470,000 cartons of calendars. Team Spirit Contribution Margin Income Statement Month Ended June 30 INC Team Spirit Calendars imprints calendars with college names. The company has fixed expenses of $1,095,000 each month plus variable expenses of $6.50 per carton of calendars. Of the variable expense, 73% is cost of goods sold, while the remaining 27% relates to variable operating expenses. The company sells each carton of calendars for $16.50. Read the requirements y $3 Be Contribution margin Target sales in Cost of goods sold ating income / Contribution margin ratio = dollars (R Fixed expenses lecimal places.) Th Operating expenses in operating income is $ 2,300,000 Re Operating income tribution margin income statement for June for sales of 470,000 ca Sales revenue t me Statement une 30 Variable expenses: Team Spirit Calendars imprints calendars with college names. The company has fixed expenses of $1,095,000 each month plus variable expenses of $6.50 per carton of calendars. Of the variable expense. 73% is cost of goods sold, while the remaining 27% relates to variable operating expenses. The company sells each carton of calendars for $16.50 Read the requirements. INC............ ..UI HIRIGINT Caics Tall PVCICHIVIO HICCUS I VIUCI LUCAH $3 ..... Be Contribution margin Cost of goods sold (RE Target sales in ating income / Contribution margin ratio = dollars lecimal places.) in operating income is $ 2,300,000 tribution margin income statement for June for sales of 470,000 Fixed expenses Th Re Operating expenses cal Operating income Sales revenue t ome Statement ine 30 Variable expenses: Team Spirit Calendars imprints calendars with college names. The company has fixed expenses of $1,095,000 each month plus variable expenses of $6.50 per carton of calendars. Of the variable expense, 73% is cost of goods sold, while the remaining 27% relates to variable operating expenses. The company sells each carton of calendars for $16.50. Read the requirements. ICYULICITICIILL. UURIMUL UID UUNII CHIUUIR UI TRIUTILITY SACST Can VAIDIUI LICOU III VILCI W Call $308,000 in operating income. Be Target sales in Contribution margin ating income / Contribution margin ratio = dollars (R lecimal places.) Cost of goods sold Th ) in operating income is $ 2,300,000 Fixed expenses Re tribution margin income statement for June for sales of 470,000 cal Operating expenses t Operating income ome Statement Sales revenue ane 30 Variable expenses: MIN Team Spirit Calendars imprints calendars with college names. The company has fixed expenses of $1,095,000 each month plus variable expenses of $6.50 per carton of calendars. Of the variable expense, 73% is cost of goods sold, while the remaining 27% relates to variable operating expenses. The company sells each carton of calendars for $16.50. Read the requirements. IncYUNCILICHILL. UUNIPULUJUHI CHUI VI UTU ir SAIDs Toan PIL VICICIO HUS I VIUI W CAR $308,000 in operating income. Begin by determining the formula. Target sales in ating income / Contribution margin ratio = dollars (R Contribution margin lecimal places.) Th Cost of goods sold in operating income is s 2,300,000 Re tribution margin income statement for June for sales of 470,000 cal Fixed expenses Operating expenses ome Statement Operating income ine 30 Sales revenue Variable expenses: Team Spirit Calendars imprints calendars with college names. The company has fixed expenses of $1,095,000 each month plus variable expenses of $6.50 per carton of calendars. Of the variable expense, 73% is cost of goods sold, while the remaining 27% relates to variable operating expenses. The company sells each carton of calendars for $16.50. Read the requirements. ICYUICHICIILL. UU PUIG UIG UUTICI MUUT VI HIVI SAICS TCAITI UPIR VAIGI ICID ICUS III UIUGI LU CAH $308,000 in operating income. Begin by determining the formula. Target sales in ating income / Contribution margin ratio = dollars (RE lecimal places.) Contribution margin Th in operating income is $ 2,300,000 Atribution margin income statement for June for sales of 470,000 Re Cost of goods sold cal Fixed expenses t Operating expenses ome Statement ine 30 Operating income Sales revenue Variable expenses: TE Team Spirit Calendars imprints calendars with college names. The company has fixed expenses of $1,095,000 each month plus variable expenses of $6.50 per carton of calendars. Of the variable expense, 73% is cost of goods sold, while the remaining 27% relates to variable operating expenses. The company sells each carton of calendars for $16.50 Read the requirements y $308,000 in operating income. Begin by determining the formula. Target sales in Fixed expenses + Target operating income / Contribution margin ratio = dollars (RE lecimal places.) Th in operating income is $ 2,300,000 Contribution margin Re tribution margin income statement for June for sales of 470,000 cai Cost of goods sold t Fixed expenses ome Statement Operating expenses une 30 Operating income Sales revenue Variable expenses: Team Spirit Calendars imprints calendars with college names. The company has fixed expenses of $1,095,000 each month plus variable expenses of $6.50 per carton of calendars. Of the variable expense, 73% is cost of goods sold, while the remaining 27% relates to variable operating expenses. The company sells each carton of calendars for $16.50. Read the requirements. IACYUTI CITICIILL. UUPULO uso uUHAI CHIUI VI HIVIRIY SAICS Tcan IR VAICI UCIO HUO HII VIUI I Can $308,000 in operating income. Begin by determining the formula. Target sales in Fixed expenses + Target operating income / Contribution margin ratio = dollars (Round the contribution margin ratio to two decimal places.) Th in operating income is $ 2,300,000 Re tribution margin income statement for June for sales of 470,000 cal Contribution margin Cost of goods sold Fixed expenses ome Statement ine 30 Operating expenses Operating income Sales revenue Variable expenses