Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please fill in every blank! Not looking for a copy and paste answer for an already answered question. Thank you. Bob sold the following assets

Please fill in every blank!

Not looking for a copy and paste answer for an already answered question.

Thank you.

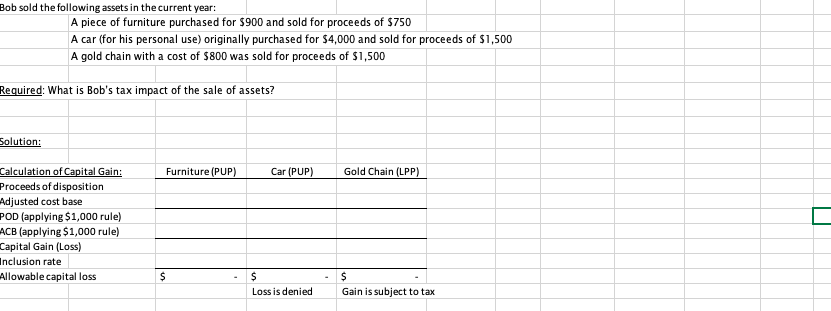

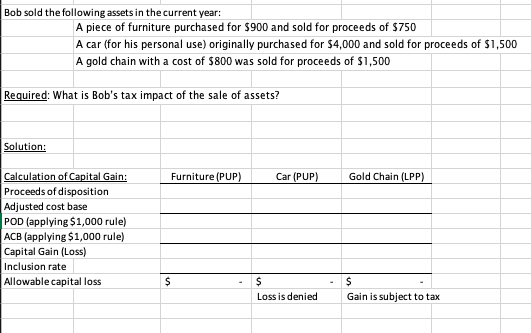

Bob sold the following assets in the current year: A piece of furniture purchased for $900 and sold for proceeds of $750 A car (for his personal use) originally purchased for $4,000 and sold for proceeds of $1,500 A gold chain with a cost of $800 was sold for proceeds of $1,500 Required: What is Bob's tax impact of the sale of assets? Solution: Furniture (PUP) Car (PUP) Gold Chain (LPP) Calculation of Capital Gain: Proceeds of disposition Adjusted cost base POD (applying $1,000 rule) ACB (applying $1,000 rule) Capital Gain (Loss) Inclusion rate Allowable capital loss $ $ Loss is denied $ Gain is subject to tax Bob sold the following assets in the current year: A piece of furniture purchased for $900 and sold for proceeds of $750 A car (for his personal use) originally purchased for $4,000 and sold for proceeds of $1,500 A gold chain with a cost of $800 was sold for proceeds of $1,500 Required: What is Bob's tax impact of the sale of assets? Solution: Furniture (PUP) Car (PUP) Gold Chain (LPP) Calculation of Capital Gain: Proceeds of disposition Adjusted cost base POD (applying $1,000 rule) ACB (applying $1,000 rule) Capital Gain (Loss) Inclusion rate Allowable capital loss $ $ Loss is denied $ Gain is subject to tax Bob sold the following assets in the current year: A piece of furniture purchased for $900 and sold for proceeds of $750 A car (for his personal use) originally purchased for $4,000 and sold for proceeds of $1,500 A gold chain with a cost of $800 was sold for proceeds of $1,500 Required: What is Bob's tax impact of the sale of assets? Solution: Furniture (PUP) Car (PUP) Gold Chain (LPP) Calculation of Capital Gain: Proceeds of disposition Adjusted cost base POD (applying $1,000 rule) ACB (applying $1,000 rule) Capital Gain (Loss) Inclusion rate Allowable capital loss $ $ Loss is denied $ Gain is subject to tax Bob sold the following assets in the current year: A piece of furniture purchased for $900 and sold for proceeds of $750 A car (for his personal use) originally purchased for $4,000 and sold for proceeds of $1,500 A gold chain with a cost of $800 was sold for proceeds of $1,500 Required: What is Bob's tax impact of the sale of assets? Solution: Furniture (PUP) Car (PUP) Gold Chain (LPP) Calculation of Capital Gain: Proceeds of disposition Adjusted cost base POD (applying $1,000 rule) ACB (applying $1,000 rule) Capital Gain (Loss) Inclusion rate Allowable capital loss $ $ Loss is denied $ Gain is subject to taxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started