Answered step by step

Verified Expert Solution

Question

1 Approved Answer

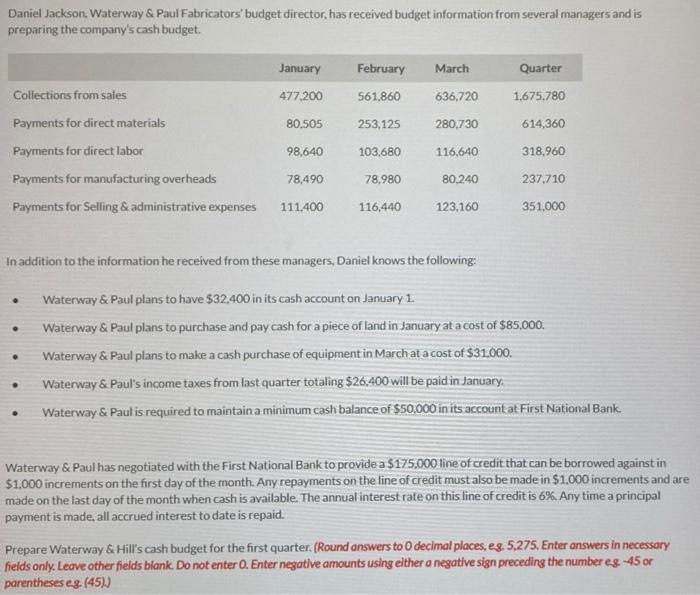

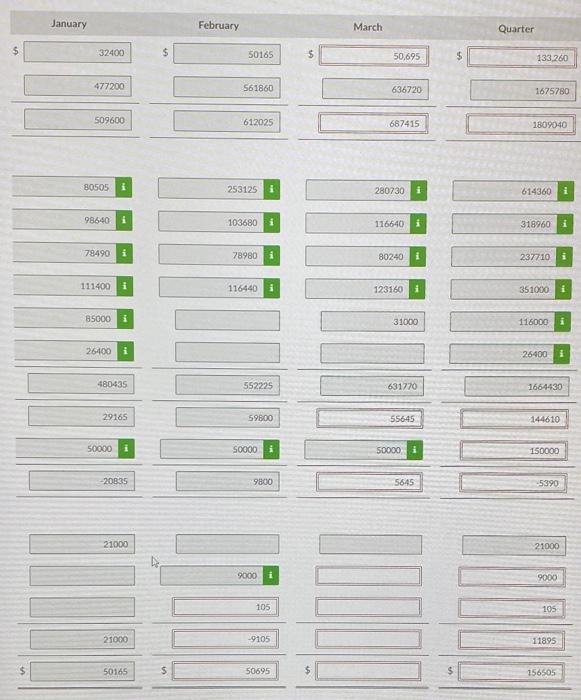

please fill in RED INCORRECT BOXES for thumbs up Daniel Jackson, Waterway & Paul Fabricators' budget director, has received budget information from several managers and

please fill in RED INCORRECT BOXES for thumbs up

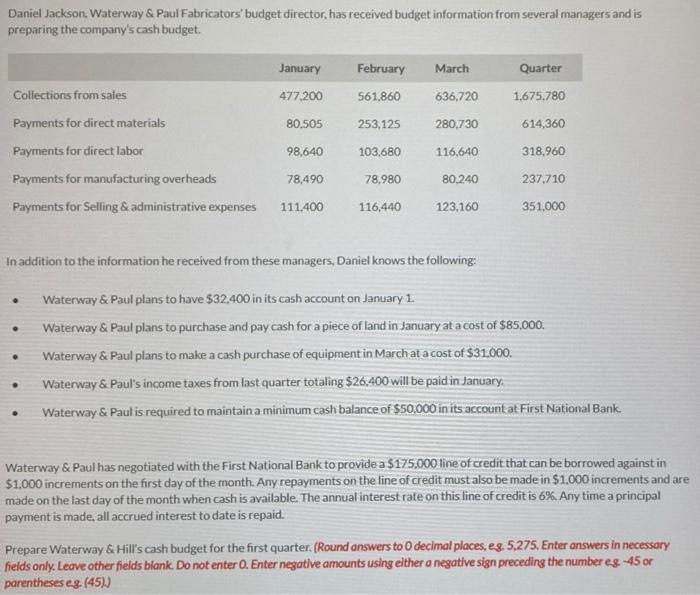

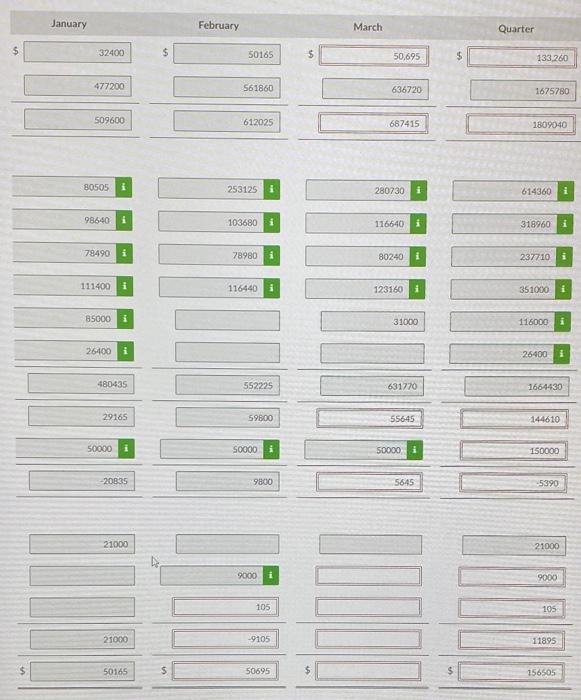

Daniel Jackson, Waterway & Paul Fabricators' budget director, has received budget information from several managers and is preparing the company's cash budget. January February March Quarter Collections from sales 477,200 561,860 636,720 1,675,780 Payments for direct materials 80,505 253,125 280,730 614,360 Payments for direct labor 98,640 103,680 116,640 318,960 Payments for manufacturing overheads 78,490 78,980 80,240 237,710 Payments for Selling & administrative expenses 111,400 116,440 123,160 351,000 In addition to the information he received from these managers, Daniel knows the following: Waterway & Paul plans to have $32,400 in its cash account on January 1. . Waterway & Paul plans to purchase and pay cash for a piece of land in January at a cost of $85,000. Waterway & Paul plans to make a cash purchase of equipment in March at a cost of $31.000. . . Waterway & Paul's income taxes from last quarter totaling $26.400 will be paid in January. Waterway & Paul is required to maintain a minimum cash balance of $50,000 in its account at First National Bank. Waterway & Paul has negotiated with the First National Bank to provide a $175,000 line of credit that can be borrowed against in $1.000 increments on the first day of the month. Any repayments on the line of credit must also be made in $1,000 increments and are made on the last day of the month when cash is available. The annual interest rate on this line of credit is 6%. Any time a principal payment is made, all accrued interest to date is repaid. Prepare Waterway & Hill's cash budget for the first quarter. (Round answers to 0 decimal places, eg. 5,275. Enter answers in necessary fields only. Leave other fields blank. Do not enter 0. Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses e.g. (45).) January 32400 477200 509600 80505 i 98640 i 78490 i 111400 i 85000 i 26400 i 480435 29165 50000 i -20835 21000 21000 50165 $ February 50165 561860 612025 253125 103680 i 78980 116440 i 552225 59800 50000 9800 9000 105 -9105 50695 March 50,695 636720 687415 280730 i 116640 i 80240 i 123160 i 31000 631770 55645 50000 5645 Quarter 133,260 1675780 1809040 614360 i 318960 i 237710 351000 i 116000 i 26400 1664430 144610 150000 5390 21000 9000 105 11895 156505 Beginning cash balance Collections from sales Total cash available to spend Less : Disbursements Payments for direct materials Direct labor Manufacturing overhead Selling & administrative expenses Land and Equipment purchases Income taxes Total cash disbursements Cash excess (deficiency) Minimum cash balance Cash excess (needed) Financing Borrowings Repayments Interest financin Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started