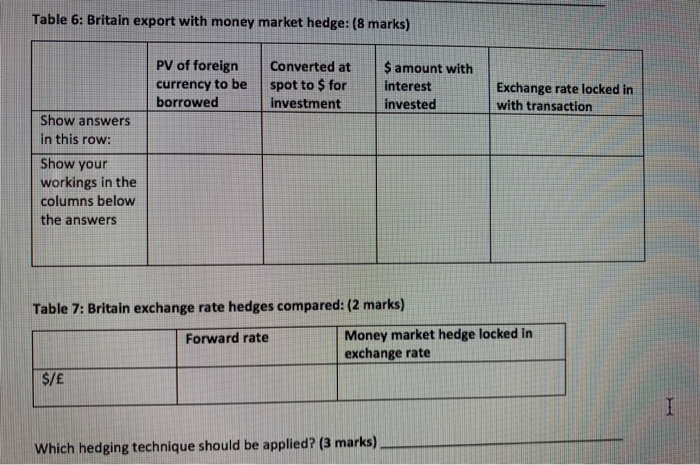

please fill in table 6 & 7

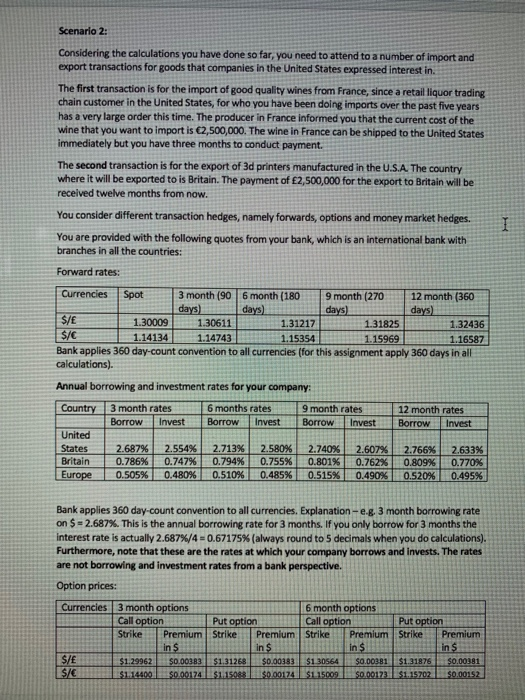

Scenario 2: Considering the calculations you have done so far, you need to attend to a number of import and export transactions for goods that companies in the United States expressed interest in. The first transaction is for the import of good quality wines from France, since a retail liquor trading chain customer in the United States, for who you have been doing imports over the past five years has a very large order this time. The producer in France informed you that the current cost of the wine that you want to import is 2,500,000. The wine in France can be shipped to the United States immediately but you have three months to conduct payment. The second transaction is for the export of 3d printers manufactured in the U.S.A. The country where it will be exported to is Britain. The payment of 2,500,000 for the export to Britain will be received twelve months from now. You consider different transaction hedges, namely forwards, options and money market hedges. You are provided with the following quotes from your bank, which is an international bank with branches in all the countries: Forward rates: Currencies Spot 3 month (906 month (180 9 month (270 12 month (360 days) days) days) days) S/E 1.30009 1.306111 .312171 .318251 .32436 $/C 1.14134 1.14743 1.15354 1.15969 1.16587 Bank applies 360 day-count convention to all currencies (for this assignment apply 360 days in all calculations). Annual borrowing and investment rates for your company: Country 3 month rates 6 months rates 9 month rates 12 month rates Borrow Invest Borrow Invest Borrow Invest | Borrow Invest United States 2.687% 2.554% 2.713% 2.580% 2.740% 2.607% 2.766% 2.633% Britain 0.786% 0.747% 0.794% 0.755% 0.801% 0.762% 0.809% 0.770% Europe | 0.505% 0.480% 0.510% 0.485% 0.515% 0.490% 0.520% 0.495% Bank applies 360 day count convention to all currencies. Explanation-e.g. 3 month borrowing rate on S = 2.687%. This is the annual borrowing rate for 3 months. If you only borrow for 3 months the interest rate is actually 2.687X/4 = 0.67175% (always round to 5 decimals when you do calculations). Furthermore, note that these are the rates at which your company borrows and invests. The rates are not borrowing and investment rates from a bank perspective. Option prices: Currencies | 3 month options 6 month options Call option s Put option Call option Put option Strike Premium Strike Premium Strike Premium Strike Premium in $ in $ in $ in s $1.29962 $0.00383 $1.31268 $0.00383 $130564 $0.00381 $1.31876 S0.00381 $1.14400 $0.00174 $1.15043 $0.00174 $1.15009 $0.00173 $1.15702 $0.00152 Table 6: Britain export with money market hedge: (8 marks) $ amount with PV of foreign currency to be borrowed Converted at spot to $ for investment Exchange rate locked in with transaction invested Show answers in this row: Show your workings in the columns below the answers Table 7: Britain exchange rate hedges compared: (2 marks) Forward rate Money market hedge locked in exchange rate S/E Which hedging technique should be applied