Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please fill in the balnace sheet using the above information and explantion for each step will be apperciated, make sure that the numbers are correct

please fill in the balnace sheet using the above information and explantion for each step will be apperciated, make sure that the numbers are correct

this all the information that is being given its a one whole question

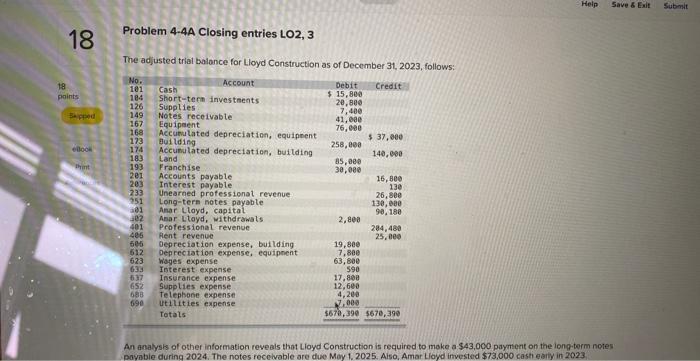

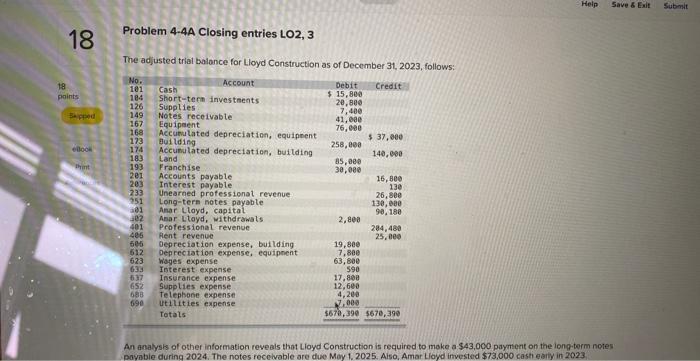

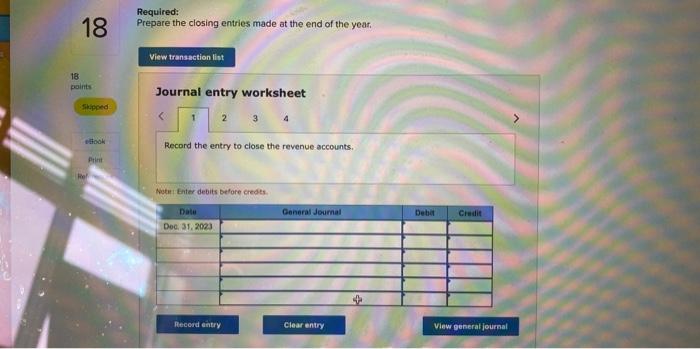

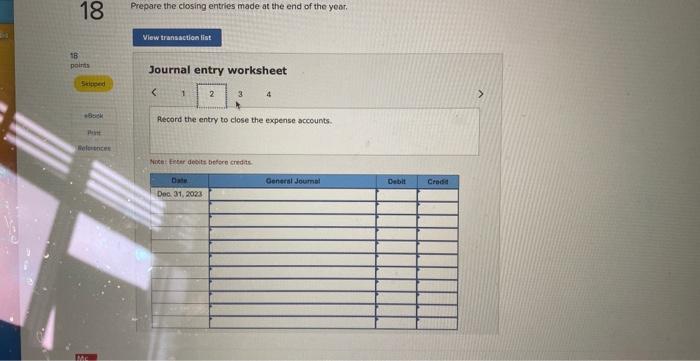

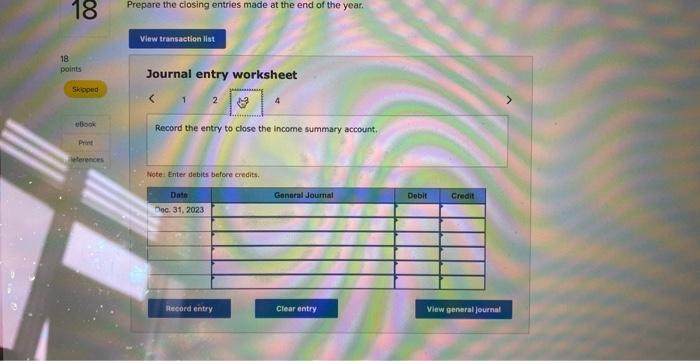

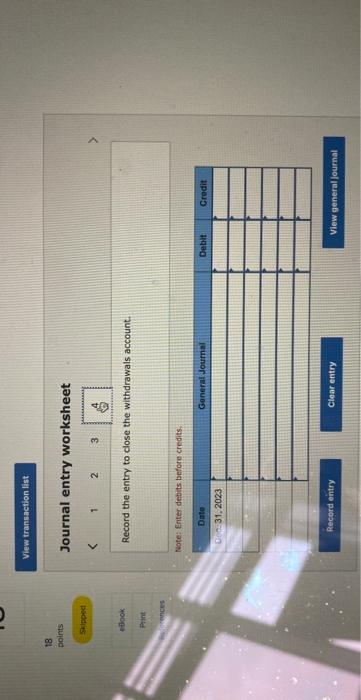

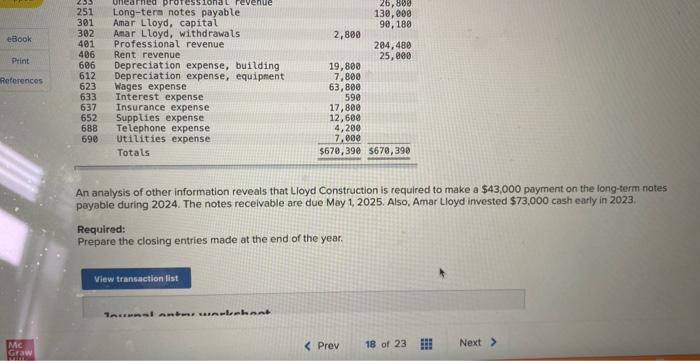

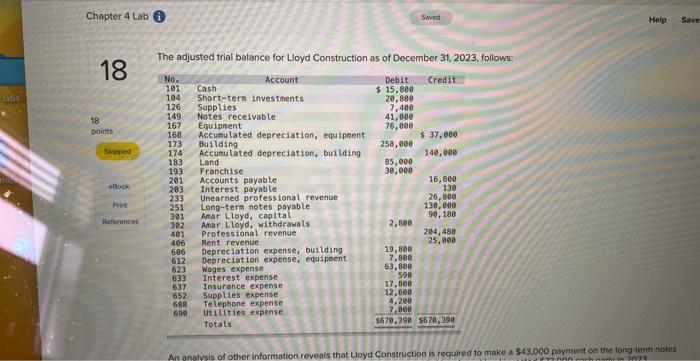

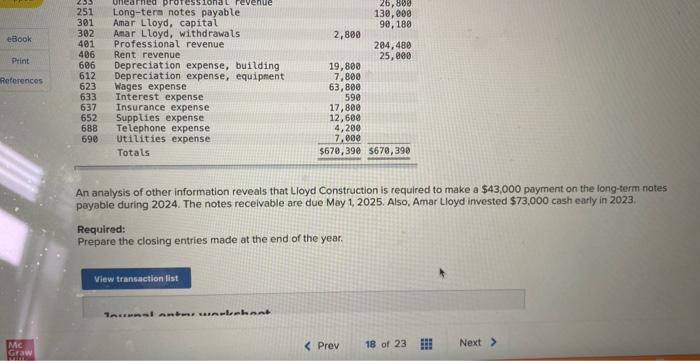

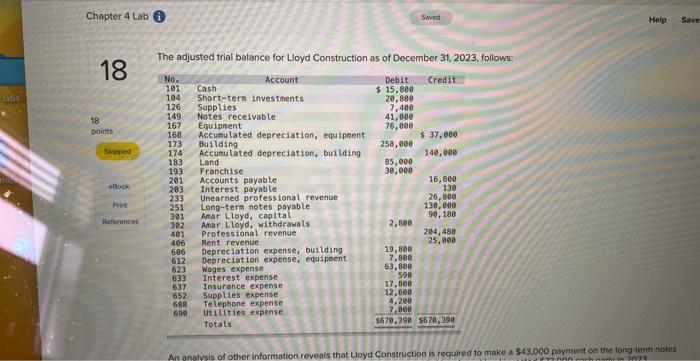

Problem 4-4A Closing entries LO2, 3 The adjusted trial balance for Lloyd Construction as of December 31, 2023, follows: An analysks of other information reveals that Lioyd Construction is required to make a $43,000 payment on the iong-term notes paynbie during 2024. The notes recelvable are due May 1. 2025. Also, Amar Lioyd invested $73.000 casti early in 2023. Required: Prepare the closing entries made at the end of the year. Journal entry worksheet 4 Record the entry to close the revenue accounts. Metu + Enter debits before credes. Prepare the ciosing entries made at the end of the yoor. Journal entry worksheet 4 Record the entry to close the expense accounts. Hinget Eefer decult bedere cre dit. Prepare the closing entries made at the end of the year. Journal entry worksheet Record the entry to close the income summary account. kiote. Enter debits before aredits. 'stipas oubjaq sicap sajuj :ajce An analysis of other information reveals that Lioyd Construction is required to make a $43,000 payment on the long-term notes poyable during 2024. The notes receivable are due May 1, 2025. Also, Amar Lloyd invested $73,000 cash early in 2023. Required: Requare the closing entries made at the end of the year. The adjusted trial balance for Lloyd Construction as of December 31, 2023, follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started