Please fill in the blanks given the following information...

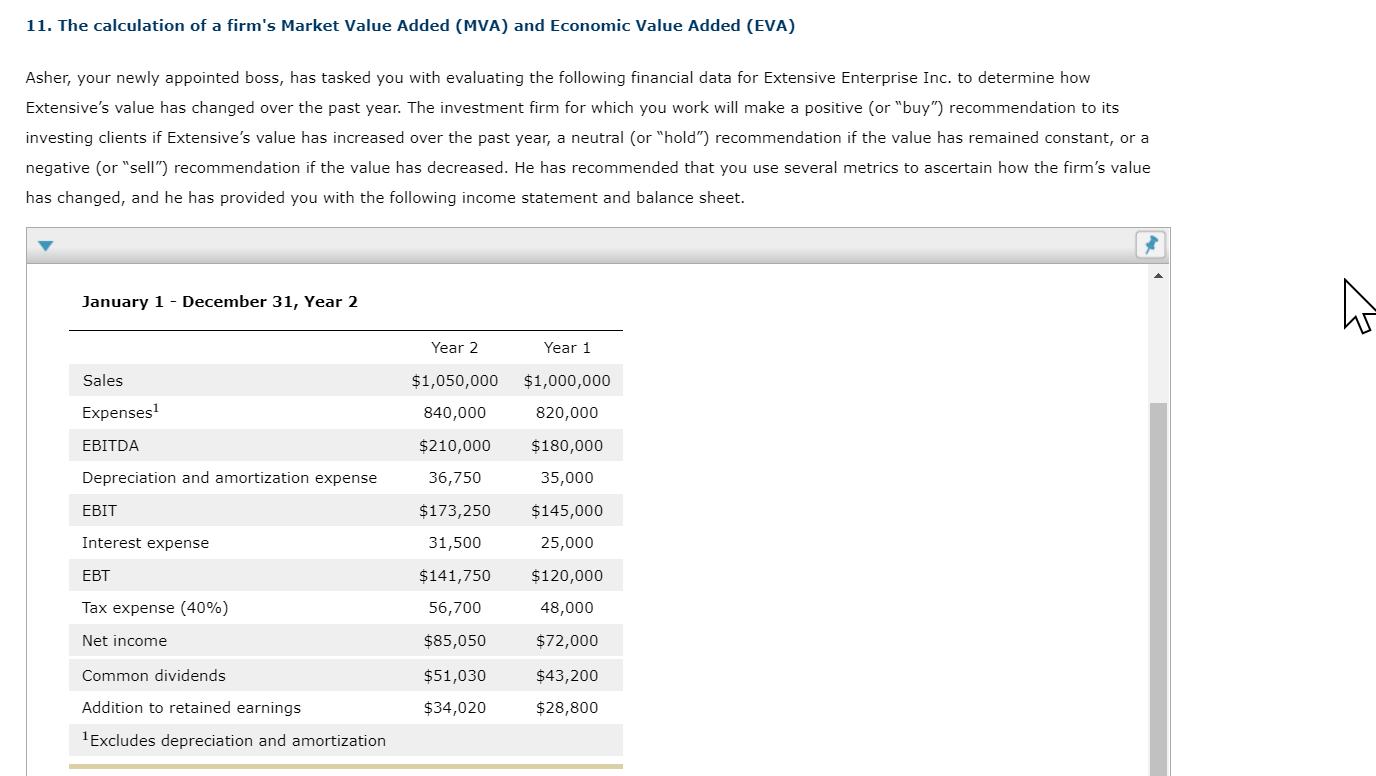

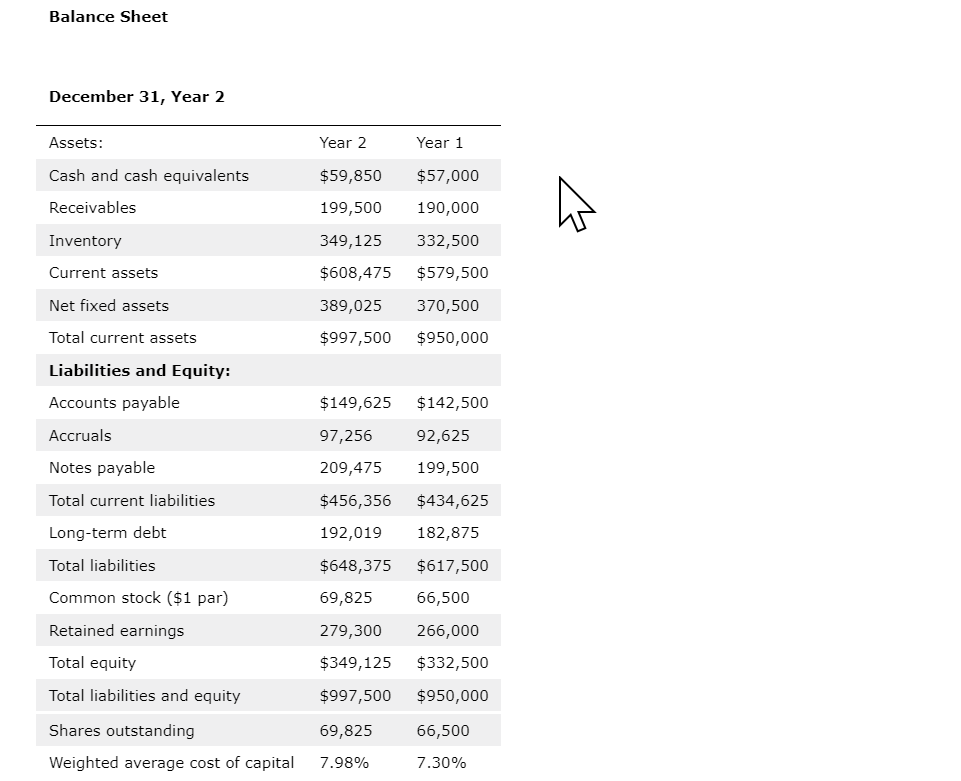

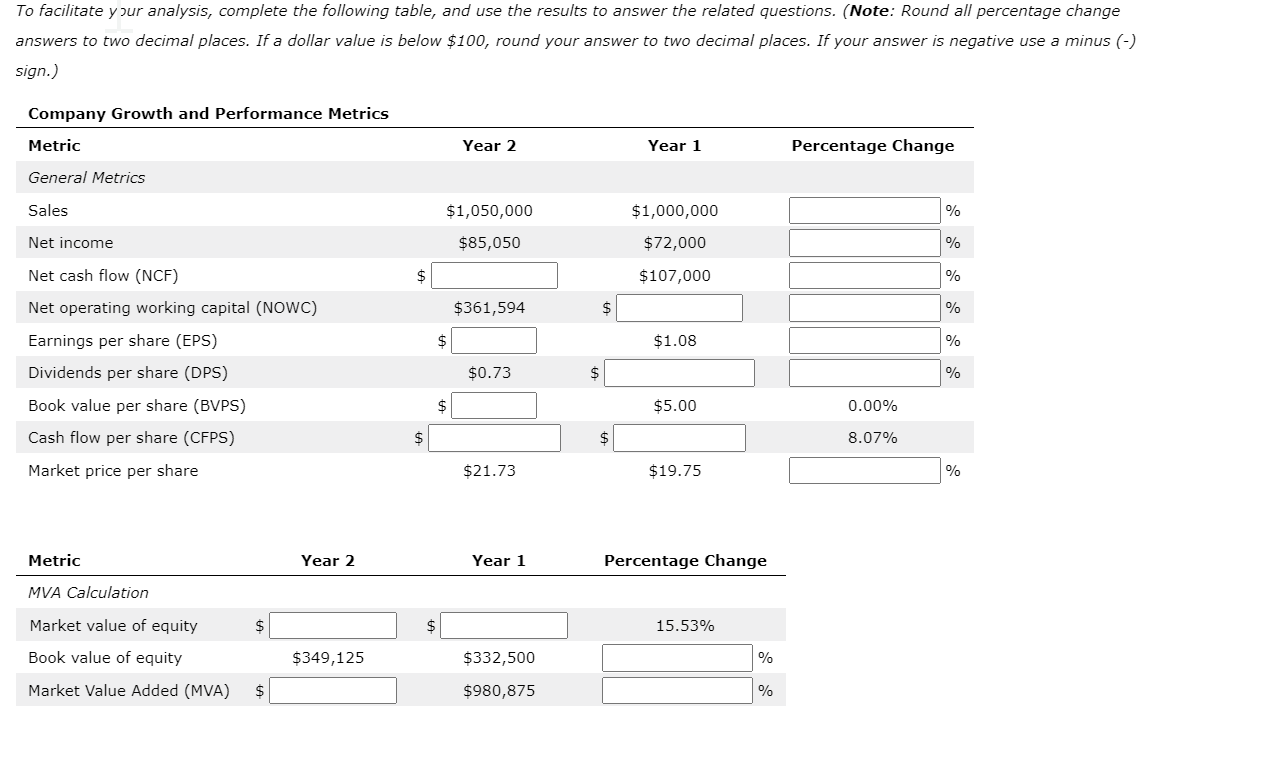

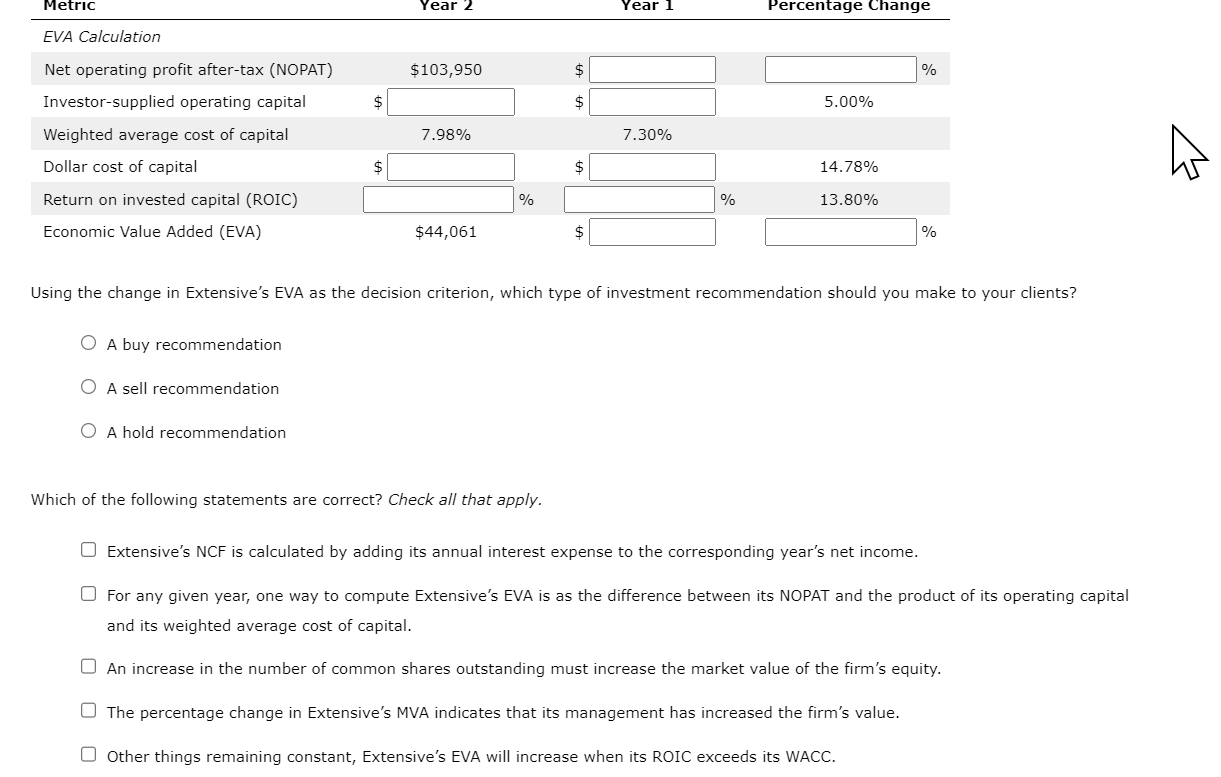

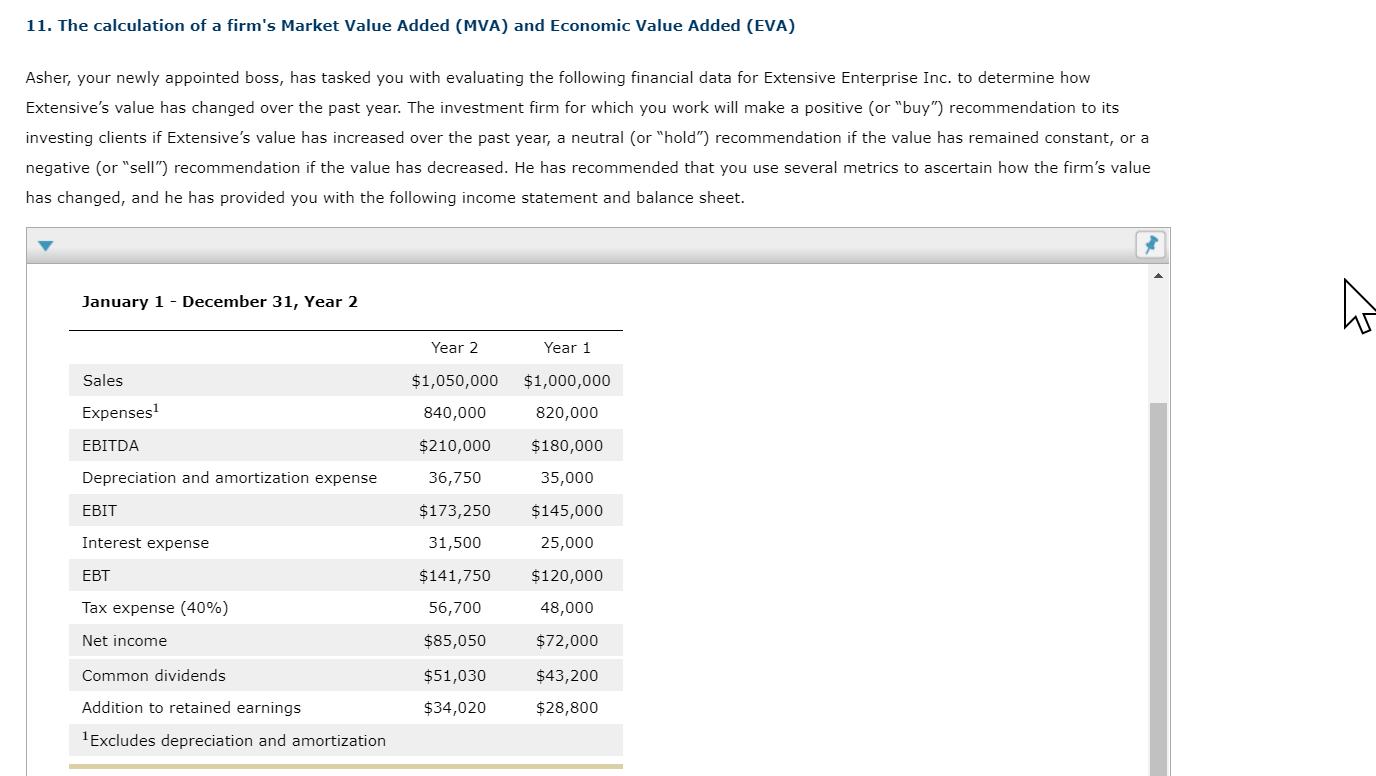

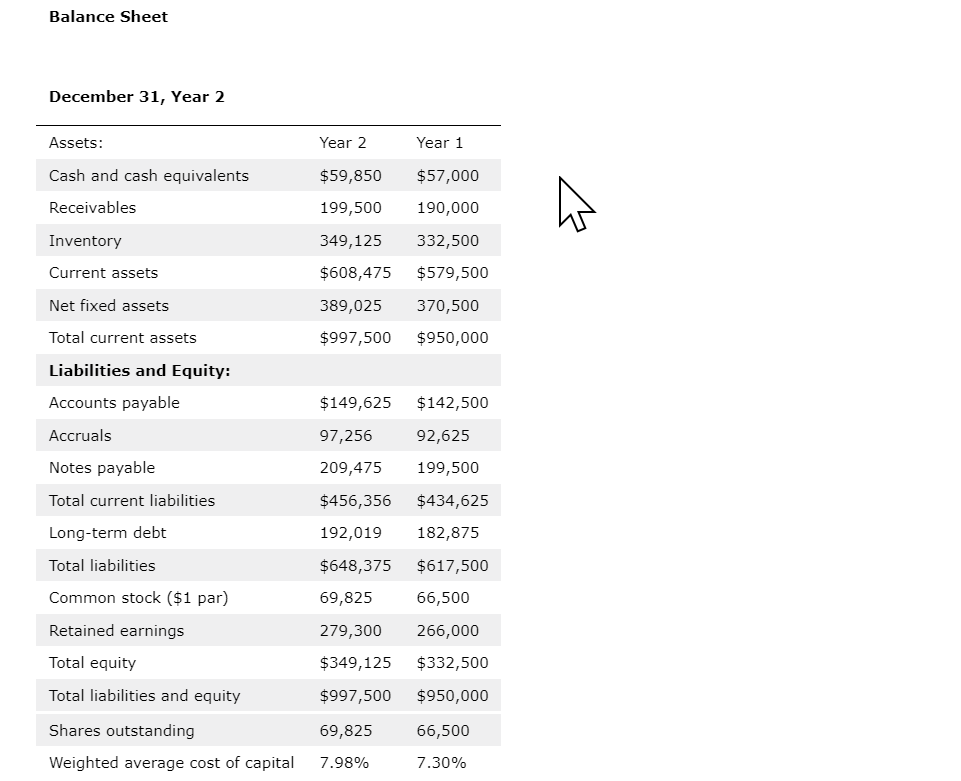

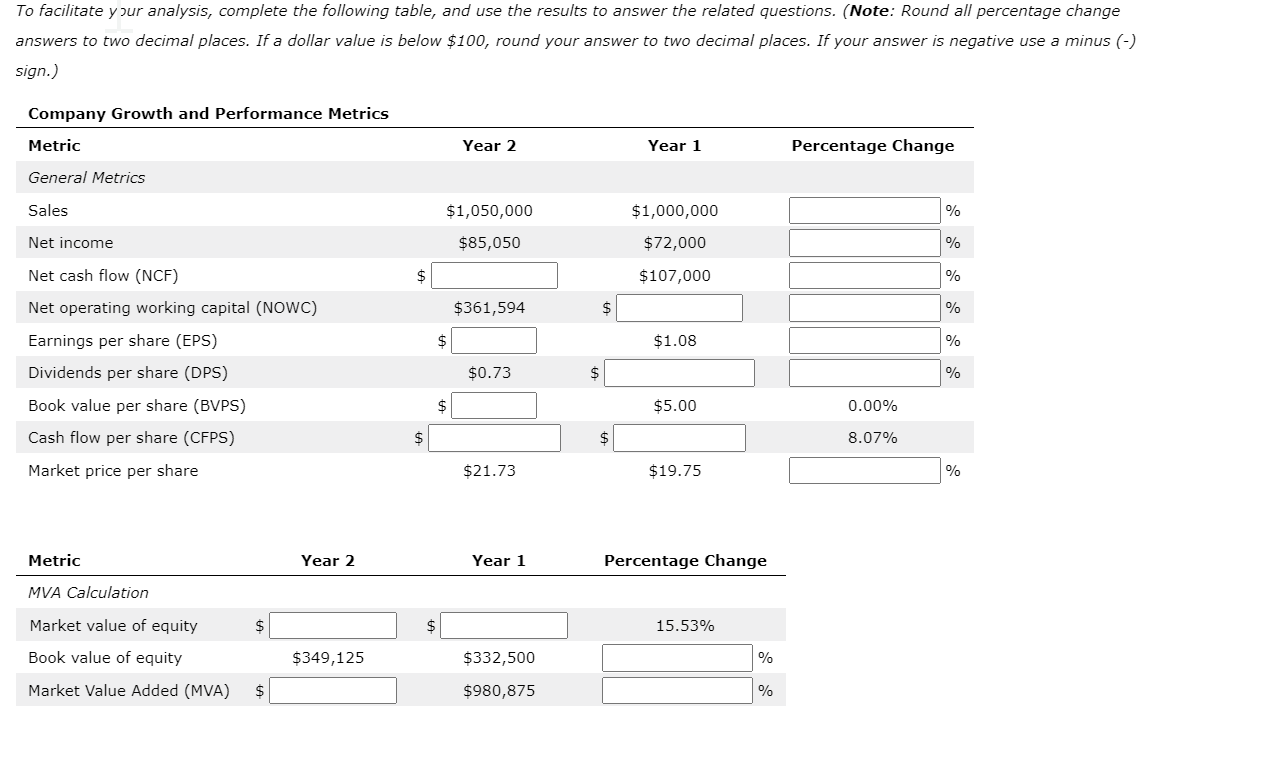

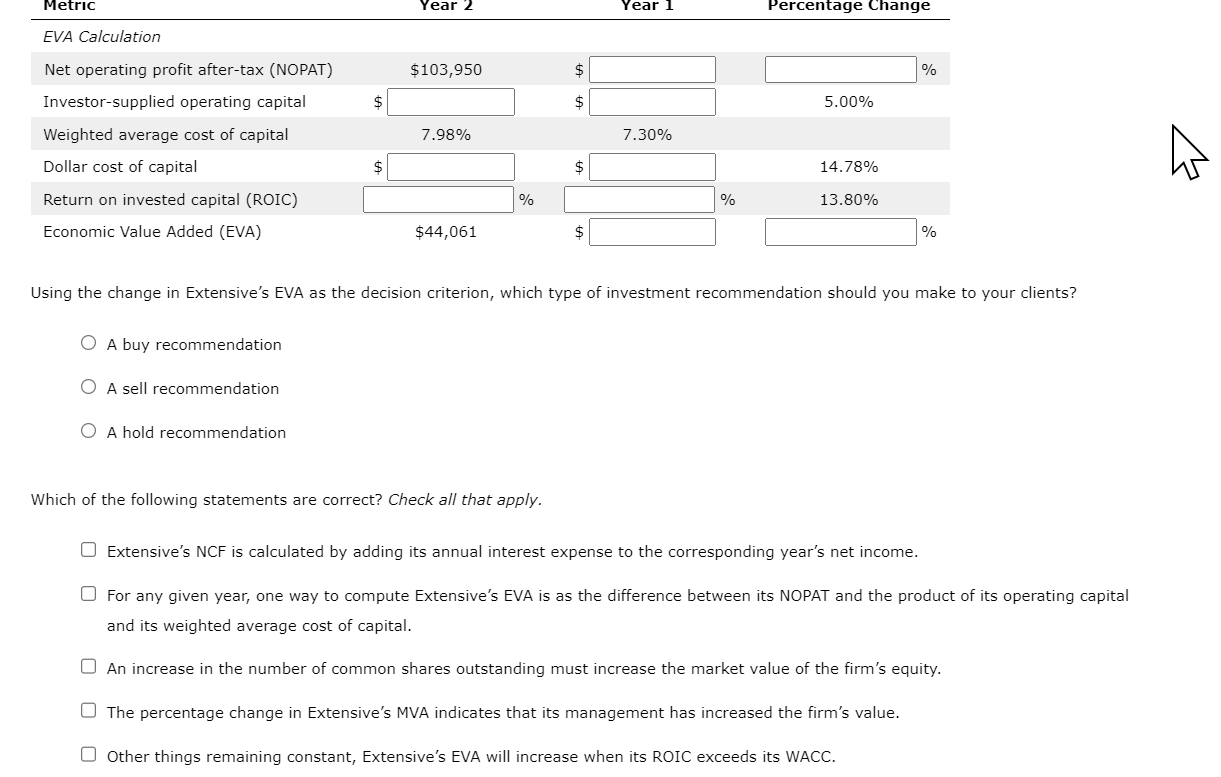

11. The calculation of a firm's Market Value Added (MVA) and Economic Value Added (EVA) Asher, your newly appointed boss, has tasked you with evaluating the following financial data for Extensive Enterprise Inc. to determine how Extensive's value has changed over the past year. The investment firm for which you work will make a positive (or "buy") recommendation to its has changed, and he has provided you with the following income statement and balance sheet. Balance Sheet To facilitate y sur analysis, complete the following table, and use the results to answer the related questions. (Note: Round all percentage change answers to two decimal places. If a dollar value is below $100, round your answer to two decimal places. If your answer is negative use a minus (-) sign.) A buy recommendation A sell recommendation A hold recommendation Which of the following statements are correct? Check all that apply. Extensive's NCF is calculated by adding its annual interest expense to the corresponding year's net income. For any given year, one way to compute Extensive's EVA is as the difference between its NOPAT and the product of its operating capital and its weighted average cost of capital. An increase in the number of common shares outstanding must increase the market value of the firm's equity. The percentage change in Extensive's MVA indicates that its management has increased the firm's value. Other things remaining constant, Extensive's EVA will increase when its ROIC exceeds its WACC. 11. The calculation of a firm's Market Value Added (MVA) and Economic Value Added (EVA) Asher, your newly appointed boss, has tasked you with evaluating the following financial data for Extensive Enterprise Inc. to determine how Extensive's value has changed over the past year. The investment firm for which you work will make a positive (or "buy") recommendation to its has changed, and he has provided you with the following income statement and balance sheet. Balance Sheet To facilitate y sur analysis, complete the following table, and use the results to answer the related questions. (Note: Round all percentage change answers to two decimal places. If a dollar value is below $100, round your answer to two decimal places. If your answer is negative use a minus (-) sign.) A buy recommendation A sell recommendation A hold recommendation Which of the following statements are correct? Check all that apply. Extensive's NCF is calculated by adding its annual interest expense to the corresponding year's net income. For any given year, one way to compute Extensive's EVA is as the difference between its NOPAT and the product of its operating capital and its weighted average cost of capital. An increase in the number of common shares outstanding must increase the market value of the firm's equity. The percentage change in Extensive's MVA indicates that its management has increased the firm's value. Other things remaining constant, Extensive's EVA will increase when its ROIC exceeds its WACC