Answered step by step

Verified Expert Solution

Question

1 Approved Answer

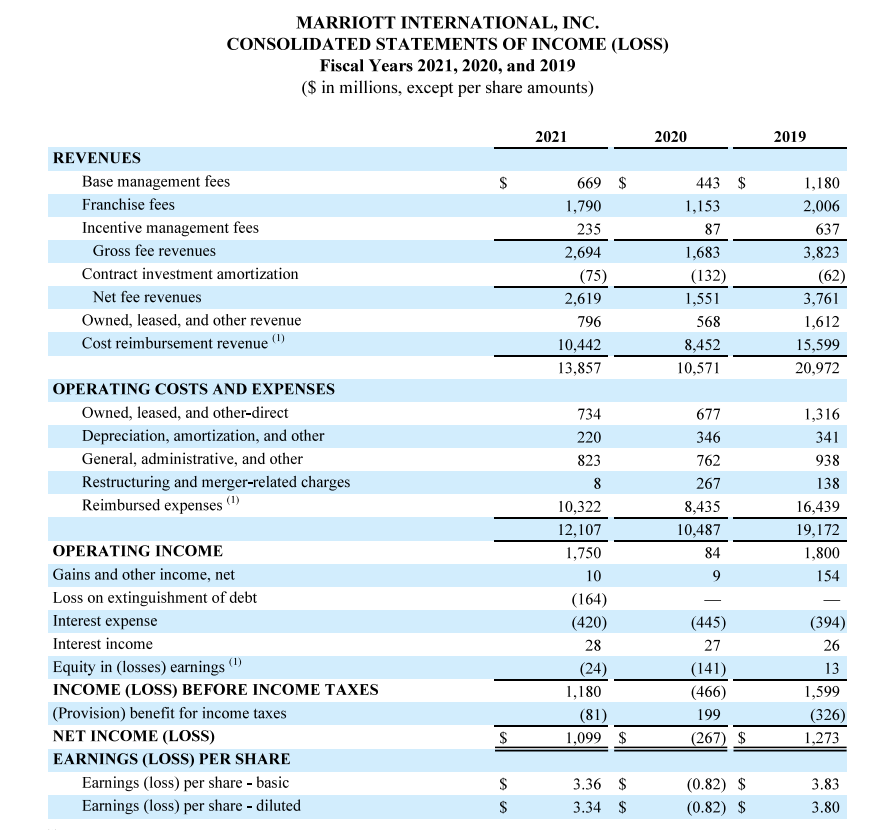

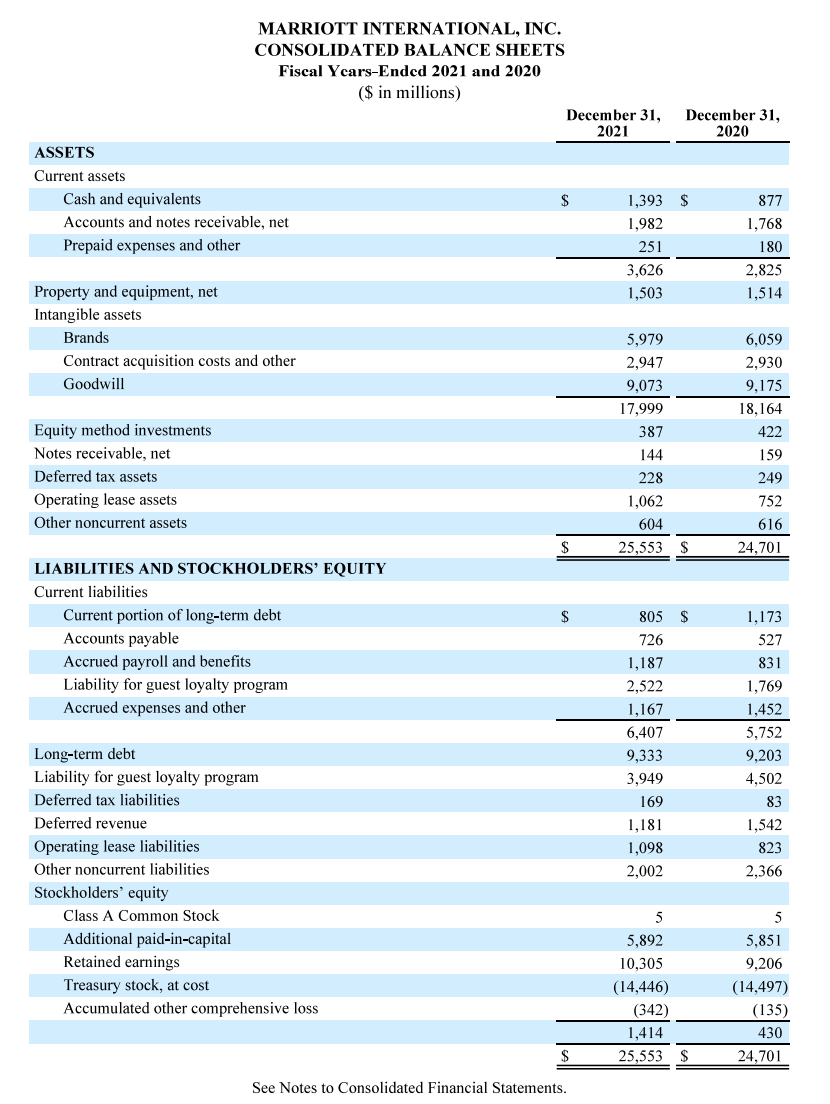

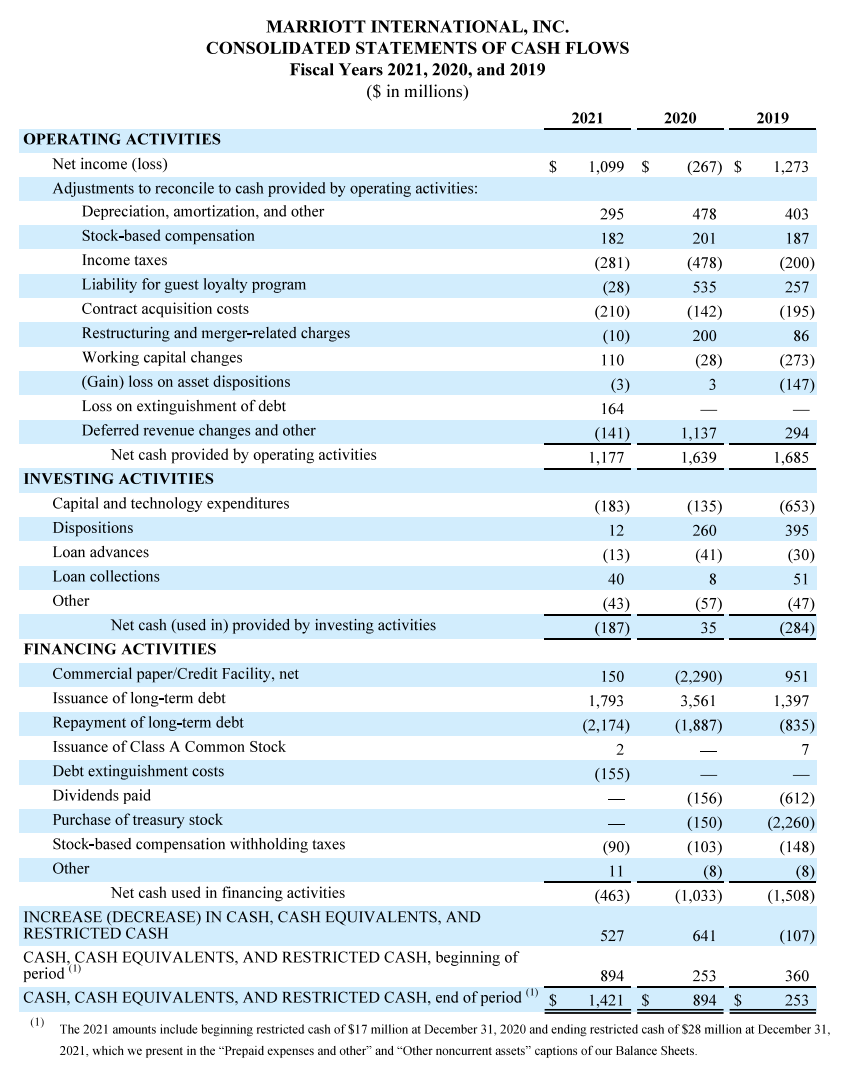

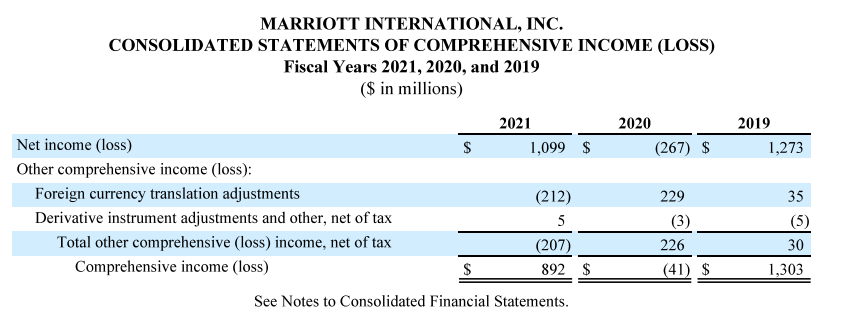

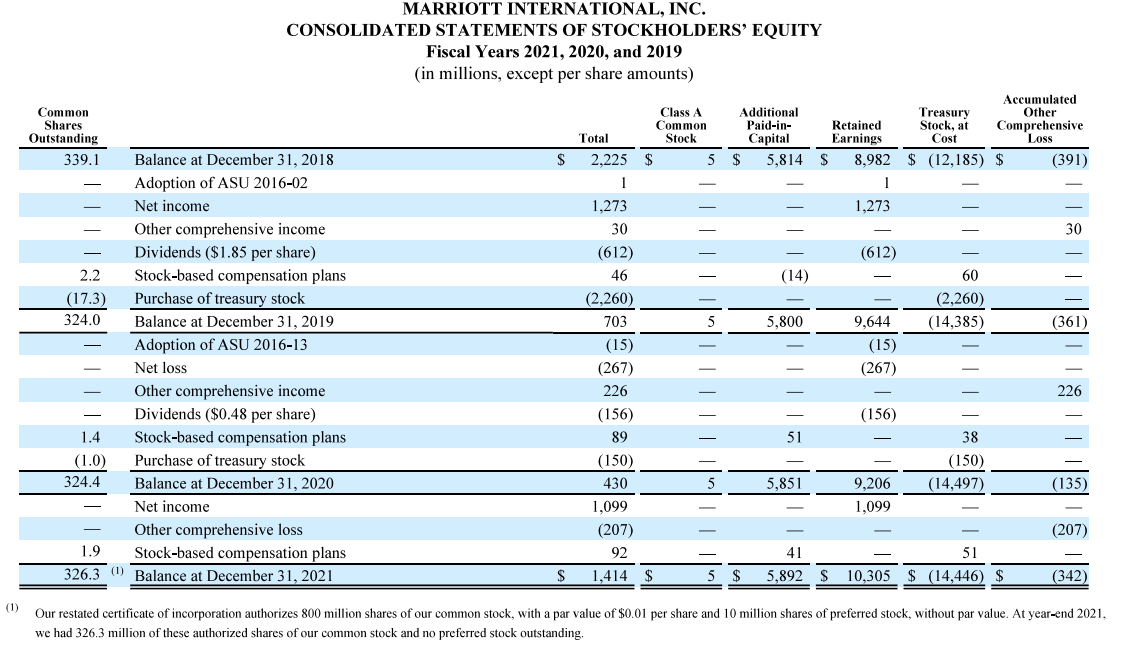

Please fill in the blanks in the table using the attached statements. Show all excel formulas. # of Times Interests Earned 1600 420 3.81 Income

Please fill in the blanks in the table using the attached statements. Show all excel formulas.

| # of Times Interests Earned | 1600 | 420 | 3.81 |

| Income before income tax | 1180 | ||

| Interest expense | 420 | ||

| OCF to Interest | 1597 | 420 | 3.80 |

| Operating cash flows | 1177 | ||

| Interest expense | 420 | ||

| Profitability Ratios | |||

| Profit Margin | given | given | calculated |

| Operating Efficiency Ratio | given | given | calculated |

| Gross ROA | given | calculated | calculated |

| 2020 assets | 24701 | ||

| Net ROA | 1099 | calculated | calculated |

| ROE | 1099 | calculated | |

| 2021 equity | 1414 | ||

| 2020 equity | 430 | ||

| EPS | given | calculated | calculated |

| P/E Ratio | $26.21 (09/27/22) | calculated | calculated |

| Turnover Ratios | |||

| Working Capital Turnover | given | calculated | calculated |

| Fixed Asset Turnover | given | calculated | calculated |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started