Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please fill in the highlighted areas. Show work. thanks! Blue Eyed Bexucy Supply is the dalk of the bown. When Baine searod her business, she

Please fill in the highlighted areas. Show work. thanks!

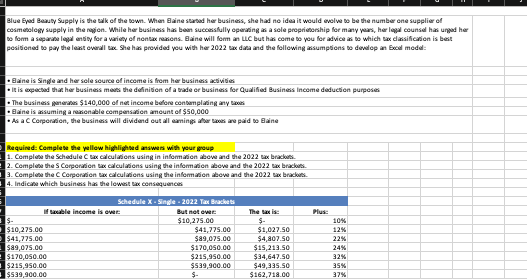

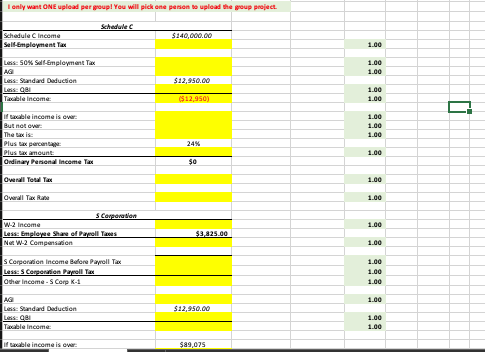

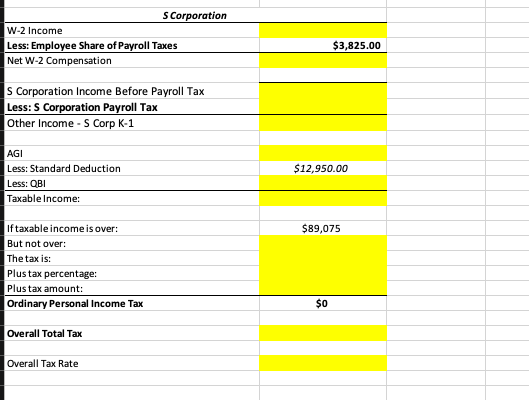

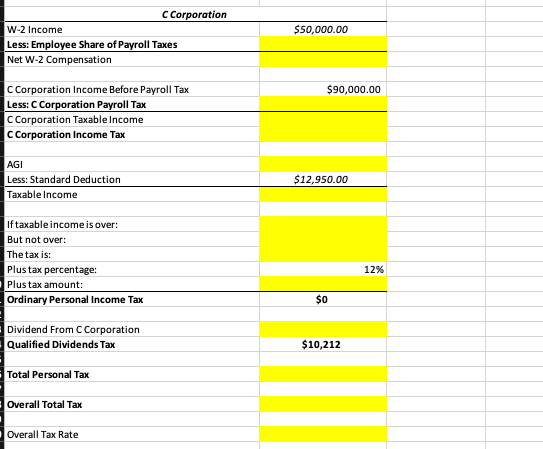

Blue Eyed Bexucy Supply is the dalk of the bown. When Baine searod her business, she had no idea it would evelve bo the the number ene supplier of - Baine is Single and her sole souroe of income is from her business activitio - It is expecbed that her businens meva the definitien of a bvade er businens fler Qualified Business inceme deductien purpeses - The business pererana $140,000 of net inceme belone cenbemplating any beok - Gaine is ansuming a rexenable cempersatien ameunt of $50,000 - As a C Cerperafien, the businens will dividend eut all emaings atber town are paid bo gaine Alequined: Cemplese the pellew highliwhsed answes with your moup 1. Complese the Schedule C cax calculariens using in informatien abeve and the 2022 exx braclust. 2. Complese the S Corperation cax calculations using the information aleve and the 2022 eax lariduts. 4. Indican which business har the lewest cax consequences I enly want oNE uplead per graupl Yau will pick ane penent bo uplead the group pnoject. SCorporation W-2 Income Less: Employee Share of Payroll Taxes Net W-2 Compensation S Corporation Income Before Payroll Tax Less: S Corporation Payroll Tax Other Income - S Corp K-1 AGI Less: Standard Deduction $12,950.00 Less: QBI Taxable Income: If taxable income is over: $89,075 But not over: The tax is: Plus tax percentage: Plus tax amount: Ordinary Personal Income Tax $0 Overall Total Tax Overall Tax Rate C Corporation W-2 Income $50,000.00 Less: Employee Share of Payroll Taxes Net W-2 Compensation C Corporation Income Before Payroll Tax $90,000.00 Less: C Corporation Payroll Tax C Corporation Taxable Income C Corporation Income Tax AGI Less: Standard Deduction Taxable Income If taxable income is over: But not over: The tax is: Plus tax percentage: 12% Plus tax amount: Ordinary Personal Income Tax $0 Dividend From C Corporation Qualified Dividends Tax $10,212 Total Personal Tax Overall Total Tax Overall Tax Rate Blue Eyed Bexucy Supply is the dalk of the bown. When Baine searod her business, she had no idea it would evelve bo the the number ene supplier of - Baine is Single and her sole souroe of income is from her business activitio - It is expecbed that her businens meva the definitien of a bvade er businens fler Qualified Business inceme deductien purpeses - The business pererana $140,000 of net inceme belone cenbemplating any beok - Gaine is ansuming a rexenable cempersatien ameunt of $50,000 - As a C Cerperafien, the businens will dividend eut all emaings atber town are paid bo gaine Alequined: Cemplese the pellew highliwhsed answes with your moup 1. Complese the Schedule C cax calculariens using in informatien abeve and the 2022 exx braclust. 2. Complese the S Corperation cax calculations using the information aleve and the 2022 eax lariduts. 4. Indican which business har the lewest cax consequences I enly want oNE uplead per graupl Yau will pick ane penent bo uplead the group pnoject. SCorporation W-2 Income Less: Employee Share of Payroll Taxes Net W-2 Compensation S Corporation Income Before Payroll Tax Less: S Corporation Payroll Tax Other Income - S Corp K-1 AGI Less: Standard Deduction $12,950.00 Less: QBI Taxable Income: If taxable income is over: $89,075 But not over: The tax is: Plus tax percentage: Plus tax amount: Ordinary Personal Income Tax $0 Overall Total Tax Overall Tax Rate C Corporation W-2 Income $50,000.00 Less: Employee Share of Payroll Taxes Net W-2 Compensation C Corporation Income Before Payroll Tax $90,000.00 Less: C Corporation Payroll Tax C Corporation Taxable Income C Corporation Income Tax AGI Less: Standard Deduction Taxable Income If taxable income is over: But not over: The tax is: Plus tax percentage: 12% Plus tax amount: Ordinary Personal Income Tax $0 Dividend From C Corporation Qualified Dividends Tax $10,212 Total Personal Tax Overall Total Tax Overall Tax Rate

Blue Eyed Bexucy Supply is the dalk of the bown. When Baine searod her business, she had no idea it would evelve bo the the number ene supplier of - Baine is Single and her sole souroe of income is from her business activitio - It is expecbed that her businens meva the definitien of a bvade er businens fler Qualified Business inceme deductien purpeses - The business pererana $140,000 of net inceme belone cenbemplating any beok - Gaine is ansuming a rexenable cempersatien ameunt of $50,000 - As a C Cerperafien, the businens will dividend eut all emaings atber town are paid bo gaine Alequined: Cemplese the pellew highliwhsed answes with your moup 1. Complese the Schedule C cax calculariens using in informatien abeve and the 2022 exx braclust. 2. Complese the S Corperation cax calculations using the information aleve and the 2022 eax lariduts. 4. Indican which business har the lewest cax consequences I enly want oNE uplead per graupl Yau will pick ane penent bo uplead the group pnoject. SCorporation W-2 Income Less: Employee Share of Payroll Taxes Net W-2 Compensation S Corporation Income Before Payroll Tax Less: S Corporation Payroll Tax Other Income - S Corp K-1 AGI Less: Standard Deduction $12,950.00 Less: QBI Taxable Income: If taxable income is over: $89,075 But not over: The tax is: Plus tax percentage: Plus tax amount: Ordinary Personal Income Tax $0 Overall Total Tax Overall Tax Rate C Corporation W-2 Income $50,000.00 Less: Employee Share of Payroll Taxes Net W-2 Compensation C Corporation Income Before Payroll Tax $90,000.00 Less: C Corporation Payroll Tax C Corporation Taxable Income C Corporation Income Tax AGI Less: Standard Deduction Taxable Income If taxable income is over: But not over: The tax is: Plus tax percentage: 12% Plus tax amount: Ordinary Personal Income Tax $0 Dividend From C Corporation Qualified Dividends Tax $10,212 Total Personal Tax Overall Total Tax Overall Tax Rate Blue Eyed Bexucy Supply is the dalk of the bown. When Baine searod her business, she had no idea it would evelve bo the the number ene supplier of - Baine is Single and her sole souroe of income is from her business activitio - It is expecbed that her businens meva the definitien of a bvade er businens fler Qualified Business inceme deductien purpeses - The business pererana $140,000 of net inceme belone cenbemplating any beok - Gaine is ansuming a rexenable cempersatien ameunt of $50,000 - As a C Cerperafien, the businens will dividend eut all emaings atber town are paid bo gaine Alequined: Cemplese the pellew highliwhsed answes with your moup 1. Complese the Schedule C cax calculariens using in informatien abeve and the 2022 exx braclust. 2. Complese the S Corperation cax calculations using the information aleve and the 2022 eax lariduts. 4. Indican which business har the lewest cax consequences I enly want oNE uplead per graupl Yau will pick ane penent bo uplead the group pnoject. SCorporation W-2 Income Less: Employee Share of Payroll Taxes Net W-2 Compensation S Corporation Income Before Payroll Tax Less: S Corporation Payroll Tax Other Income - S Corp K-1 AGI Less: Standard Deduction $12,950.00 Less: QBI Taxable Income: If taxable income is over: $89,075 But not over: The tax is: Plus tax percentage: Plus tax amount: Ordinary Personal Income Tax $0 Overall Total Tax Overall Tax Rate C Corporation W-2 Income $50,000.00 Less: Employee Share of Payroll Taxes Net W-2 Compensation C Corporation Income Before Payroll Tax $90,000.00 Less: C Corporation Payroll Tax C Corporation Taxable Income C Corporation Income Tax AGI Less: Standard Deduction Taxable Income If taxable income is over: But not over: The tax is: Plus tax percentage: 12% Plus tax amount: Ordinary Personal Income Tax $0 Dividend From C Corporation Qualified Dividends Tax $10,212 Total Personal Tax Overall Total Tax Overall Tax Rate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started