Please fill in the missing values

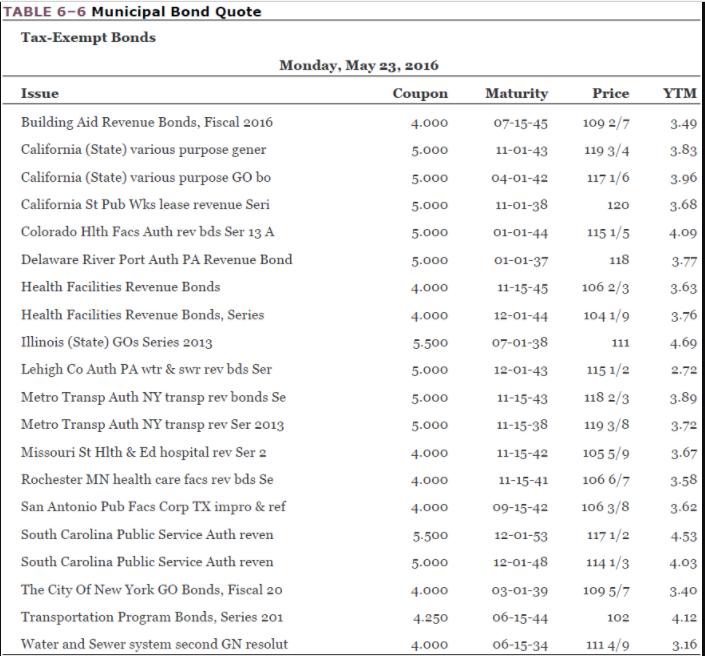

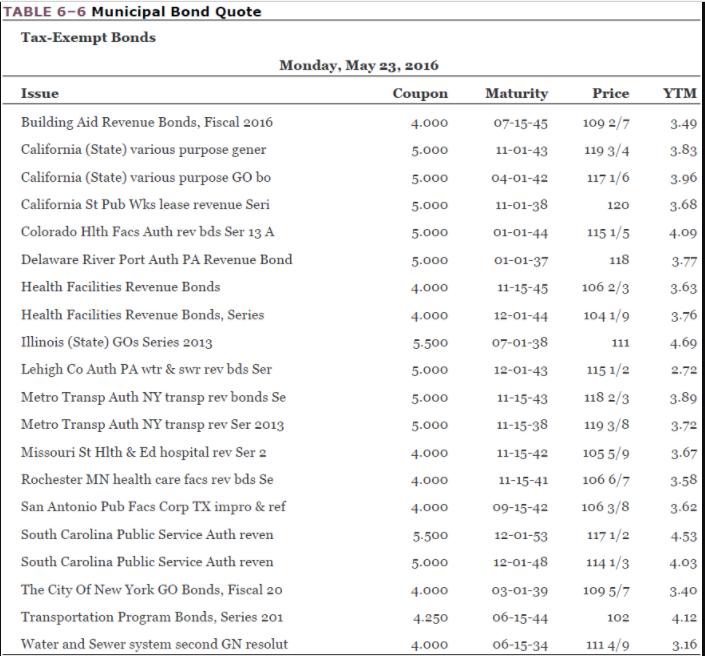

Maturity YTM 3-49 07-15-45 11-01-43 3.83 3.96 04-01-42 11-01-38 3.68 01-01-44 4.09 01-01-37 11-15-45 3.77 3.63 3.76 TABLE 6-6 Municipal Bond Quote Tax-Exempt Bonds Monday, May 23, 2016 Issue Coupon Building Aid Revenue Bonds, Fiscal 2016 4.000 California (State) various purpose gener 5.000 California (State) various purpose GO bo 5.000 California St Pub Wks lease revenue Seri 5.000 Colorado Hlth Facs Auth rev bds Ser 13 A 5.000 Delaware River Port Auth PA Revenue Bond 5.000 Health Facilities Revenue Bonds 4.000 Health Facilities Revenue Bonds, Series 4.000 Illinois (State) GOs Series 2013 5.500 Lehigh Co Auth PA wtr & swr rev bds Ser 5.000 Metro Transp Auth NY transp rev bonds Se 5.000 Metro Transp Auth NY transp rev Ser 2013 5.000 Missouri St Hlth & Ed hospital rev Ser 2 4.000 Rochester MN health care facs rev bds Se San Antonio Pub Facs Corp TX impro & ref 4.000 South Carolina Public Service Auth reven 5.500 South Carolina Public Service Auth reven 5.000 The City of New York GO Bonds, Fiscal 20 4.000 Transportation Program Bonds, Series 201 4.250 Water and Sewer system second GN resolut 4.000 12-01-44 07-01-38 12-01-43 4.69 Price 109 2/7 119 3/4 1171/6 120 115 1/5 118 106 2/3 104 1/9 111 1151/2 118 2/3 119 3/8 1055/9 106 6/7 106 3/8 1171/2 114 1/3 1095/7 102 1114/9 2.72 3.89 11-15-43 11-15-38 11-15-42 3.72 3.67 4.000 3-58 3.62 11-15-41 09-15-42 12-01-53 12-01-48 4.53 4.03 3.40 03-01-39 06-15-44 06-15-34 4.12 3.16 Refer to Table 6-6. a. On May 23, 2016, what were the coupon rate, price, and yield on municipal bonds issued by the Health Facilities Revenue Bonds, Series maturing on December 1, 2044? b. What was the yield to maturity, on May 23, 2016, on The City Of New York GO Bonds, Fiscal 20 maturing on March 1, 2039? (For all requirements, round your answers to 2 decimal places. (e.g., 32.16)) % a. Health Facilities Revenue Bonds, Series Coupon rate Price Yield % % % b Yield to maturity Maturity YTM 3-49 07-15-45 11-01-43 3.83 3.96 04-01-42 11-01-38 3.68 01-01-44 4.09 01-01-37 11-15-45 3.77 3.63 3.76 TABLE 6-6 Municipal Bond Quote Tax-Exempt Bonds Monday, May 23, 2016 Issue Coupon Building Aid Revenue Bonds, Fiscal 2016 4.000 California (State) various purpose gener 5.000 California (State) various purpose GO bo 5.000 California St Pub Wks lease revenue Seri 5.000 Colorado Hlth Facs Auth rev bds Ser 13 A 5.000 Delaware River Port Auth PA Revenue Bond 5.000 Health Facilities Revenue Bonds 4.000 Health Facilities Revenue Bonds, Series 4.000 Illinois (State) GOs Series 2013 5.500 Lehigh Co Auth PA wtr & swr rev bds Ser 5.000 Metro Transp Auth NY transp rev bonds Se 5.000 Metro Transp Auth NY transp rev Ser 2013 5.000 Missouri St Hlth & Ed hospital rev Ser 2 4.000 Rochester MN health care facs rev bds Se San Antonio Pub Facs Corp TX impro & ref 4.000 South Carolina Public Service Auth reven 5.500 South Carolina Public Service Auth reven 5.000 The City of New York GO Bonds, Fiscal 20 4.000 Transportation Program Bonds, Series 201 4.250 Water and Sewer system second GN resolut 4.000 12-01-44 07-01-38 12-01-43 4.69 Price 109 2/7 119 3/4 1171/6 120 115 1/5 118 106 2/3 104 1/9 111 1151/2 118 2/3 119 3/8 1055/9 106 6/7 106 3/8 1171/2 114 1/3 1095/7 102 1114/9 2.72 3.89 11-15-43 11-15-38 11-15-42 3.72 3.67 4.000 3-58 3.62 11-15-41 09-15-42 12-01-53 12-01-48 4.53 4.03 3.40 03-01-39 06-15-44 06-15-34 4.12 3.16 Refer to Table 6-6. a. On May 23, 2016, what were the coupon rate, price, and yield on municipal bonds issued by the Health Facilities Revenue Bonds, Series maturing on December 1, 2044? b. What was the yield to maturity, on May 23, 2016, on The City Of New York GO Bonds, Fiscal 20 maturing on March 1, 2039? (For all requirements, round your answers to 2 decimal places. (e.g., 32.16)) % a. Health Facilities Revenue Bonds, Series Coupon rate Price Yield % % % b Yield to maturity