Please fill in the numbers below. Thanks :)

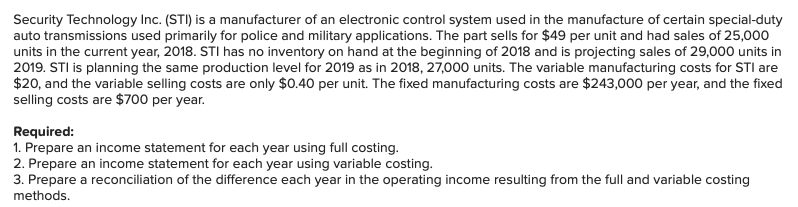

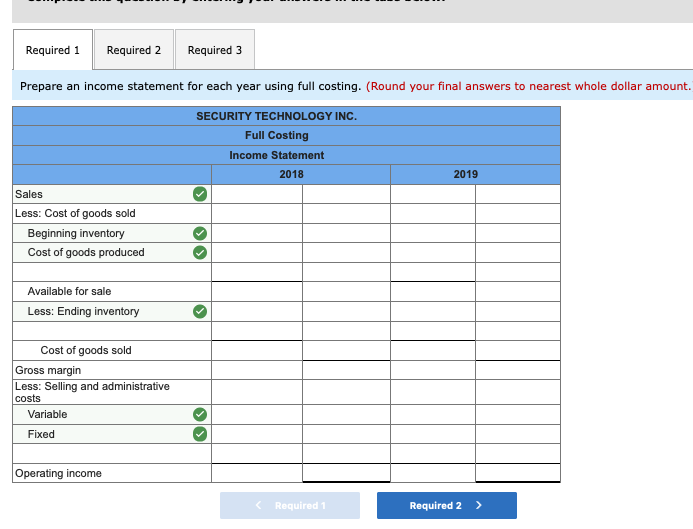

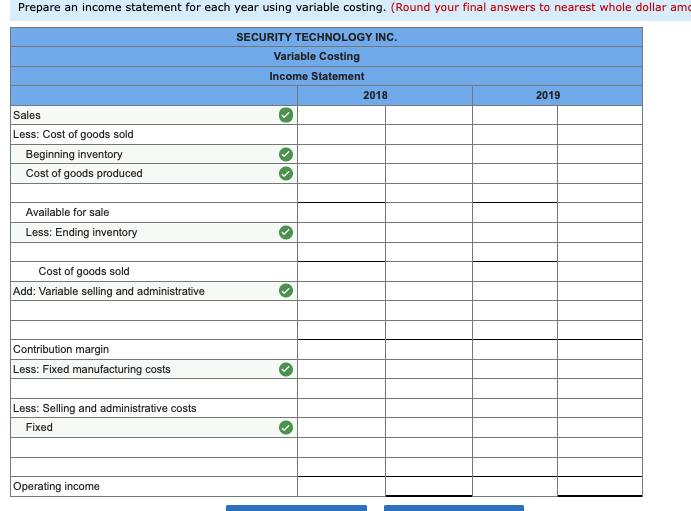

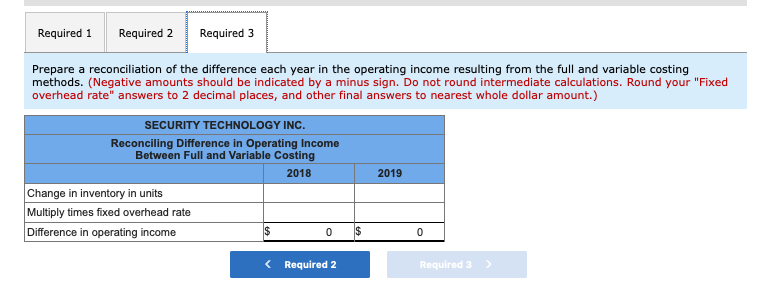

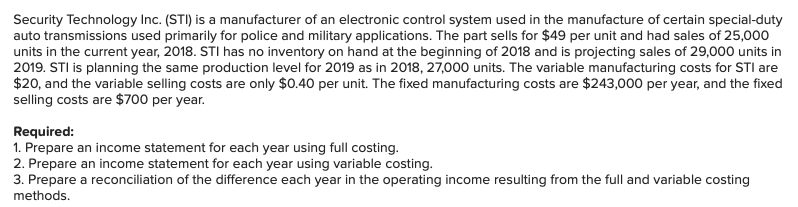

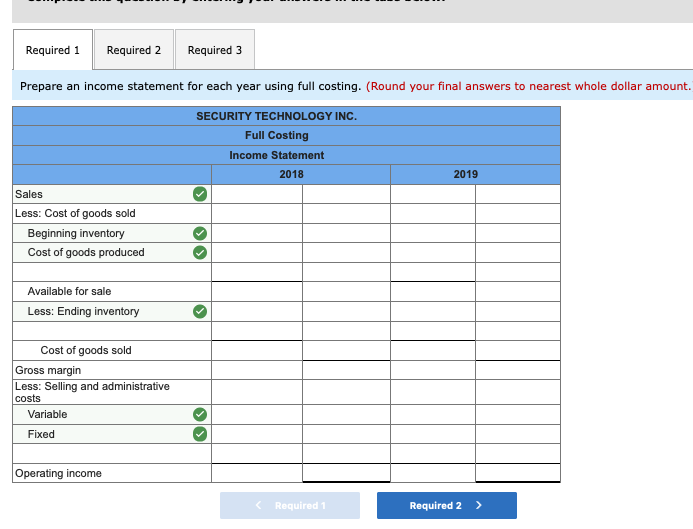

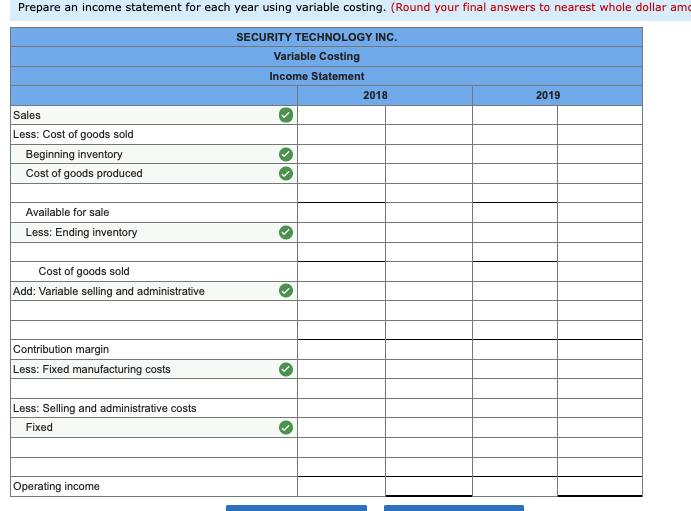

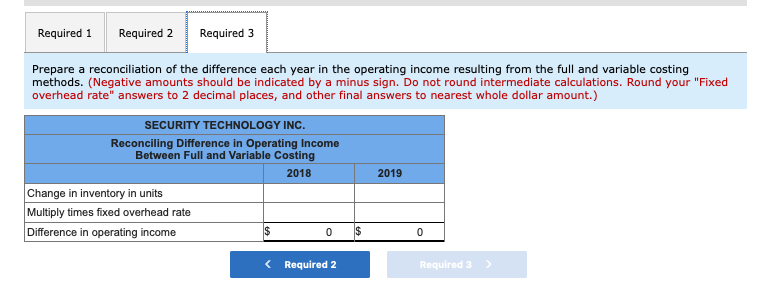

Security Technology Inc. (STI) is a manufacturer of an electronic control system used in the manufacture of certain special-duty auto transmissions used primarily for police and military applications. The part sells for $49 per unit and had sales of 25,000 units in the current year, 2018. STI has no inventory on hand at the beginning of 2018 and is projecting sales of 29,000 units in 2019. STI is planning the same production level for 2019 as in 2018, 27,000 units. The variable manufacturing costs for STI are $20, and the variable selling costs are only $0.40 per unit. The fixed manufacturing costs are $243,000 per year, and the fixed selling costs are $700 per year. Required: 1. Prepare an income statement for each year using full costing. 2. Prepare an income statement for each year using variable costing. 3. Prepare a reconciliation of the difference each year in the operating income resulting from the full and variable costing methods. Required 1 Required 2 Required 3 Prepare an income statement for each year using full costing. (Round your final answers to nearest whole dollar amount. SECURITY TECHNOLOGY INC. Full Costing Income Statement 2018 2019 Sales Less: Cost of goods sold Beginning inventory Cost of goods produced Available for sale Less: Ending inventory Cost of goods sold Gross margin Less: Selling and administrative costs Variable Fixed Operating income Prepare an income statement for each year using variable costing. (Round your final answers to nearest whole dollar am SECURITY TECHNOLOGY INC. Variable Costing Income Statement 2018 2019 Sales Less: Cost of goods sold Beginning inventory Cost of goods produced Available for sale Less: Ending inventory Cost of goods sold Add: Variable selling and administrative Contribution margin Less: Fixed manufacturing costs Less: Selling and administrative costs Fixed Operating income Required 1 Required 2 Required 3 Prepare a reconciliation of the difference each year in the operating income resulting from the full and variable costing methods. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your "Fixed overhead rate" answers to 2 decimal places, and other final answers to nearest whole dollar amount.) Reconciling Difference in Operating Income Between Full and Variable Costing 2018 2019 Change in inventory in units Multiply times fixed overhead rate Difference in operating income 0 $ 0