please fill in the remaining formulas and show work.

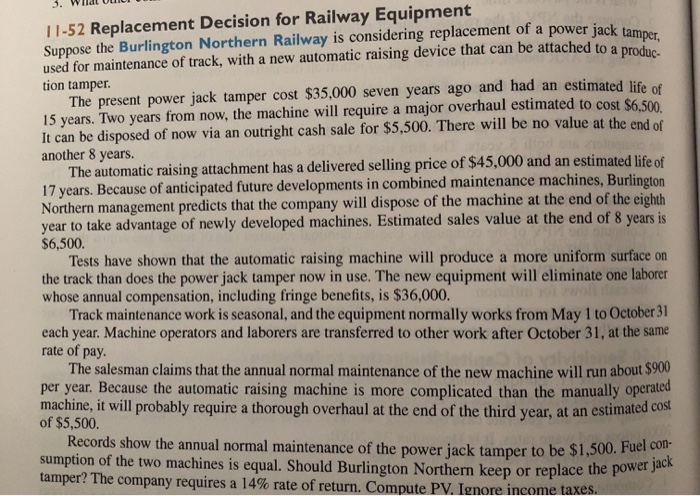

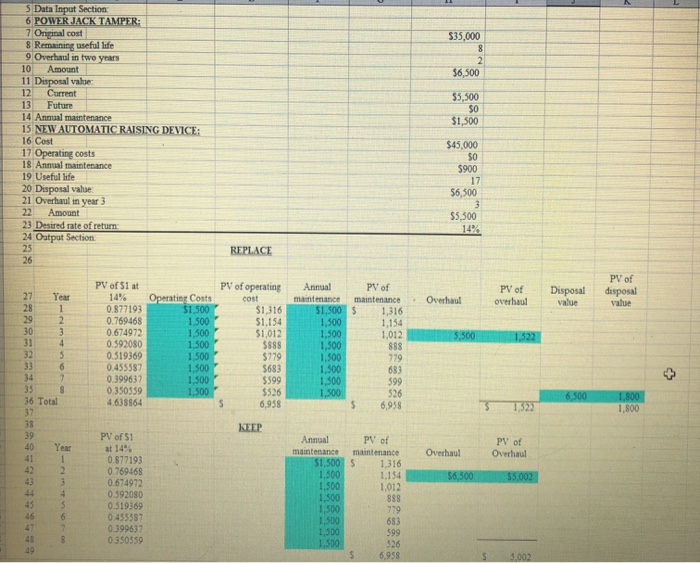

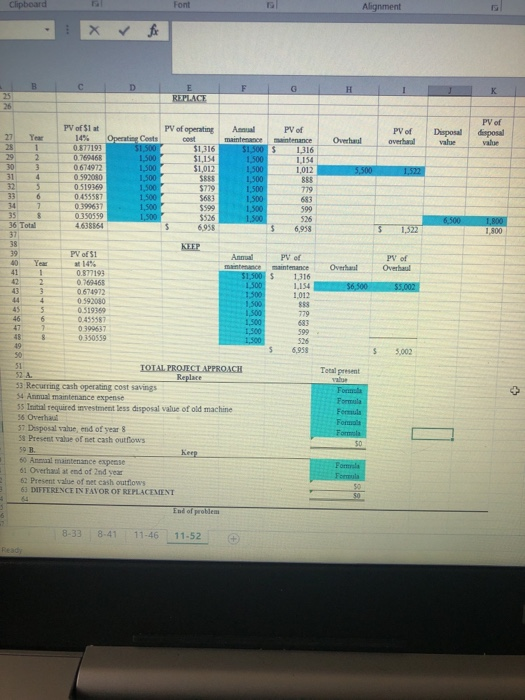

11-52 Replacement Decision for Railway Equipment used for maintenance of track, with a new automatic raising device that can be attached to a produc- Suppose the Burlington Northern Railway is considering replacement of a power jack tamper, tion tamper The present power jack tamper cost $35,000 seven years ago and had an estimated life of 15 years. Two years from now, the machine will require a major overhaul estimated to cost $6,500 It can be disposed of now via an outright cash sale for $5,500. There will be no value at the end of another 8 years. The automatic raising attachment has a delivered selling price of $45,000 and an estimated life of 17 years. Because of anticipated future developments in combined maintenance machines, Burlington Northern management predicts that the company will dispose of the machine at the end of the eighth year to take advantage of newly developed machines. Estimated sales value at the end of 8 years is $6,500. Tests have shown that the automatic raising machine will produce a more uniform surface on the track than does the power jack tamper now in use. The new equipment will eliminate one laborer whose annual compensation, including fringe benefits, is $36,000. Track maintenance work is seasonal, and the equipment normally works from May 1 to October 31 each year. Machine operators and laborers are transferred to other work after October 31, at the same rate of pay. The salesman claims that the annual normal maintenance of the new machine will run about $900 per year. Because the automatic raising machine is more complicated than the manually operated machine, it will probably require a thorough overhaul at the end of the third year, at an estimated cost of $5,500 Records show the annual normal maintenance of the power jack tamper to be $1,500. Fuel con sumption of the two machines is equal. Should Burlington Northern keep or replace the power jack tamper? The company requires a 14% rate of return. Compute PV. Ignore income taxes. $35,000 2 $6,500 $5,500 $0 $1,500 5 Data Input Section 6 POWER JACK TAMPER: 7 Original cost 8 Remaining useful life 9 Overhaul in two years 10 Amount 11 Disposal value 12 Current 13 Future 14 Annual maintenance 15 NEW AUTOMATIC RAISING DEVICE: 16 Cost 17 Operating costs 18 Annual maintenance 19 Useful life 20 Disposal value 21 Overhaul in year 3 22 Amount 23 Desired rate of return 24 Output Section 25 26 $45,000 $0 $900 17 $6,500 $5,500 REPLACE PV of $1 at Overhaul Overhaul PV of overhaul PV of disposal value Disposal value 1 5,500 1,522 4 Operating Costs $1,500 1.500 1.500 1,500 1,500 1,500 1,500 1,500 0.877193 0.769468 0.674972 0.592080 0.519369 0.455587 0.399637 0.350359 4.638864 PV of operating cost $1,316 $1,154 $1,012 $888 $779 $683 $599 $526 S 6,958 888 Annual PV of maintenance maintenance $1,500 $ 1,316 1,500 1,154 1,500 1,012 1,500 1,500 779 1,500 1,500 599 1,500 526 $ 6,958 27 Year 28 29 2 30 31 32 5 33 6 34 33 36 Total 37 38 39 40 Year 41 42 2 3 44 4 683 + 7 8 6,500 3 1.522 1.800 1,800 KEEP Overhaul PV of Overhaul 56,500 $5.002 PV of S1 at 14% 0.877193 0.769468 0.674972 0.592080 0.519369 0.455587 0.399637 0.350559 Annual PV of maintenance maintenance $1,500 5 1,316 1,500 1.154 1,500 1,012 1,500 888 1,500 779 1,500 683 1,500 599 1.500 526 6,958 u 6 8 43 49 5,002 Clipboard Font Alignment B D K REPLACE 26 PV of operating PV of overhaal Overhaal PV of disposal value Disposal value cost $1,316 $1,154 $1,012 $888 $779 $683 Annual maintenance $1.500 1,500 1,500 1,500 1,500 1,500 1.500 1,500 5,500 PV of S1 at 14% Operating costs 0.877193 51.500 0.769468 1.500 0.674972 1,500 0.592080 1,500 0.519369 1,500 0.455587 1,500 0.399637 1,500 0.350559 1,500 4638554 1,522 PV of maintenance 1,316 1154 1,012 888 779 683 599 526 $ 6,958 7 $599 5 $526 6,938 27 Year 25 1 29 2 30 31 4 32 5 33 6 34 35 8 36 Total 37 38 39 40 Year 41 1 42 43 3 44 4 45 5 46 6 47 7 $ 1,522 1,800 1.800 KEEP Overhaal PV of Overhaul 56,500 55.002 PV of $1 at 14% 0.877193 0760465 0.674972 0.592080 0.519369 0.455587 0399637 0350559 Anal PV of maintenance 51,500 5 1,316 1.500 1,154 1500 1,012 1,500 893 1,500 779 1,500 683 1,500 599 1,500 526 3 6,958 19 $ 5,002 Total 51 TOTAL PROJECL APPROACH 52 A. Replace 53 Recurring cash operating cost savings 54 Annual maintenance expense 55 Initial required investment less disposal value of old machine 56 Overhaul 57 Disposal value, end of year 8 58 Present value of net cash outflows 59 B Keep 60 Annual maintenance expense 61 Overhaul at end of 2nd year 62 Present value of net cash outflows 63 DIFFERENCE IN FAVOR OF REPLACEMENT End of problem wao Formula Formula Formula Formal Formula $0 Formula Formula 50 50 8-33 8-41 11-46 11-52