Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please fill in the yellow area. Bentley Corporation's most recent financial statements. Use the following ratios and other selected information for the current and projected

please fill in the yellow area.

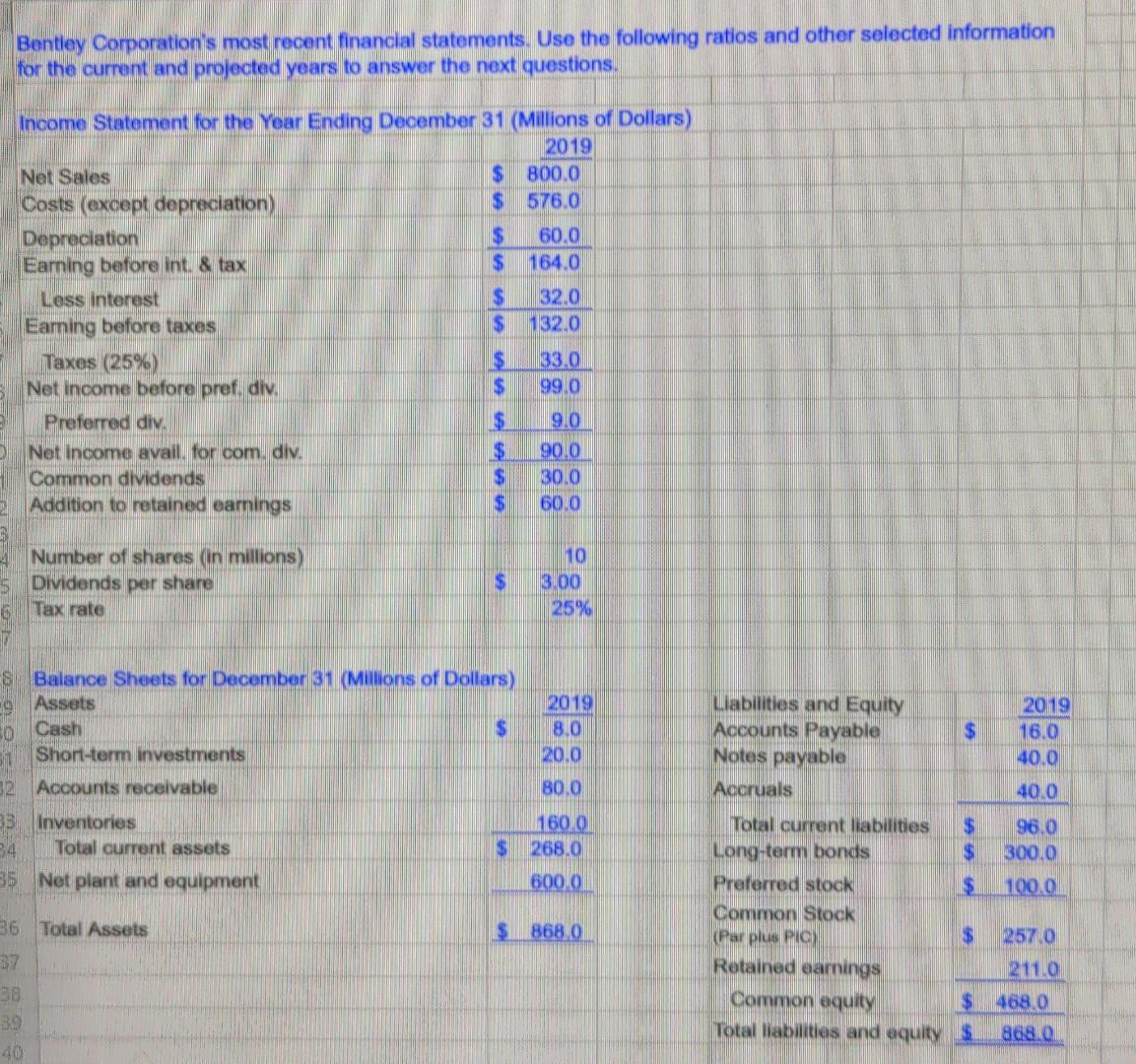

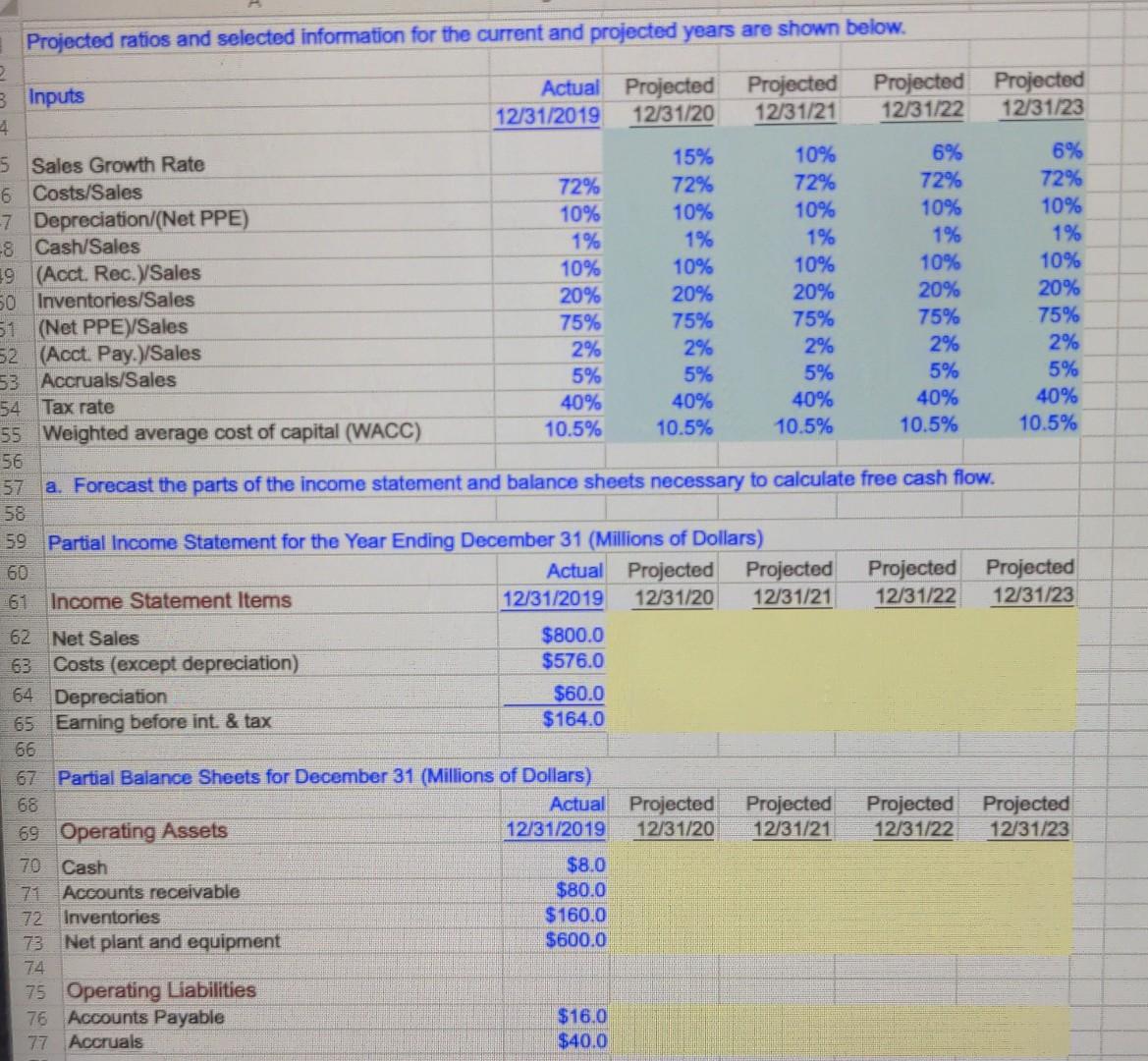

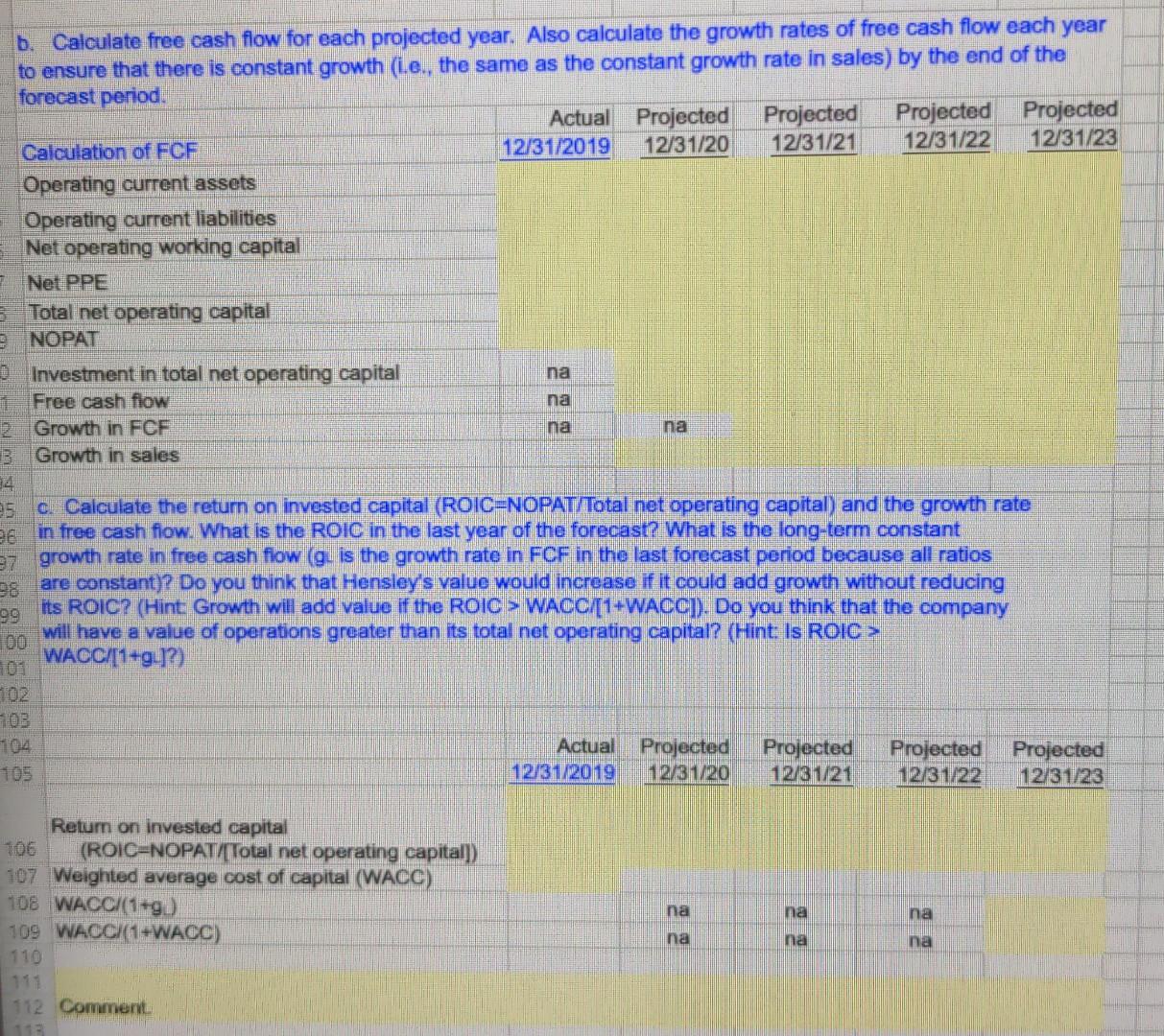

Bentley Corporation's most recent financial statements. Use the following ratios and other selected information for the current and projected years to answer the next questions. Income Statement for the Year Ending December 31 (Millions of Dollars) 2019 Net Sales $ 800.0 Costs (except depreciation) $ 576.0 Depreciation $ 60.0 Eaming before int. & tax $ 164.0 Less interest $ 32.0 Eaming before taxes S 132.0 Taxos (25% $ 33.0 Net income before pref. div. $ 99.0 Preferred div. $ 9,0 Net income avail, for com, div. $ Common dividends $ 30.0 Addition to retained eamings $ 60.0 90.0 Number of shares (in millions) 5. Dividends per share 6 Tax rate $ 10 3.00 25% $ 2019 16.0 40.0 8 Balance Sheets for December 31 (Millions of Dollars) 9 Assets 2019 0 Cash $ 8.0 31 Short-term investments 20.0 2 Accounts receivable 80.0 33 Inventories 160,0 34 Total current assets 268.0 36 Net plant and equipment 600.0 40.0 $ $ 96.0 300.0 Liabilities and Equity Accounts Payable Notes payable Accruals Total current liabilities Long-term bonds Preferred stock Common Stock (Par plus PIC Retained earnings Common equity Total liabilities and equity $ 100.0 36 Total Assets $868,0 $ 257 0 211.0 37 38 39 40 $ 468.0 8080 10% 1% 2% 5% Projected ratios and selected information for the current and projected years are shown below. 2 3 Inputs Actual Projected Projected Projected Projected 12/31/2019 12/31/20 4 12/31/21 12/31/22 12/31/23 5 Sales Growth Rate 15% 10% 6% 6% 6 Costs/Sales 72% 72% 72% 72% 72% 7 Depreciation/(Net PPE) 10% 10% 10% 10% -8 Cash/Sales 1% 1% 1% 1% 19 (Acct. Rec.)Sales 10% 10% 10% 10% 10% 50 Inventories/Sales 20% 20% 20% 20% 20% 51 (Net PPE)/Sales 75% 75% 75% 75% 75% 52 (Acct . Pay.)/Sales 2% 2% 2% 2% 53 Accruals/Sales 5% 5% 5% 5% 54 Tax rate 40% 40% 40% 40% 40% 55 Weighted average cost of capital (WACC) 10.5% 10.5% 10.5% 10.5% 10.5% 56 57 a. Forecast the parts of the income statement and balance sheets necessary to calculate free cash flow. 58 59 Partial Income Statement for the Year Ending December 31 (Millions of Dollars) 60 Actual Projected Projected Projected Projected Income Statement Items 12/31/2019 12/31/20 12/31/21 12/31/22 12/31/23 62 Net Sales $800.0 63 Costs (except depreciation) $576.0 64 Depreciation $60.0 65 Earning before int. & tax $164.0 66 67 Partial Balance Sheets for December 31 (Millions of Dollars) 68 Actual Projected Projected Projected Projected 69 Operating Assets 12/31/2019 12/31/20 12/31/21 12/31/22 12/31/23 70 Cash $8.0 71 Accounts receivable $80.0 72 Inventories $160.0 73 Net plant and equipment $600.0 74 75 Operating Liabilities 76 Accounts Payable $16.0 77 Accruals $40.0 b. Calculate free cash flow for each projected year. Also calculate the growth rates of free cash flow each year to ensure that there is constant growth (i.e., the same as the constant growth rate in sales) by the end of the forecast period. Actual Projected Projected Projected Projected Calculation of FCF 12/31/2019 12/31/20 12/31/21 12/31/22 12/31/23 Operating current assets Operating current liabilities Net operating working capital Net PPE Total net operating capital NOPAT Investment in total net operating capital Free cash flow na 2 Growth in FCF 13 Growth in sales na na na 25 c. Calculate the return on invested capital (ROIC=NOPAT/Total net operating capital) and the growth rate in free cash flow. What is the ROIC in the last year of the forecast? What is the long-term constant 97 growth rate in free cash fiow (g. is the growth rate in FCF in the last forecast period because all ratios are constant)? Do you think that Hensley's value would increase if it could add growth without reducing its ROIC? (Hint Growth will add value if the ROIC > WACC/(1+WACC). Do you think that the company 99 will have a value of operations greater than its total net operating capital? (Hint Is ROIC > WACC/[1+g-]?) 102 104 Actual Projected Projected 12/31/2019 12/31/20 12/31/21 Projected 12/31/22 Projected 12/31/23 Return on invested capital 106 (ROIC=NOPAT/Total net operating capital]) 107 Weighted average cost of capital (WACC) 108 WACC/(1+g 109 WACC (1+WACC) 110 na na na na na na 112 Comment 113 113 114 d. Calculate the current value of operations. (Hint First calculate the horizon value at the end of the forecast 115 period, which is equal to the value of operations at the end of the forecast period. Assume that the annual growth 116 rate beyond the horizon is equal to the growth rate at the horizon.) How does the current value of operations 117 compare with the current amount of total net operating capital? 118 119 Weighted average cost of capital (WACC) 10.5% 120 121 Actual Projected Projected Projected Projected 122 12/31/2019 12/31/20 12/31/21 12/31/22 12/31/23 123 Free cash flow 124 Long-term constant growth in FCF 125 Horizon value 126 127 Present value of horizon value 128 Present value of forecasted FCF 129 Value of operations (PV of HV] + [PV of FCF]) 130 131 Total net operating capital 132 133 134 Comment 135 136 e. Calculate the price per share of common equity as of 12/31/2019 137 138 Millions except price per share Actual 139 12/31/2019 140 Value of operations 141 + Value of short-term investments 142 Total value of company 143 Total value of all debt 144 - Value of preferred stock 145 Value of common equity 146 Divided by number of shares 147 Price per share Bentley Corporation's most recent financial statements. Use the following ratios and other selected information for the current and projected years to answer the next questions. Income Statement for the Year Ending December 31 (Millions of Dollars) 2019 Net Sales $ 800.0 Costs (except depreciation) $ 576.0 Depreciation $ 60.0 Eaming before int. & tax $ 164.0 Less interest $ 32.0 Eaming before taxes S 132.0 Taxos (25% $ 33.0 Net income before pref. div. $ 99.0 Preferred div. $ 9,0 Net income avail, for com, div. $ Common dividends $ 30.0 Addition to retained eamings $ 60.0 90.0 Number of shares (in millions) 5. Dividends per share 6 Tax rate $ 10 3.00 25% $ 2019 16.0 40.0 8 Balance Sheets for December 31 (Millions of Dollars) 9 Assets 2019 0 Cash $ 8.0 31 Short-term investments 20.0 2 Accounts receivable 80.0 33 Inventories 160,0 34 Total current assets 268.0 36 Net plant and equipment 600.0 40.0 $ $ 96.0 300.0 Liabilities and Equity Accounts Payable Notes payable Accruals Total current liabilities Long-term bonds Preferred stock Common Stock (Par plus PIC Retained earnings Common equity Total liabilities and equity $ 100.0 36 Total Assets $868,0 $ 257 0 211.0 37 38 39 40 $ 468.0 8080 10% 1% 2% 5% Projected ratios and selected information for the current and projected years are shown below. 2 3 Inputs Actual Projected Projected Projected Projected 12/31/2019 12/31/20 4 12/31/21 12/31/22 12/31/23 5 Sales Growth Rate 15% 10% 6% 6% 6 Costs/Sales 72% 72% 72% 72% 72% 7 Depreciation/(Net PPE) 10% 10% 10% 10% -8 Cash/Sales 1% 1% 1% 1% 19 (Acct. Rec.)Sales 10% 10% 10% 10% 10% 50 Inventories/Sales 20% 20% 20% 20% 20% 51 (Net PPE)/Sales 75% 75% 75% 75% 75% 52 (Acct . Pay.)/Sales 2% 2% 2% 2% 53 Accruals/Sales 5% 5% 5% 5% 54 Tax rate 40% 40% 40% 40% 40% 55 Weighted average cost of capital (WACC) 10.5% 10.5% 10.5% 10.5% 10.5% 56 57 a. Forecast the parts of the income statement and balance sheets necessary to calculate free cash flow. 58 59 Partial Income Statement for the Year Ending December 31 (Millions of Dollars) 60 Actual Projected Projected Projected Projected Income Statement Items 12/31/2019 12/31/20 12/31/21 12/31/22 12/31/23 62 Net Sales $800.0 63 Costs (except depreciation) $576.0 64 Depreciation $60.0 65 Earning before int. & tax $164.0 66 67 Partial Balance Sheets for December 31 (Millions of Dollars) 68 Actual Projected Projected Projected Projected 69 Operating Assets 12/31/2019 12/31/20 12/31/21 12/31/22 12/31/23 70 Cash $8.0 71 Accounts receivable $80.0 72 Inventories $160.0 73 Net plant and equipment $600.0 74 75 Operating Liabilities 76 Accounts Payable $16.0 77 Accruals $40.0 b. Calculate free cash flow for each projected year. Also calculate the growth rates of free cash flow each year to ensure that there is constant growth (i.e., the same as the constant growth rate in sales) by the end of the forecast period. Actual Projected Projected Projected Projected Calculation of FCF 12/31/2019 12/31/20 12/31/21 12/31/22 12/31/23 Operating current assets Operating current liabilities Net operating working capital Net PPE Total net operating capital NOPAT Investment in total net operating capital Free cash flow na 2 Growth in FCF 13 Growth in sales na na na 25 c. Calculate the return on invested capital (ROIC=NOPAT/Total net operating capital) and the growth rate in free cash flow. What is the ROIC in the last year of the forecast? What is the long-term constant 97 growth rate in free cash fiow (g. is the growth rate in FCF in the last forecast period because all ratios are constant)? Do you think that Hensley's value would increase if it could add growth without reducing its ROIC? (Hint Growth will add value if the ROIC > WACC/(1+WACC). Do you think that the company 99 will have a value of operations greater than its total net operating capital? (Hint Is ROIC > WACC/[1+g-]?) 102 104 Actual Projected Projected 12/31/2019 12/31/20 12/31/21 Projected 12/31/22 Projected 12/31/23 Return on invested capital 106 (ROIC=NOPAT/Total net operating capital]) 107 Weighted average cost of capital (WACC) 108 WACC/(1+g 109 WACC (1+WACC) 110 na na na na na na 112 Comment 113 113 114 d. Calculate the current value of operations. (Hint First calculate the horizon value at the end of the forecast 115 period, which is equal to the value of operations at the end of the forecast period. Assume that the annual growth 116 rate beyond the horizon is equal to the growth rate at the horizon.) How does the current value of operations 117 compare with the current amount of total net operating capital? 118 119 Weighted average cost of capital (WACC) 10.5% 120 121 Actual Projected Projected Projected Projected 122 12/31/2019 12/31/20 12/31/21 12/31/22 12/31/23 123 Free cash flow 124 Long-term constant growth in FCF 125 Horizon value 126 127 Present value of horizon value 128 Present value of forecasted FCF 129 Value of operations (PV of HV] + [PV of FCF]) 130 131 Total net operating capital 132 133 134 Comment 135 136 e. Calculate the price per share of common equity as of 12/31/2019 137 138 Millions except price per share Actual 139 12/31/2019 140 Value of operations 141 + Value of short-term investments 142 Total value of company 143 Total value of all debt 144 - Value of preferred stock 145 Value of common equity 146 Divided by number of shares 147 Price per shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

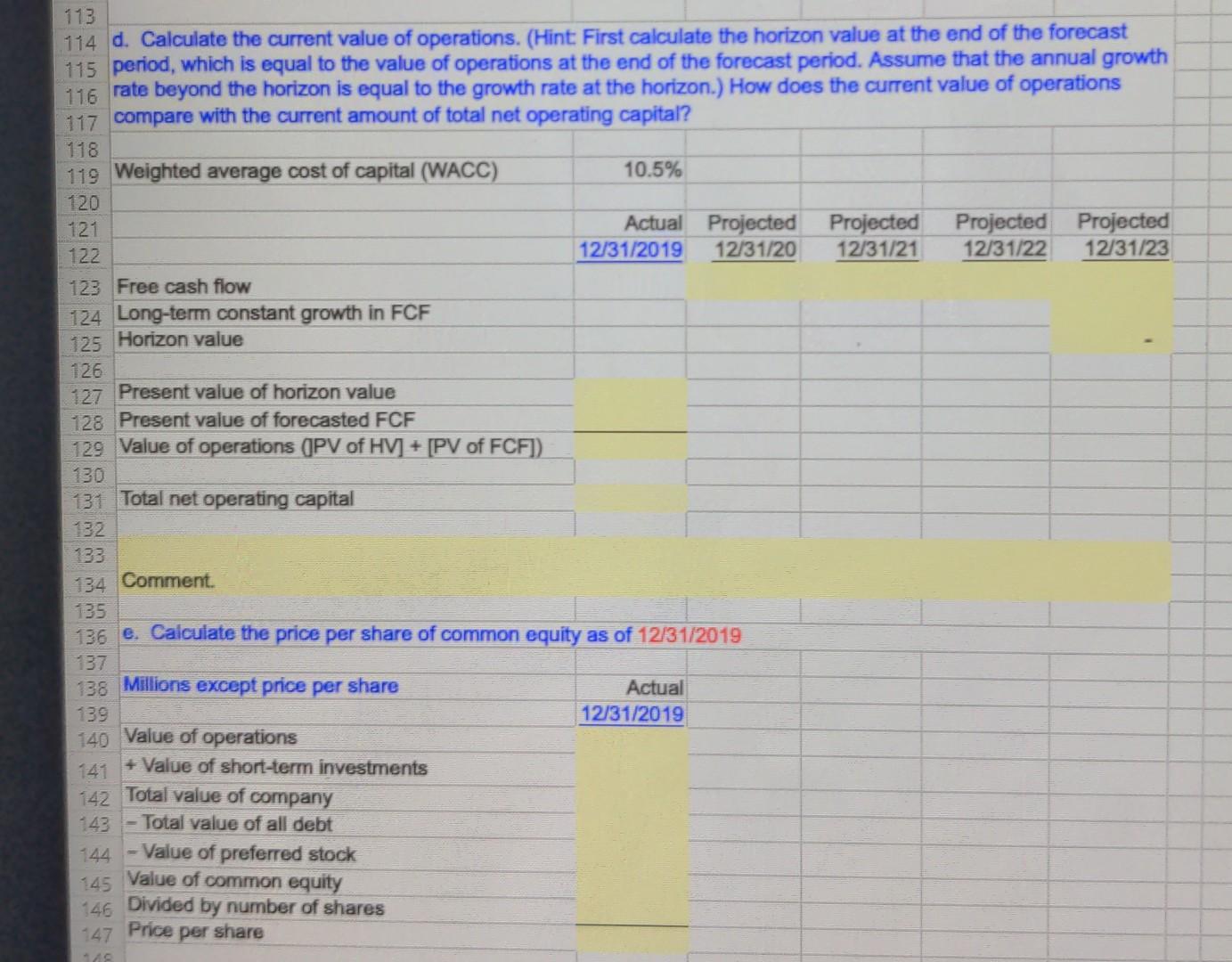

Get Started