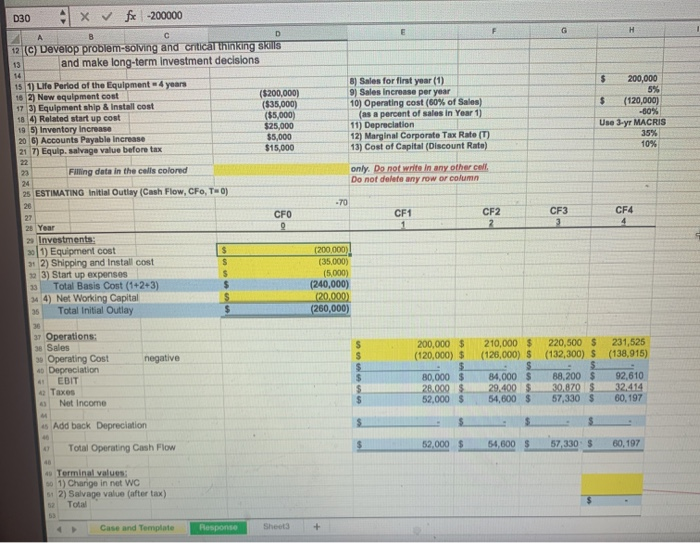

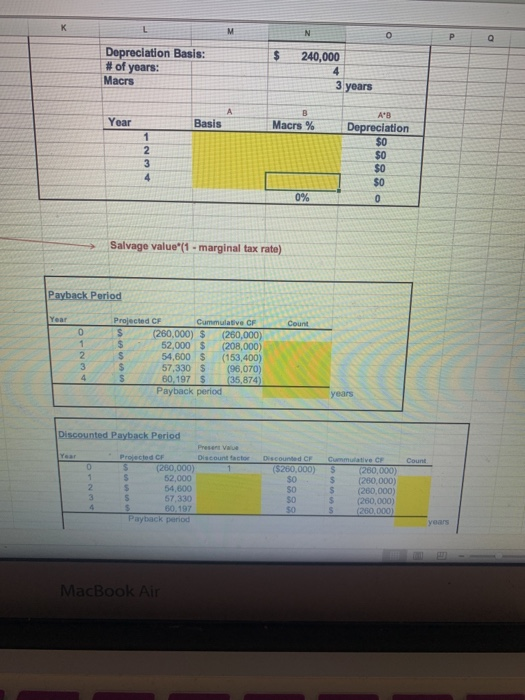

please fill in the yellow blanks only

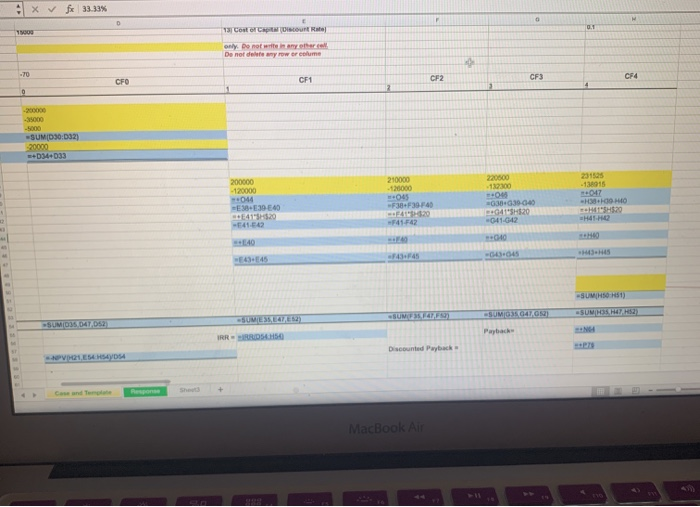

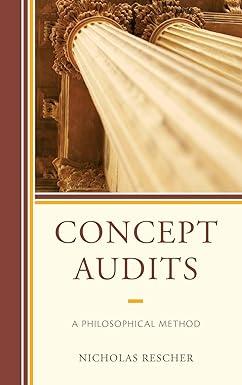

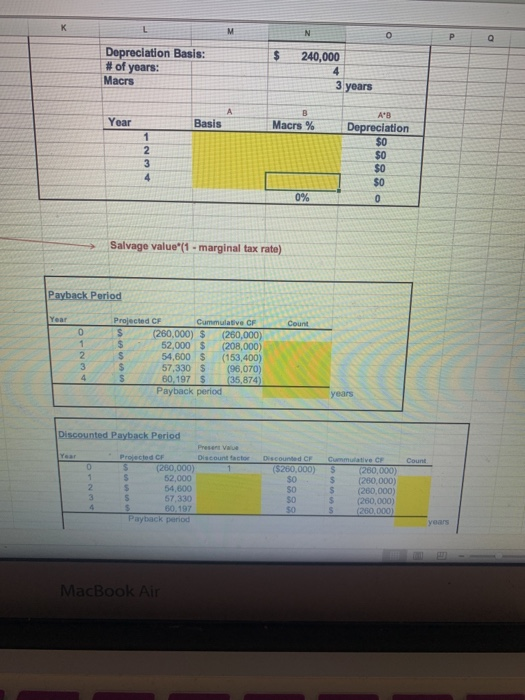

D30 4X fx -200000 A 12 C) Develop problem-solving and critical thinking skills and make long-term Investment decisions 200,000 15 1) Life Period of the Equipment 4 years 19 2) New equipment cost 17 3) Equipment ship & Install cost 184) Related start up cost 195) Inventory Increase 206) Accounts Payable Increase 21 ) Equip. salvage value before tax ($200,000) $35.000) ($5,000) $25.000 $5.000 $15.000 8) Sales for first year (1) 9) Sales increase per year 10) Operating cost (80% of Sales) (as a percent of sales in Year 1) 11) Depreciation 12) Marginal Corporate Tax Rate (T) 13) Cost of Capital (Discount Rate) (120,000) -60% Use 3-yr MACRIS 35% 109 Filing data in the cells colored only. Do not write in any other call Do not delete any row or column 25 ESTIMATING Initial Outlay (Cash Flow, CFO, T-) CFO CF2 2 Investments 301) Equipment cost 312) Shipping and Install cost 3) Start up expenses 33 Total Basis Cost (1+2+3) 344) Net Working Capital * Total Initial Outlay 200.000 (35,000) (5000) (240,000) 20.000) (260,000) negative 200,000 $ (120,000) $ 210,000 $ (126,000) $ 220,500 $ (132,300) $ 231,525 (138,915) 37 Operations: 38 Sales 30 Operating Cost Depreciation EDIT Taxes - Net Income 80,000 $ 28.000 $ 52,000 $ 84,000 29.400$ 54,600 $ 88200 $ 30,670 $ 57,330 $ 92,610 322414 60,197 45 Add back Depreciation Total Operating Cash Flow 52.000 $ 54,600 $ 57,330 $ 60,197 Terminal values: 501) Change in net WC 512) Salvage value (after tax) 62 Total Sheets + Depreciation Basis: # of years: 240,000 Macrs 3 years Year acns Depreciation & Salvage value"(1 - marginal tax rate) Payback Period Cumulative C (260,000) $ (260,000) 52,000 $ (208,000) 54,600 $ (153,400) 57,330 $ 96,070) 60,197 $ 35,874) Payback period Count icon CF 80 Discounted Payback Period Presente Your projected OF Discount factor (280,000) 52.000 54 000 57,330 0197 Payback period Cumulative 2 007000) 250.000 260.000 200,000) (260.000 DOS 1 Cost of t he Demoty GOOSE SUMD30:03) 2310 E38 E39 E40 E411H2O - 40 POSED OCHISO -6345 -04045 SUMO5047052 SUMI41.6 SUMO 1544 Depreciation Basis: of years: Maers years Depreciation VILNI NO M46 NAT"MET -SUMO4047 SUMN44 N47 Salvage Value 1 - marginal tax rate Pack PTG 54 GS M5960 MBO+61 M61 +62 M2+ Payback period Discounted Payback perio 71"M71 73" TA 7S MITS TNT 12N73 ON

please fill in the yellow blanks only

please fill in the yellow blanks only