Answered step by step

Verified Expert Solution

Question

1 Approved Answer

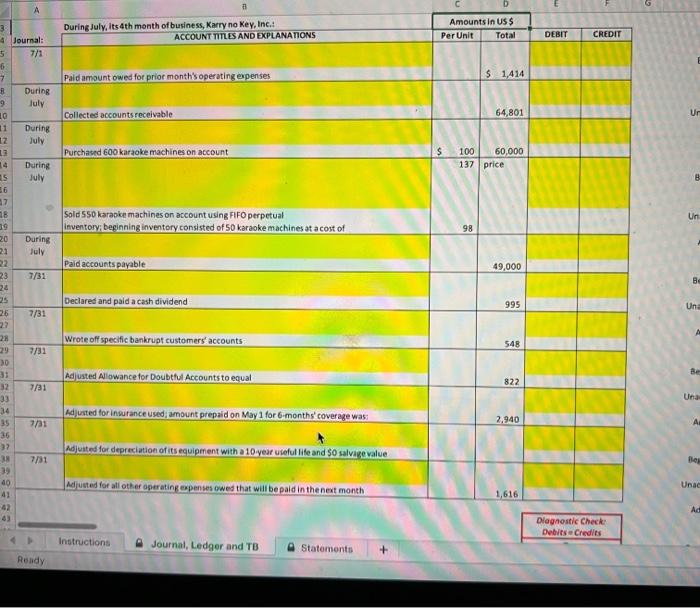

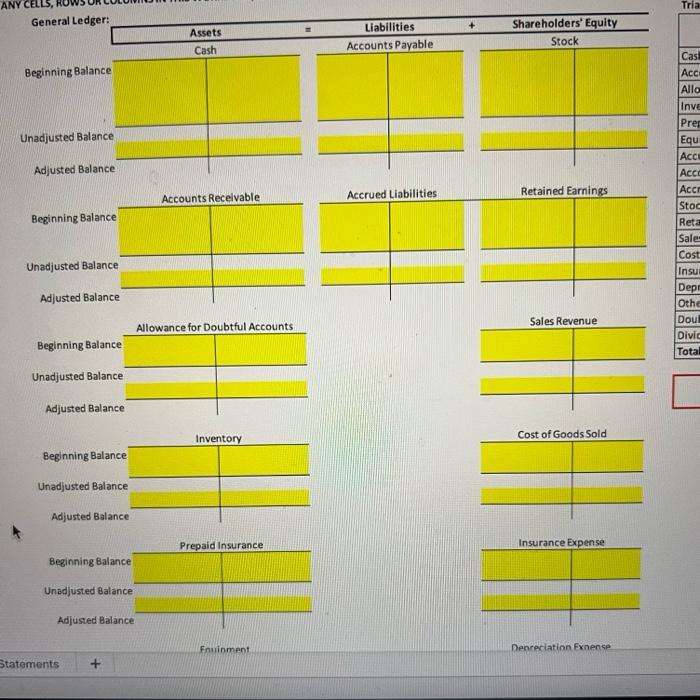

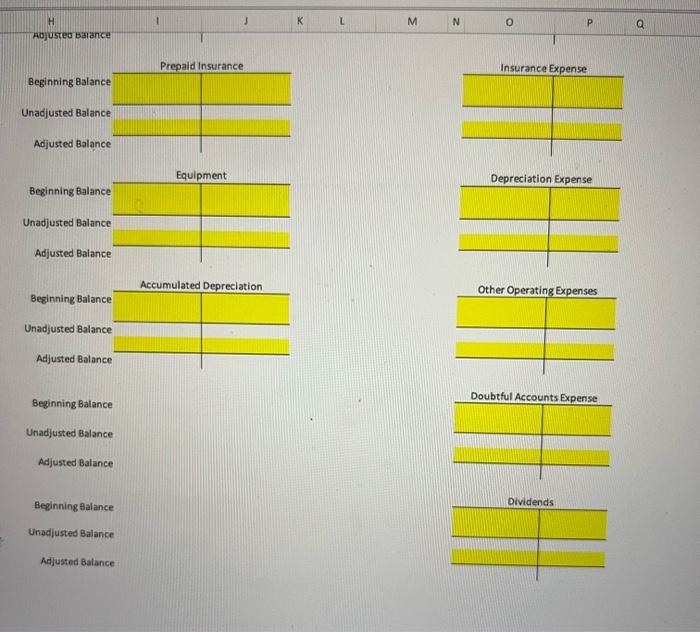

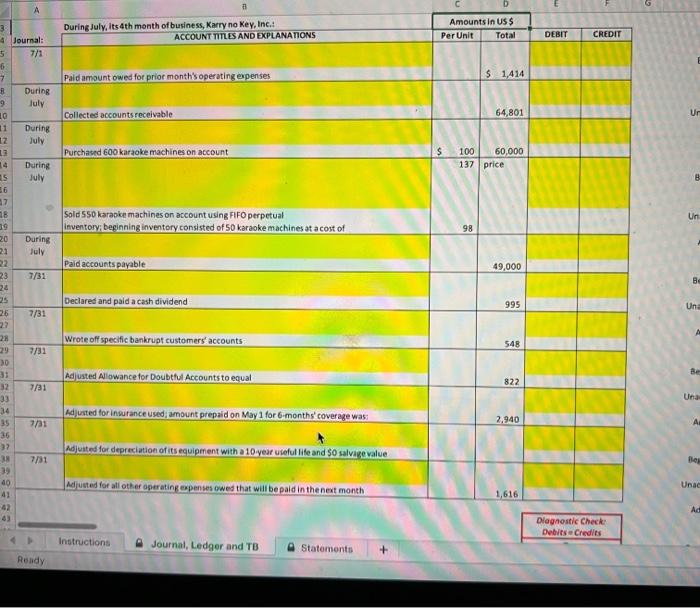

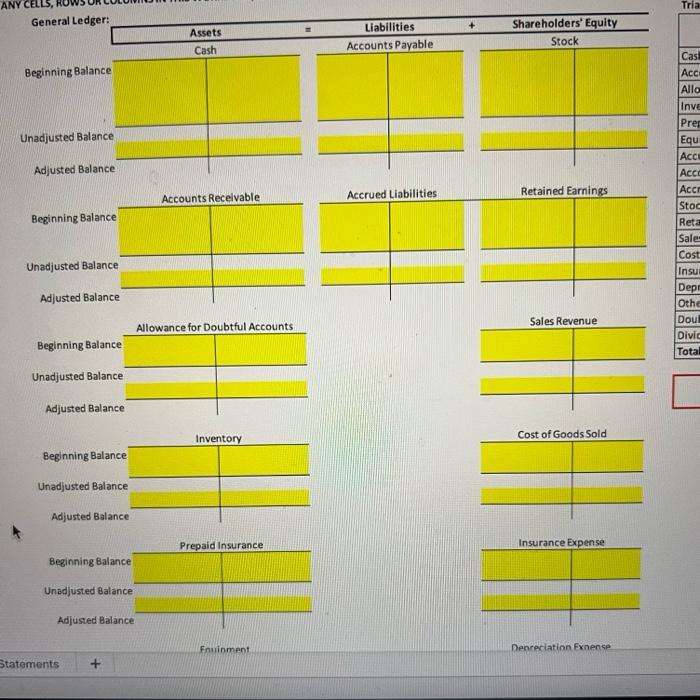

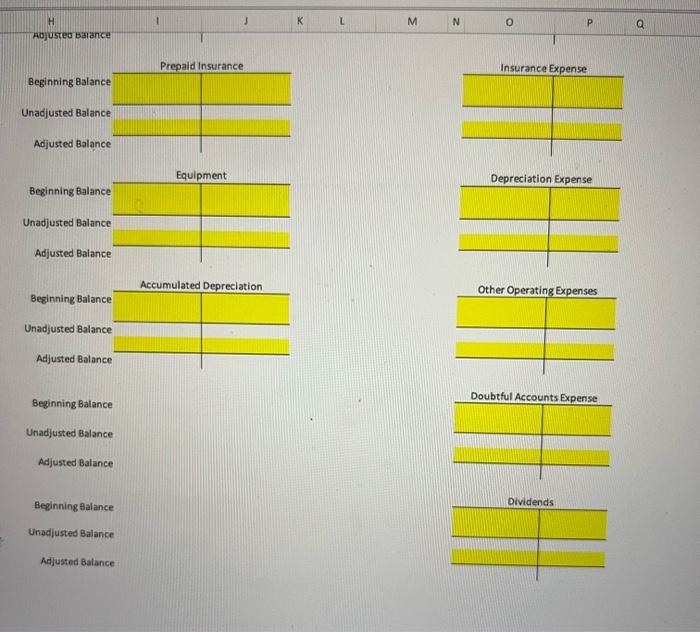

please fill in yellow areas and post formulas 3 4 Journal: 5 7/1 6 7 B During 9 July 10 During July During July 11

please fill in yellow areas and post formulas

3 4 Journal: 5 7/1 6 7 B During 9 July 10 During July During July 11 12 13 14 15 16 17 18 39 20 21 22 23 24 25 26 27 28 30 31 32 33 34 35 36 37 38 39 40 41 42 43 During July 7/31 7/31 7/31 7/31 7/31 7/31 Ready B During July, its 4th month of business, Karry no Key, Inc.: Paid amount owed for prior month's operating expenses Collected accounts receivable Purchased 600 karaoke machines on account Sold 550 karaoke machines on account using FIFO perpetual inventory; beginning inventory consisted of 50 karaoke machines at a cost of Paid accounts payable Declared and paid a cash dividend Wrote off specific bankrupt customers' accounts Adjusted Allowance for Doubtful Accounts to equal Adjusted for insurance used; amount prepaid on May 1 for 6-months' coverage was: Adjusted for depreciation of its equipment with a 10-year useful life and $0 salvage value Adjusted for all other operating expenses owed that will be paid in the next month Instructions Journal, Ledger and TB Statements + ACCOUNT TITLES AND EXPLANATIONS Amounts in US $ Total $ 1,414 64,801 60,000 Per Unit $ 100 137 price 98 49,000 995 548 822 2,940 1,616 DEBIT CREDIT Diagnostic Check: Debits Credits Un 8 Un Be Una A Be Una As Beg Unac Ad ANY CEL General Ledger: Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance. Beginning Balance Unadjusted Balance Adjusted Balance. Statements Assets Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Fouinment Liabilities Accounts Payable Accrued Liabilities. Shareholders' Equity Stock Retained Earnings Sales Revenue Cost of Goods Sold Insurance Expense Denreciation Exnense Tria Cas Acc Allo Inve Prep Equi Acce Acco Accr Stoc Reta Sales Cost Insur Depr Othe Doul Divic Total H Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance 1 Prepaid Insurance Equipment Accumulated Depreciation K L M N 0 P Insurance Expense Depreciation Expense Other Operating Expenses Doubtful Accounts Expense Dividends Q 3 4 Journal: 5 7/1 6 7 B During 9 July 10 During July During July 11 12 13 14 15 16 17 18 39 20 21 22 23 24 25 26 27 28 30 31 32 33 34 35 36 37 38 39 40 41 42 43 During July 7/31 7/31 7/31 7/31 7/31 7/31 Ready B During July, its 4th month of business, Karry no Key, Inc.: Paid amount owed for prior month's operating expenses Collected accounts receivable Purchased 600 karaoke machines on account Sold 550 karaoke machines on account using FIFO perpetual inventory; beginning inventory consisted of 50 karaoke machines at a cost of Paid accounts payable Declared and paid a cash dividend Wrote off specific bankrupt customers' accounts Adjusted Allowance for Doubtful Accounts to equal Adjusted for insurance used; amount prepaid on May 1 for 6-months' coverage was: Adjusted for depreciation of its equipment with a 10-year useful life and $0 salvage value Adjusted for all other operating expenses owed that will be paid in the next month Instructions Journal, Ledger and TB Statements + ACCOUNT TITLES AND EXPLANATIONS Amounts in US $ Total $ 1,414 64,801 60,000 Per Unit $ 100 137 price 98 49,000 995 548 822 2,940 1,616 DEBIT CREDIT Diagnostic Check: Debits Credits Un 8 Un Be Una A Be Una As Beg Unac Ad ANY CEL General Ledger: Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance. Beginning Balance Unadjusted Balance Adjusted Balance. Statements Assets Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Fouinment Liabilities Accounts Payable Accrued Liabilities. Shareholders' Equity Stock Retained Earnings Sales Revenue Cost of Goods Sold Insurance Expense Denreciation Exnense Tria Cas Acc Allo Inve Prep Equi Acce Acco Accr Stoc Reta Sales Cost Insur Depr Othe Doul Divic Total H Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance 1 Prepaid Insurance Equipment Accumulated Depreciation K L M N 0 P Insurance Expense Depreciation Expense Other Operating Expenses Doubtful Accounts Expense Dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started