please fill it by using above rules i must give an upvote please help. Me dear expert

please fill it by using above rules i must give an upvote please help. Me dear expert

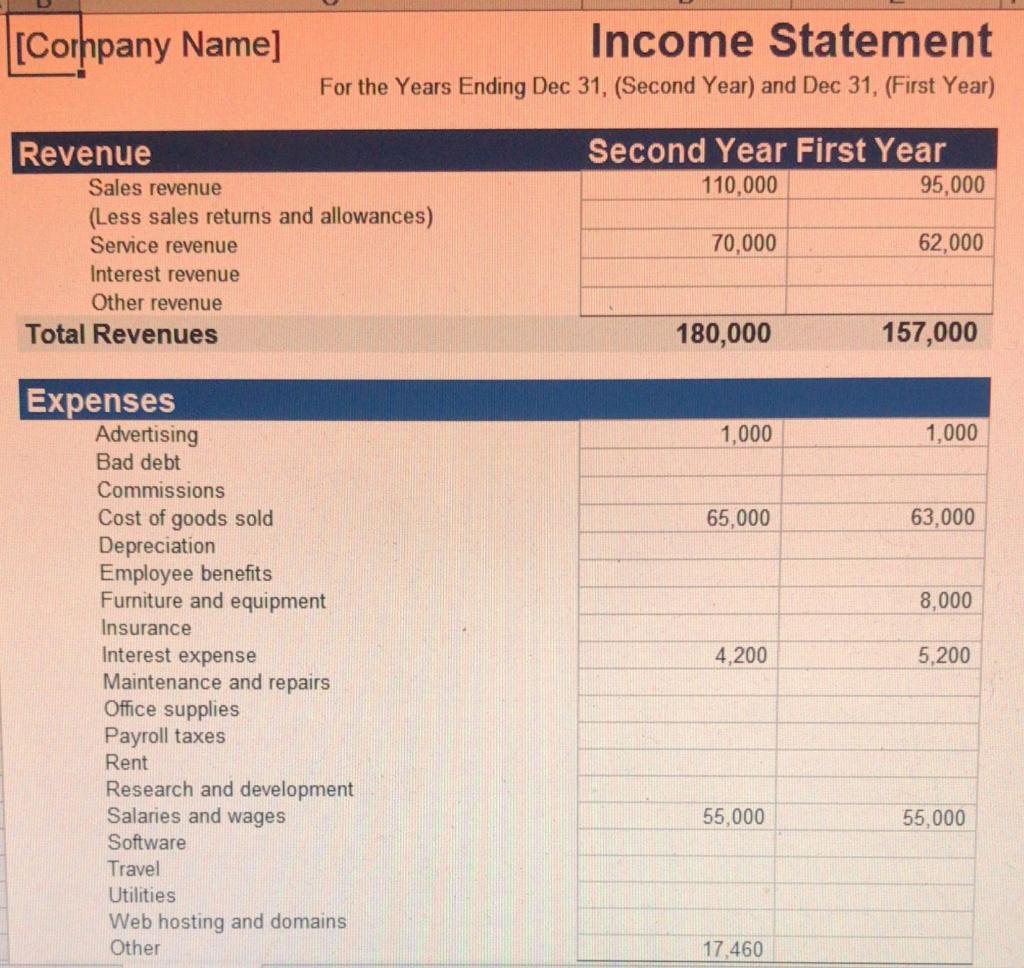

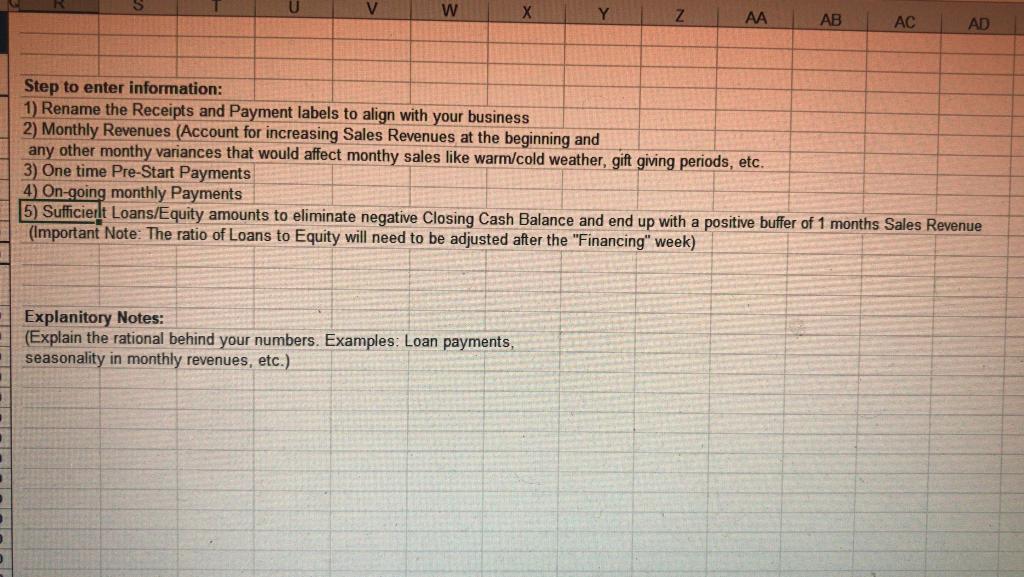

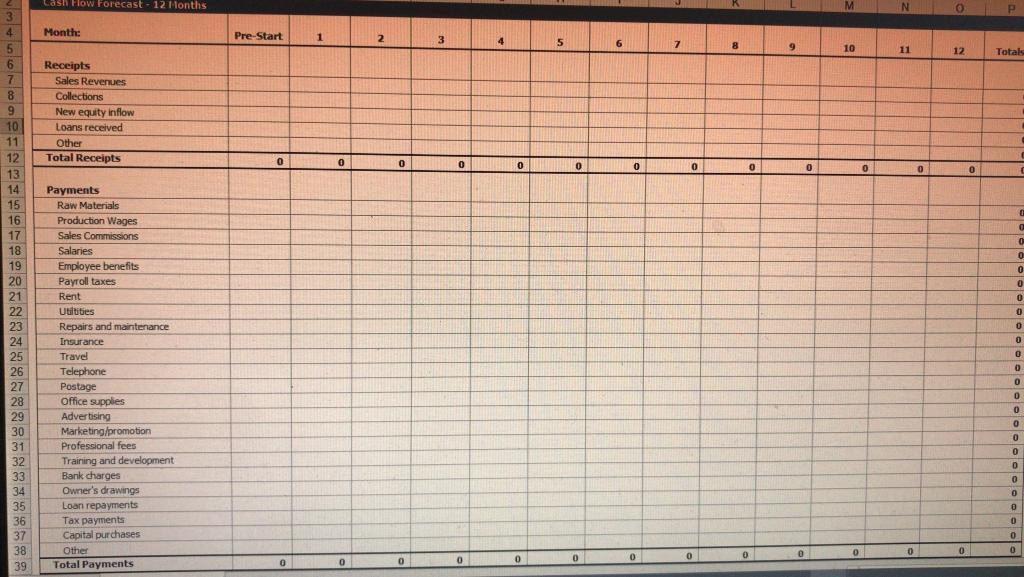

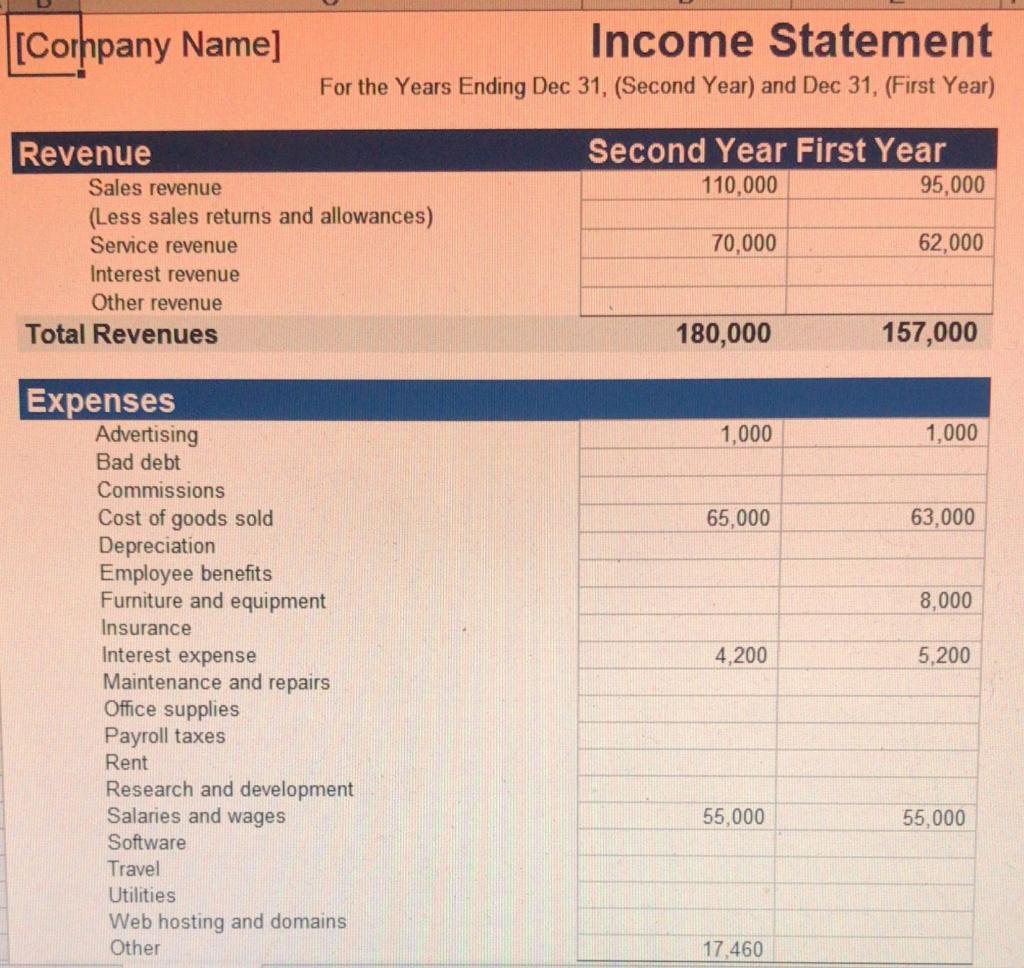

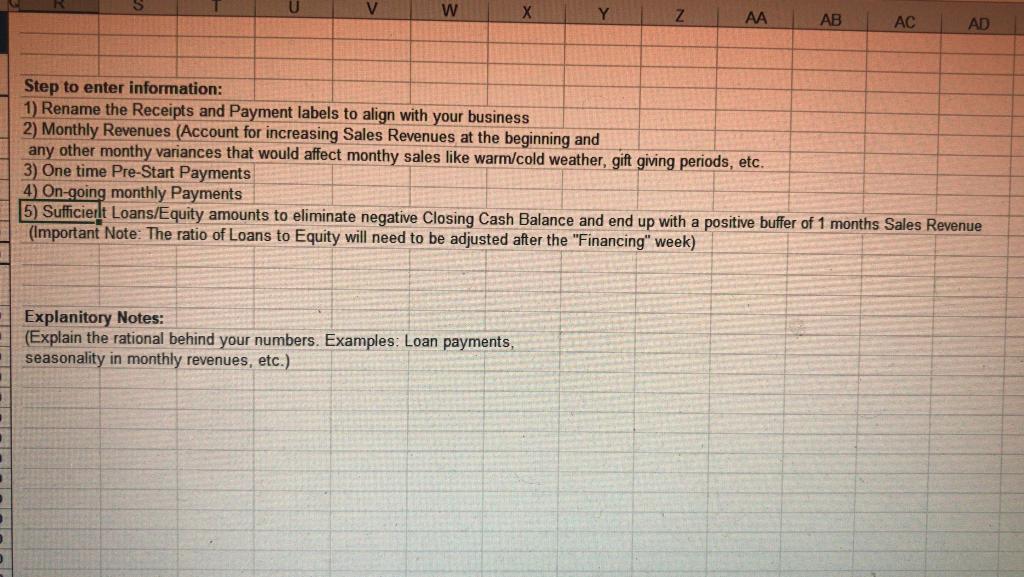

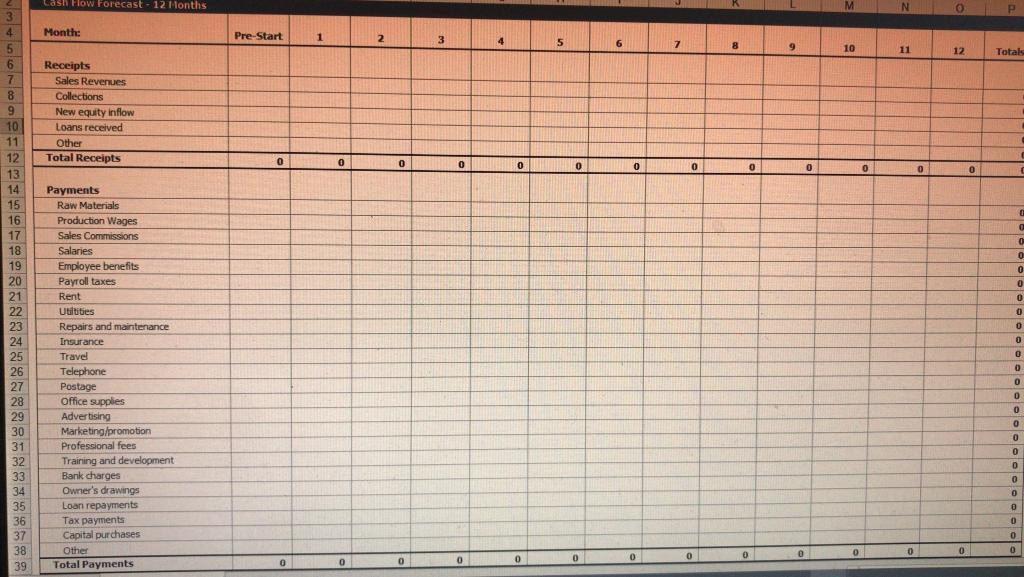

[Company Name] Income Statement For the Years Ending Dec 31, (Second Year) and Dec 31, (First Year) Second Year First Year 110,000 95,000 Revenue Sales revenue (Less sales retums and allowances) Service revenue Interest revenue Other revenue Total Revenues 70,000 62,000 180,000 157,000 1,000 1,000 65,000 63,000 8,000 4,200 5,200 Expenses Advertising Bad debt Commissions Cost of goods sold Depreciation Employee benefits Furniture and equipment Insurance Interest expense Maintenance and repairs Office supplies Payroll taxes Rent Research and development Salaries and wages Software Travel Utilities Web hosting and domains Other 55,000 55,000 17,460 U V w Y Z AB AC AD Step to enter information: 1) Rename the Receipts and Payment labels to align with your business 2) Monthly Revenues (Account for increasing Sales Revenues at the beginning and any other monthy variances that would affect monthy sales like warm/cold weather, gift giving periods, etc. 3) One time Pre-Start Payments 4) On-going monthly Payments 5) Sufficierlt Loans/Equity amounts to eliminate negative Closing Cash Balance and end up with a positive buffer of 1 months Sales Revenue (Important Note: The ratio of Loans to Equity will need to be adjusted after the "Financing" week) Explanitory Notes: (Explain the rational behind your numbers. Examples: Loan payments, seasonality in monthly revenues, etc.) . . Las Flow Forecast - 12 months M N P Month Pre-Start 1 1 2 3 4 5 6 7 8 9 10 3 4 5 6 b 7 8 11 12 Totals Receipts Sales Revenues Collections New equity Inflow Loans received Other Total Receipts 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 O Payments Raw Materials Production Wages Sales Commissions Salaries Employee benefits Payroll taxes Rent Uutities Repairs and maintenance Insurance Travel Telephone Postage Office supplies Advertising Marketing/promotion Professional fees Training and development Bank charges Owner's drawings Loan repayments Tax payments Capital purchases Other Total Payments 0 0 0 o 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 [Company Name] Income Statement For the Years Ending Dec 31, (Second Year) and Dec 31, (First Year) Second Year First Year 110,000 95,000 Revenue Sales revenue (Less sales retums and allowances) Service revenue Interest revenue Other revenue Total Revenues 70,000 62,000 180,000 157,000 1,000 1,000 65,000 63,000 8,000 4,200 5,200 Expenses Advertising Bad debt Commissions Cost of goods sold Depreciation Employee benefits Furniture and equipment Insurance Interest expense Maintenance and repairs Office supplies Payroll taxes Rent Research and development Salaries and wages Software Travel Utilities Web hosting and domains Other 55,000 55,000 17,460 U V w Y Z AB AC AD Step to enter information: 1) Rename the Receipts and Payment labels to align with your business 2) Monthly Revenues (Account for increasing Sales Revenues at the beginning and any other monthy variances that would affect monthy sales like warm/cold weather, gift giving periods, etc. 3) One time Pre-Start Payments 4) On-going monthly Payments 5) Sufficierlt Loans/Equity amounts to eliminate negative Closing Cash Balance and end up with a positive buffer of 1 months Sales Revenue (Important Note: The ratio of Loans to Equity will need to be adjusted after the "Financing" week) Explanitory Notes: (Explain the rational behind your numbers. Examples: Loan payments, seasonality in monthly revenues, etc.) . . Las Flow Forecast - 12 months M N P Month Pre-Start 1 1 2 3 4 5 6 7 8 9 10 3 4 5 6 b 7 8 11 12 Totals Receipts Sales Revenues Collections New equity Inflow Loans received Other Total Receipts 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 O Payments Raw Materials Production Wages Sales Commissions Salaries Employee benefits Payroll taxes Rent Uutities Repairs and maintenance Insurance Travel Telephone Postage Office supplies Advertising Marketing/promotion Professional fees Training and development Bank charges Owner's drawings Loan repayments Tax payments Capital purchases Other Total Payments 0 0 0 o 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

please fill it by using above rules i must give an upvote please help. Me dear expert

please fill it by using above rules i must give an upvote please help. Me dear expert