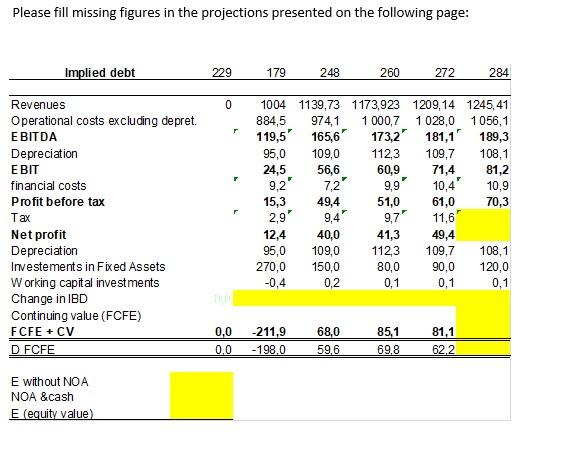

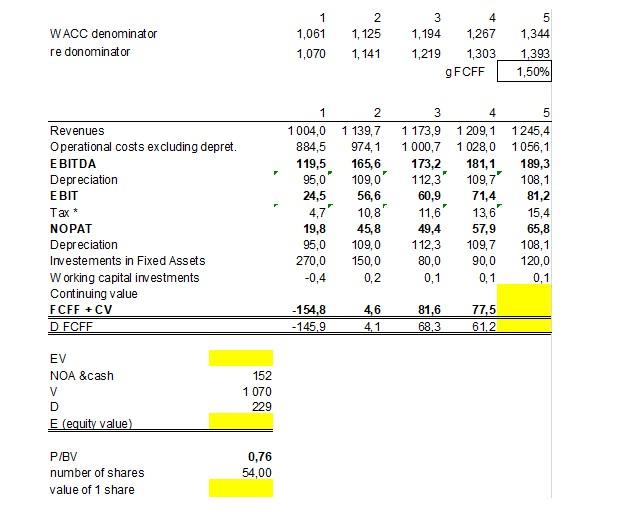

Please fill missing figures in the projections presented on the following page: WACC denominator re donominator 11,0611,07021,1251,14131,1941,21941,2671,303gFCFF51,3441,3931,50% \begin{tabular}{lrrrrr} & 1 & 2 & 3 & 4 & 5 \\ \hline Revenues & 1004,0 & 1139,7 & 1173,9 & 1209,1 & 1245,4 \\ Operational costs excluding depret. & 884,5 & 974,1 & 1000,7 & 1028,0 & 1056,1 \\ EBITDA & 119,5 & 165,6 & 173,2 & 181,1 & 189,3 \\ Depreciation & 95,0 & 109,rr & 112,3 & 109,rr & 108,1 \\ EBIT & 24,5 & 56,6 & 60,9 & 71,4 & 81,2 \\ Tax * & 4,7r & 10,8r & 11,6 & 13,6 & 15,4 \\ NOPAT & 19,8 & 45,8 & 49,4 & 57,9 & 65,8 \\ Depreciation & 95,0 & 109,0 & 112,3 & 109,7 & 108,1 \\ Irvestements in Fixed Assets & 270,0 & 150,0 & 80,0 & 90,0 & 120,0 \\ W orking capital irvestments & 0,4 & 0,2 & 0,1 & 0,1 & 0,1 \end{tabular} Continuing value \begin{tabular}{lcccc} FCFF + CV & 154,8 & 4,6 & 81,6 & 77,5 \\ \hline D FCFF & 145,9 & 4,1 & 68,3 & 61,2 \\ \hline \hline \end{tabular} \begin{tabular}{lr} EV & \\ NOA \&cash & 152 \\ V & 1070 \\ D & 229 \\ E (equity value) & \\ \hline \hline \end{tabular} PlBV 0,76 number of shares 54,00 value of 1 share Please fill missing figures in the projections presented on the following page: WACC denominator re donominator 11,0611,07021,1251,14131,1941,21941,2671,303gFCFF51,3441,3931,50% \begin{tabular}{lrrrrr} & 1 & 2 & 3 & 4 & 5 \\ \hline Revenues & 1004,0 & 1139,7 & 1173,9 & 1209,1 & 1245,4 \\ Operational costs excluding depret. & 884,5 & 974,1 & 1000,7 & 1028,0 & 1056,1 \\ EBITDA & 119,5 & 165,6 & 173,2 & 181,1 & 189,3 \\ Depreciation & 95,0 & 109,rr & 112,3 & 109,rr & 108,1 \\ EBIT & 24,5 & 56,6 & 60,9 & 71,4 & 81,2 \\ Tax * & 4,7r & 10,8r & 11,6 & 13,6 & 15,4 \\ NOPAT & 19,8 & 45,8 & 49,4 & 57,9 & 65,8 \\ Depreciation & 95,0 & 109,0 & 112,3 & 109,7 & 108,1 \\ Irvestements in Fixed Assets & 270,0 & 150,0 & 80,0 & 90,0 & 120,0 \\ W orking capital irvestments & 0,4 & 0,2 & 0,1 & 0,1 & 0,1 \end{tabular} Continuing value \begin{tabular}{lcccc} FCFF + CV & 154,8 & 4,6 & 81,6 & 77,5 \\ \hline D FCFF & 145,9 & 4,1 & 68,3 & 61,2 \\ \hline \hline \end{tabular} \begin{tabular}{lr} EV & \\ NOA \&cash & 152 \\ V & 1070 \\ D & 229 \\ E (equity value) & \\ \hline \hline \end{tabular} PlBV 0,76 number of shares 54,00 value of 1 share