please fill out all areas with formulas and explain. will upvote. thanks.

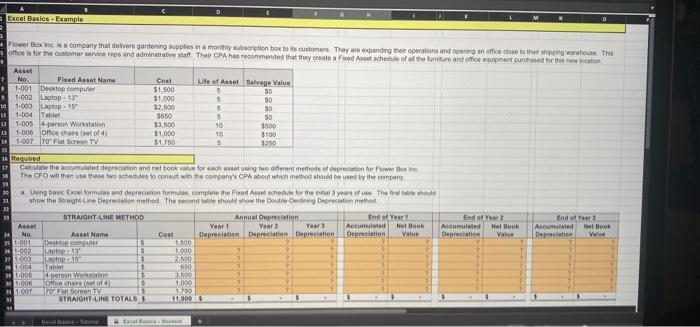

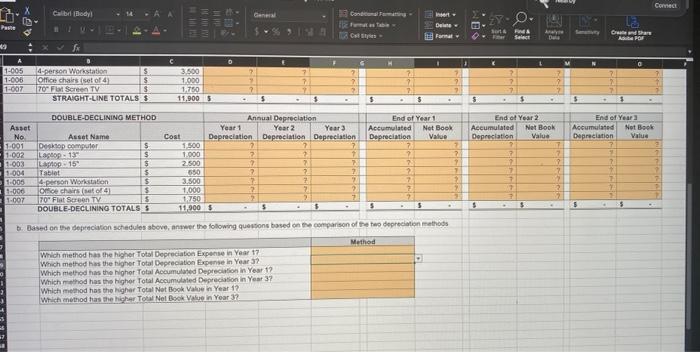

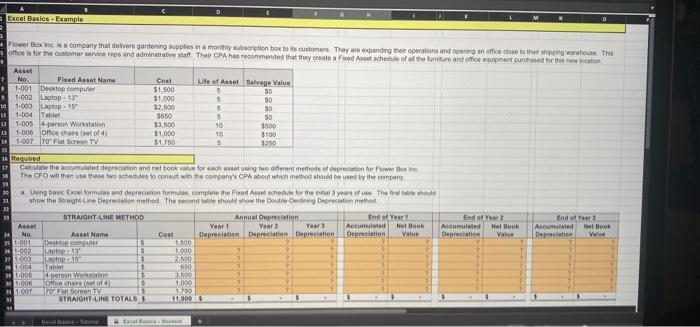

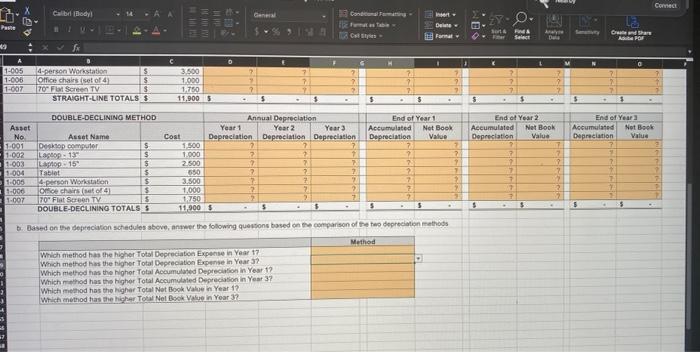

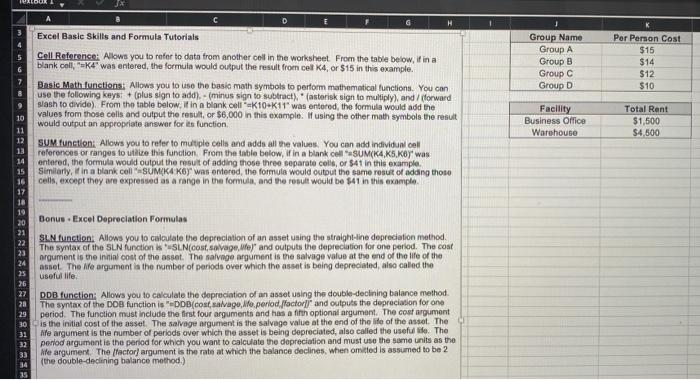

Excel Basics-Example Flower Box is a company that delivers gardening supplies in a monthly subscribe to its customers. They wepanding their operation and opening on orice close to the thing was the office is for the customer caree and adminstrative all Their CPA recommended that they create a Fred Aset schedule of all the triture and office equipment purchased for this newton Asset 7 No. Fixed Asset Name Cost Life of Asset Salvage Value 1-001 Desktop computer 51.500 5 SO 1.002 Laptop $1.000 1 SO 10 1.003 Laptop - 15 $2.500 5 80 111-001 Tablet 3650 5 50 21-005 person Won station $3,500 10 3500 D 1.000 of hair tot 4) $1,000 10 $100 14 1.007 Tout screen TV 51.750 5 $210 1. Required 17 Calculate the accumulated depreciation and not book value for eachers in the methods of deprecation for Power Boxing The CFO with two schedules to consth the company's CPA bout which method should be used by the company Uang basic Exis and depreciation forms, complete the Fed hele for the ential years. The first tabloid show the Straigtoine Deprecimiehed The second table should show the Double Declining Deprecated STRAIGHT LIVE METHOD Annual Depreciation End of Yout Asset Year! Year Year Acumulated Netbook No. Asset Name Cou Depreciation Depreciation Depreciation Deprecation Value 2009 DOO 5 1,500 Laptop.13 5 3000 201.00 Laptop:19 S 2100 100 Tab 050 1:00 person Weaton 1 5.000 O chart $ 1000 100T For Fat Screen TV 3 17 STRAIGHT LINE TOTALS 11000 End of You Accumulated Het look Depreciation Valur End of Year Acced Nello Den en Valve 002 Beli Connect Calibrl Bodyl AA Gane Poste De 16 F LA Clips Analye Create and Share APOF 9 O A 1-005 1-006 1-007 4 person Workstation $ Office chairs (set of S 170" For Screen TV IS STRAIGHT-LINE TOTALS $ C 3.500 1.000 1.750 11,900 S $ $ DOUBLE-DECLINING METHOD End of Year Accumulated Net Book Depreciation Value End of Year 2 Accumulated Net Book Depreciation Value End of Years Accumulated Net Book Depreciation Value Asset No 11.001 1.002 1.003 1-004 1.000 3.000 1.007 2 2 Annual Depreciation Year 1 Year 2 Year Cost Depreciation Depreciation Depreciation 1.500 1.000 2 7 2.500 650 ? 2 3.500 2 1,000 2 ? 1750 2 7 11,900 $ $ $ Asset Name Desktop computer $ Lahop - 135 $ Laptop: 159 $ Tabiat 4 person Workstation $ Office chairs (4) $ 70 Fiat Screen TV $ DOUBLE-DECLINING TOTALS S 7 2 7 7 2 7 7 7 2 5 $ $ 5 5 b. Based on the depreciation schedules above, we the following questions based on the comparison of the two depreciation methods Method Which method has the higher Tot Depreciation Expose in Year 17 Which method has the higher Total Depreciation Experte in Year 3? Which method has the higher Total Accumulated Depreciation in Year 12 Which method has the higher Total Accumulated Depreciation in Year 3? Which method has the higher Total Not Book Value in Year 17 Which method has the higher Total Nel Bok Value in Year 32 LOOK H Group Name Group A Group B Group C Group D Per Person Cost $15 $14 $12 $10 Facility Business Office Warehouse Total Rent $1,500 $4.500 G Excel Basic Skills and Formula Tutorials Cell Reference: Allows you to refer to data from another cell in the worksheet. From the table below, itina blank celik was entered, the formula would output the result from cell K4, or $15 in this example, Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys + (plus sign to add). - (minus sign to subtract) astorisk sign to multiply), and/ forward slash to divide). From the table below, if in a blank coll K10 K11" was entered the formula would add the values from those cells and output the result, or $6,000 in this example, if using the other math symbols the result 10 would output an appropriate answer for its function 11 12 SUM function: Allows you to refer to multiple calls and adds all the values. You can add individual coll 13 references or ranges to the this function. From the table below, if in a blank cell SUMK4 K5, Koy" was 14 entered, the formula would output the result of adding those three separate colls, or 541 in this example. 15 Similarly, in a blank coll"SUMIKA K6) was entered the formula would outout the same result of adding thoso 16 cells, except they are expressed as a range in the formula, and the result would be $41 in this example, 17 10 19 20 Bonus. Excel Depreciation Formulas 21 22 SI.N function: Allows you to calculate the depreciation of an asset using the straight-line depreciation method The syntax of the SLN function is-SLN(cost salvage, We)" and outputs the depreciation for one period. The cost 23 argument is the initial cost of the asset. The salvage argument is the salvage value at the end of the life of the 24 asnet. The e argument is the number of periods over which the asset is being depreciated also called the 25 useful life 26 27 DDB function: Allows you to calculate the depreciation of an asset using the double-declining balance method 28 The syntax of the DOB function is DDB(cost salvago, le period factor and outputs the depreciation for one 29 period. The function must include the first four arguments and has a fifth optional argument. The cost argument 30 is the initial cost of the asset. The salvage argument is the salvage value at the end of the life of the assol. The 31 Afe argument is the number of periods over which the asset is being depreciated, also called the useful. The 32 period argument is the period for which you want to calculate the depreciation and must use the same units as the 33 Me argument. The factor argument is the rate at which the balance declines, when omitted is assumed to be 2 14 (the double-declining balance method.) 35