Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please fill out all parts please and thank u! Hometowne Bicycle speclalizes In custom paInting and design of bicycles. December 31 is the company's fiscal

please fill out all parts please and thank u!

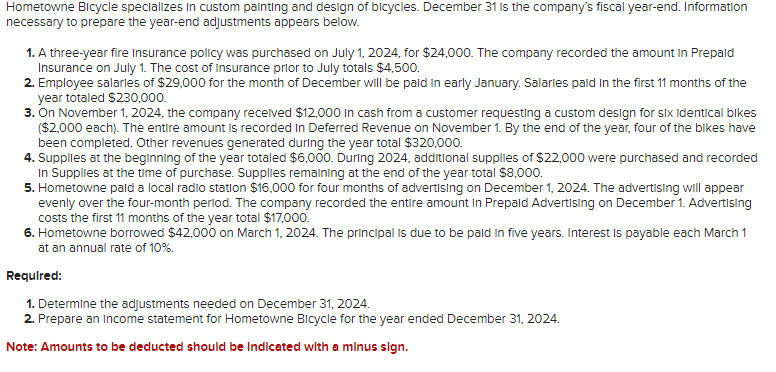

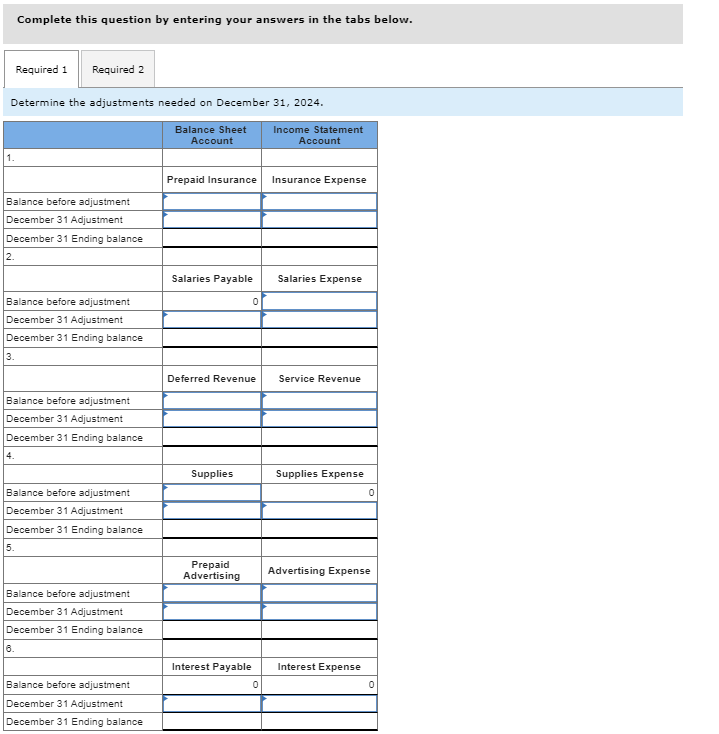

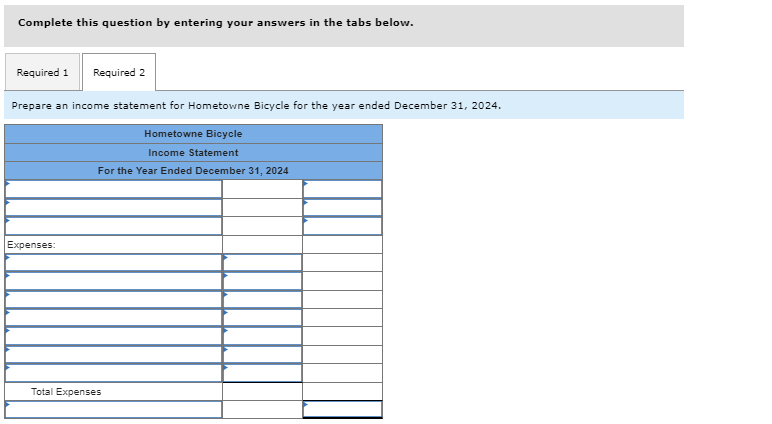

Hometowne Bicycle speclalizes In custom paInting and design of bicycles. December 31 is the company's fiscal year-end. Information necessary to prepare the year-end adjustments appears below. 1. A three-year fire Insurance policy was purchased on July 1,2024 , for $24,000. The company recorded the amount In Prepald Insurance on July 1. The cost of Insurance prior to July totals $4,500. 2. Employee salarles of $29,000 for the month of December will be pald In early January. Salarles pald In the first 11 months of the year totaled $230,000. 3. On November 1, 2024, the company recelved $12,000 In cash from a customer requesting a custom design for slx Identical bikes ( $2,000 each). The entire amount Is recorded In Deferred Revenue on November 1. By the end of the year, four of the bikes have been completed. Other revenues generated durlng the year total $320,000. 4. Supplies at the beginning of the year totaled $6,000. Durlng 2024 , additional supplies of $22,000 were purchased and recorded In Supplies at the time of purchase. Supplies remaining at the end of the year total $8,000. 5. Hometowne pald a local radlo station $16,000 for four months of advertisling on December 1,2024 . The advertlsing will appear evenly over the four-month perlod. The company recorded the entire amount In Prepald Advertising on December 1. Advertising costs the first 11 months of the year total $17,000. 6. Hometowne borrowed $42,000 on March 1, 2024. The principal Is due to be pald in five years. Interest Is payable each March 1 at an annual rate of 10%. Requlred: 1. Determine the adjustments needed on December 31, 2024. 2. Prepare an Income statement for Hometowne Bicycle for the year ended December 31, 2024. Note: Amounts to be deducted should be Indicated with a minus sign. Complete this question by entering your answers in the tabs below. Determine the adjustments needed on December 31, 2024. Complete this question by entering your answers in the tabs below. Prepare an income statement for Hometowne Bicycle for the year ended December 31, 2024Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started