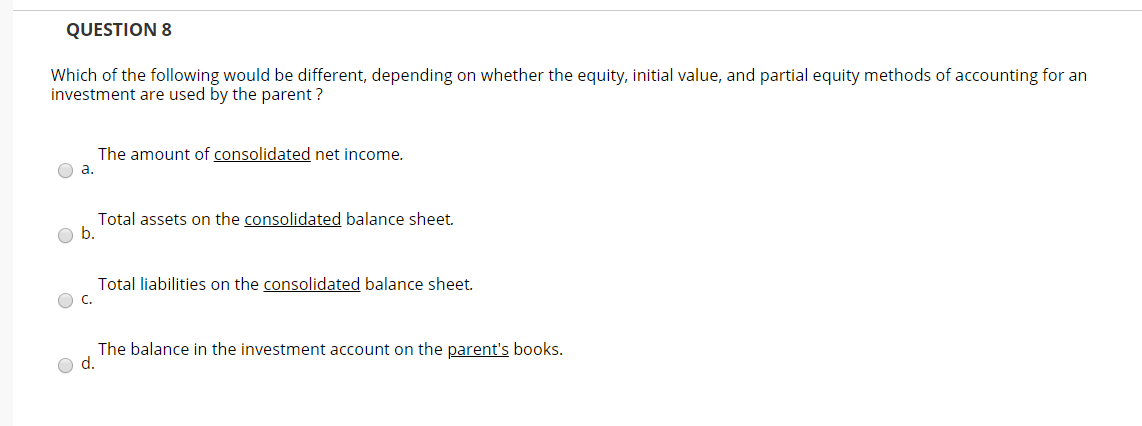

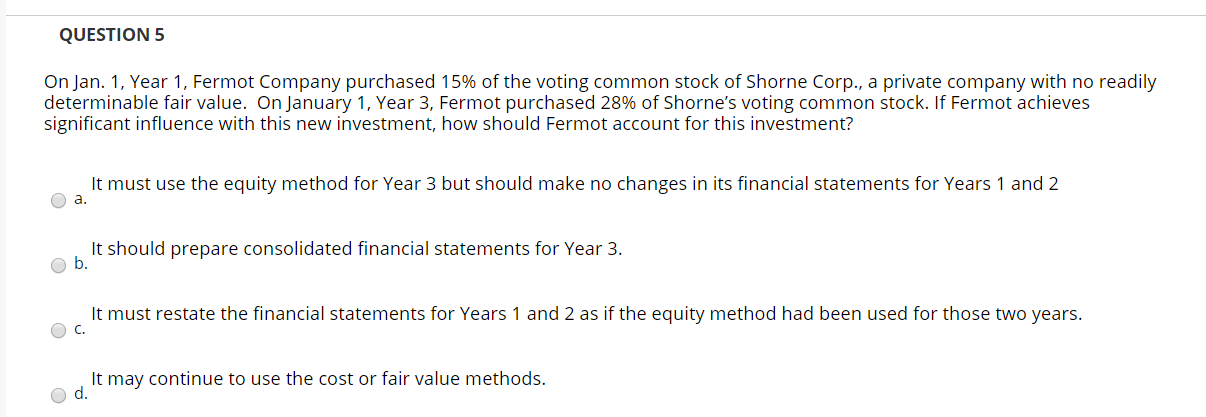

QUESTION 6 Major bought 100% of Medium. on January 1, Year 1, for $8,000,000. Annual amortization of $40,000 resulted from this acquisition. Medium reported net income of $500,000 in Year 1 and paid $100,000 in dividends. What is the Investment in Medium Co. balance on Major's books as of December 31, Year 1, if the equity method has been applied? a. $8,000,000 ob. $8,460,000. $8,400,000 Oc. O d. $8,360,000 QUESTION 7 Under the acquisition method for business combinations, and assuming the buyer gets 100% ownership, a bargain purchase gain would be shown when: a. Cost of the investment was less than the net fair value of the subsidiary's assets at the beginning of the year of the acquisition Cost of the investment was less than the net fair value of the subsidiary's assets at the acquisition date. O b. Costa Cost of the investment was less than the net book value of the subsidiary's assets at the beginning of the year of the acquisition. Oc. Cost of the investment was less than the net book value of the subsidiary's assets at the acquisition date QUESTION 8 Which of the following would be different, depending on whether the equity, initial value, and partial equity methods of accounting for an investment are used by the parent ? a. The amount of consolidated net income. Total assets on the consolidated balance sheet. b.' Total liabilities on the consolidated balance sheet. . The balance in the investment account on the parent's books. Od ne bala QUESTION 5 On Jan. 1, Year 1, Fermot Company purchased 15% of the voting common stock of Shorne Corp., a private company with no readily determinable fair value. On January 1, Year 3, Fermot purchased 28% of Shorne's voting common stock. If Fermot achieves significant influence with this new investment, how should Fermot account for this investment? It must use the equity method for Year 3 but should make no changes in its financial statements for Years 1 and 2 a. It should prepare consolidated financial statements for Year 3. b." It must restate the financial statements for Years 1 and 2 as if the equity method had been used for those two years. O C. It may continue to use the cost or fair value methods. d