Answered step by step

Verified Expert Solution

Question

1 Approved Answer

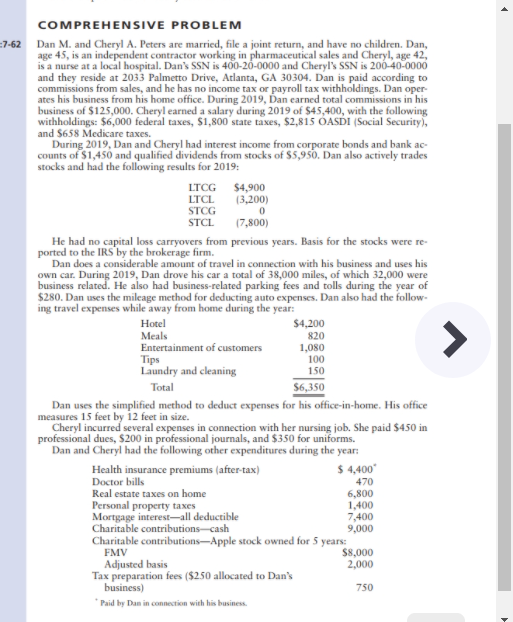

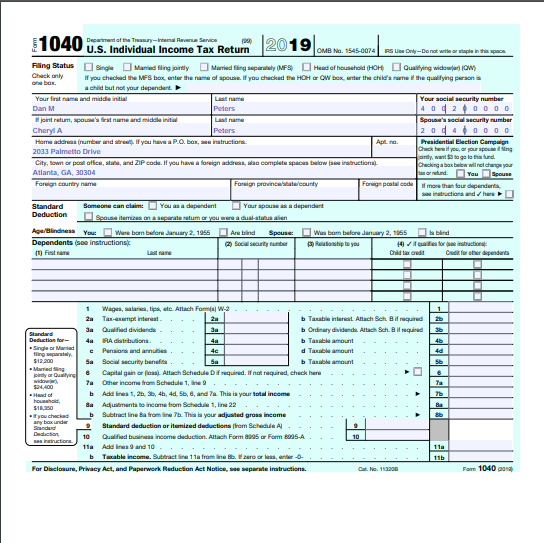

Please fill out Form 1040 schedule B, and form 1040 schedule D for the information given above. COMPREHENSIVE PROBLEM :7-62 Dan M. and Cheryl A.

Please fill out Form 1040 schedule B, and form 1040 schedule D for the information given above.

COMPREHENSIVE PROBLEM :7-62 Dan M. and Cheryl A. Peters are married, file a joint return, and have no children. Dan, age 45, is an independent contractor working in pharmaceutical sales and Cheryl, age 42 is a nurse at a local hospital. Dan's SSN is 400-20-0000 and Cheryl's SSN is 200-40-0000 and they reside at 2033 Palmetto Drive, Atlanta, GA 30304. Dan is paid according to commissions from sales, and he has no income tax or payroll tax withholdings. Dan oper ates his business from his home office. During 2019, Dan earned total commissions in his business of $125,000. Cheryl earned a salary during 2019 of $45,400, with the following withholdings: $6,000 federal taxes, $1,800 state taxes, $2,815 OASDI (Social Security), and $658 Medicare taxes. During 2019. Dan and Cheryl had interest income from corporate bonds and bank ac counts of $1,450 and qualified dividends from stocks of $5,950. Dan also actively trades stocks and had the following results for 2019: LTCG $4,900 LTCL (3,200) STCG 0 STCL 17,800) He had no capital loss carryovers from previous years. Basis for the stocks were re- ported to the IRS by the brokerage firm. Dan does a considerable amount of travel in connection with his business and uses his own car. During 2019, Dan drove his car a total of 38,000 miles, of which 32,000 were business related. He also had business-related parking fees and tolls during the year of $280. Dan uses the mileage method for deducting auto expenses. Dan also had the follow- ing travel expenses while away from home during the year: Hotel $4,200 Meals 820 Entertainment of customers 1,080 Tips 100 Laundry and cleaning 150 Total $6,350 Dan uses the simplified method to deduct expenses for his office-in-home. His office measures 15 feet by 12 feet in size. Cheryl incurred several expenses in connection with her nursing job. She paid $450 in professional dues, $200 in professional journals, and $350 for uniforms. Dan and Cheryl had the following other expenditures during the year: Health insurance premiums (after-tax) $4,400 Doctor bills 470 Real estate taxes on home 6,800 Personal property taxes 1,400 Mortgage interest-all deductible 7,400 Charitable contributions-cash 9,000 Charitable contributions--Apple stock owned for 5 years: FMV $8,000 Adjusted basis 2,000 Tax preparation fees ($250 allocated to Dan's business) 750 * Paid by Dan in connection with his business - 2019 1040 Department of the Tasy-Intemal venue Service U.S. Individual Income Tax Return OMB No. 1545-0074 Rs Un Only - Do not wilde ortaple in this pace Filing Status Single Mamed filing jointly Married fling separately (MFS Head of household HOH Qualifying widower) (OW) Check only If you checked the MES box, enter the name of spouse. If you checked the HOH OW box, enter the child's name is the qualifying person is a child but not your dependient. Your first name and middle initial Your social security number Dan M Peters 4020DOO joint ratum, spouse's first name and middle initial Last name Spouse's social security number Cheryl A Peters 2004 ODOO Home address number andre. If you have a P.O. bas, se instruction Apt. Presidential Election Campaign Chick hail you, or your spousing 2033 Palmetto Drive Hardly, wants to get the fund. City, town or pool office, state, and 21P code. If you have a foreignader, complete spaces below instruction Checking box below will change your Atlanta, GA, 30304 und You Spouse Foreign country are Foreign provincesitate/county Foreign postal code If more than four dependent instructions and/hare Standard Someone can claim You as a dependent Your spouses a dependent Deduction Spousse itemizes on prate ratum er you were a dus- en Aga/Blindness You Were bombefore January 2, 1955 Are blind Spouse: Was bom before January 2, 1955 Dependents (see instructions Relationship to you 11 Fiesta Last name Child tax credit Cifre dependents 1 40 4d 50 Ta 1 Wage salaria, tips, etc. Allach Fortwa 2a Tas-unempt interest Taxable interest Allah Sh. Bit required 3a Qualified dividende Standard b Ordinary dividencka Altach Sch. Bit required Deduction for 4a RA distribution b Tabout Singer e Pensions and annuilles 4c d Taxable amount ting patay 512.200 Sa Social security benefits Sa Tanable amount - Marteding por Daire Capital gain or loss. Altach Schedule Dif required. If not required. Check here where 7a Other income from Schedule 1, line 9 ad of Adelines 1, 2, 4, 4, 5, 6, and 7. This is your total income household da Adjustment to income from Schedule 1, line 22 - you chached Subtract line Ba from line 76. This is your adjusted gross income Standard deduction or itemized deduction from Schedule 10 was con Qualified business income deduction. Altach Form 5 or Form 8025-A 11 Add in 9 and 10 - . Table income. Subtract line 11a from line. Waaroor beds, enter- For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, se separate instructions Cat. 113200 110 11b Form 104001 COMPREHENSIVE PROBLEM :7-62 Dan M. and Cheryl A. Peters are married, file a joint return, and have no children. Dan, age 45, is an independent contractor working in pharmaceutical sales and Cheryl, age 42 is a nurse at a local hospital. Dan's SSN is 400-20-0000 and Cheryl's SSN is 200-40-0000 and they reside at 2033 Palmetto Drive, Atlanta, GA 30304. Dan is paid according to commissions from sales, and he has no income tax or payroll tax withholdings. Dan oper ates his business from his home office. During 2019, Dan earned total commissions in his business of $125,000. Cheryl earned a salary during 2019 of $45,400, with the following withholdings: $6,000 federal taxes, $1,800 state taxes, $2,815 OASDI (Social Security), and $658 Medicare taxes. During 2019. Dan and Cheryl had interest income from corporate bonds and bank ac counts of $1,450 and qualified dividends from stocks of $5,950. Dan also actively trades stocks and had the following results for 2019: LTCG $4,900 LTCL (3,200) STCG 0 STCL 17,800) He had no capital loss carryovers from previous years. Basis for the stocks were re- ported to the IRS by the brokerage firm. Dan does a considerable amount of travel in connection with his business and uses his own car. During 2019, Dan drove his car a total of 38,000 miles, of which 32,000 were business related. He also had business-related parking fees and tolls during the year of $280. Dan uses the mileage method for deducting auto expenses. Dan also had the follow- ing travel expenses while away from home during the year: Hotel $4,200 Meals 820 Entertainment of customers 1,080 Tips 100 Laundry and cleaning 150 Total $6,350 Dan uses the simplified method to deduct expenses for his office-in-home. His office measures 15 feet by 12 feet in size. Cheryl incurred several expenses in connection with her nursing job. She paid $450 in professional dues, $200 in professional journals, and $350 for uniforms. Dan and Cheryl had the following other expenditures during the year: Health insurance premiums (after-tax) $4,400 Doctor bills 470 Real estate taxes on home 6,800 Personal property taxes 1,400 Mortgage interest-all deductible 7,400 Charitable contributions-cash 9,000 Charitable contributions--Apple stock owned for 5 years: FMV $8,000 Adjusted basis 2,000 Tax preparation fees ($250 allocated to Dan's business) 750 * Paid by Dan in connection with his business - 2019 1040 Department of the Tasy-Intemal venue Service U.S. Individual Income Tax Return OMB No. 1545-0074 Rs Un Only - Do not wilde ortaple in this pace Filing Status Single Mamed filing jointly Married fling separately (MFS Head of household HOH Qualifying widower) (OW) Check only If you checked the MES box, enter the name of spouse. If you checked the HOH OW box, enter the child's name is the qualifying person is a child but not your dependient. Your first name and middle initial Your social security number Dan M Peters 4020DOO joint ratum, spouse's first name and middle initial Last name Spouse's social security number Cheryl A Peters 2004 ODOO Home address number andre. If you have a P.O. bas, se instruction Apt. Presidential Election Campaign Chick hail you, or your spousing 2033 Palmetto Drive Hardly, wants to get the fund. City, town or pool office, state, and 21P code. If you have a foreignader, complete spaces below instruction Checking box below will change your Atlanta, GA, 30304 und You Spouse Foreign country are Foreign provincesitate/county Foreign postal code If more than four dependent instructions and/hare Standard Someone can claim You as a dependent Your spouses a dependent Deduction Spousse itemizes on prate ratum er you were a dus- en Aga/Blindness You Were bombefore January 2, 1955 Are blind Spouse: Was bom before January 2, 1955 Dependents (see instructions Relationship to you 11 Fiesta Last name Child tax credit Cifre dependents 1 40 4d 50 Ta 1 Wage salaria, tips, etc. Allach Fortwa 2a Tas-unempt interest Taxable interest Allah Sh. Bit required 3a Qualified dividende Standard b Ordinary dividencka Altach Sch. Bit required Deduction for 4a RA distribution b Tabout Singer e Pensions and annuilles 4c d Taxable amount ting patay 512.200 Sa Social security benefits Sa Tanable amount - Marteding por Daire Capital gain or loss. Altach Schedule Dif required. If not required. Check here where 7a Other income from Schedule 1, line 9 ad of Adelines 1, 2, 4, 4, 5, 6, and 7. This is your total income household da Adjustment to income from Schedule 1, line 22 - you chached Subtract line Ba from line 76. This is your adjusted gross income Standard deduction or itemized deduction from Schedule 10 was con Qualified business income deduction. Altach Form 5 or Form 8025-A 11 Add in 9 and 10 - . Table income. Subtract line 11a from line. Waaroor beds, enter- For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, se separate instructions Cat. 113200 110 11b Form 104001Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started