please fill out the 2004(p)

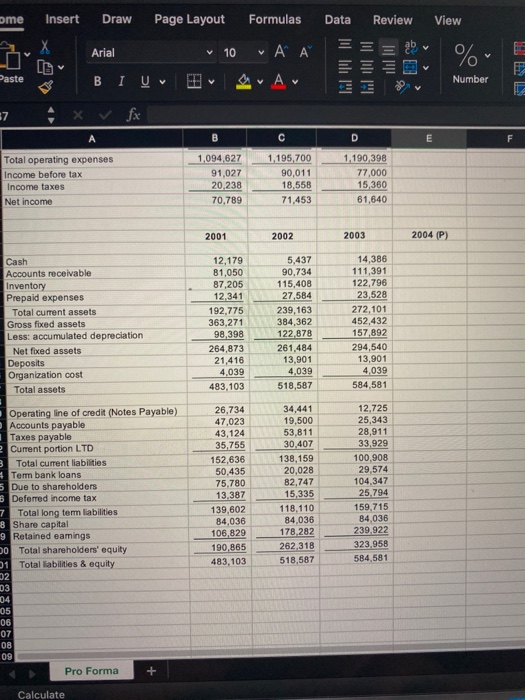

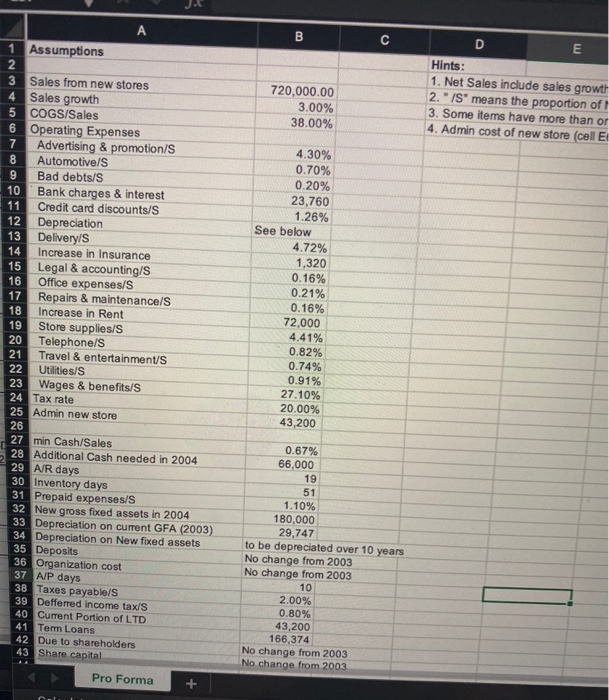

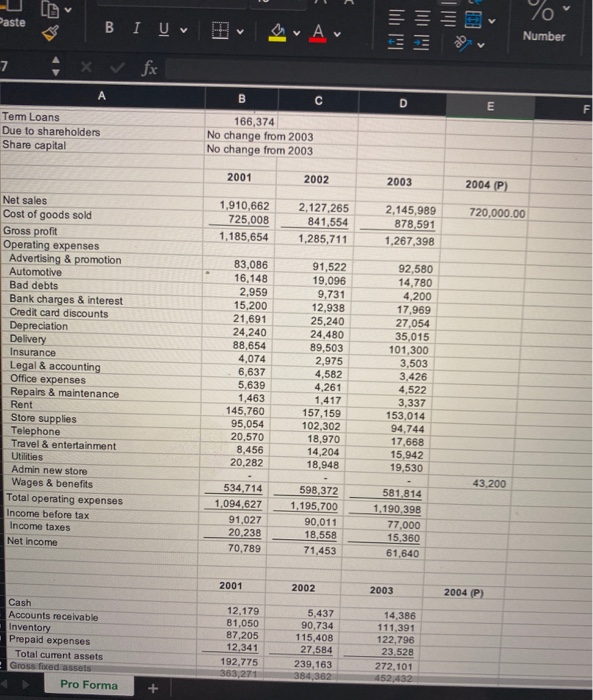

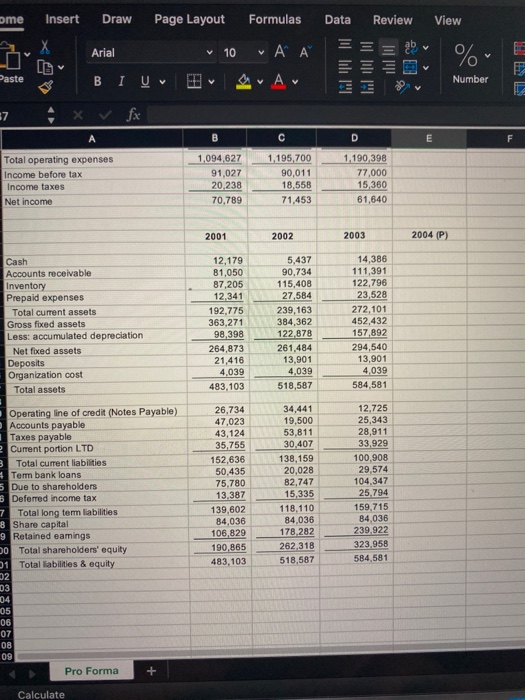

Assumptions 720,000.00 3.00% 38.00% Hints: 1. Net Sales include sales growth 2./S" means the proportion of 3. Some items have more than or 4. Admin cost of new store (cell E 3 Sales from new stores 4 Sales growth 5 COGS/Sales 6 Operating Expenses 7 Advertising & promotion/S 8 Automotive/S 9 Bad debts/S 10 Bank charges & interest 11 Credit card discounts/S 12 Depreciation 13 Delivery/S 14 Increase in Insurance 15 Legal & accounting/S 16 Office expenses/S 17 Repairs & maintenance/S 18 Increase in Rent 19 Store supplies/S 20 Telephone/S 21 Travel & entertainments 22 Utilities/S 23 Wages & benefits/S 24 Tax rate 25 Admin new store 4.30% 0.70% 0.20% 23,760 1.26% See below 4.72% 1,320 0.16% 0.21% 0.16% 72,000 4.41% 0.82% 0.74% 0.91% 27.10% 20.00% 43,200 26 0.67% 66,000 27 min Cash/Sales 28 Additional Cash needed in 2004 29 A/R days 30 Inventory days 31 Prepaid expenses/S 32 New gross fixed assets in 2004 33 Depreciation on current GFA (2003) 34 Depreciation on New fixed assets 35 Deposits 36 Organization cost 37 A/P days 36 Taxes payable/S 39 Defferred income tax/S 40 Current Portion of LTD 41 Tem Loans 42 Due to shareholders 43 Share capital Pro Forma 51 1.10% 180,000 29,747 to be depreciated over 10 years No change from 2003 No change from 2003 10 2.00% 0.80% 43,200 166,374 No change from 2003 No change from 2003 10 ste B IU E SA Number em Loans Due to shareholders Share capital 166,374 No change from 2003 No change from 2003 2001 2002 2003 2004 (P) 720,000.00 1,910,662 725,008 1,185,654 2,127,265 841,554 1,285,711 2,145,989 878,591 1,267,398 Net sales Cost of goods sold Gross profit Operating expenses Advertising & promotion Automotive Bad debts Bank charges & interest Credit card discounts Depreciation Delivery Insurance Legal & accounting Office expenses Repairs & maintenance Rent Store supplies Telephone Travel & entertainment Utilities Admin new store Wages & benefits Total operating expenses Income before tax Income taxes Net income 83,086 16,148 2.959 15,200 21,691 24,240 88,654 4,074 6,637 5,639 1,463 145,760 95,054 20,570 8,456 20,282 91,522 19,096 9,731 12,938 25,240 24,480 89,503 2,975 4,582 4,261 1,417 157,159 102,302 18,970 14,204 18,948 92,580 14,780 4,200 17,969 27,054 35,015 101,300 3,503 3,426 4,522 3,337 153,014 94.744 17,668 15,942 19,530 43,200 534 714 1,094,627 91,027 20238 70,789 598,372 1,195,700 90,011 18.558 71,453 581,814 1,190,398 77,000 15,360 61,640 2001 2002 2003 2004 (P) Cash Accounts receivable Inventory Prepaid expenses Total current assets Gros faced assets Pro Forma 12,179 81,050 87,205 12.341 192,775 5,437 90,734 115,408 27584 239,163 386,362 14,386 111,391 122,796 23,528 272,101 me Insert Draw Page Layout Formulas Data Review View Arial 10 A A = = = 25 Paste BIV- A Number Total operating expenses Income before tax Income taxes Net income 1,094,627 91,027 20 238 70,789 1,195,700 90,011H 18,558 _ 71,453 1,190,398 77,000 15,360 61,640 2001 2002 2003 2004 (P) Cash Accounts receivable Inventory Prepaid expenses Total current assets Gross fixed assets Less: accumulated depreciation Net fixed assets Deposits Organization cost Total assets 12,179 81,050 87,205 12,341 192,775 363,271 98,398 264,873 21,416 4,039 483,103 5,437 90.734 115,408 27,584 239,163 384,362 122,878 261,484 13,901 4,039 518,587 14,386 111,391 122,796 23,528 272,101 452,432 157,892 294,540 13,901 4,039 584,581 Operating line of credit (Notes Payable) Accounts payable Taxes payable 2 Current portion LTD 3 Total current liabilities Tem bank loans 5 Due to shareholders B Deferred income tax 7 Total long term liabilities 8 Share capital 9 Retained eamings 0 Total shareholders' equity 1 Total liabilities & equity 26,734 47,023 43,124 35,755 152,636 50,435 75.780 13,387 139,602 84,036 106,829 190,865 483,103 34,441 19,500 53,811 30,407 138,159 20,028 82,747 15,335 118.110 84,036 178.282 262,318 518,587 12,725 25,343 28,911 33,929 100,908 29,574 104,347 25.794 159,715 84,036 239.922 323 958 584,581 07 Pro Forma Calculate

please fill out the 2004(p)

please fill out the 2004(p)