Answered step by step

Verified Expert Solution

Question

1 Approved Answer

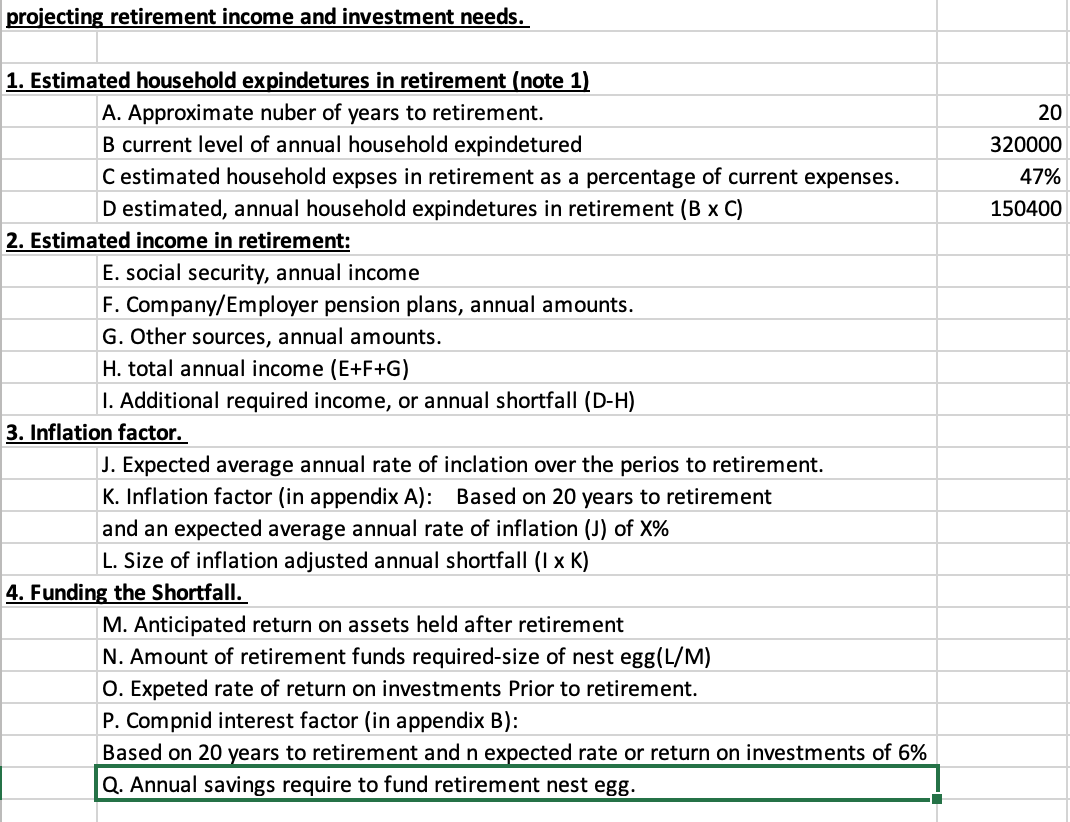

Please fill out the following information that is projecting retirement income and investment needs based off the wealth management client criteria. WEALTH MANAGEMENT CLIENT Bill

Please fill out the following information that is projecting retirement income and investment needs based off the wealth management client criteria.

WEALTH MANAGEMENT CLIENT

Bill and Tammy Jones are a 40 year old couple with two children ages 12 and 14.

- Their annual income is $350K (before tax)

- Annual expenses: Income taxes: $170K, Mortgage expense: $40K, Property taxes: $35K, car payments: $20K, 401K contributions: $17K, living expenses, food, etc: $38K

- They own a $900K home with a $500K mortgage.

- They want to find a bigger house in the $1.5M range.

- They have $20K in credit card debit @19%/year. They maintain 6 credit cards with a line of credit of $70K

- They have an unsecured personal loan of $10K @17%/year.

- They have a bank NOW account with $20K in deposits

- They have $50K in a 401K plan.

- They have saved $50K towards education.

- They have other savings of $200K invested in long term CDs

- They have $100K in term life insurance. They have a standard auto and HO1 homeowners insurance policy.

- They own an Audi A3 with a value of $45,000 and a car loan of $25,000 and a used car valued at $20K with no loan. They are considering leasing a BMW X5 at $700/month vs buying it.

- They also own an investment property valued at $800K with a $400K mortgage which produces rental income to offset all expenses and provide a $30K profit.

- Retirement dreams: They would like to retire by 60. They need help in planning their future and retirement options. They would like to travel extensively, spending $50K per year for the rest of their lives on travel. They envision a retirement where they can spend $100K per year on expenses other than travel for incidentals and live in a $4M home. They would like to fund their future grandchildrens education.

- Estate planning: They do not have a will nor have done any other estate planning.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started