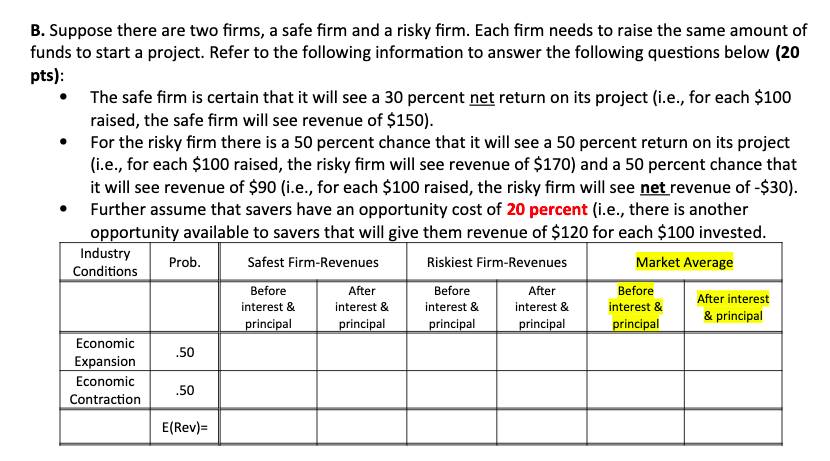

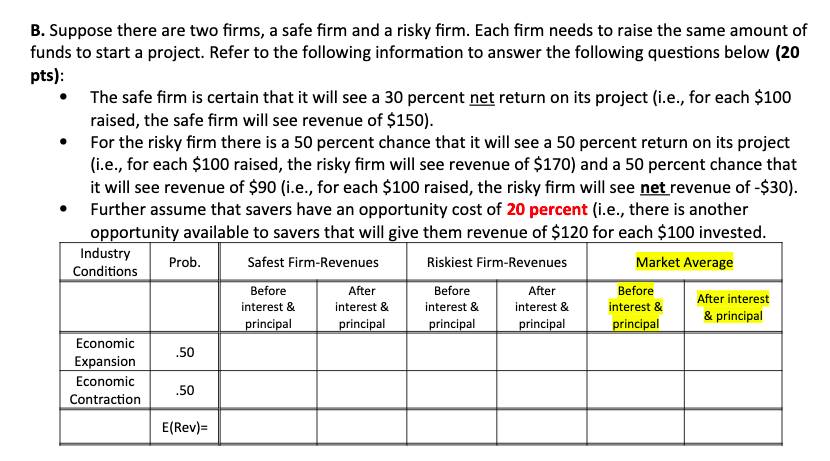

Please fill table and show working. Thank you.

B. Suppose there are two firms, a safe firm and a risky firm. Each firm needs to raise the same amount of funds to start a project. Refer to the following information to answer the following questions below (20 pts): The safe firm is certain that it will see a 30 percent net return on its project (i.e., for each $100 raised, the safe firm will see revenue of $150). For the risky firm there is a 50 percent chance that it will see a 50 percent return on its project (i.e., for each $100 raised, the risky firm will see revenue of $170) and a 50 percent chance that it will see revenue of $90 (i.e., for each $100 raised, the risky firm will see net revenue of $30). Further assume that savers have an opportunity cost of 20 percent (i.e., there is another opportunity available to savers that will give them revenue of $120 for each $100 invested. Industry Conditions Prob. Safest Firm-Revenues Riskiest Firm-Revenues Market Average Before After Before After Before interest & interest & interest & interest & interest & After interest & principal principal principal principal principal principal Economic .50 Expansion Economic .50 Contraction E(Rev) B. Suppose there are two firms, a safe firm and a risky firm. Each firm needs to raise the same amount of funds to start a project. Refer to the following information to answer the following questions below (20 pts): The safe firm is certain that it will see a 30 percent net return on its project (i.e., for each $100 raised, the safe firm will see revenue of $150). For the risky firm there is a 50 percent chance that it will see a 50 percent return on its project (i.e., for each $100 raised, the risky firm will see revenue of $170) and a 50 percent chance that it will see revenue of $90 (i.e., for each $100 raised, the risky firm will see net revenue of $30). Further assume that savers have an opportunity cost of 20 percent (i.e., there is another opportunity available to savers that will give them revenue of $120 for each $100 invested. Industry Conditions Prob. Safest Firm-Revenues Riskiest Firm-Revenues Market Average Before After Before After Before interest & interest & interest & interest & interest & After interest & principal principal principal principal principal principal Economic .50 Expansion Economic .50 Contraction E(Rev)