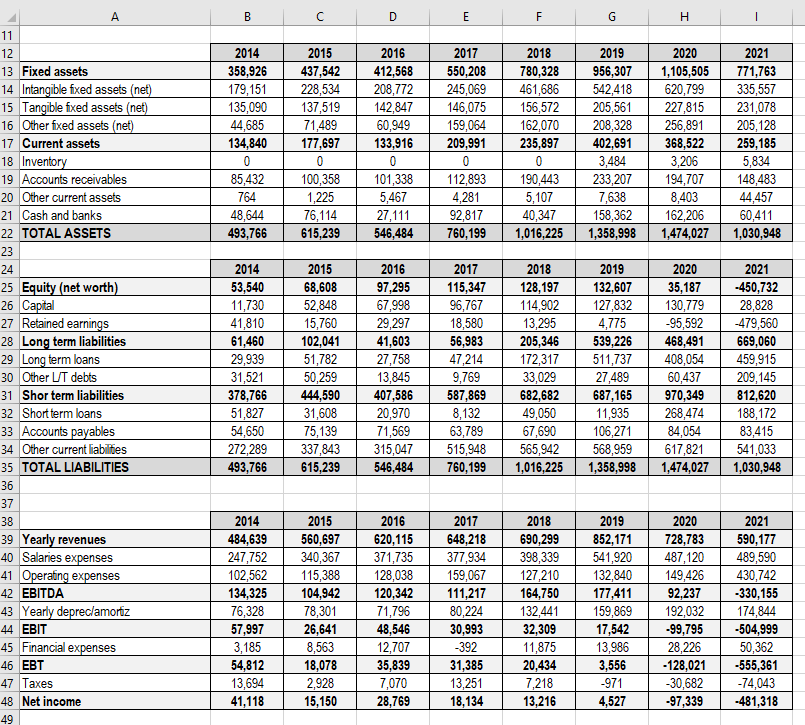

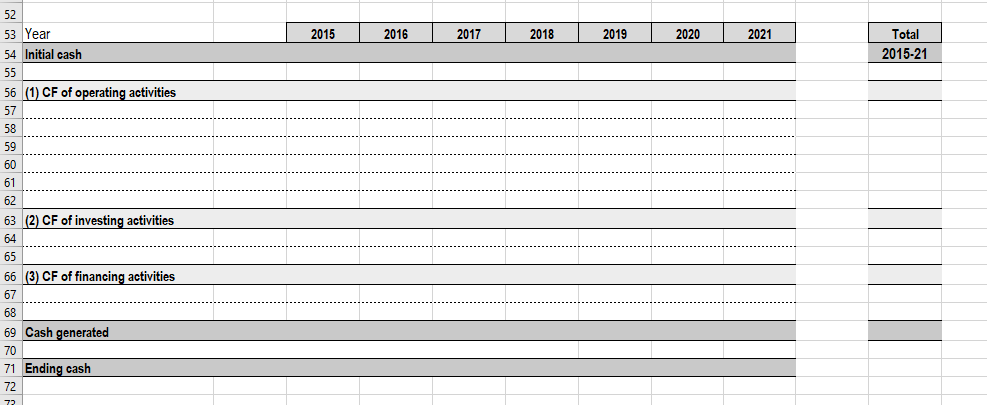

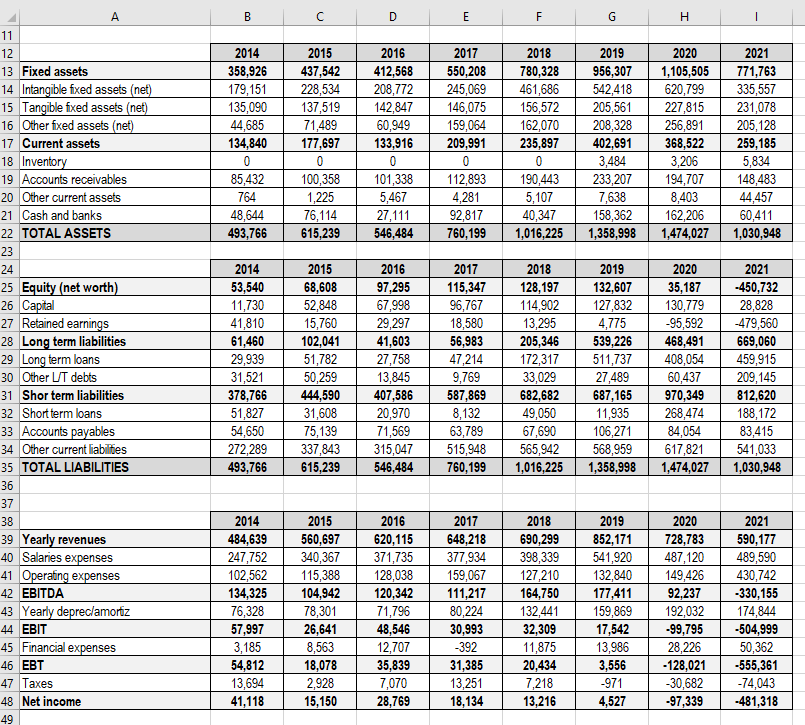

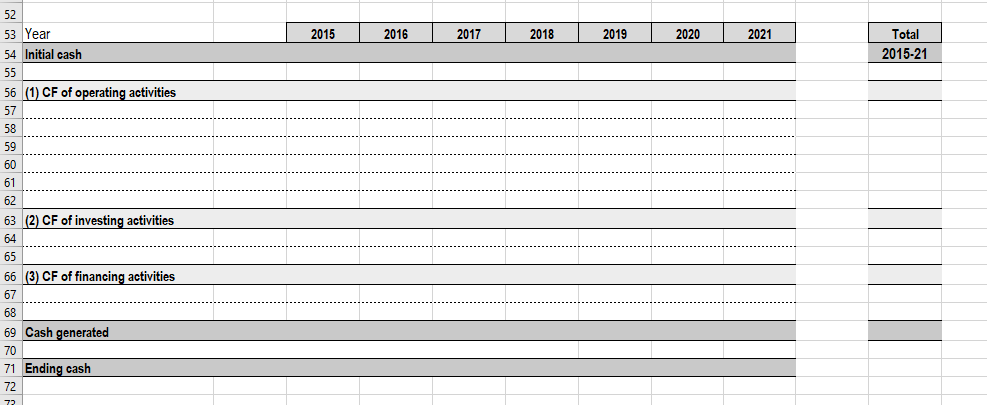

Please fill the below excel based on the above data

\begin{tabular}{|l|l|c|c|c|c|c|c|c|c|c|} \hline 36 & & & & & & \\ \hline 37 & & 2014 & 2015 & 2016 & 2017 & 2018 & 2019 & 2020 & 2021 \\ \hline 38 & & 484,639 & 560,697 & 620,115 & 648,218 & 690,299 & 852,171 & 728,783 & 590,177 \\ \hline 39 & Yearly revenues & 247,752 & 340,367 & 371,735 & 377,934 & 398,339 & 541,920 & 487,120 & 489,590 \\ \hline 40 & Salaries expenses & 102,562 & 115,388 & 128,038 & 159,067 & 127,210 & 132,840 & 149,426 & 430,742 \\ \hline 41 & Operafing expenses & 134,325 & 104,942 & 120,342 & 111,217 & 164,750 & 177,411 & 92,237 & 330,155 \\ \hline 42 & EBITDA & 76,328 & 78,301 & 71,796 & 80,224 & 132,441 & 159,869 & 192,032 & 174,844 \\ \hline 43 & Yearly deprec/amorfz & 57,997 & 26,641 & 48,546 & 30,993 & 32,309 & 17,542 & 99,795 & 504,999 \\ \hline 44 & EBIT & 3,185 & 8,563 & 12,707 & 392 & 11,875 & 13,986 & 28,226 & 50,362 \\ \hline 45 & Financial expenses & 54,812 & 18,078 & 35,839 & 31,385 & 20,434 & 3,556 & 128,021 & 555,361 \\ \hline 46 & EBT & 13,694 & 2,928 & 7,070 & 13,251 & 7,218 & 971 & 30,682 & 74,043 \\ \hline 47 & Taxes & 41,118 & 15,150 & 28,769 & 18,134 & 13,216 & 4,527 & 97,339 & 481,318 \\ \hline 48 & Net income & & & & & & & & & \end{tabular} 49 \begin{tabular}{|l|l|c|c|c|c|c|c|c|c|c|} \hline 36 & & & & & & \\ \hline 37 & & 2014 & 2015 & 2016 & 2017 & 2018 & 2019 & 2020 & 2021 \\ \hline 38 & & 484,639 & 560,697 & 620,115 & 648,218 & 690,299 & 852,171 & 728,783 & 590,177 \\ \hline 39 & Yearly revenues & 247,752 & 340,367 & 371,735 & 377,934 & 398,339 & 541,920 & 487,120 & 489,590 \\ \hline 40 & Salaries expenses & 102,562 & 115,388 & 128,038 & 159,067 & 127,210 & 132,840 & 149,426 & 430,742 \\ \hline 41 & Operafing expenses & 134,325 & 104,942 & 120,342 & 111,217 & 164,750 & 177,411 & 92,237 & 330,155 \\ \hline 42 & EBITDA & 76,328 & 78,301 & 71,796 & 80,224 & 132,441 & 159,869 & 192,032 & 174,844 \\ \hline 43 & Yearly deprec/amorfz & 57,997 & 26,641 & 48,546 & 30,993 & 32,309 & 17,542 & 99,795 & 504,999 \\ \hline 44 & EBIT & 3,185 & 8,563 & 12,707 & 392 & 11,875 & 13,986 & 28,226 & 50,362 \\ \hline 45 & Financial expenses & 54,812 & 18,078 & 35,839 & 31,385 & 20,434 & 3,556 & 128,021 & 555,361 \\ \hline 46 & EBT & 13,694 & 2,928 & 7,070 & 13,251 & 7,218 & 971 & 30,682 & 74,043 \\ \hline 47 & Taxes & 41,118 & 15,150 & 28,769 & 18,134 & 13,216 & 4,527 & 97,339 & 481,318 \\ \hline 48 & Net income & & & & & & & & & \end{tabular} 49