Answered step by step

Verified Expert Solution

Question

1 Approved Answer

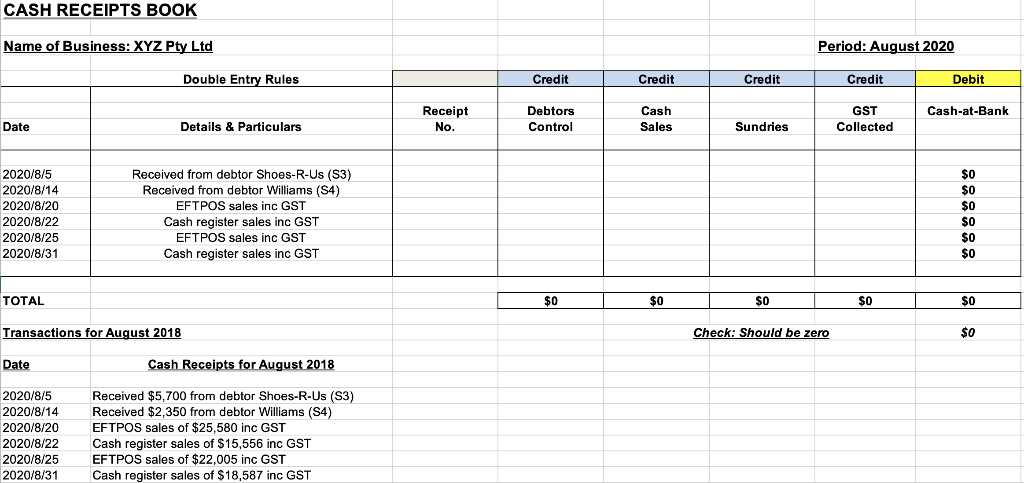

please fill the blank of the table, handwriting is acceptable. CASH RECEIPTS BOOK Name of Business: XYZ Pty Ltd Period: August 2020 Double Entry Rules

please fill the blank of the table, handwriting is acceptable.

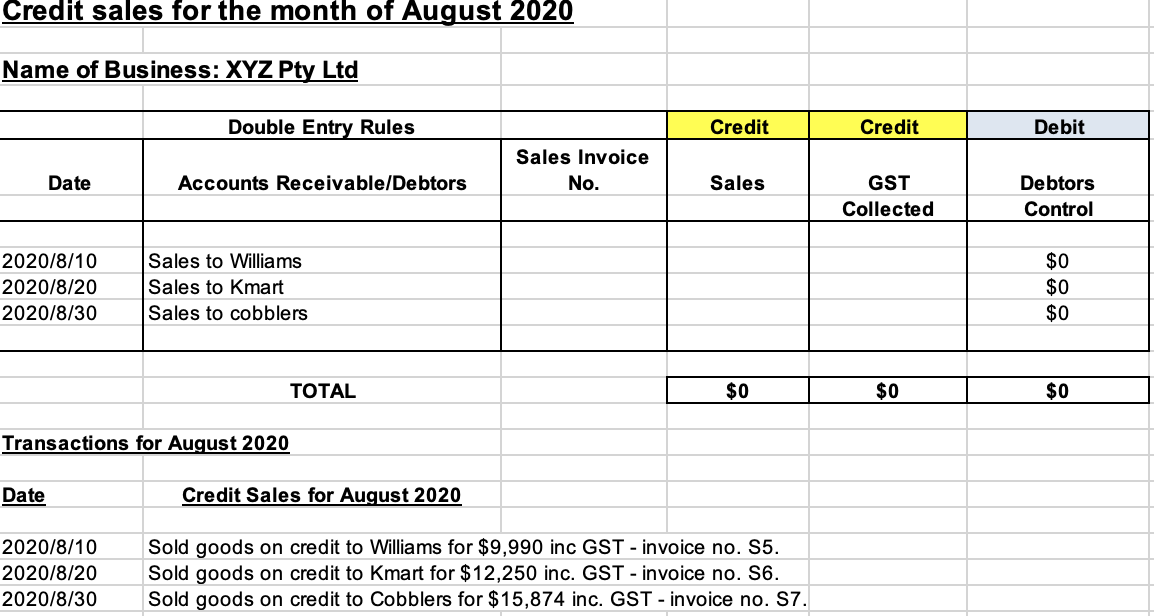

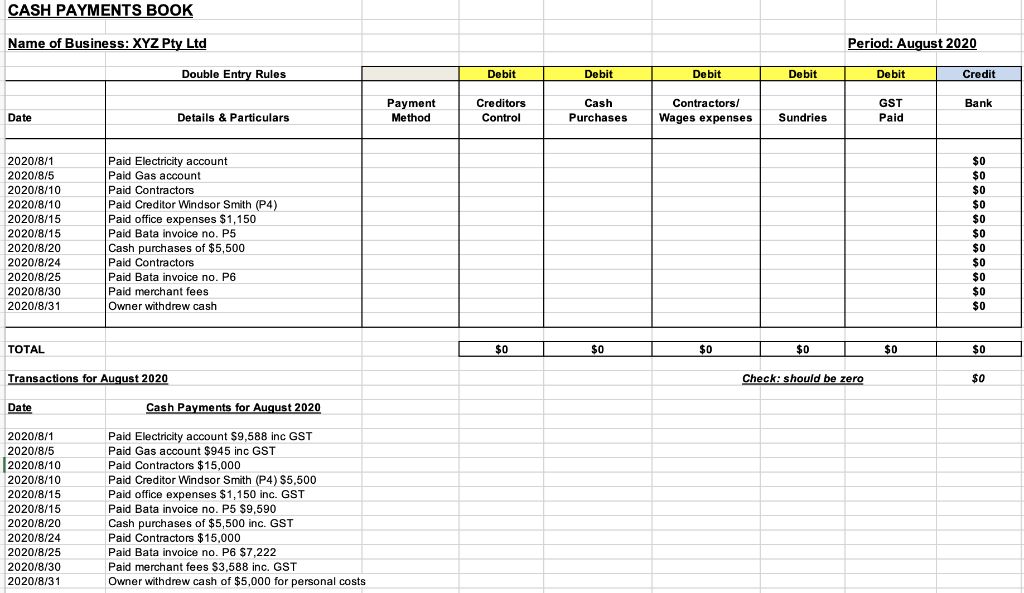

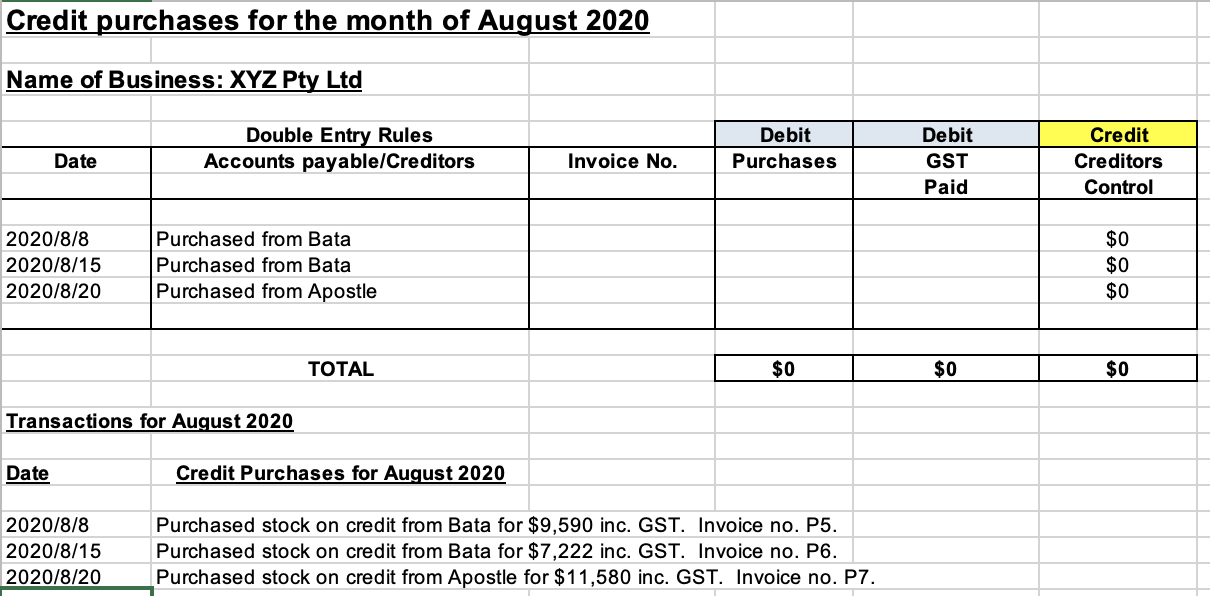

CASH RECEIPTS BOOK Name of Business: XYZ Pty Ltd Period: August 2020 Double Entry Rules Credit Credit Credit Credit Debit Cash-at-Bank Receipt No. Debtors Control Cash Sales GST Collected Date Details & Particulars Sundries Sundries 2020/8/5 2020/8/14 2020/8/20 2020/8/22 2020/8/25 2020/8/31 Received from debtor Shoes-R-Us (53) Received from debtor Williams (S4) EFTPOS sales inc GST Cash register sales inc GST EFTPOS sales inc GST Cash register sales inc GST $0 $0 $0 $0 $0 $0 TOTAL $0 $0 $0 $0 $0 Transactions for August 2018 Check: Should be zero $0 Date Cash Receipts for August 2018 2020/8/5 2020/8/14 2020/8/20 2020/8/22 2020/8/25 2020/8/31 Received $5,700 from debtor Shoes-R-Us (S3) Received $2,350 from debtor Williams (S4) EFTPOS sales of $25,580 inc GST Cash register sales of $15,556 inc GST EFTPOS sales of $22,005 inc GST Cash register sales of $18,587 inc GST Credit sales for the month of August 2020 Name of Business: XYZ Pty Ltd Double Entry Rules Credit Credit Debit Sales Invoice No. Date Accounts Receivable/Debtors Sales GST Collected Debtors Control 2020/8/10 2020/8/20 2020/8/30 Sales to Williams Sales to Kmart Sales to cobblers $0 $0 $0 TOTAL $0 $0 $0 Transactions for August 2020 Date Credit Sales for August 2020 2020/8/10 2020/8/20 2020/8/30 Sold goods on credit to Williams for $9,990 inc GST - invoice no. S5. Sold goods on credit to Kmart for $12,250 inc. GST - invoice no. 56. Sold goods on credit to Cobblers for $15,874 inc. GST - invoice no. 57. CASH PAYMENTS BOOK Name of Business: XYZ Pty Ltd Period: August 2020 Double Entry Rules Debit Debit Debit Debit Debit Credit Bank Payment Method Creditors Control Cash Purchases Contractors/ Wages expenses GST Paid Date Details & Particulars Sundries 2020/8/1 2020/8/5 2020/8/10 2020/8/10 2020/8/15 2020/8/15 2020/8/20 2020/8/24 2020/8/25 2020/8/30 2020/8/31 Paid Electricity account Paid Gas account Paid Contractors Paid Creditor Windsor Smith (P4) Paid office expenses $1,150 Paid Bata invoice no. P5 Cash purchases of $5,500 Paid Contractors Paid Bata invoice no. P6 Paid merchant fees Owner withdrew cash $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 TOTAL $0 $0 $0 $0 $0 $0 Transactions for August 2020 Check: should be zero $0 Date Cash Payments for August 2020 2020/8/1 2020/8/5 2020/8/10 2020/8/10 2020/8/15 2020/8/15 2020/8/20 2020/8/24 2020/8/25 2020/8/30 2020/8/31 Paid Electricity account $9,588 inc GST Paid Gas account $945 inc GST Paid Contractors $15,000 Paid Creditor Windsor Smith (P4) $5,500 Paid office expenses $1,150 inc. GST Paid Bata invoice no. P5 $9,590 Cash purchases of $5,500 inc. GST Paid Contractors $15,000 Paid Bata invoice no. P6 $7,222 Paid merchant fees $3,588 inc. GST Owner withdrew cash of $5,000 for personal costs Credit purchases for the month of August 2020 Name of Business: XYZ Pty Ltd Double Entry Rules Accounts payable/Creditors Debit Purchases Date Invoice No. Debit GST Paid Credit Creditors Control 2020/8/8 2020/8/15 2020/8/20 Purchased from Bata Purchased from Bata Purchased from Apostle $0 $0 $0 TOTAL $0 $0 $0 Transactions for August 2020 Date Credit Purchases for August 2020 2020/8/8 2020/8/15 2020/8/20 Purchased stock on credit from Bata for $9,590 inc. GST. Invoice no. P5. Purchased stock on credit from Bata for $7,222 inc. GST. Invoice no. P6. Purchased stock on credit from Apostle for $11,580 inc. GST. Invoice no. P7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started