Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please fill the blanks for the table below, this is a home financing project assignment. and the steps are bellow how to do it. *

Please fill the blanks for the table below, this is a home financing project assignment. and the steps are bellow how to do it.

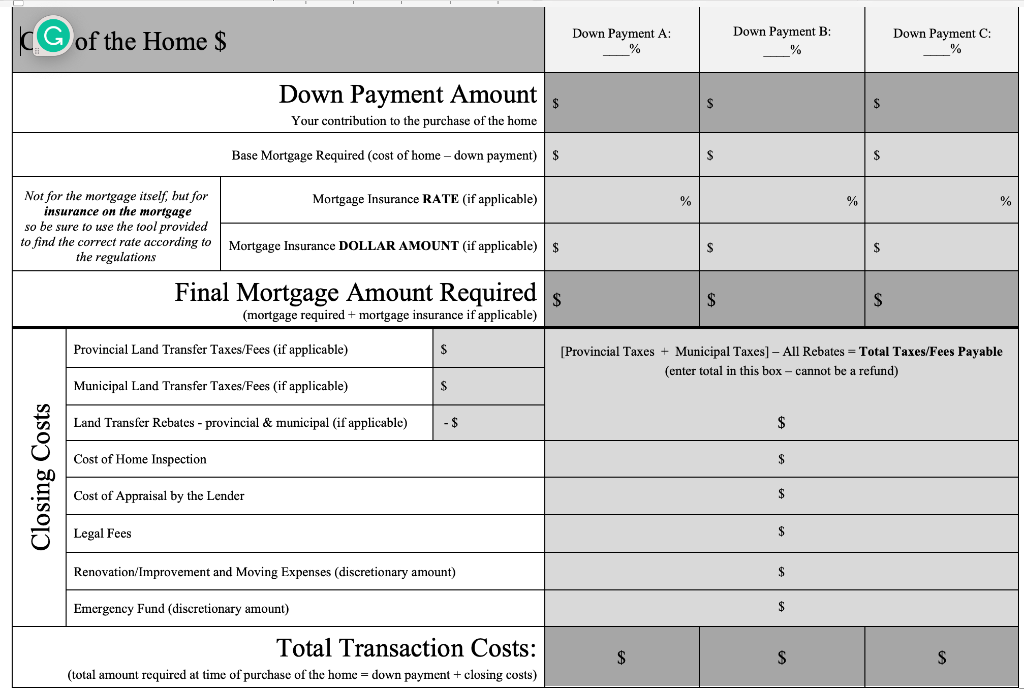

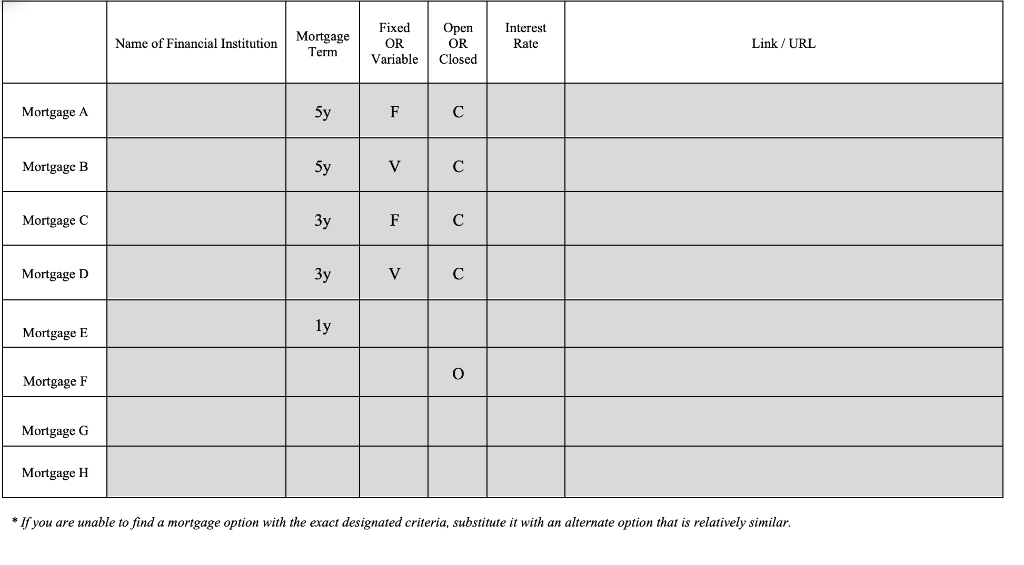

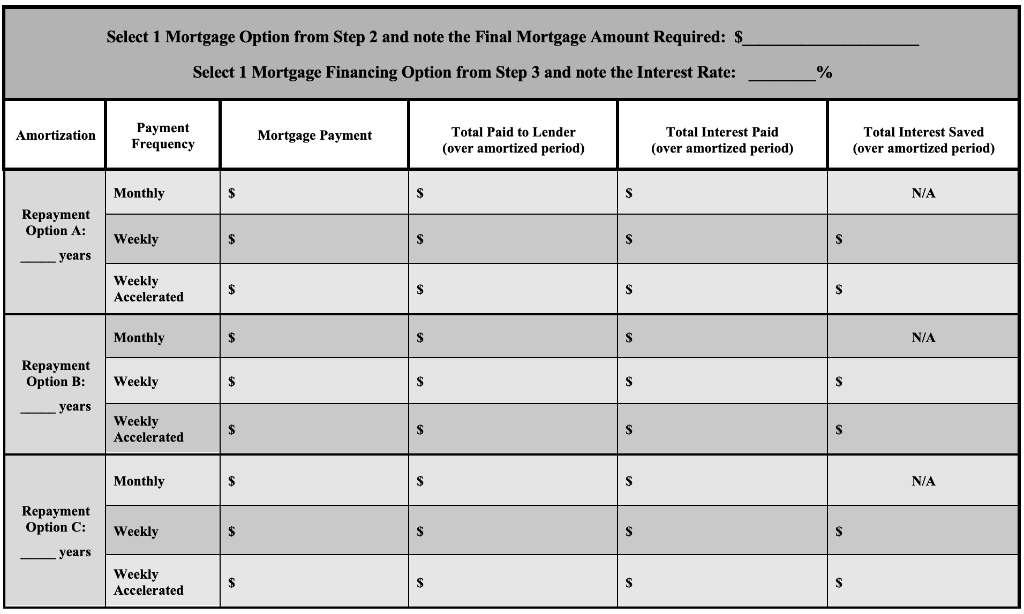

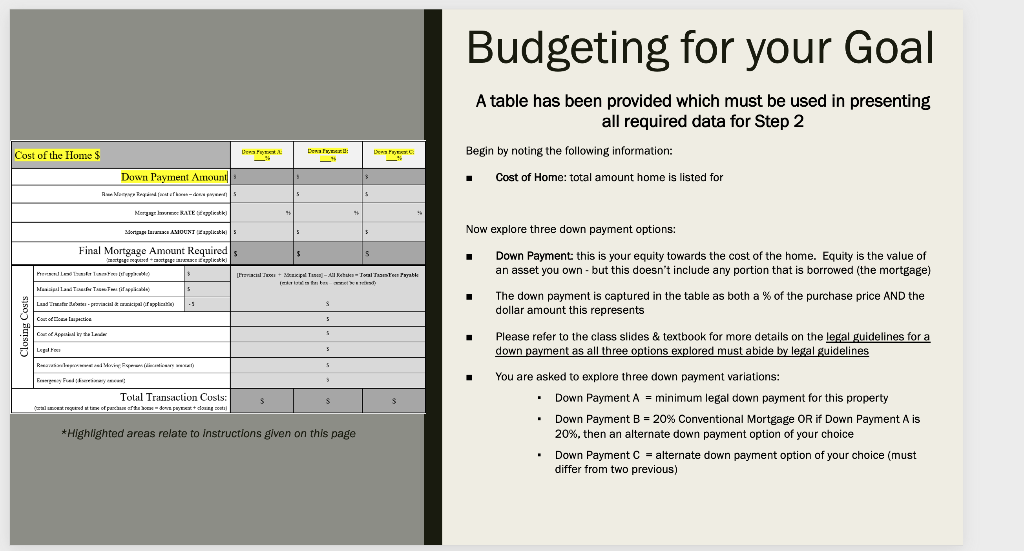

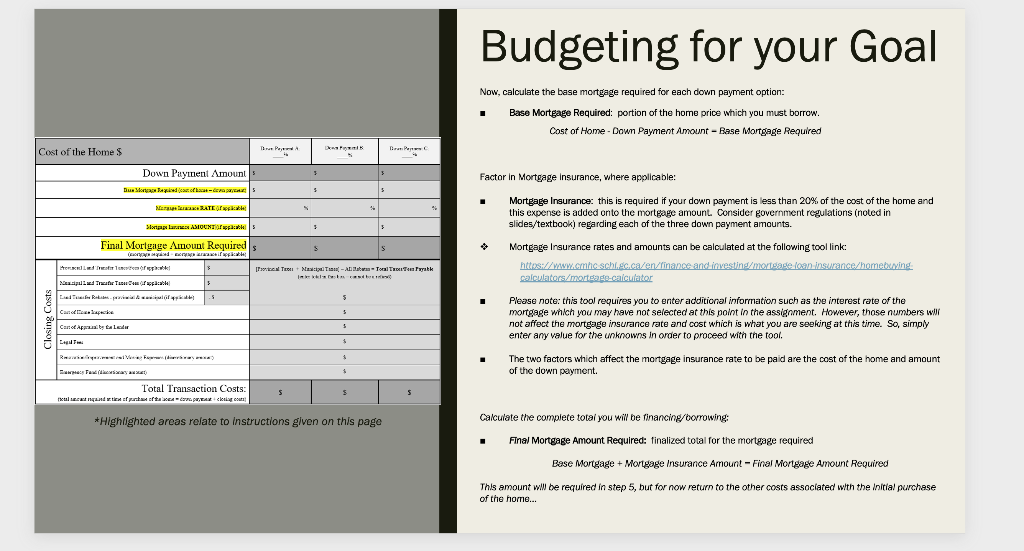

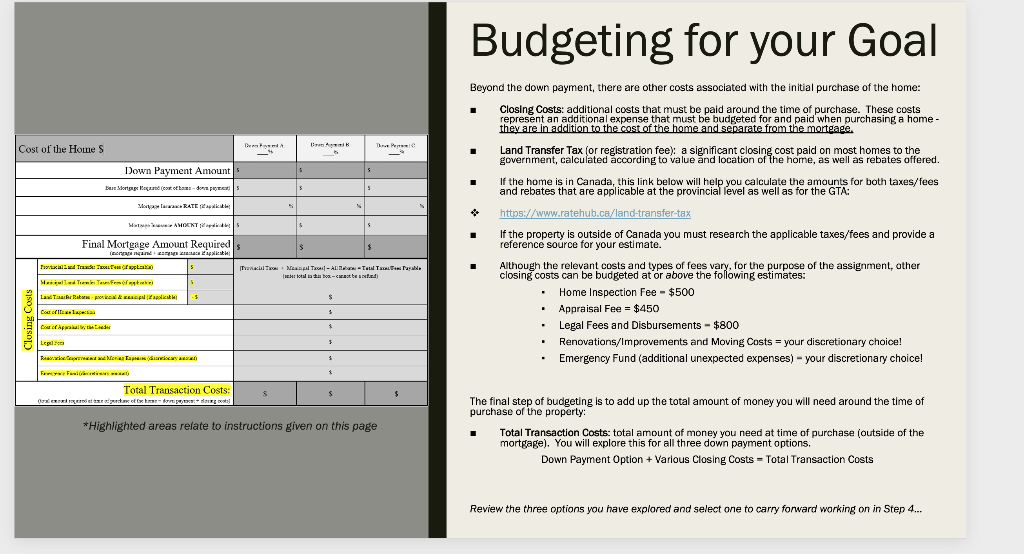

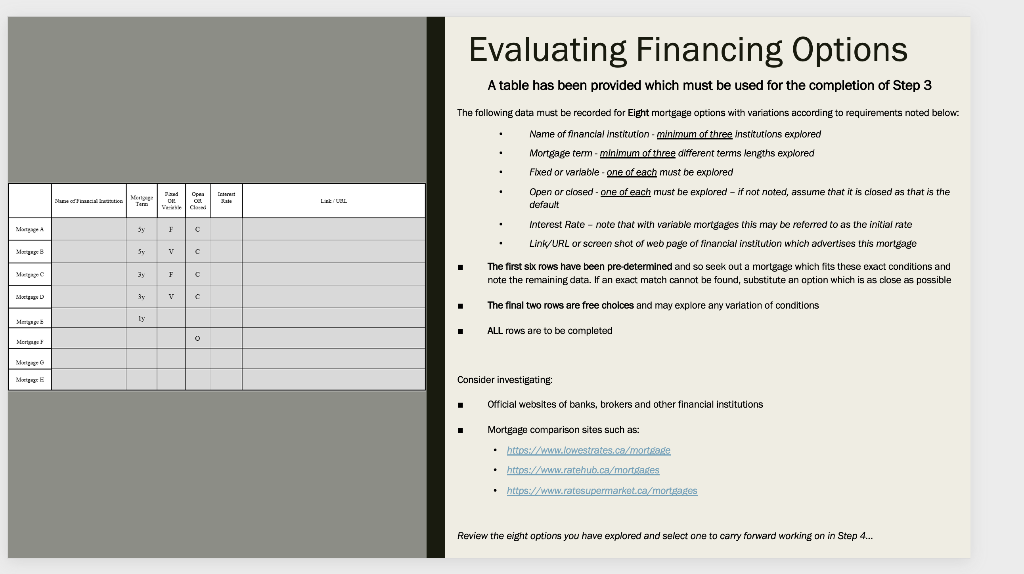

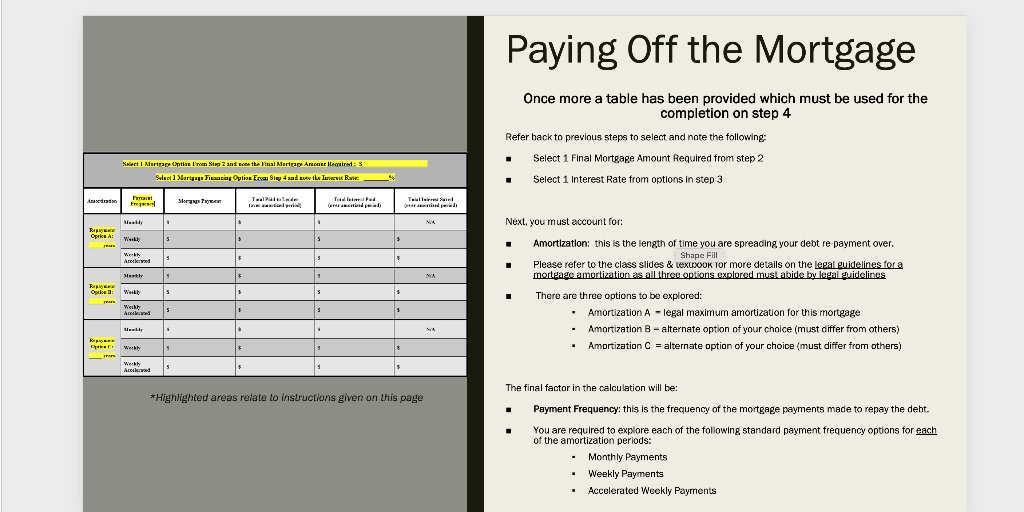

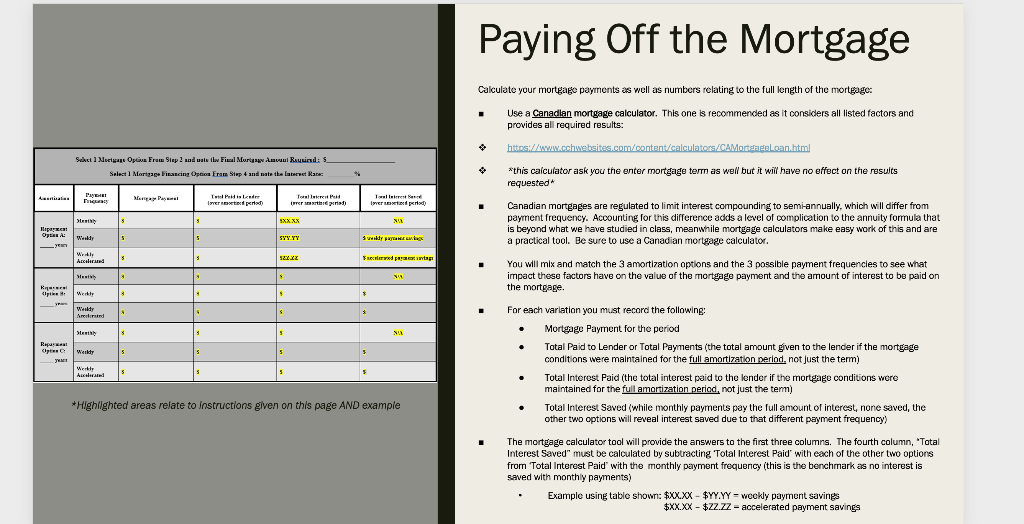

* If you are unable to find a mortgage option with the exact designated criteria, substitute it with an alternate option that is relatively similar. Select 1 Mortgage Option from Step 2 and note the Final Mortgage Amount Required: $ Select 1 Mortgage Financing Option from Step 3 and note the Interest Rate: % Objective The purpose of this assignment is to familiarize students with the process of budgeting for the purchase and financing of a home, or another significant financed purchase, as well as building awareness of key factors not to be overlooked throughout this process. Overview This assignment is comprised of four parts: 1. Selecting a Property Goal: Students must select, and secure a copy of, a current property listing which is representative of a real estate investment goal they may wish to pursue. 2. Budgeting for your Goal: Students must perform several calculations to determine the total transaction costs, including both the down payment and closing costs, that will be required in order to purchase the home they have selected. Variations on these calculations will explore the effects of making financial planning adjustments 3. Evaluating Financing Options: Students must examine the advertised mortgage options available through various financial institutions, considering several financing contract factors, in order to finance the remaining cost of the home. Various financing options will help expose the impacts of different mortgage factors 4. Paying Off the Mortgage: Finally, applying data collected, previous decisions made and incorporating some additional considerations, students must calculate the corresponding monthly mortgage payments by using an online mortgage calculator. Variations on these calculations will explore the effects of making financial planning adjustments. Selecting a Property Goal - Students must secure a copy of a real estate listing (screen capture). This copy must be easily legible and contain a minimum of the following details: - Price of home - Type of home - Location of home a size of home 2 Picture of home Links or URLs are NOT an acceptable format for submitting the property listing as the listing may close before the assignment is complete and the listing information is then inaccessible. Students are encouraged to select a property that aligns as closely as possible with their real life property ownership goals. Therefore the criteria is quite flexible: - The property can be anything from a house, to a condo, to a mobile home or even a piece of land for later development - There is no maximum or minimum price, but attainable and desirabie for your lifestyle shouid be considered guidelines - consider starter vs dream homes - The house may be located anywhere, so long as all information for the completion of the assignment can be obtained and submitted in English. Some places to locate Canadian property listings include: - hittos://ww.realtor.ca/mis - hitps://propertyguys.com/ - hittps://purplebricks.ca - There are many other property ilsting sites so feel free to browse! STEP 2: BUDGETING FOR YOUR GOAL Suchershus budgeting tor your aoal A table has been provided which must be used in presenting all required data for Step 2 Begin by noting the following information: - Cost of Home: total amount home is listed for Now explore three down payment options: - Down Payment this is your equity towards the cost of the home. Equity is the value of an asset you own - but this doesn't include any portion that is borrowed (the mortgage) - The down payment is captured in the table as both a % of the purchase price AND the dollar amount this represents - Please refer to the class slides \& textbook for more details on the legal guidelines for a down payment as all three options explored must abide by legal guidelines - You are asked to explore three down payment variations: - Down Payment A= minimum legal down payment for this property - Down Payment B=20% Conventional Mortgage OR if Down Payment A is *Highlighted areas relate to instructions given on this page - Down Payment C= alternate down payment option of your choice (must differ from two previous) buageting ror vour aoal Now, calculate the base mortgage required for each down payment option: - Base Mortgage Required: portion of the home price which you must borrow. Cost of Home - Down Payment Amount - Base Martgage Required Factor in Mortgage insurance, where applicable: - Mortgage Insurance: this is required if your down payment is less than 20% of the cost of the home and this expense is added onto the mortgage amount. Consider government regulations (noted in slides/textbookj regarding each of the three down payment amounts. * Mortgage Insurance rates and amounts can be calculated at the following tool link: Please note: this tool requires you to enter additional information such as the interest rate of the mortgage which you may have not selected at this point in the assignment. However, those numbers wilf not affect the mortgage insurance rate and cost which is what you are seefing at this time. So, simply' enter any value for the unknowns in order to proceed with the toor. - The two factors which affect the mortgage insurance rate to be paid are the cost of the home and amount of the down peryment. *Highlighted areas rolate to instructions given on this page Calculate the complete totar you will be rinancing/borrowing: - Final Mortgage Amount Required: finalized total for the mortgage required Base Mortgage + Mortgage insurance Amount - Final Mortgage Amount Required This amount will be required in step 5, but for now return to the other costs associated with the initial purchase of the home... budgeting tor yourGoal Beyond the down payment, there are other costs associated with the initial purchase of the home: Closing Costs: additional costs that must be paid around the time of purchase. These costs represent an additional expense that must be budgeted for and paid when purchasing a home they are in addition to the cost of the home and separate from the mortgage. - Land Transfer Tax (or registration fee): a significant closing cost paid on most homes to the government, calculated according to value and location of the home, as well as rebates offered. - If the home is in Canada, this link below will help you calculate the amounts for both taxes/fees and rebates that are applicable at the provincial level as well as for the GTA: If the property is outside of Canada you must research the applicable taxes/fees and provide a reference source for your estimate. Although the relevant costs and types of fees vary, for the purpose of the assignment, other closing costs can be budgeted at or above the following estimates: - Home Inspection Fee =$500 - Appraisal Fee =$450 - Legal Fees and Disbursements - $800 - Renovations/mprovements and Moving Costs = your discretionary choice! - Emergency Fund (additional unexpected expenses) - your discretionary choice! The final step of budgeting is to add up the total amount of money you will need around the time of purchase of the property: *Highlighted areas relate to instructions given on this page Total Transaction Costs: total amount of money you need at time of purchase coutside of the mortgage). You will explore this for all three down payment options. Down Payment Option + Various Closing Costs = Total Transaction Costs Review the three options you have explored and select one to carry forward working on in 5 tep 4.. STEP 3: EVALUATING FINANCING OPTIONS Evaluating Financing options A table has been provided which must be used for the completion of Step 3 The following data must be recorded for Eight mortgage options with variations according to requirements noted below: - Name of financial institution - minimum of three institutions explored - Mortgage term - minimim of three different terms lengths explored - Fbed or variable - one of each must be explored - Open or ciosed - one of each must be expiored - if not noted, assume that it is ciosed as that is the defacilt Interest Rate - note that with variable mortgages this may be referred to as the initial rate Link/URL or screen shot of weo page of financial institution which advertises this mortgage The first six rows have been pre-determined and so seck out a mortgage which fits these exact conditions and note the remaining data. If an exact match cannot be found, substitute an option which is as close as possible The final two rows are free cholces and may explore any variation of conditions ALL rows are to be completed Consider investigating: Official websites of banks, brokers and other financial institutions Mortgage comparison sites such as: - hithosi/ mmyilomestrates,ca/mortorap - httas:/ mum.ratehub.ca/mortgeres - hettps://mw.rateswpermarket.ca/morteages Review the eight options you have explored and select one to cary fonward working on in Step 4 STEP 4: PAYING OFF THE MORTGAGE Paying Off the Mortgage Once more a table has been provided which must be used for the completion on step 4 Refer back to previous steps to select and note the following: - Select 1 Final Mortgage Amount Required from step 2 - Select 1 interest Rate from options in step 3 Next, you must account for: - Amortization: this is the length of time you are spreacing your debt re payment over. Shape Fill - Please refer to the class slides \& texcoook ror more details on the legal quidelines for a mortgage amortization as all throe options explored must abide by legal quidelines There are three options to be explored: - Amortization A - legal maximum amortization for this mortgage - Amortization B - alternate option of your choice (must differ from others) - Amortization C = alternate option of your choice (must differ from others) *Highlighted areas relate to instructions given on this page The final factor in the calculation will be: - Payment Frequency: this is the frequency of the mortgage payments made to repay the deht. - You are required to explore each of the following standard payment frequency options for each of the amortization periods: - Monthly Payments - Weekly Payments - Accelerated Weekly Payments Calculate your mortgage payments as well as numbers relating to the full length of the mortgage: - Use a Canadlan mortgage calculator. This one is recommended as it considers all listed factors and provides all required results: 4. "this caiculator ask you the enter mortgage term as well but it will have no effect on the resuits requested * - Canadian mortgages are regulated to limit interest compounding to semi-annually, which will differ from payment frequency. Accounting for this difference adds a level of complication to the annuity formula that is beyond what we have studied in class, meanwhile mortgage calculators make easy work of this and are a practical tool. Be sure to use a Canadian mortgage calculator. - You will mix and match the 3 amortization options and the 3 possible payment frequencles to see what impact these factors have on the value of the mortgage payment and the amount of interest to be paid on the mortgage. - For each variation you must record the following: - Mortgage Payment for the period - Total Paid to Lender or Total Payments (the total amount given to the lender if the mortgage conditons were maintained for the full amortization perlod. not just the termi - Total Interest Paid (the total interest paid to the lender if the mortgage conditions were maintained for the full amortization period, not just the termi - Total Interest Saved (while monthly payments pay the full amount of interest, none saved, the *Highighted areas relate to instructions given on this page AND example other two options will reveal interest saved due to that different payment frequency) - The mortgage calculator tool will provide the answers to the first three columns. The fourth column, "Total Interest Saved" must be calculated by subtracting 'Total Interest Paid' with each of the other two options from 'Total Interest Paid' with the monthly paryment frequency (this is the benchmark as no interest is saved with monthly payments) - Example using table showri $XXX$YY,YY= weckly payment savings $XX.XX$ZZ.ZZ= accelerated payment savings * If you are unable to find a mortgage option with the exact designated criteria, substitute it with an alternate option that is relatively similar. Select 1 Mortgage Option from Step 2 and note the Final Mortgage Amount Required: $ Select 1 Mortgage Financing Option from Step 3 and note the Interest Rate: % Objective The purpose of this assignment is to familiarize students with the process of budgeting for the purchase and financing of a home, or another significant financed purchase, as well as building awareness of key factors not to be overlooked throughout this process. Overview This assignment is comprised of four parts: 1. Selecting a Property Goal: Students must select, and secure a copy of, a current property listing which is representative of a real estate investment goal they may wish to pursue. 2. Budgeting for your Goal: Students must perform several calculations to determine the total transaction costs, including both the down payment and closing costs, that will be required in order to purchase the home they have selected. Variations on these calculations will explore the effects of making financial planning adjustments 3. Evaluating Financing Options: Students must examine the advertised mortgage options available through various financial institutions, considering several financing contract factors, in order to finance the remaining cost of the home. Various financing options will help expose the impacts of different mortgage factors 4. Paying Off the Mortgage: Finally, applying data collected, previous decisions made and incorporating some additional considerations, students must calculate the corresponding monthly mortgage payments by using an online mortgage calculator. Variations on these calculations will explore the effects of making financial planning adjustments. Selecting a Property Goal - Students must secure a copy of a real estate listing (screen capture). This copy must be easily legible and contain a minimum of the following details: - Price of home - Type of home - Location of home a size of home 2 Picture of home Links or URLs are NOT an acceptable format for submitting the property listing as the listing may close before the assignment is complete and the listing information is then inaccessible. Students are encouraged to select a property that aligns as closely as possible with their real life property ownership goals. Therefore the criteria is quite flexible: - The property can be anything from a house, to a condo, to a mobile home or even a piece of land for later development - There is no maximum or minimum price, but attainable and desirabie for your lifestyle shouid be considered guidelines - consider starter vs dream homes - The house may be located anywhere, so long as all information for the completion of the assignment can be obtained and submitted in English. Some places to locate Canadian property listings include: - hittos://ww.realtor.ca/mis - hitps://propertyguys.com/ - hittps://purplebricks.ca - There are many other property ilsting sites so feel free to browse! STEP 2: BUDGETING FOR YOUR GOAL Suchershus budgeting tor your aoal A table has been provided which must be used in presenting all required data for Step 2 Begin by noting the following information: - Cost of Home: total amount home is listed for Now explore three down payment options: - Down Payment this is your equity towards the cost of the home. Equity is the value of an asset you own - but this doesn't include any portion that is borrowed (the mortgage) - The down payment is captured in the table as both a % of the purchase price AND the dollar amount this represents - Please refer to the class slides \& textbook for more details on the legal guidelines for a down payment as all three options explored must abide by legal guidelines - You are asked to explore three down payment variations: - Down Payment A= minimum legal down payment for this property - Down Payment B=20% Conventional Mortgage OR if Down Payment A is *Highlighted areas relate to instructions given on this page - Down Payment C= alternate down payment option of your choice (must differ from two previous) buageting ror vour aoal Now, calculate the base mortgage required for each down payment option: - Base Mortgage Required: portion of the home price which you must borrow. Cost of Home - Down Payment Amount - Base Martgage Required Factor in Mortgage insurance, where applicable: - Mortgage Insurance: this is required if your down payment is less than 20% of the cost of the home and this expense is added onto the mortgage amount. Consider government regulations (noted in slides/textbookj regarding each of the three down payment amounts. * Mortgage Insurance rates and amounts can be calculated at the following tool link: Please note: this tool requires you to enter additional information such as the interest rate of the mortgage which you may have not selected at this point in the assignment. However, those numbers wilf not affect the mortgage insurance rate and cost which is what you are seefing at this time. So, simply' enter any value for the unknowns in order to proceed with the toor. - The two factors which affect the mortgage insurance rate to be paid are the cost of the home and amount of the down peryment. *Highlighted areas rolate to instructions given on this page Calculate the complete totar you will be rinancing/borrowing: - Final Mortgage Amount Required: finalized total for the mortgage required Base Mortgage + Mortgage insurance Amount - Final Mortgage Amount Required This amount will be required in step 5, but for now return to the other costs associated with the initial purchase of the home... budgeting tor yourGoal Beyond the down payment, there are other costs associated with the initial purchase of the home: Closing Costs: additional costs that must be paid around the time of purchase. These costs represent an additional expense that must be budgeted for and paid when purchasing a home they are in addition to the cost of the home and separate from the mortgage. - Land Transfer Tax (or registration fee): a significant closing cost paid on most homes to the government, calculated according to value and location of the home, as well as rebates offered. - If the home is in Canada, this link below will help you calculate the amounts for both taxes/fees and rebates that are applicable at the provincial level as well as for the GTA: If the property is outside of Canada you must research the applicable taxes/fees and provide a reference source for your estimate. Although the relevant costs and types of fees vary, for the purpose of the assignment, other closing costs can be budgeted at or above the following estimates: - Home Inspection Fee =$500 - Appraisal Fee =$450 - Legal Fees and Disbursements - $800 - Renovations/mprovements and Moving Costs = your discretionary choice! - Emergency Fund (additional unexpected expenses) - your discretionary choice! The final step of budgeting is to add up the total amount of money you will need around the time of purchase of the property: *Highlighted areas relate to instructions given on this page Total Transaction Costs: total amount of money you need at time of purchase coutside of the mortgage). You will explore this for all three down payment options. Down Payment Option + Various Closing Costs = Total Transaction Costs Review the three options you have explored and select one to carry forward working on in 5 tep 4.. STEP 3: EVALUATING FINANCING OPTIONS Evaluating Financing options A table has been provided which must be used for the completion of Step 3 The following data must be recorded for Eight mortgage options with variations according to requirements noted below: - Name of financial institution - minimum of three institutions explored - Mortgage term - minimim of three different terms lengths explored - Fbed or variable - one of each must be explored - Open or ciosed - one of each must be expiored - if not noted, assume that it is ciosed as that is the defacilt Interest Rate - note that with variable mortgages this may be referred to as the initial rate Link/URL or screen shot of weo page of financial institution which advertises this mortgage The first six rows have been pre-determined and so seck out a mortgage which fits these exact conditions and note the remaining data. If an exact match cannot be found, substitute an option which is as close as possible The final two rows are free cholces and may explore any variation of conditions ALL rows are to be completed Consider investigating: Official websites of banks, brokers and other financial institutions Mortgage comparison sites such as: - hithosi/ mmyilomestrates,ca/mortorap - httas:/ mum.ratehub.ca/mortgeres - hettps://mw.rateswpermarket.ca/morteages Review the eight options you have explored and select one to cary fonward working on in Step 4 STEP 4: PAYING OFF THE MORTGAGE Paying Off the Mortgage Once more a table has been provided which must be used for the completion on step 4 Refer back to previous steps to select and note the following: - Select 1 Final Mortgage Amount Required from step 2 - Select 1 interest Rate from options in step 3 Next, you must account for: - Amortization: this is the length of time you are spreacing your debt re payment over. Shape Fill - Please refer to the class slides \& texcoook ror more details on the legal quidelines for a mortgage amortization as all throe options explored must abide by legal quidelines There are three options to be explored: - Amortization A - legal maximum amortization for this mortgage - Amortization B - alternate option of your choice (must differ from others) - Amortization C = alternate option of your choice (must differ from others) *Highlighted areas relate to instructions given on this page The final factor in the calculation will be: - Payment Frequency: this is the frequency of the mortgage payments made to repay the deht. - You are required to explore each of the following standard payment frequency options for each of the amortization periods: - Monthly Payments - Weekly Payments - Accelerated Weekly Payments Calculate your mortgage payments as well as numbers relating to the full length of the mortgage: - Use a Canadlan mortgage calculator. This one is recommended as it considers all listed factors and provides all required results: 4. "this caiculator ask you the enter mortgage term as well but it will have no effect on the resuits requested * - Canadian mortgages are regulated to limit interest compounding to semi-annually, which will differ from payment frequency. Accounting for this difference adds a level of complication to the annuity formula that is beyond what we have studied in class, meanwhile mortgage calculators make easy work of this and are a practical tool. Be sure to use a Canadian mortgage calculator. - You will mix and match the 3 amortization options and the 3 possible payment frequencles to see what impact these factors have on the value of the mortgage payment and the amount of interest to be paid on the mortgage. - For each variation you must record the following: - Mortgage Payment for the period - Total Paid to Lender or Total Payments (the total amount given to the lender if the mortgage conditons were maintained for the full amortization perlod. not just the termi - Total Interest Paid (the total interest paid to the lender if the mortgage conditions were maintained for the full amortization period, not just the termi - Total Interest Saved (while monthly payments pay the full amount of interest, none saved, the *Highighted areas relate to instructions given on this page AND example other two options will reveal interest saved due to that different payment frequency) - The mortgage calculator tool will provide the answers to the first three columns. The fourth column, "Total Interest Saved" must be calculated by subtracting 'Total Interest Paid' with each of the other two options from 'Total Interest Paid' with the monthly paryment frequency (this is the benchmark as no interest is saved with monthly payments) - Example using table showri $XXX$YY,YY= weckly payment savings $XX.XX$ZZ.ZZ= accelerated payment savings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started