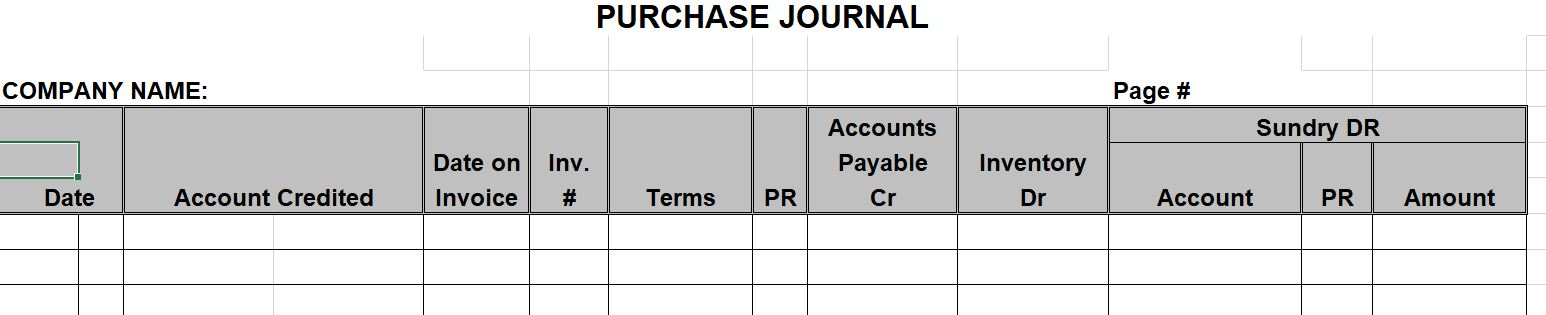

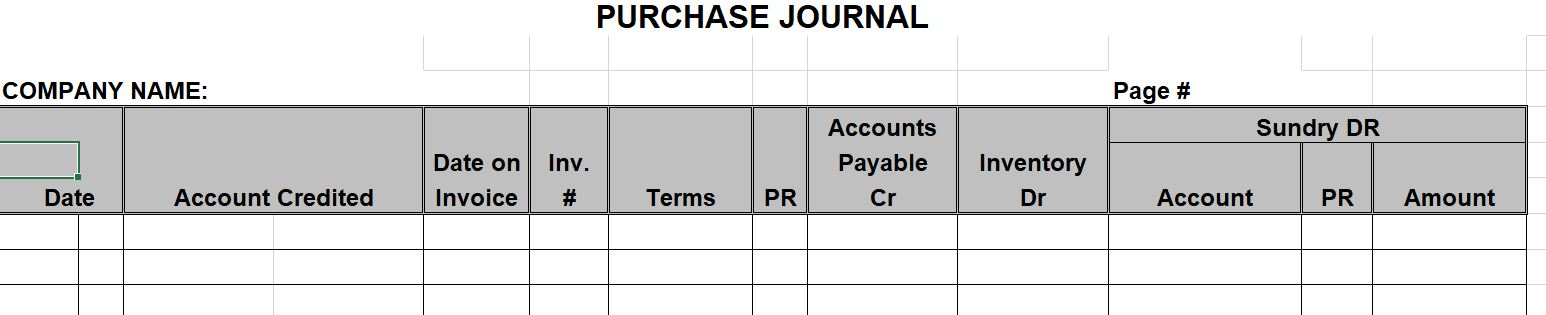

Please fill the purchase journal below.

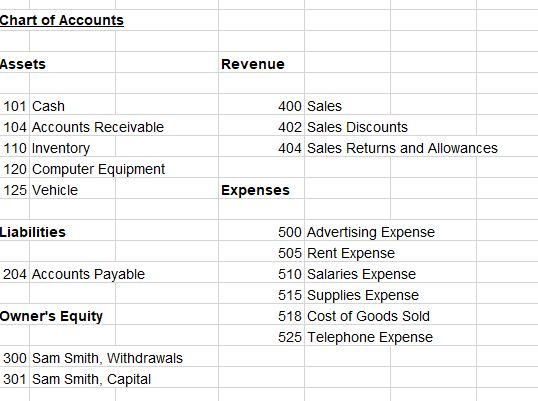

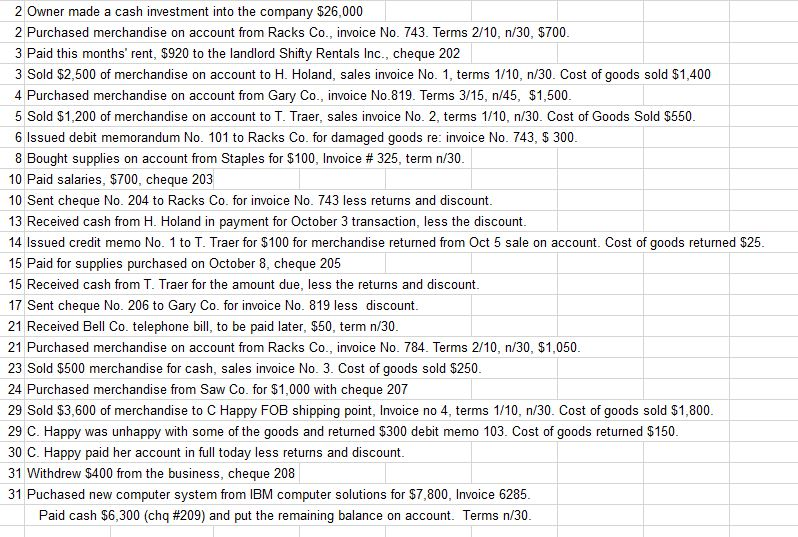

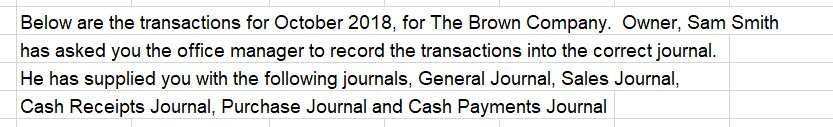

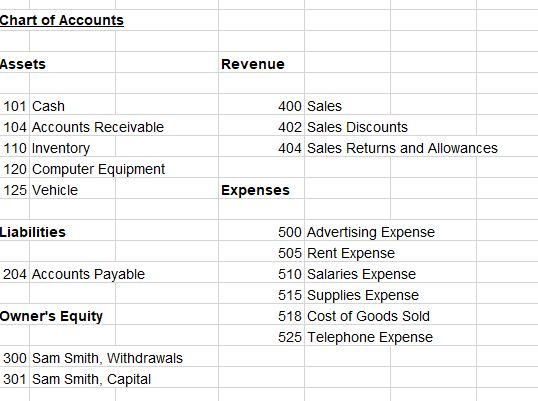

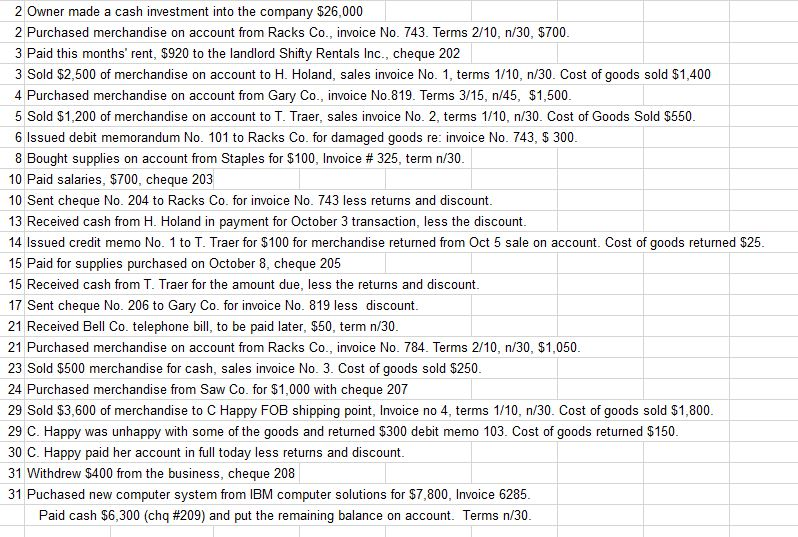

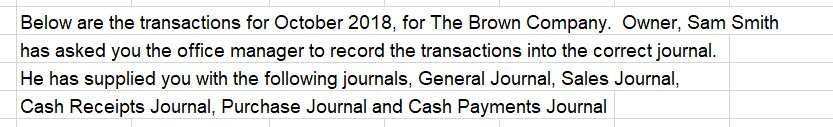

PURCHASE JOURNAL COMPANY NAME: Page # Sundry DR Date on Inv. # Accounts Payable Cr Inventory Dr Date Account Credited Invoice Terms PR Account PR Amount Chart of Accounts Assets Revenue 101 Cash 104 Accounts Receivable 110 Inventory 120 Computer Equipment 125 Vehicle 400 Sales 402 Sales Discounts 404 Sales Returns and Allowances Expenses Liabilities 204 Accounts Payable 500 Advertising Expense 505 Rent Expense 510 Salaries Expense 515 Supplies Expense 518 Cost of Goods Sold 525 Telephone Expense Owner's Equity 300 Sam Smith, Withdrawals 301 Sam Smith, Capital 2 Owner made a cash investment into the company $26,000 2 Purchased merchandise on account from Racks Co., invoice No. 743. Terms 2/10, n/30, $700. 3 Paid this months' rent, $920 to the landlord Shifty Rentals Inc., cheque 202 3 Sold $2,500 of merchandise on account to H. Holand, sales invoice No. 1, terms 1/10, n/30. Cost of goods sold $1,400 4 Purchased merchandise on account from Gary Co., invoice No.819. Terms 3/15, n/45, $1,500. 5 Sold $1,200 of merchandise on account to T. Traer, sales invoice No. 2, terms 1/10, n/30. Cost of Goods Sold $550. 6 Issued debit memorandum No. 101 to Racks Co. for damaged goods re: invoice No. 743, $ 300. 8 Bought supplies on account from Staples for $100, Invoice # 325, term n/30. 10 Paid salaries, $700, cheque 203 10 Sent cheque No 204 to Racks Co. for invoice No. 743 less returns and discount. 13 Received cash from H. Holand in payment for October 3 transaction, less the discount. 14 Issued credit memo No. 1 to T. Traer for $100 for merchandise returned from Oct 5 sale on account. Cost of goods returned $25. 15 Paid for supplies purchased on October 8, cheque 205 15 Received cash from T. Traer for the amount due, less the returns and discount. 17 Sent cheque No. 206 to Gary Co. for invoice No. 819 less discount. 21 Received Bell Co. telephone bill, to be paid later, $50, term n/30. 21 Purchased merchandise on account from Racks Co., invoice No. 784. Terms 2/10, n/30, $1,050. 23 Sold $500 merchandise for cash, sales invoice No. 3. Cost of goods sold $250. 24 Purchased merchandise from Saw Co. for $1,000 with cheque 207 29 Sold $3,600 of merchandise to C Happy FOB shipping point, Invoice no 4, terms 1/10, n/30. Cost of goods sold $1,800 29 C. Happy was unhappy with some of the goods and returned $300 debit memo 103. Cost of goods returned $150. 30 C. Happy paid her account in full today less returns and discount. 31 Withdrew $400 from the business, cheque 208 31 Puchased new computer system from IBM computer solutions for $7,800, Invoice 6285. Paid cash $6,300 (chq #209) and put the remaining balance on account. Terms n/30. Below are the transactions for October 2018, for The Brown Company. Owner, Sam Smith has asked you the office manager to record the transactions into the correct journal. He has supplied you with the following journals, General Journal, Sales Journal, Cash Receipts Journal, Purchase Journal and Cash Payments Journal