Answered step by step

Verified Expert Solution

Question

1 Approved Answer

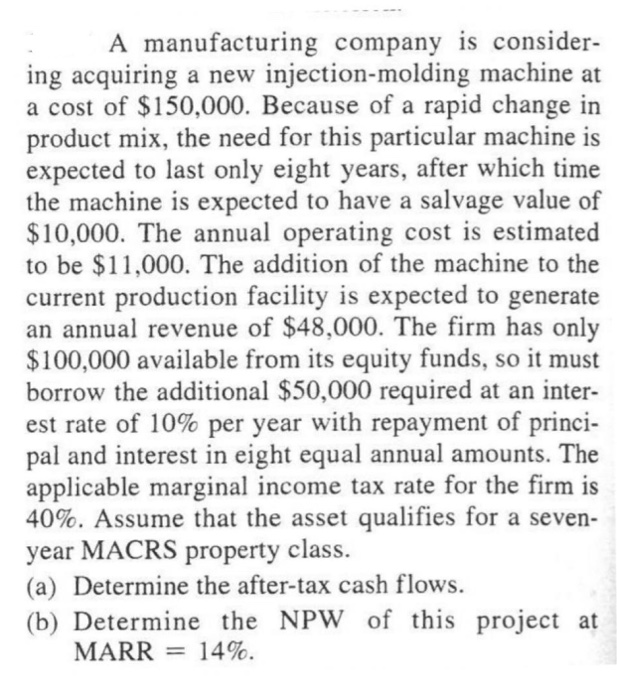

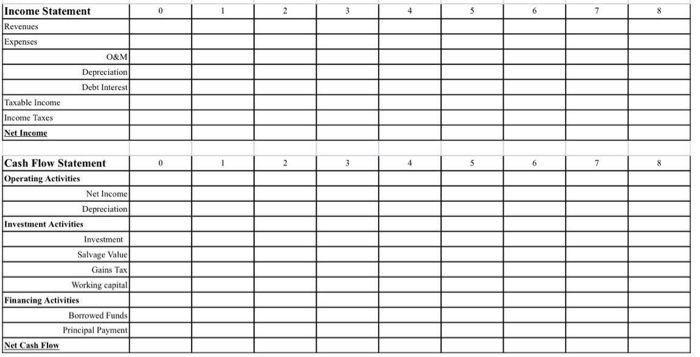

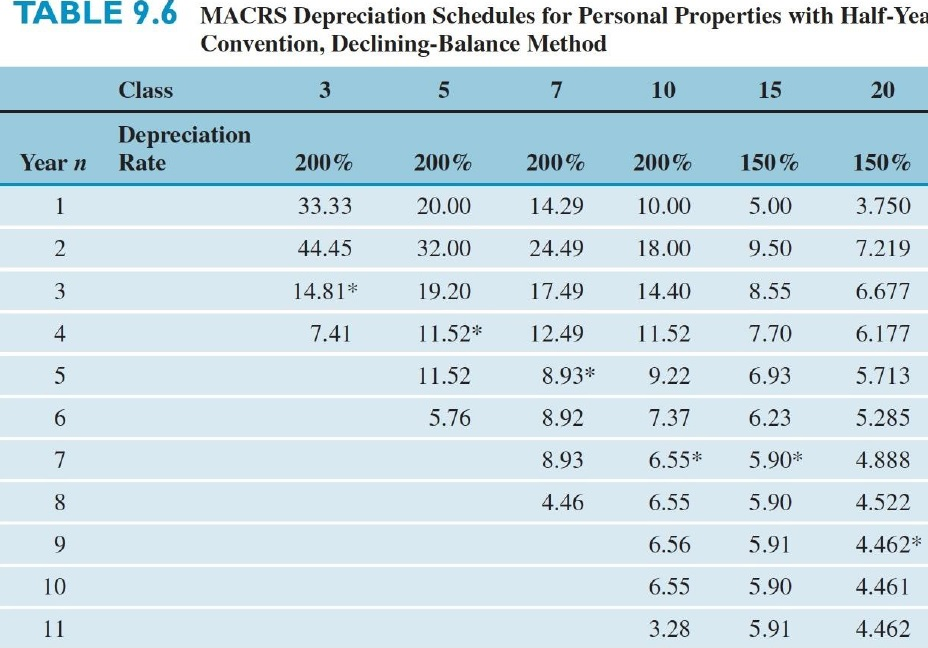

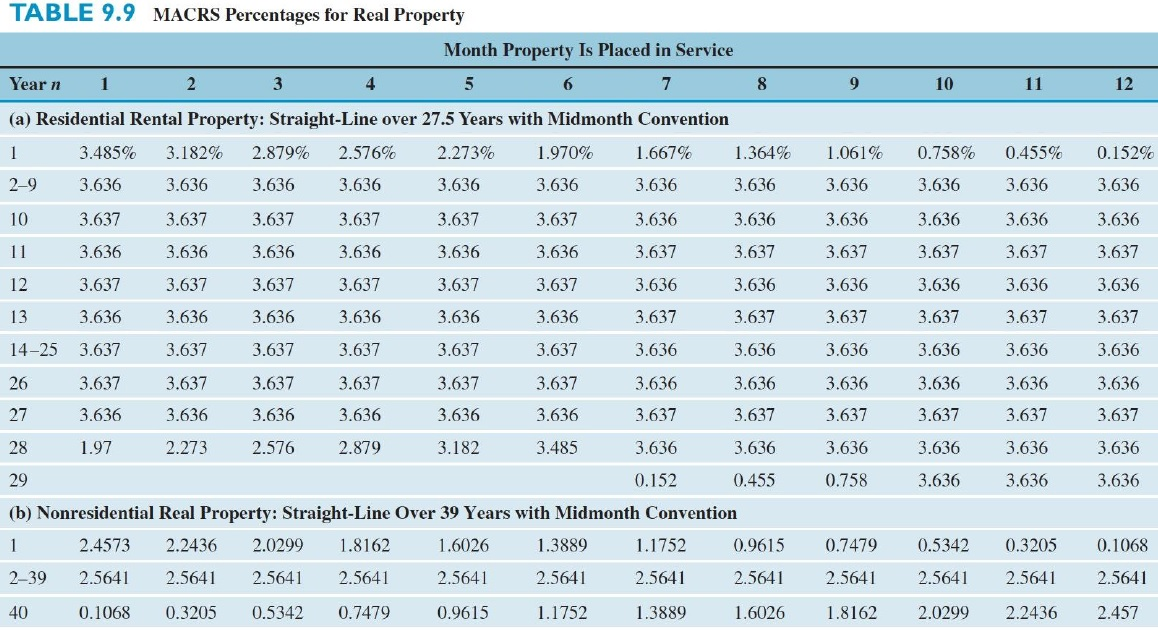

Please fill the table. A manufacturing company is consider- ing acquiring a new injection-molding machine at a cost of $150,000. Because of a rapid change

Please fill the table.

A manufacturing company is consider- ing acquiring a new injection-molding machine at a cost of $150,000. Because of a rapid change in product mix, the need for this particular machine is expected to last only eight years, after which time the machine is expected to have a salvage value of $10,000. The annual operating cost is estimated to be $11,000. The addition of the machine to the current production facility is expected to generate an annual revenue of $48,000. The firm has only $100,000 available from its equity funds, so it must borrow the additional $50,000 required at an inter- est rate of 10% per year with repayment of princi- pal and interest in eight equal annual amounts. The applicable marginal income tax rate for the firm is 40%. Assume that the asset qualifies for a seven- year MACRS property class. (a) Determine the after-tax cash flows. (b) Determine the NPW of this project at MARR = 14%. Income Statement 0 2 6 8 Revenues Expenses O&M Depreciation Debt Interest Taxable income Income Taxes Net Income 0 7 Cash Flow Statement Operating Activities Net Income Depreciation Investment Activities Investment Salvage Value Gains Tax Working capital Financing Activities Borrowed Funds Principal Payment Net Cash Flow TABLE 9.6 MACRS Depreciation Schedules for Personal Properties with Half-Yea Convention, Declining-Balance Method Class 3 5 7 10 15 20 Depreciation Rate Year n 200% 200% 200% 200% 150% 150% 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81* 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52* 12.49 11.52 7.70 6.177 5 11.52 8.93* 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55* 5.90* 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462* 10 6.55 5.90 4.461 11 3.28 5.91 4.462 9 10 11 12 TABLE 9.9 MACRS Percentages for Real Property Month Property Is Placed in Service Year n 1 2 3 4 5 6 7 8 (a) Residential Rental Property: Straight-Line over 27.5 Years with Midmonth Convention 3.485% 3.182% 2.879% 2.576% 2.273% 1.970% 1.667% 1.364% 2-9 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 1.061% 0.758% 0.455% 0.152% 3.636 3.636 3.636 3.636 10 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.636 11 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.637 3.637 3.637 12 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.636 13 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.637 3.637 3.637 14-25 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.636 26 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.636 27 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.637 3.637 3.637 28 1.97 2.273 2.576 2.879 3.182 3.485 3.636 3.636 3.636 3.636 3.636 3.636 0.758 3.636 3.636 3.636 29 0.152 0.455 (b) Nonresidential Real Property: Straight-Line Over 39 Years with Midmonth Convention 2.4573 2.2436 2.0299 1.8162 1.6026 1.3889 1.1752 0.9615 2-39 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 1 0.7479 0.5342 0.3205 0.1068 2.5641 2.5641 2.5641 2.5641 40 0.1068 0.3205 0.5342 0.7479 0.9615 1.1752 1.3889 1.6026 1.8162 2.0299 2.2436 2.457 A manufacturing company is consider- ing acquiring a new injection-molding machine at a cost of $150,000. Because of a rapid change in product mix, the need for this particular machine is expected to last only eight years, after which time the machine is expected to have a salvage value of $10,000. The annual operating cost is estimated to be $11,000. The addition of the machine to the current production facility is expected to generate an annual revenue of $48,000. The firm has only $100,000 available from its equity funds, so it must borrow the additional $50,000 required at an inter- est rate of 10% per year with repayment of princi- pal and interest in eight equal annual amounts. The applicable marginal income tax rate for the firm is 40%. Assume that the asset qualifies for a seven- year MACRS property class. (a) Determine the after-tax cash flows. (b) Determine the NPW of this project at MARR = 14%. Income Statement 0 2 6 8 Revenues Expenses O&M Depreciation Debt Interest Taxable income Income Taxes Net Income 0 7 Cash Flow Statement Operating Activities Net Income Depreciation Investment Activities Investment Salvage Value Gains Tax Working capital Financing Activities Borrowed Funds Principal Payment Net Cash Flow TABLE 9.6 MACRS Depreciation Schedules for Personal Properties with Half-Yea Convention, Declining-Balance Method Class 3 5 7 10 15 20 Depreciation Rate Year n 200% 200% 200% 200% 150% 150% 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81* 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52* 12.49 11.52 7.70 6.177 5 11.52 8.93* 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55* 5.90* 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462* 10 6.55 5.90 4.461 11 3.28 5.91 4.462 9 10 11 12 TABLE 9.9 MACRS Percentages for Real Property Month Property Is Placed in Service Year n 1 2 3 4 5 6 7 8 (a) Residential Rental Property: Straight-Line over 27.5 Years with Midmonth Convention 3.485% 3.182% 2.879% 2.576% 2.273% 1.970% 1.667% 1.364% 2-9 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 1.061% 0.758% 0.455% 0.152% 3.636 3.636 3.636 3.636 10 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.636 11 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.637 3.637 3.637 12 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.636 13 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.637 3.637 3.637 14-25 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.636 26 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.636 27 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.637 3.637 3.637 28 1.97 2.273 2.576 2.879 3.182 3.485 3.636 3.636 3.636 3.636 3.636 3.636 0.758 3.636 3.636 3.636 29 0.152 0.455 (b) Nonresidential Real Property: Straight-Line Over 39 Years with Midmonth Convention 2.4573 2.2436 2.0299 1.8162 1.6026 1.3889 1.1752 0.9615 2-39 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 1 0.7479 0.5342 0.3205 0.1068 2.5641 2.5641 2.5641 2.5641 40 0.1068 0.3205 0.5342 0.7479 0.9615 1.1752 1.3889 1.6026 1.8162 2.0299 2.2436 2.457Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started