Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please fill this out Considerations: Apple currently has $120 Billion of debt on the balance sheet paying a 3% annual coupon on average. The debt

Please fill this out

Considerations:

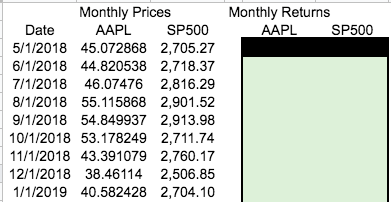

Apple currently has $120 Billion of debt on the balance sheet paying a 3% annual coupon on average. The debt is rated at AA+ which sells to yield 1.82% at current rates. Apples market value of equity of $2.24 Trillion. The current yield on the 10-year treasury is 1.58%. Assume a market risk premium of 8.5%. Apple pays a corporate tax rate of 21%.

Monthly Returns AAPL SP500 Monthly Prices Date AAPL SP500 5/1/2018 45.072868 2,705.27 6/1/2018 44.820538 2,718.37 7/1/2018 46.07476 2,816.29 8/1/2018 55.115868 2,901.52 9/1/2018 54.849937 2,913.98 10/1/2018 53.178249 2,711.74 11/1/2018 43.391079 2,760.17 12/1/2018 38.46114 2,506.85 1/1/2019 40.582428 2,704.10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started