Question

(Please finance experts, answer me for this qs with description what is required. Kindly read each and every thing before answering.) The appraisal process is

(Please finance experts, answer me for this qs with description what is required. Kindly read each and every thing before answering.)

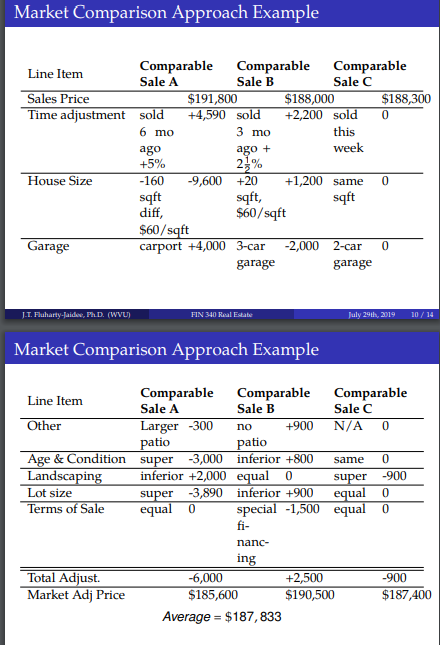

The appraisal process is an attempt at using valuation techniques to come to an estimate for the value of a house. Practicing these techniques is important to how you will be able to value the purchase, mortgage and even sale of a property at a later date. For this discussion, pick a home for sale in the Pittsburgh, PA, area. Then, like the examples provided below, find 3 comparable homes that recently sold within the last 6 months.

Next perform comparable analysis on the homes to arrive at a price that is appropriate for your home value. Next, determine the local going rents if you were to rent the property for the purpose of investment, for this exercise assume vacancy rates of 20%. Assuming you wish to obtain a return of 10% per year on your investment and that operating expenses account for 50% of the monthly rents throughout the year, what is the price that you should pay for the property under the Income Approach method?

Are the two different? Discuss what may have caused the difference, is it due to a poorly chosen comparable, the market being temporarily suppressed, or are there issues in your assumptions used in the income approach. Be detailed in your response, make sure to present each of the three comparables and a brief description of the house you are valuing.

Hopefully I will get the reply this time, finance experts did not reply any question which I posted till yet. They only answer childish questions.

Market Comparison Approach Example Comparable Sale A Comparable Comparable Line Item Sale B Sale C Sales Price Time adjustment $191,800 +4,590 sold $188,000 +2,200 sold this $188,300 sold 3 mo 6 mo week ago ago +5% 22% House Size -160 -9,600 +20 +1,200 same 0 sqft $60/sqft sqft diff, $60/sqft carport +4,000 3-car sqft -2,000 2-car Garage 0 garage garage J.T. Fluharty-Jaidoe, Ph D. (WVU) FIN 340 Real Estate July 29th, 2019 10/14 Market Comparison Approach Example Comparable Comparable Comparable Line Item Sale A Sale B Sale C Larger -300 patio N/A Other +900 C no patio Age & Condition super -3,000 inferior +800 Landscaping same inferior +2,000 equal 0 super -3,890 inferior +900 equal 0 -900 super equal 0 special -1,500 equal 0 Lot size Terms of Sale fi nanc ing -6,000 $185,600 Total Adjust Market Adj Price +2,500 -900 $187,400 $190,500 Average $187,833 Market Comparison Approach Example Comparable Sale A Comparable Comparable Line Item Sale B Sale C Sales Price Time adjustment $191,800 +4,590 sold $188,000 +2,200 sold this $188,300 sold 3 mo 6 mo week ago ago +5% 22% House Size -160 -9,600 +20 +1,200 same 0 sqft $60/sqft sqft diff, $60/sqft carport +4,000 3-car sqft -2,000 2-car Garage 0 garage garage J.T. Fluharty-Jaidoe, Ph D. (WVU) FIN 340 Real Estate July 29th, 2019 10/14 Market Comparison Approach Example Comparable Comparable Comparable Line Item Sale A Sale B Sale C Larger -300 patio N/A Other +900 C no patio Age & Condition super -3,000 inferior +800 Landscaping same inferior +2,000 equal 0 super -3,890 inferior +900 equal 0 -900 super equal 0 special -1,500 equal 0 Lot size Terms of Sale fi nanc ing -6,000 $185,600 Total Adjust Market Adj Price +2,500 -900 $187,400 $190,500 Average $187,833Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started