Answered step by step

Verified Expert Solution

Question

1 Approved Answer

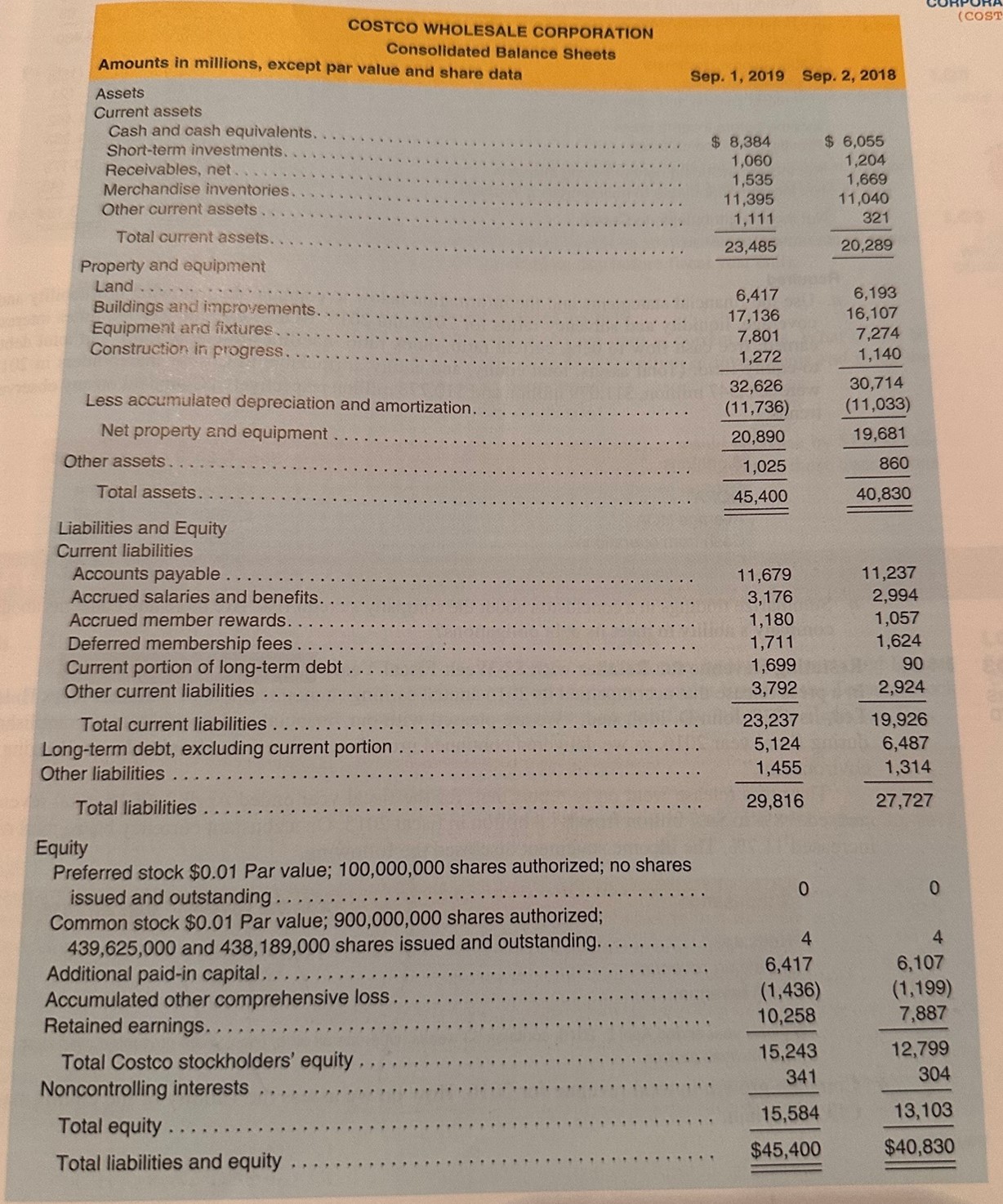

Please Financial Statement information for Costco. Refer to these financial statements to answer the requirements. COSTCO WHOLESALE CORPORATION Consolidated Balance Sheets Amounts in millions, except

Please Financial Statement information for Costco. Refer to these financial statements to answer the requirements.

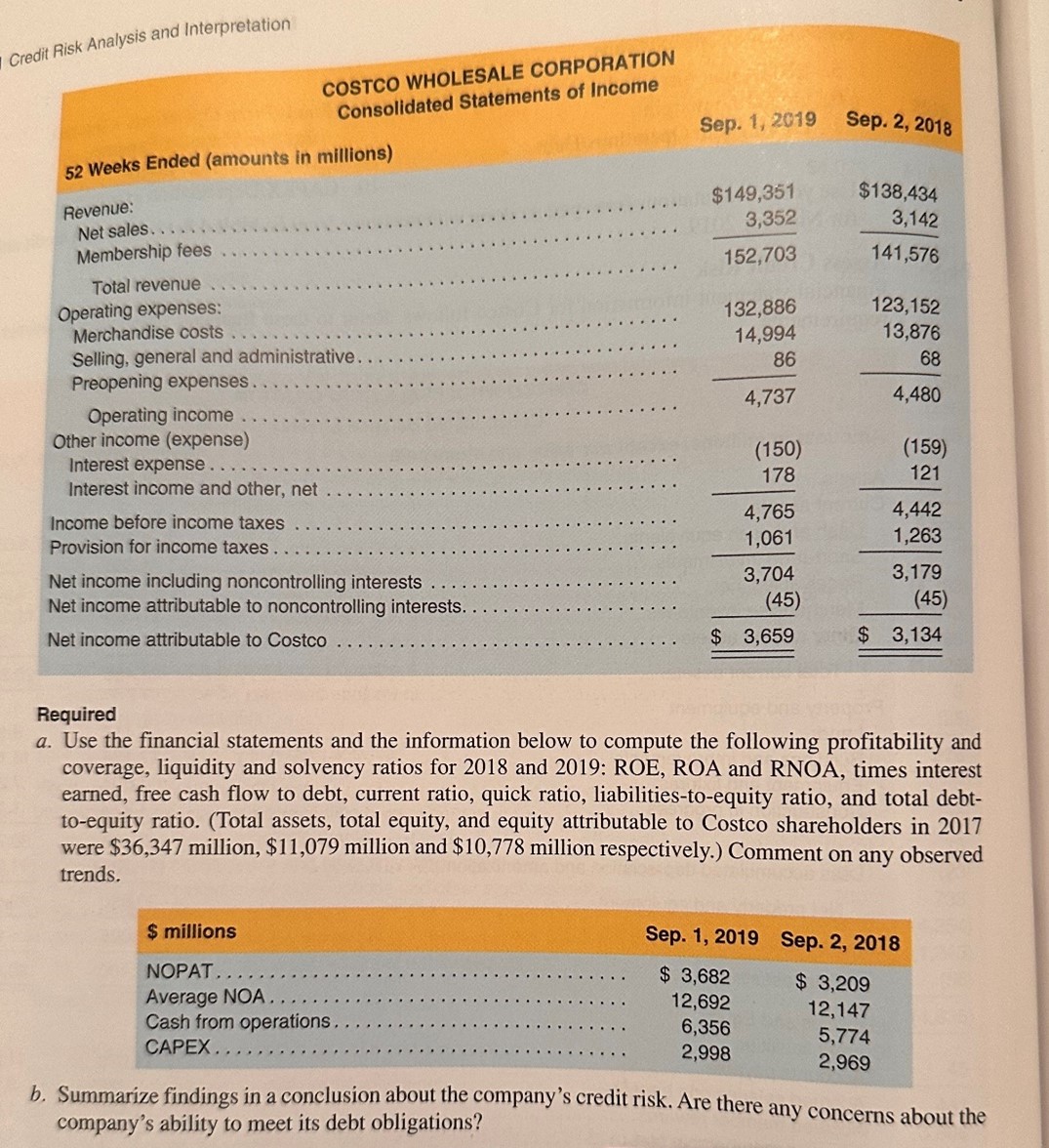

COSTCO WHOLESALE CORPORATION Consolidated Balance Sheets Amounts in millions, except par value and share data Assets Sep. 1, 2019 Sep. 2, 2018 Current assets Cash and cash equivalents. Short-term investments. Receivables, net Merchandise inventories. Other current assets Total current assets. Property and equipment Land Buildings and improvements. Equipment and ixtures. Construction in progress. Less accumulated depreciation and amortization. Net property and equipment Other assets. Total assets \begin{tabular}{rr} $8,384 & $6,055 \\ 1,060 & 1,204 \\ 1,535 & 1,669 \\ 11,395 & 11,040 \\ 1,111 & 321 \\ \hline 23,485 & 20,289 \\ \hline \end{tabular} (COST \begin{tabular}{rr} 6,417 & 6,193 \\ 17,136 & 16,107 \\ 7,801 & 7,274 \\ 1,272 & 1,140 \\ \hline 32,626 & 30,714 \\ 20,890(11,736) & (11,033) \\ \hline 1,025 & 19,681 \\ \hline 45,400 & \\ \hline \end{tabular} Liabilities and Equity Current liabilities Accounts payable Accrued salaries and benefits. Accrued member rewards. Deferred membership fees Current portion of long-term debt Other current liabilities Total current liabilities Long-term debt, excluding current portion Other liabilities Total liabilities \begin{tabular}{rr} 11,679 & 11,237 \\ 3,176 & 2,994 \\ 1,180 & 1,057 \\ 1,711 & 1,624 \\ 1,699 & 90 \\ 3,792 & 2,924 \\ \hline 23,237 & 19,926 \\ 5,124 & 6,487 \\ 1,455 & 1,314 \\ \hline 29,816 & 27,727 \end{tabular} Equity Preferred stock $0.01 Par value; 100,000,000 shares authorized; no shares issued and outstanding. Common stock $0.01 Par value; 900,000,000 shares authorized; 439,625,000 and 438,189,000 shares issued and outstanding. Additional paid-in capital. Accumulated other comprehensive loss Retained earnings. Total Costco stockholders' equity Noncontrolling interests Total equity Total liabilities and equity \begin{tabular}{rr} 0 & 0 \\ 4 & 4 \\ 6,417 & 6,107 \\ (1,436) & (1,199) \\ 10,258 & 7,887 \\ \hline 15,243 & 30412,799 \\ \hline 15,584 & $45,40013,103 \\ \hline \hline \end{tabular} Required a. Use the financial statements and the information below to compute the following profitability and coverage, liquidity and solvency ratios for 2018 and 2019: ROE, ROA and RNOA, times interest earned, free cash flow to debt, current ratio, quick ratio, liabilities-to-equity ratio, and total debtto-equity ratio. (Total assets, total equity, and equity attributable to Costco shareholders in 2017 were $36,347 million, $11,079 million and $10,778 million respectively.) Comment on any observed trends. b. Summarize findings in a conclusion about the company's credit risk. Are there any concerns about the company's ability to meet its debt obligations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started