Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please find a house worth $250,000 or less on Zillow or another real estate website. You may look in any location you want to

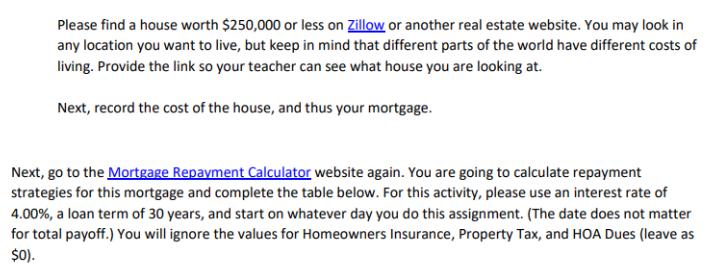

Please find a house worth $250,000 or less on Zillow or another real estate website. You may look in any location you want to live, but keep in mind that different parts of the world have different costs of living. Provide the link so your teacher can see what house you are looking at. Next, record the cost of the house, and thus your mortgage. Next, go to the Mortgage Repayment Calculator website again. You are going to calculate repayment strategies for this mortgage and complete the table below. For this activity, please use an interest rate of 4.00%, a loan term of 30 years, and start on whatever day you do this assignment. (The date does not matter for total payoff.) You will ignore the values for Homeowners Insurance, Property Tax, and HOA Dues (leave as $0). 10. Which repayment option would you choose and why? Be sure to support your argument with 2-3 sentences. Repayment Strategy Total Time from Now Until Mortgage Paid Off Total Interest Example No Changes-Original Mortgage 25 years, 10 months Payments . 3b. Extra $50 per Month 4a. 4b. Extra $100 per Month 5a. 5b. Extra $150 per Month 6a. 6b. Extra $1000 per Year (Annually) 7a. Extra $2000 per Year (Annually) 7b. 8a. 8b. Biweekly Payments 9a. 9b. $73,251

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started