Answered step by step

Verified Expert Solution

Question

1 Approved Answer

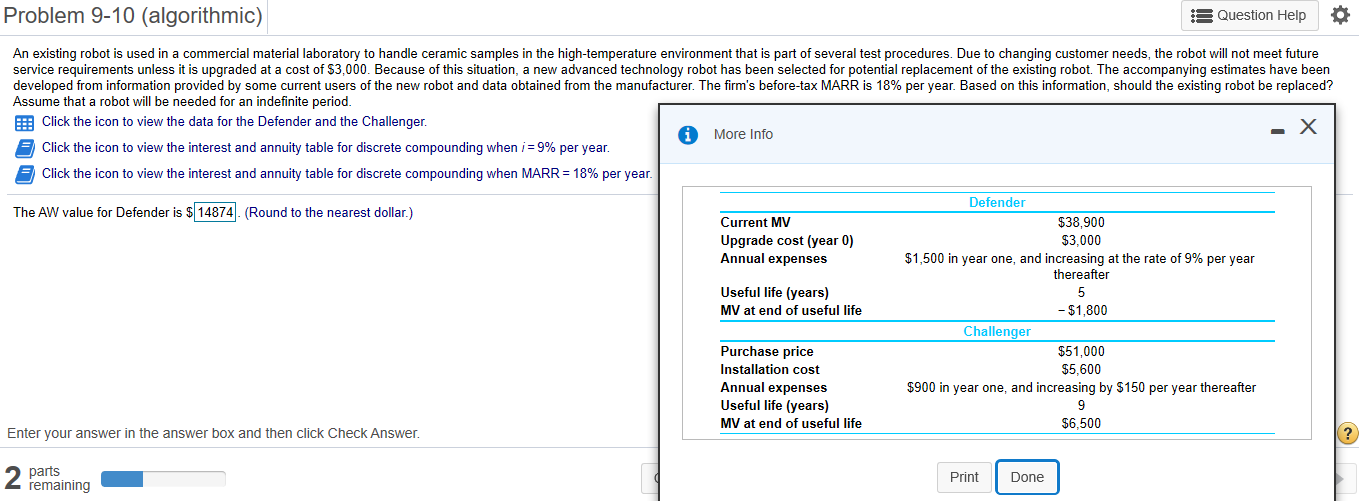

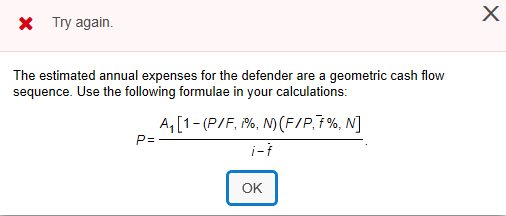

Please find AW for Defender and Challenger. Problem 9-10 (algorithmic) Question Help An existing robot is used in a commercial material laboratory to handle ceramic

Please find AW for Defender and Challenger.

Problem 9-10 (algorithmic) Question Help An existing robot is used in a commercial material laboratory to handle ceramic samples in the high-temperature environment that is part of several test procedures. Due to changing customer needs, the robot will not meet future service requirements unless it is upgraded at a cost of $3,000. Because of this situation, a new advanced technology robot has been selected for potential replacement of the existing robot. The accompanying estimates have been developed from information provided by some current users of the new robot and data obtained from the manufacturer. The firm's before-tax MARR is 18% per year. Based on this information, should the existing robot be replaced? Assume that a robot will be needed for an indefinite period. Click the icon to view the data for the Defender and the Challenger. 0 More Info - Click the icon to view the interest and annuity table for discrete compounding when i = 9% per year. Click the icon to view the interest and annuity table for discrete compounding when MARR = 18% per year. The AW value for Defender is $ 14874. (Round to the nearest dollar.) Current MV Upgrade cost (year 0) Annual expenses Defender $38,900 $3,000 $1,500 in year one, and increasing at the rate of 9% per year thereafter Useful life (years) MV at end of useful life Purchase price Installation cost Annual expenses Useful life (years) MV at end of useful life - $1,800 Challenger $51,000 $5,600 $900 in year one, and increasing by $150 per year thereafter $6,500 Enter your answer in the answer box and then click Check Answer. parts 2 remaining Print Print Done Done X Try again. The estimated annual expenses for the defender are a geometric cash flow sequence. Use the following formulae in your calculations: A [1-(P/F, 1%, M (F/P,7%, N] P= OK Problem 9-10 (algorithmic) Question Help An existing robot is used in a commercial material laboratory to handle ceramic samples in the high-temperature environment that is part of several test procedures. Due to changing customer needs, the robot will not meet future service requirements unless it is upgraded at a cost of $3,000. Because of this situation, a new advanced technology robot has been selected for potential replacement of the existing robot. The accompanying estimates have been developed from information provided by some current users of the new robot and data obtained from the manufacturer. The firm's before-tax MARR is 18% per year. Based on this information, should the existing robot be replaced? Assume that a robot will be needed for an indefinite period. Click the icon to view the data for the Defender and the Challenger. 0 More Info - Click the icon to view the interest and annuity table for discrete compounding when i = 9% per year. Click the icon to view the interest and annuity table for discrete compounding when MARR = 18% per year. The AW value for Defender is $ 14874. (Round to the nearest dollar.) Current MV Upgrade cost (year 0) Annual expenses Defender $38,900 $3,000 $1,500 in year one, and increasing at the rate of 9% per year thereafter Useful life (years) MV at end of useful life Purchase price Installation cost Annual expenses Useful life (years) MV at end of useful life - $1,800 Challenger $51,000 $5,600 $900 in year one, and increasing by $150 per year thereafter $6,500 Enter your answer in the answer box and then click Check Answer. parts 2 remaining Print Print Done Done X Try again. The estimated annual expenses for the defender are a geometric cash flow sequence. Use the following formulae in your calculations: A [1-(P/F, 1%, M (F/P,7%, N] P= OKStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started