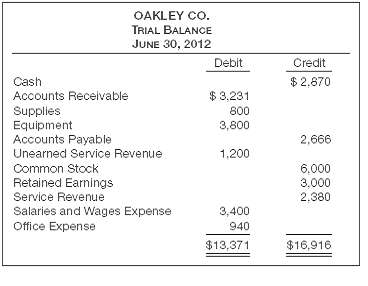

The following trial balance of Oakley Co. does not balance. Each of the listed accounts should have

Question:

The following trial balance of Oakley Co. does not balance.

Each of the listed accounts should have a normal balance per the general ledger. An examination of the ledger and journal reveals the following errors.1. Cash received from a customer on account was debited for $370, and Accounts Receivable was credited for the same amount. The actual collection was for $730.2. The purchase of a computer printer on account for $500 was recorded as a debit to Supplies for $500 and a credit to Accounts Payable for $500.3. Services were performed on account for a client for $890. Accounts Receivable was debited for $890 and Service Revenue was credited for $89.4. A payment of $65 for telephone charges was recorded as a debit to Office Expense for $65 and a debit to Cash for $65.5. When the Unearned Service Revenue account was reviewed, it was found that $225 of the balance was earned prior to June 30.6. A debit posting to Salaries and Wages Expense of $670 was omitted.7. A payment on account for $206 was credited to Cash for $206 and credited to Accounts Payable for $260.8. A dividend of $575 was debited to Salaries and Wages Expense for $575 and credited to Cash for $575.InstructionsPrepare a correct trial balance. (Note: It may be necessary to add one or more accounts to the trialbalance.)

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer: