Answered step by step

Verified Expert Solution

Question

1 Approved Answer

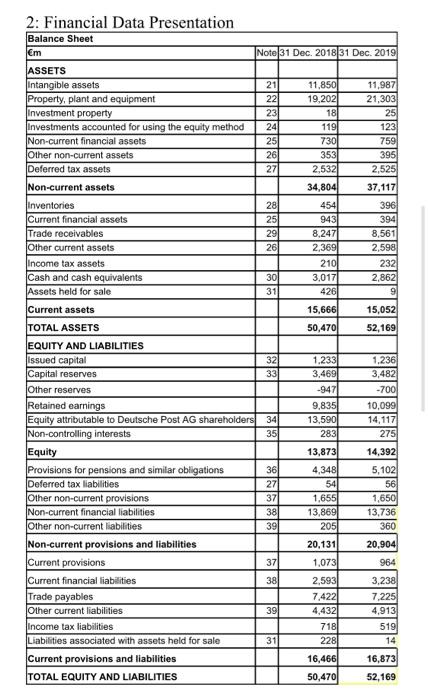

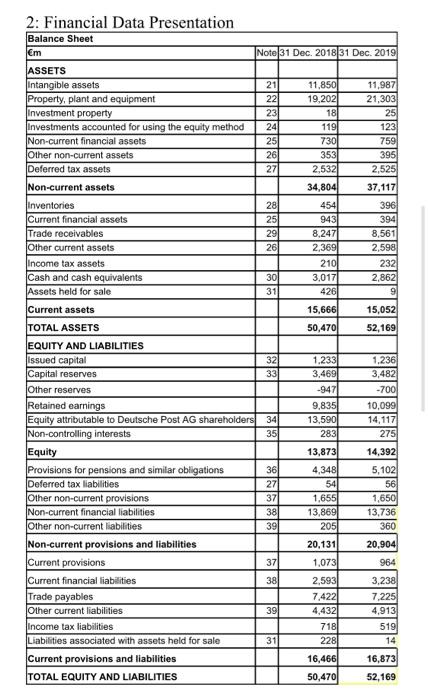

please find for me a Debt Utilization with fourmla Note 31 Dec. 2018|31 Dec. 2019 2: Financial Data Presentation Balance Sheet m ASSETS Intangible assets

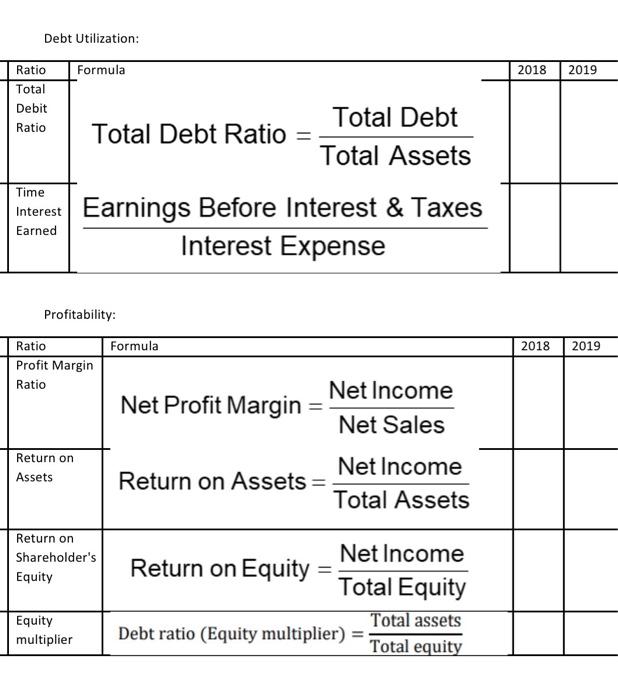

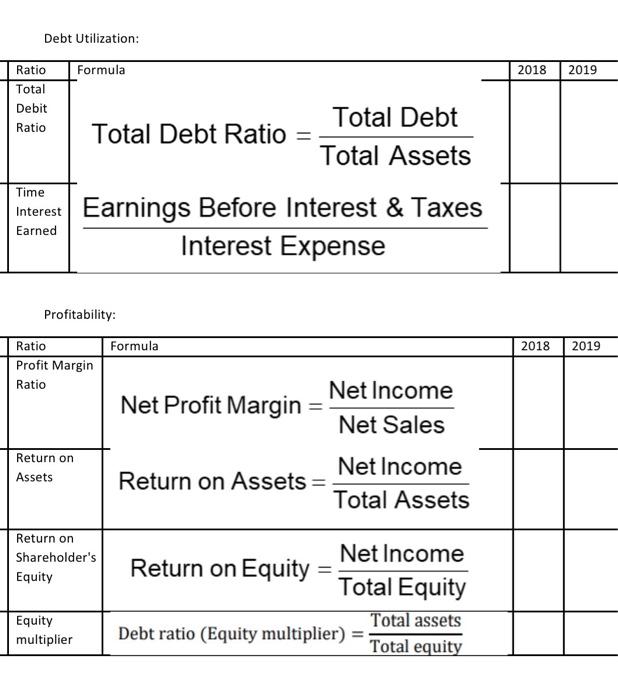

please find for me a Debt Utilization with fourmla

Note 31 Dec. 2018|31 Dec. 2019 2: Financial Data Presentation Balance Sheet m ASSETS Intangible assets Property, plant and equipment Investment property Investments accounted for using the equity method Non-current financial assets Other non-current assets Deferred tax assets Non-current assets 21 22 23 24 25 26 27 11,850 19,202 18 119 730 353 2,532 34,804 454 943 8,247 2,369 210 3,017 426 11,987 21,303 25 123 759 395 2,525 37,117 396 394 8,561 2,598 232 2,862 9 28 25 29 26 301 31 15,666 15,052 52,169 50,470 32 33 1.233 3,469 -947 9.835 13,590 283 1.236 3,482 -700 10,099 14,117 275 34 35 Inventories Current financial assets Trade receivables Other current assets income tax assets Cash and cash equivalents Assets held for sale Current assets TOTAL ASSETS EQUITY AND LIABILITIES issued capital Capital reserves Other reserves Retained earnings Equity attributable to Deutsche Post AG shareholders Non-controlling interests Equity Provisions for pensions and similar obligations Deferred tax liabilities Other non-current provisions Non-current financial liabilities Other non-current liabilities Non-current provisions and liabilities Current provisions Current financial liabilities Trade payables Other current liabilities Income tax liabilities Liabilities associated with assets held for sale Current provisions and liabilities TOTAL EQUITY AND LIABILITIES 13,873 36 27 37 38 39 4,348 54 1,655 13,869 205 14,392 5,102 56 1,650 13,736 360 20,131 1,073 20,904 964 37 38 39 2,593 7,422 4,432 718 228 3,238 7.225 4,913 519 14 31 16,466 50,470 16,873 52,169 Debt Utilization: Formula 2018 2019 Ratio Total Debit Ratio Total Debt Total Debt Ratio = Total Assets Time Interest Earned Earnings Before Interest & Taxes Interest Expense Profitability: Formula 2018 2019 Ratio Profit Margin Ratio Net Profit Margin Net Income Net Sales Return on Assets Net Income Return on Assets = Total Assets Return on Shareholder's Equity Net Income Return on Equity Total Equity Total assets Debt ratio (Equity multiplier) = Total equity Equity multiplier Note 31 Dec. 2018|31 Dec. 2019 2: Financial Data Presentation Balance Sheet m ASSETS Intangible assets Property, plant and equipment Investment property Investments accounted for using the equity method Non-current financial assets Other non-current assets Deferred tax assets Non-current assets 21 22 23 24 25 26 27 11,850 19,202 18 119 730 353 2,532 34,804 454 943 8,247 2,369 210 3,017 426 11,987 21,303 25 123 759 395 2,525 37,117 396 394 8,561 2,598 232 2,862 9 28 25 29 26 301 31 15,666 15,052 52,169 50,470 32 33 1.233 3,469 -947 9.835 13,590 283 1.236 3,482 -700 10,099 14,117 275 34 35 Inventories Current financial assets Trade receivables Other current assets income tax assets Cash and cash equivalents Assets held for sale Current assets TOTAL ASSETS EQUITY AND LIABILITIES issued capital Capital reserves Other reserves Retained earnings Equity attributable to Deutsche Post AG shareholders Non-controlling interests Equity Provisions for pensions and similar obligations Deferred tax liabilities Other non-current provisions Non-current financial liabilities Other non-current liabilities Non-current provisions and liabilities Current provisions Current financial liabilities Trade payables Other current liabilities Income tax liabilities Liabilities associated with assets held for sale Current provisions and liabilities TOTAL EQUITY AND LIABILITIES 13,873 36 27 37 38 39 4,348 54 1,655 13,869 205 14,392 5,102 56 1,650 13,736 360 20,131 1,073 20,904 964 37 38 39 2,593 7,422 4,432 718 228 3,238 7.225 4,913 519 14 31 16,466 50,470 16,873 52,169 Debt Utilization: Formula 2018 2019 Ratio Total Debit Ratio Total Debt Total Debt Ratio = Total Assets Time Interest Earned Earnings Before Interest & Taxes Interest Expense Profitability: Formula 2018 2019 Ratio Profit Margin Ratio Net Profit Margin Net Income Net Sales Return on Assets Net Income Return on Assets = Total Assets Return on Shareholder's Equity Net Income Return on Equity Total Equity Total assets Debt ratio (Equity multiplier) = Total equity Equity multiplier

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started