Answered step by step

Verified Expert Solution

Question

1 Approved Answer

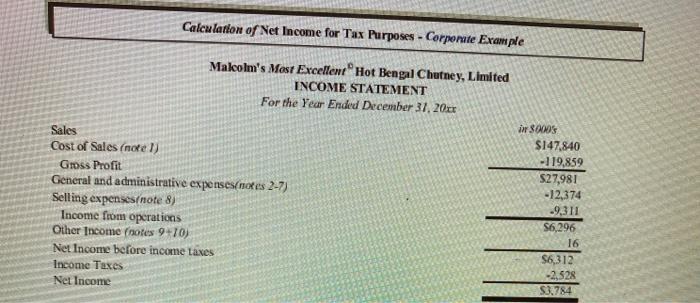

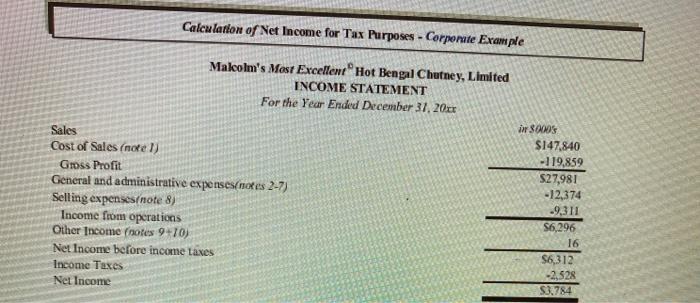

please find ITA references and explain why yes taxation Calculation of Net Income for Tax Purposes - Corporate Example Makolm's Most Excellent Hot Bengal Chutney,

please find ITA references and explain why

yes taxation

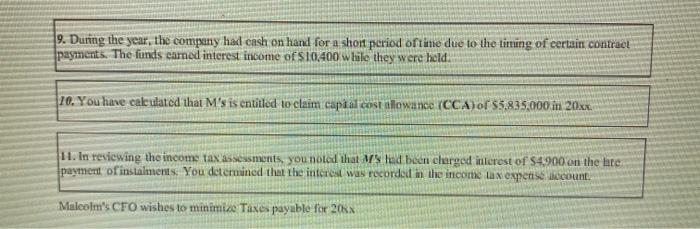

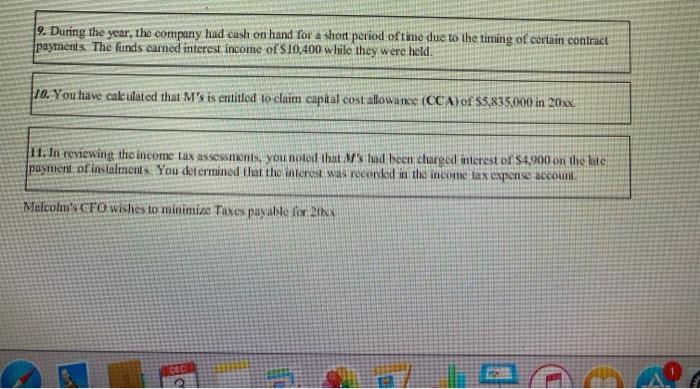

Calculation of Net Income for Tax Purposes - Corporate Example Makolm's Most Excellent Hot Bengal Chutney, Limited INCOME STATEMENT For the Year Ended December 31, 2006 Sales Cost of Sales (note 1) Gross Profit General and administrative expenses nees 2-7) Selling expensesote 8) Income from operations Other Income (notes 9+10) Net Income before income taxes Income Taxes Net Income in 3000 $147.840 -119.859 $27,981 - 12,374 .9,311 S6,296 16 $6,312 -2,528 53.784 9. During the year, the company had cash on hand for a short period of time due to the timing of certain contract payments. The funds camned interest income of $10,400 while they were held. 10. You have calculated that M's is entitled to claim cap al cost allowance (CCA) of $5,835,000 in 20xx 11. In reviewing the income tax assessments, you noted that had been charged interest of $4.900 on the late payment of instalments. You determined that the interest was recorded in the income tax expense locount. Malcolm's CFO wishes to minimize Taxes payable for 20 9. During the year, the company had cash on hand for a short period of time due to the timing of certain contract payments. The finds canned interest income of $10,400 while they were held. 10. You have calculated that M's is entitled to claim capital cost allowance (CCA)of $3,835,000 in 20x2. 111. In reviewing the income tax assessments, you note that's been charged interest or $4.900 on the late payment of instalments You determined that the interest was recorded in the income tax expense account Malcolm's CFO wishes to minimize Taxes payable for 2018 CEC Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started