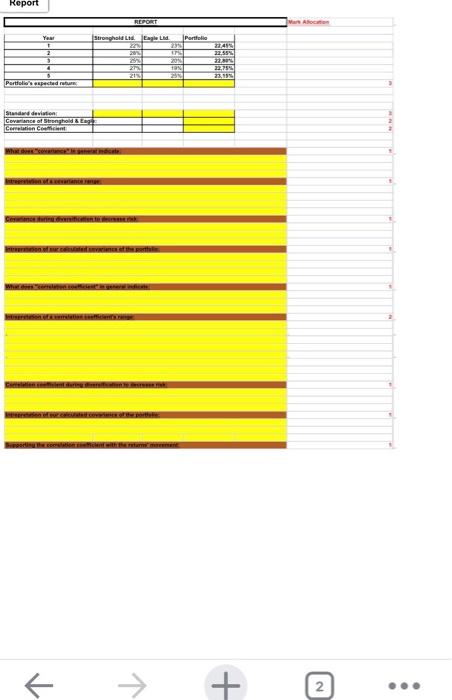

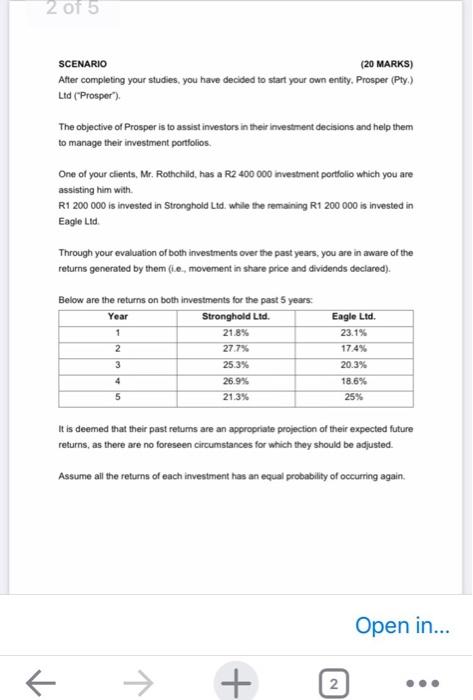

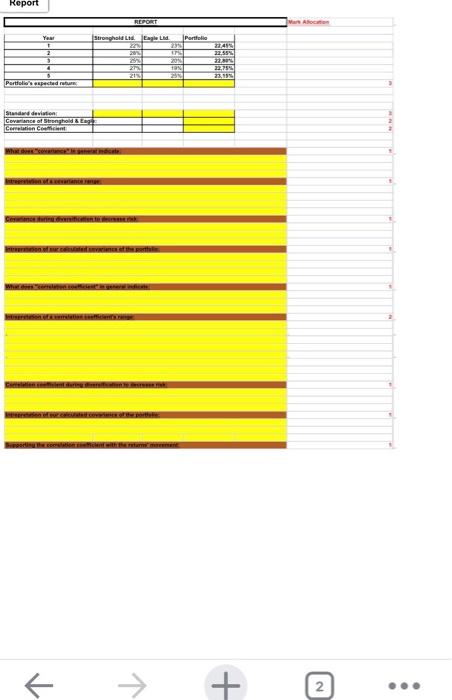

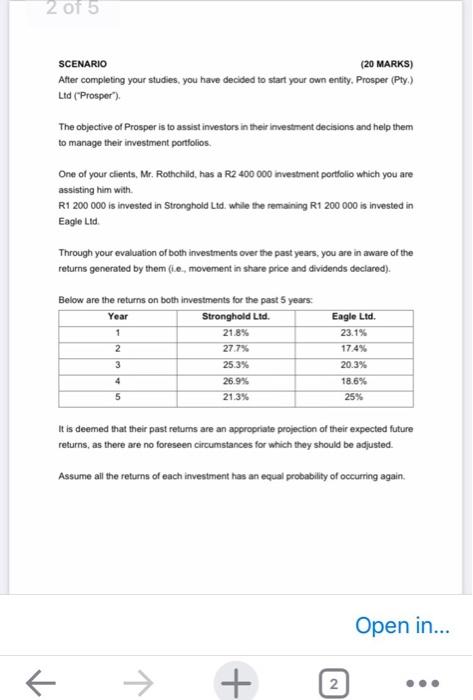

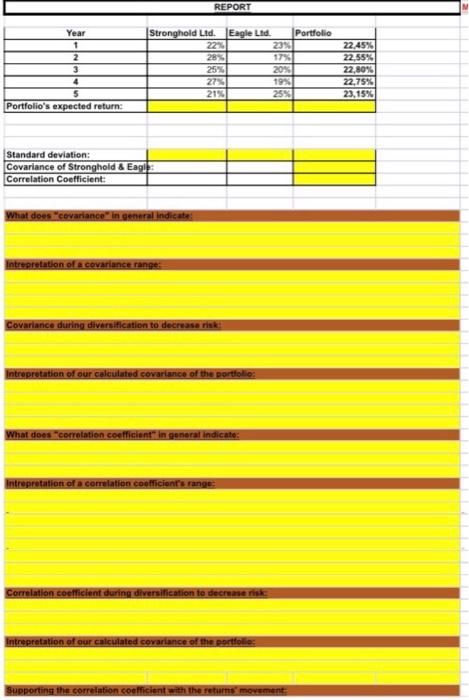

Report REPORT Act Year 2 Stronghold Ltd. Lagle Lad Portfolio an 23 241 20. TE 22,55% 20 22 10 22.758 215 23,195 Portfolio sapected returns Standard deviation Covance of Stronghold at Current W ten + 2 2015 SCENARIO (20 MARKS) After completing your studies, you have decided to start your own entity. Prosper (Pty) Ltd ("Prosper) The objective of Prosper is to assist investors in their investment decisions and help them to manage their investment portfolios One of your clients, Mr. Rothchild, has a R2 400 000 investment portfolio which you are assisting him with R1 200 000 is invested in Stronghold Ltd. while the remaining R1 200 000 is invested in Eagle Lid Through your evaluation of both investments over the past years, you are in aware of the returns generated by them (10., movement in share price and dividends declared). Below are the returns on both investments for the past 5 years Year Stronghold Ltd. 1 21.8% 2 27.7% 3 25.3% 4 26.9% 5 21.3% Eagle Ltd. 23.1% 17.4% 20.3% 18.6% 25% It is deemed that their past returns are an appropriate projection of their expected future returns, as there are no foreseen circumstances for which they should be adjusted. Assume all the returns of each investment has an equal probability of occurring again. Open in... K + 2 REPORT Year 1 2 3 Stronghold Ltd Eagle Lid. Portfolio 22 235 28% 17% 25% 20% 27% 19% 21% 25% 22.45% 22,55% 22,80% 22,75% 23,15% 5 Portfolio's expected return; Standard deviation: Covariance of Stronghold & Eagles Correlation coefficient: What does "covariance in general indicates Intrepretation of a covariance range: Covariance during diversification to decrease risk Intrepretation of our calculated covariance of the portfolio What does correlation coefficient in general indicato: Intrepretation of a correlation coefficient's range Correlation coefficient during diversification to decrease risk Intrepretation of our calculated covariance of the portfolie Supporting the correlation coefficient with the returns movement: Report REPORT Act Year 2 Stronghold Ltd. Lagle Lad Portfolio an 23 241 20. TE 22,55% 20 22 10 22.758 215 23,195 Portfolio sapected returns Standard deviation Covance of Stronghold at Current W ten + 2 2015 SCENARIO (20 MARKS) After completing your studies, you have decided to start your own entity. Prosper (Pty) Ltd ("Prosper) The objective of Prosper is to assist investors in their investment decisions and help them to manage their investment portfolios One of your clients, Mr. Rothchild, has a R2 400 000 investment portfolio which you are assisting him with R1 200 000 is invested in Stronghold Ltd. while the remaining R1 200 000 is invested in Eagle Lid Through your evaluation of both investments over the past years, you are in aware of the returns generated by them (10., movement in share price and dividends declared). Below are the returns on both investments for the past 5 years Year Stronghold Ltd. 1 21.8% 2 27.7% 3 25.3% 4 26.9% 5 21.3% Eagle Ltd. 23.1% 17.4% 20.3% 18.6% 25% It is deemed that their past returns are an appropriate projection of their expected future returns, as there are no foreseen circumstances for which they should be adjusted. Assume all the returns of each investment has an equal probability of occurring again. Open in... K + 2 REPORT Year 1 2 3 Stronghold Ltd Eagle Lid. Portfolio 22 235 28% 17% 25% 20% 27% 19% 21% 25% 22.45% 22,55% 22,80% 22,75% 23,15% 5 Portfolio's expected return; Standard deviation: Covariance of Stronghold & Eagles Correlation coefficient: What does "covariance in general indicates Intrepretation of a covariance range: Covariance during diversification to decrease risk Intrepretation of our calculated covariance of the portfolio What does correlation coefficient in general indicato: Intrepretation of a correlation coefficient's range Correlation coefficient during diversification to decrease risk Intrepretation of our calculated covariance of the portfolie Supporting the correlation coefficient with the returns movement