Answered step by step

Verified Expert Solution

Question

1 Approved Answer

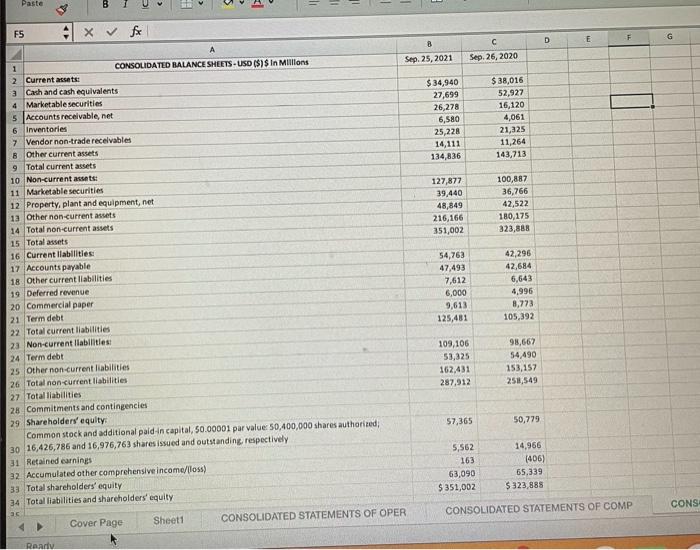

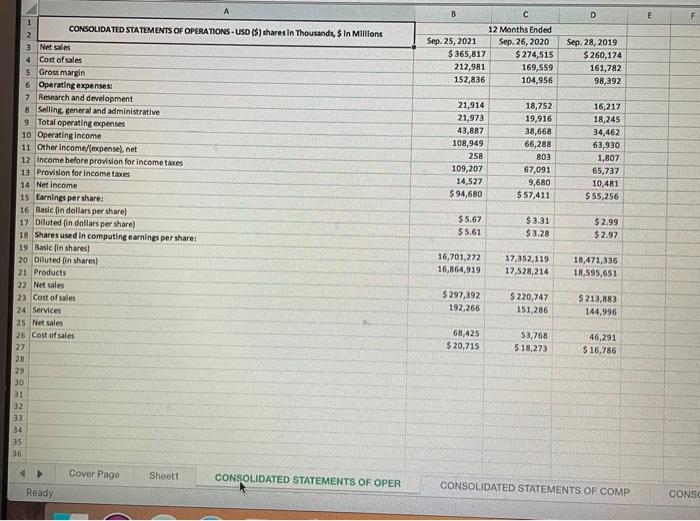

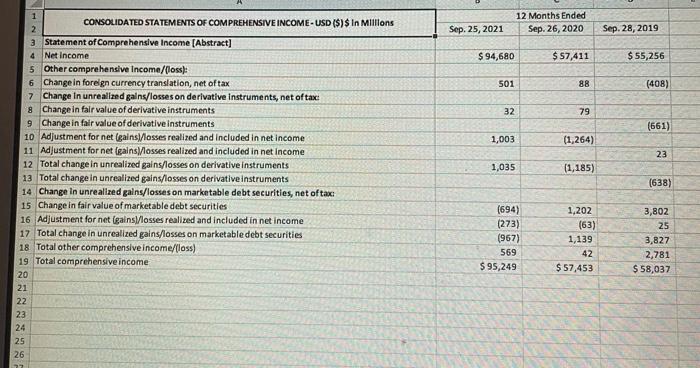

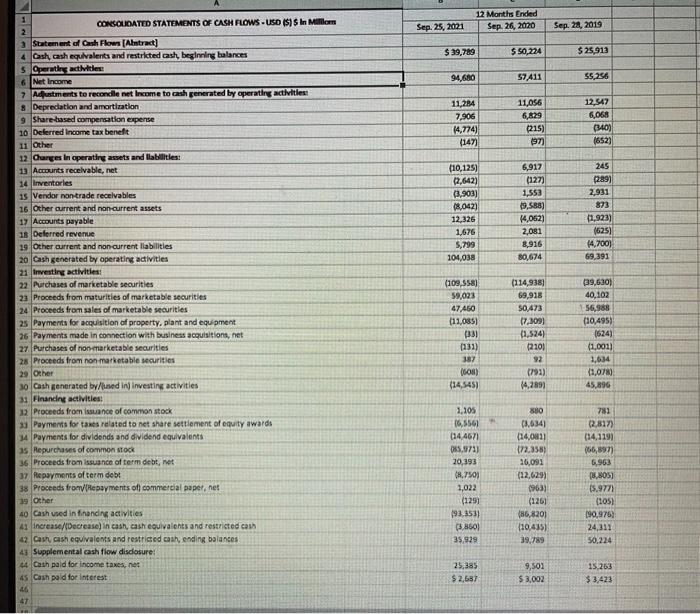

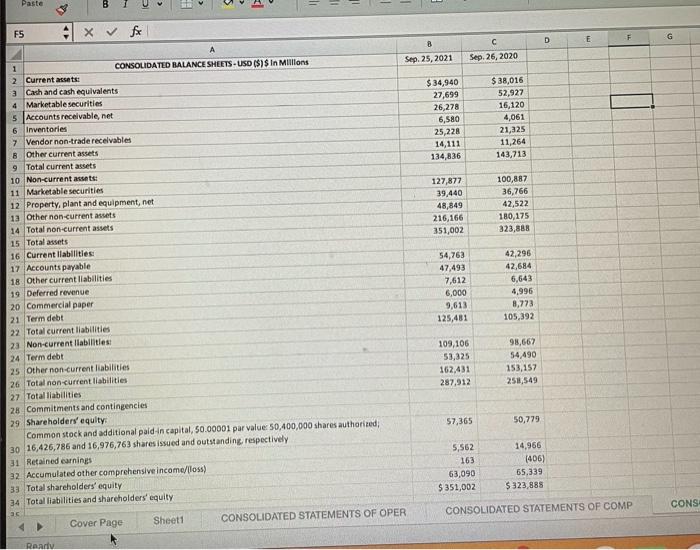

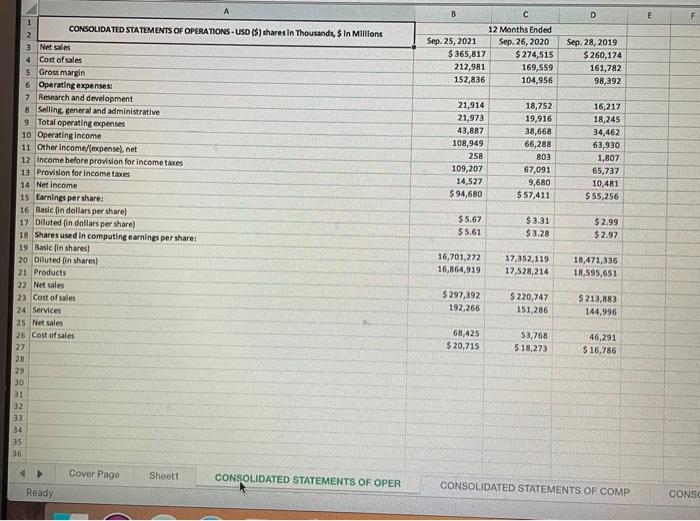

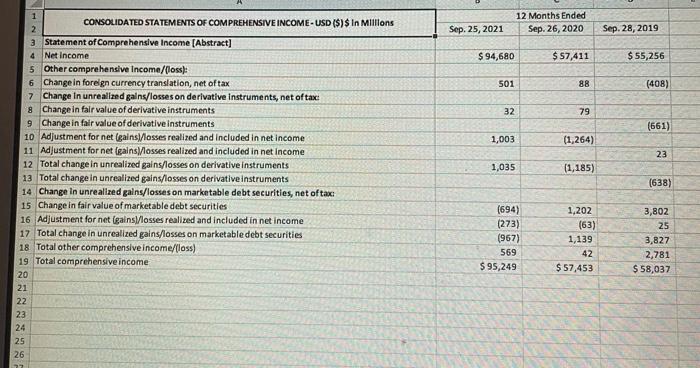

please find the financial ratios? 11 Paste = F5 x fx G D B Sep 25, 2021 Sep 26, 2020 $ 34,940 27,699 26,278 6,580

please find the financial ratios?

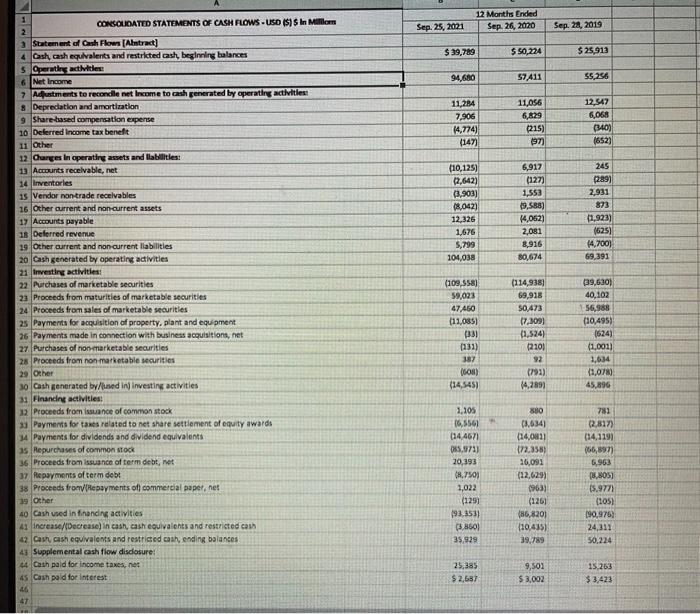

11 Paste = F5 x fx G D B Sep 25, 2021 Sep 26, 2020 $ 34,940 27,699 26,278 6,580 25,228 14,111 134,836 $ 38,016 52,927 16,120 4,061 21,325 11,264 143,713 127,877 39,440 48,849 216,166 51,002 100,887 36,766 42,522 180,175 323,888 1 CONSOLIDATED BALANCE SHEETS- USD ($) $ In Millions 2 Current assets: 3 Cash and cash equivalents 4 Marketable securities 5 Accounts receivable, net 6 Inventories 7 Vendor non-traderecelvables B other current assets 9 Total current assets 10 Non-current assets 11 Marketable securities 12 Property, plant and equipment, net 13 Other non-current assets 14 Total non-current assets 15 Total assets 16 Current liabilities 17 Accounts payable 18 Other current liabilities 19 Deferred revenue 20 Commercial paper 21 Term debt 22 Total current liabilities 23 Non-current liabilities 24 Term debt 25 Other non-current liabilities 26 Total non-current liabilities 27 Total liabilities 28 Commitments and contingencies 29 Shareholders' equity Common stock and additional paid in capital, 50.00001 par value 50,400,000 shares authorized 30 16,426,786 and 16,976,763 shares issued and outstanding respectively 31 Retained earnings 32 Accumulated other comprehensive income/loss) 33 Total shareholders' equity 34 Total liabilities and shareholders' equity 25 Cover Page Sheet1 CONSOLIDATED STATEMENTS OF OPER 54,763 47,493 7,612 6,000 9,613 125,481 42,296 42,684 6,643 4,995 8,773 105,392 109,106 53,325 162,431 287,912 98,667 54490 153,157 2511,549 57,365 50,779 5,562 163 63,090 $351,002 14,966 (406) 65,339 $323,888 CONS CONSOLIDATED STATEMENTS OF COMP Raart A B D NIN CONSOLIDATED STATEMENTS OF OPERATIONS- USD ($) shares in Thousands, $ in Millions 12 Months Ended Sep. 25, 2021 Sep. 26, 2020 S 365,817 $ 274,515 212,981 169,559 152,836 104,956 Sep. 28, 2019 $ 260,174 161,782 98,392 21,914 21,973 43,887 108,949 258 18,752 19,916 38,668 66,288 803 67,091 9,680 $ 57,411 16,217 18,245 34,462 63,930 1,807 65,737 10,481 $ 55,256 109,207 14,527 594,680 $5.67 $5.61 $3.31 $ 3.28 $2.99 $2.97 3 Netales 4 Cost of sales 5 Gross margin 6 Operating expenses 7 Research and development 8 Selling general and administrative 9 Total operating expenses 10 Operating income 11 Other income/expense), net 12 Income before provision for Income taxes 13 Provision for Income taxes 14 Net Income 15 Earnings per share: 16 Basic in dollars per sharel 17 Diluted (in dollars per share) 18 Shares used in computing earnings per share! 19 Basic in shares) 20 Diluted in shares) 21 Products 22 Net sales 23 Cost of sales 24 Services 25 Net sales 26 Cost of sales 27 28 29 30 31 32 33 34 35 36 16,701,272 16,864,919 17,352,119 17,528,214 18,471,336 18,595,651 $ 297,392 192,266 $ 220,747 151,286 S213,883 144,996 68,425 $ 20,715 53,768 $ 18,273 46,291 $ 16,786 Cover Page Sheet1 CONSOLIDATED STATEMENTS OF OPER CONSOLIDATED STATEMENTS OF COMP Ready CONSC 12 Months Ended Sep. 26, 2020 Sep. 25, 2021 Sep. 28, 2019 $ 94,680 $ 57,411 $ 55,256 501 88 (408) 32 79 (661) 1,003 (1,264) 23 1,035 (1,185) 1 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME- USD ($) $ in Millions 2 3 Statement of Comprehensive Income (Abstract] 4 Net Income 5 Other comprehensive Income/loss): 6 Change in foreign currency translation, net of tax 7 Change in unrealized galns/losses on derivative Instruments, net of tax 8 Change in fair value of derivative Instruments 9 Change in fair value of derivative instruments 10 Adjustment for net (gains/losses realized and included in net income 11 Adjustment for net(gainslosses realized and included in net income 12 Total change in unrealized gains/losses on derivative Instruments 13 Total change in unrealized gains/losses on derivative Instruments 14 Change in unrealized galns/losses on marketable debt securities, net of taxi 15 Change in fair value of marketable debt securities 16 Adjustment for net (gains/losses realized and included in net income 17 Total change in unrealized gains/losses on marketable debt securities 18 Total other comprehensive income/loss) 19 Total comprehensive income 20 21 22 23 24 25 26 (638) (694) (273) (967) 569 $ 95,249 1,202 (63) 1,139 42 $ 57,453 3,802 25 3,827 2,781 $ 58,037 12 Months Ended Sep. 26, 2020 Sep 25, 2021 Sep. 24, 2019 $ 39,789 $50,224 $ 25,913 94.680 57,411 55,256 11,284 7,906 14,774) (147) 11,056 6,829 (215) (97) 12,547 6,068 (340) 1652) 245 (289) 2,931 1 CONSOLIDATED STATEMENTS OF CASH FLOWS - USD (S) S In Mililom 2 3 Statement of Cash Flows (Altract] 4 Cash, cash equivalents and restricted cash, beginning balances 5 Querating activities 6 Net Income 7 Adjustments to recondile net Income to cash generated by operating activities 8 Depreciation and amortization 9 Share-based compensation expense 10 Deferred Income tax benefit 11 Other 12 Changes in operating assets and liabilities: 13 Accounts receivable, net 14 Inventories 15 Vendor non trade receivables 16 Other current and noncurrent assets 17 Accounts payable 18 Deferred revenue 19 Other current and non current liabilities 20 Cash generated by operating activities 21 Investing activities 22 Purchases of marketable securities 23 Proceeds from maturities of marketable securities 24 Proceeds from sales of marketable securities 2 Payments for acquisition of property, plant and equipment 26 Payments made in connection with business acquisitions, net 27. Purchases of non-marketable securities 26 Proceeds from non marketable securities 29 Other 30 Cash generated by used in investing activities 31 Finanding activities: 12 Proceeds from issuance of common stock Payments for taxes related to net share settlement of equity awards 14 Payments for dividends and dividend equivalents as Repurchases of common STOCK 36 Proceeds from issuance of term debt, net 37 Repayments of term debt 38 Proceeds from Repayments of commercial paper, net (10,125) (2,642) (3,903) 18,042) 12,326 1,676 5.799 104,038 6,917 (127) 1,553 19.588) 14,062) 2,081 8,916 80,674 7,923) (625) 14,700) 69,391 (109,558) 59,023 47.450 [11,085) (331 (131) 387 (608) (14,545) (114,938) 69,918 50,473 17,309) (1,524) (2101 92 (792) 14,289) 29,630) 40,102 156,988 (10,495) (524) (1,001) 1,634 11,078) 45,896 3.105 16,556) 114 4671 085.973) 20,393 8.750) 1,022 (129) 193,3531 5,8601 35.929 880 (3.634) (14,0011 172.358 26,091 (22,629 9631 (126) (86,8201 110,435) 39.789 781 12,817) (134,119) (66,897 5,963 8.8051 5.9771 (105) 190,975) 24,311 50,224 39 Other 40 Cash used in financing activities 43 Increase/Decrease in cash, cash equivalents and restricted cash 42 Casaish equivalents and restricted cash, ending balances 43 Supplemental cash flow disdosure! 44 Cash paid for income taxes, net 45 Cash pald for interest 46 47 25,385 $ 2,637 9,503 $ 3.002 15.263 $3,423 11 Paste = F5 x fx G D B Sep 25, 2021 Sep 26, 2020 $ 34,940 27,699 26,278 6,580 25,228 14,111 134,836 $ 38,016 52,927 16,120 4,061 21,325 11,264 143,713 127,877 39,440 48,849 216,166 51,002 100,887 36,766 42,522 180,175 323,888 1 CONSOLIDATED BALANCE SHEETS- USD ($) $ In Millions 2 Current assets: 3 Cash and cash equivalents 4 Marketable securities 5 Accounts receivable, net 6 Inventories 7 Vendor non-traderecelvables B other current assets 9 Total current assets 10 Non-current assets 11 Marketable securities 12 Property, plant and equipment, net 13 Other non-current assets 14 Total non-current assets 15 Total assets 16 Current liabilities 17 Accounts payable 18 Other current liabilities 19 Deferred revenue 20 Commercial paper 21 Term debt 22 Total current liabilities 23 Non-current liabilities 24 Term debt 25 Other non-current liabilities 26 Total non-current liabilities 27 Total liabilities 28 Commitments and contingencies 29 Shareholders' equity Common stock and additional paid in capital, 50.00001 par value 50,400,000 shares authorized 30 16,426,786 and 16,976,763 shares issued and outstanding respectively 31 Retained earnings 32 Accumulated other comprehensive income/loss) 33 Total shareholders' equity 34 Total liabilities and shareholders' equity 25 Cover Page Sheet1 CONSOLIDATED STATEMENTS OF OPER 54,763 47,493 7,612 6,000 9,613 125,481 42,296 42,684 6,643 4,995 8,773 105,392 109,106 53,325 162,431 287,912 98,667 54490 153,157 2511,549 57,365 50,779 5,562 163 63,090 $351,002 14,966 (406) 65,339 $323,888 CONS CONSOLIDATED STATEMENTS OF COMP Raart A B D NIN CONSOLIDATED STATEMENTS OF OPERATIONS- USD ($) shares in Thousands, $ in Millions 12 Months Ended Sep. 25, 2021 Sep. 26, 2020 S 365,817 $ 274,515 212,981 169,559 152,836 104,956 Sep. 28, 2019 $ 260,174 161,782 98,392 21,914 21,973 43,887 108,949 258 18,752 19,916 38,668 66,288 803 67,091 9,680 $ 57,411 16,217 18,245 34,462 63,930 1,807 65,737 10,481 $ 55,256 109,207 14,527 594,680 $5.67 $5.61 $3.31 $ 3.28 $2.99 $2.97 3 Netales 4 Cost of sales 5 Gross margin 6 Operating expenses 7 Research and development 8 Selling general and administrative 9 Total operating expenses 10 Operating income 11 Other income/expense), net 12 Income before provision for Income taxes 13 Provision for Income taxes 14 Net Income 15 Earnings per share: 16 Basic in dollars per sharel 17 Diluted (in dollars per share) 18 Shares used in computing earnings per share! 19 Basic in shares) 20 Diluted in shares) 21 Products 22 Net sales 23 Cost of sales 24 Services 25 Net sales 26 Cost of sales 27 28 29 30 31 32 33 34 35 36 16,701,272 16,864,919 17,352,119 17,528,214 18,471,336 18,595,651 $ 297,392 192,266 $ 220,747 151,286 S213,883 144,996 68,425 $ 20,715 53,768 $ 18,273 46,291 $ 16,786 Cover Page Sheet1 CONSOLIDATED STATEMENTS OF OPER CONSOLIDATED STATEMENTS OF COMP Ready CONSC 12 Months Ended Sep. 26, 2020 Sep. 25, 2021 Sep. 28, 2019 $ 94,680 $ 57,411 $ 55,256 501 88 (408) 32 79 (661) 1,003 (1,264) 23 1,035 (1,185) 1 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME- USD ($) $ in Millions 2 3 Statement of Comprehensive Income (Abstract] 4 Net Income 5 Other comprehensive Income/loss): 6 Change in foreign currency translation, net of tax 7 Change in unrealized galns/losses on derivative Instruments, net of tax 8 Change in fair value of derivative Instruments 9 Change in fair value of derivative instruments 10 Adjustment for net (gains/losses realized and included in net income 11 Adjustment for net(gainslosses realized and included in net income 12 Total change in unrealized gains/losses on derivative Instruments 13 Total change in unrealized gains/losses on derivative Instruments 14 Change in unrealized galns/losses on marketable debt securities, net of taxi 15 Change in fair value of marketable debt securities 16 Adjustment for net (gains/losses realized and included in net income 17 Total change in unrealized gains/losses on marketable debt securities 18 Total other comprehensive income/loss) 19 Total comprehensive income 20 21 22 23 24 25 26 (638) (694) (273) (967) 569 $ 95,249 1,202 (63) 1,139 42 $ 57,453 3,802 25 3,827 2,781 $ 58,037 12 Months Ended Sep. 26, 2020 Sep 25, 2021 Sep. 24, 2019 $ 39,789 $50,224 $ 25,913 94.680 57,411 55,256 11,284 7,906 14,774) (147) 11,056 6,829 (215) (97) 12,547 6,068 (340) 1652) 245 (289) 2,931 1 CONSOLIDATED STATEMENTS OF CASH FLOWS - USD (S) S In Mililom 2 3 Statement of Cash Flows (Altract] 4 Cash, cash equivalents and restricted cash, beginning balances 5 Querating activities 6 Net Income 7 Adjustments to recondile net Income to cash generated by operating activities 8 Depreciation and amortization 9 Share-based compensation expense 10 Deferred Income tax benefit 11 Other 12 Changes in operating assets and liabilities: 13 Accounts receivable, net 14 Inventories 15 Vendor non trade receivables 16 Other current and noncurrent assets 17 Accounts payable 18 Deferred revenue 19 Other current and non current liabilities 20 Cash generated by operating activities 21 Investing activities 22 Purchases of marketable securities 23 Proceeds from maturities of marketable securities 24 Proceeds from sales of marketable securities 2 Payments for acquisition of property, plant and equipment 26 Payments made in connection with business acquisitions, net 27. Purchases of non-marketable securities 26 Proceeds from non marketable securities 29 Other 30 Cash generated by used in investing activities 31 Finanding activities: 12 Proceeds from issuance of common stock Payments for taxes related to net share settlement of equity awards 14 Payments for dividends and dividend equivalents as Repurchases of common STOCK 36 Proceeds from issuance of term debt, net 37 Repayments of term debt 38 Proceeds from Repayments of commercial paper, net (10,125) (2,642) (3,903) 18,042) 12,326 1,676 5.799 104,038 6,917 (127) 1,553 19.588) 14,062) 2,081 8,916 80,674 7,923) (625) 14,700) 69,391 (109,558) 59,023 47.450 [11,085) (331 (131) 387 (608) (14,545) (114,938) 69,918 50,473 17,309) (1,524) (2101 92 (792) 14,289) 29,630) 40,102 156,988 (10,495) (524) (1,001) 1,634 11,078) 45,896 3.105 16,556) 114 4671 085.973) 20,393 8.750) 1,022 (129) 193,3531 5,8601 35.929 880 (3.634) (14,0011 172.358 26,091 (22,629 9631 (126) (86,8201 110,435) 39.789 781 12,817) (134,119) (66,897 5,963 8.8051 5.9771 (105) 190,975) 24,311 50,224 39 Other 40 Cash used in financing activities 43 Increase/Decrease in cash, cash equivalents and restricted cash 42 Casaish equivalents and restricted cash, ending balances 43 Supplemental cash flow disdosure! 44 Cash paid for income taxes, net 45 Cash pald for interest 46 47 25,385 $ 2,637 9,503 $ 3.002 15.263 $3,423

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started