Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please find the Net Present Value (@ 10%) the IRR the MIRR and the simple pay back. You must analyze a potential new product--a caulking

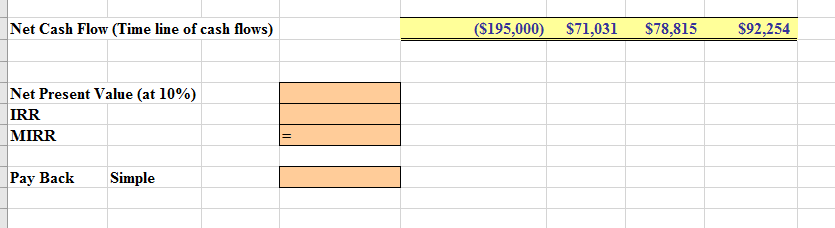

Please find the Net Present Value (@ 10%) the IRR the MIRR and the simple pay back.

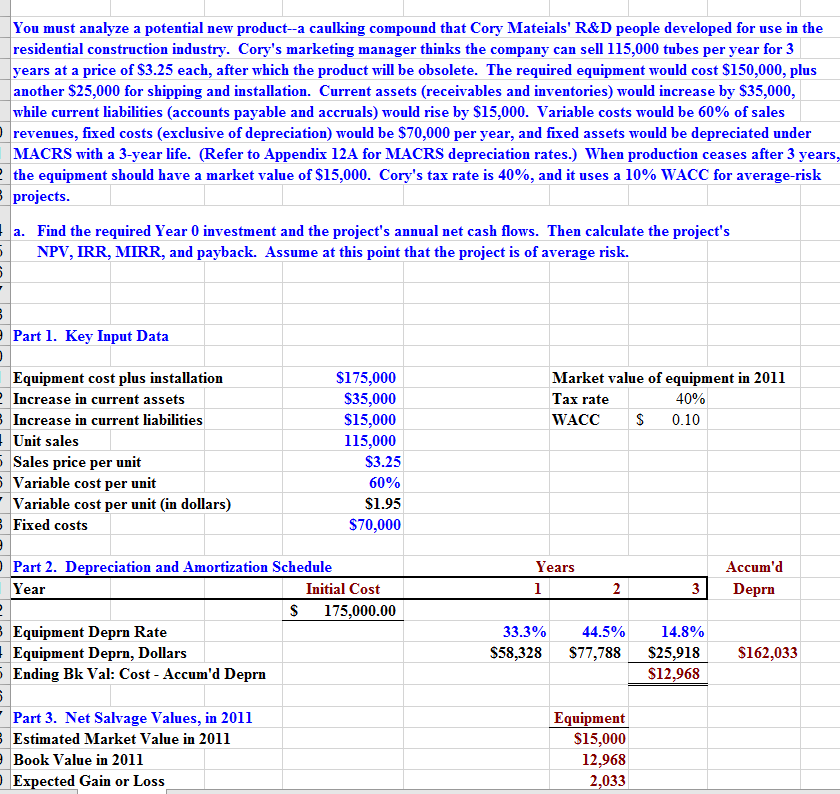

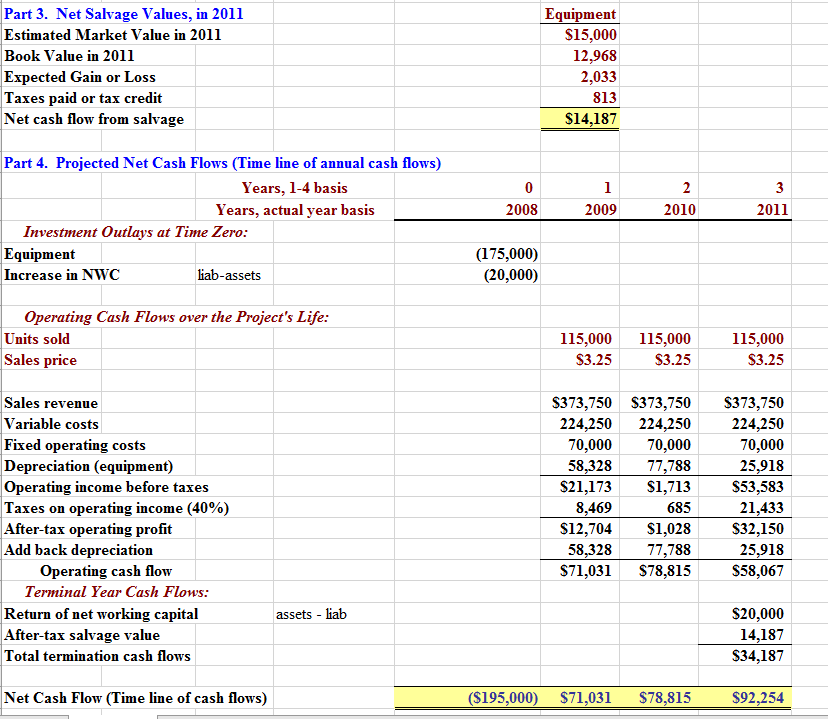

You must analyze a potential new product--a caulking compound that Cory Mateials' R\&D people developed for use in the residential construction industry. Cory's marketing manager thinks the company can sell 115,000 tubes per year for 3 years at a price of $3.25 each, after which the product will be obsolete. The required equipment would cost $150,000, plus another $25,000 for shipping and installation. Current assets (receivables and inventories) would increase by $35,000, while current liabilities (accounts payable and accruals) would rise by $15,000. Variable costs would be 60% of sales revenues, fixed costs (exclusive of depreciation) would be $70,000 per year, and fixed assets would be depreciated under MACRS with a 3-year life. (Refer to Appendix 12A for MACRS depreciation rates.) When production ceases after 3 years, the equipment should have a market value of $15,000. Cory's tax rate is 40%, and it uses a 10% WACC for average-risk projects. a. Find the required Year 0 investment and the project's annual net cash flows. Then calculate the project's NPV, IRR, MIRR, and payback. Assume at this point that the project is of average risk. Part 1. Key Input Data \begin{tabular}{|l|r|r|r|} \hline Equipment cost plus installation & $175,000 & \multicolumn{2}{|c|}{ Market value of equipment in 2011 } \\ \hline Increase in current assets & $35,000 & Tax rate & 40% \\ \hline Increase in current liabilities & $15,000 & WACC & $0.10 \\ \hline Unit sales & 115,000 & & \\ \hline Sales price per unit & $3.25 & & \\ \hline Variable cost per unit & 60% & & \\ \hline Variable cost per unit (in dollars) & $1.95 & & \\ \hline Fixed costs & $70,000 & & \\ \hline \end{tabular} Part 3. Net Salvage Values, in 2011 Estimated Market Value in 2011 Book Value in 2011 Expected Gain or Loss \begin{tabular}{|r|} \hline Equipment \\ \hline$15,000 \\ \hline 12,968 \\ \hline 2,033 \end{tabular} Part 3. Net Salvage Values, in 2011 Estimated Market Value in 2011 Book Value in 2011 Expected Gain or Loss Taxes paid or tax credit Net cash flow from salvage Equipment$15,00012,9682,033813$14,187 Part 4. Projected Net Cash Flows (Time line of annual cash flows) Investment Outlays at Time Zero: \begin{tabular}{|l|r|r|} \hline Equipment & & (175,000) \\ \hline Increase in NWC & liab-assets & (20,000) \\ \hline \end{tabular} Operating Cash Flows over the Project's Life: Units sold Sales price \begin{tabular}{|r|r|r|} \hline 115,000 & 115,000 & 115,000 \\ \hline$3.25 & $3.25 & $3.25 \\ \hline \end{tabular} Sales revenue Variable costs Fixed operating costs Depreciation (equipment) Operating income before taxes Taxes on operating income (40%) After-tax operating profit Add back depreciation Operating cash flow \begin{tabular}{|r|r|r|} \hline$373,750 & $373,750 & $373,750 \\ \hline 224,250 & 224,250 & 224,250 \\ \hline 70,000 & 70,000 & 70,000 \\ \hline 58,328 & 77,788 & 25,918 \\ \hline$21,173 & $1,713 & $53,583 \\ \hline 8,469 & 685 & 21,433 \\ \hline$12,704 & $1,028 & $32,150 \\ \hline 58,328 & 77,788 & 25,918 \\ \hline$71,031 & $78,815 & $58,067 \\ \hline \end{tabular} Terminal Year Cash Flows: Return of net working capital assets - liab After-tax salvage value Total termination cash flows Net Cash Flow (Time line of cash flows) \begin{tabular}{rrrr} \hline($195,000) & $71,031 & $78,815 & $92,254 \\ \hline \hline \end{tabular} Net Cash Flow (Time line of cash flows) \begin{tabular}{llll} ($195,000) & $71,031 & $78,815 & $92,254 \\ \hline \end{tabular} Net Present Value (at 10% ) IRR MIRR \begin{tabular}{|l|} \hline \\ \hline \\ \hline \end{tabular} Pay Back Simple You must analyze a potential new product--a caulking compound that Cory Mateials' R\&D people developed for use in the residential construction industry. Cory's marketing manager thinks the company can sell 115,000 tubes per year for 3 years at a price of $3.25 each, after which the product will be obsolete. The required equipment would cost $150,000, plus another $25,000 for shipping and installation. Current assets (receivables and inventories) would increase by $35,000, while current liabilities (accounts payable and accruals) would rise by $15,000. Variable costs would be 60% of sales revenues, fixed costs (exclusive of depreciation) would be $70,000 per year, and fixed assets would be depreciated under MACRS with a 3-year life. (Refer to Appendix 12A for MACRS depreciation rates.) When production ceases after 3 years, the equipment should have a market value of $15,000. Cory's tax rate is 40%, and it uses a 10% WACC for average-risk projects. a. Find the required Year 0 investment and the project's annual net cash flows. Then calculate the project's NPV, IRR, MIRR, and payback. Assume at this point that the project is of average risk. Part 1. Key Input Data \begin{tabular}{|l|r|r|r|} \hline Equipment cost plus installation & $175,000 & \multicolumn{2}{|c|}{ Market value of equipment in 2011 } \\ \hline Increase in current assets & $35,000 & Tax rate & 40% \\ \hline Increase in current liabilities & $15,000 & WACC & $0.10 \\ \hline Unit sales & 115,000 & & \\ \hline Sales price per unit & $3.25 & & \\ \hline Variable cost per unit & 60% & & \\ \hline Variable cost per unit (in dollars) & $1.95 & & \\ \hline Fixed costs & $70,000 & & \\ \hline \end{tabular} Part 3. Net Salvage Values, in 2011 Estimated Market Value in 2011 Book Value in 2011 Expected Gain or Loss \begin{tabular}{|r|} \hline Equipment \\ \hline$15,000 \\ \hline 12,968 \\ \hline 2,033 \end{tabular} Part 3. Net Salvage Values, in 2011 Estimated Market Value in 2011 Book Value in 2011 Expected Gain or Loss Taxes paid or tax credit Net cash flow from salvage Equipment$15,00012,9682,033813$14,187 Part 4. Projected Net Cash Flows (Time line of annual cash flows) Investment Outlays at Time Zero: \begin{tabular}{|l|r|r|} \hline Equipment & & (175,000) \\ \hline Increase in NWC & liab-assets & (20,000) \\ \hline \end{tabular} Operating Cash Flows over the Project's Life: Units sold Sales price \begin{tabular}{|r|r|r|} \hline 115,000 & 115,000 & 115,000 \\ \hline$3.25 & $3.25 & $3.25 \\ \hline \end{tabular} Sales revenue Variable costs Fixed operating costs Depreciation (equipment) Operating income before taxes Taxes on operating income (40%) After-tax operating profit Add back depreciation Operating cash flow \begin{tabular}{|r|r|r|} \hline$373,750 & $373,750 & $373,750 \\ \hline 224,250 & 224,250 & 224,250 \\ \hline 70,000 & 70,000 & 70,000 \\ \hline 58,328 & 77,788 & 25,918 \\ \hline$21,173 & $1,713 & $53,583 \\ \hline 8,469 & 685 & 21,433 \\ \hline$12,704 & $1,028 & $32,150 \\ \hline 58,328 & 77,788 & 25,918 \\ \hline$71,031 & $78,815 & $58,067 \\ \hline \end{tabular} Terminal Year Cash Flows: Return of net working capital assets - liab After-tax salvage value Total termination cash flows Net Cash Flow (Time line of cash flows) \begin{tabular}{rrrr} \hline($195,000) & $71,031 & $78,815 & $92,254 \\ \hline \hline \end{tabular} Net Cash Flow (Time line of cash flows) \begin{tabular}{llll} ($195,000) & $71,031 & $78,815 & $92,254 \\ \hline \end{tabular} Net Present Value (at 10% ) IRR MIRR \begin{tabular}{|l|} \hline \\ \hline \\ \hline \end{tabular} Pay Back SimpleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started