Answered step by step

Verified Expert Solution

Question

1 Approved Answer

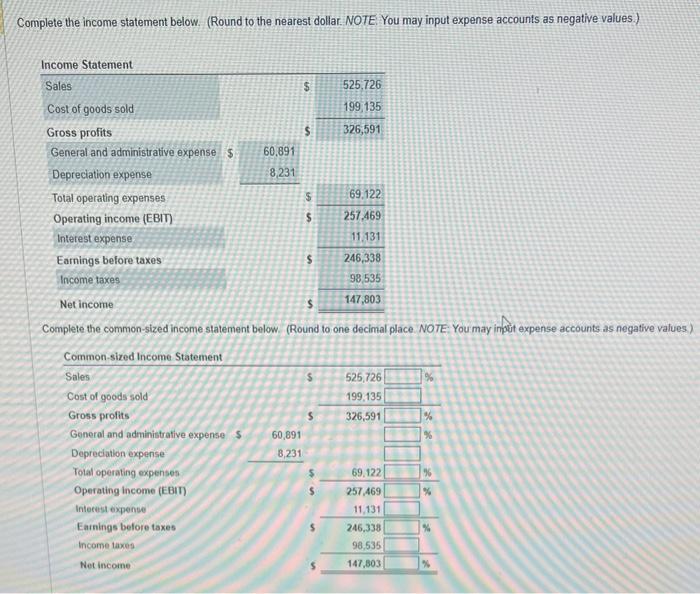

Complete the income statement below. (Round to the nearest dollar. NOTE: You may input expense accounts as negative values.) Income Statement Sales Cost of

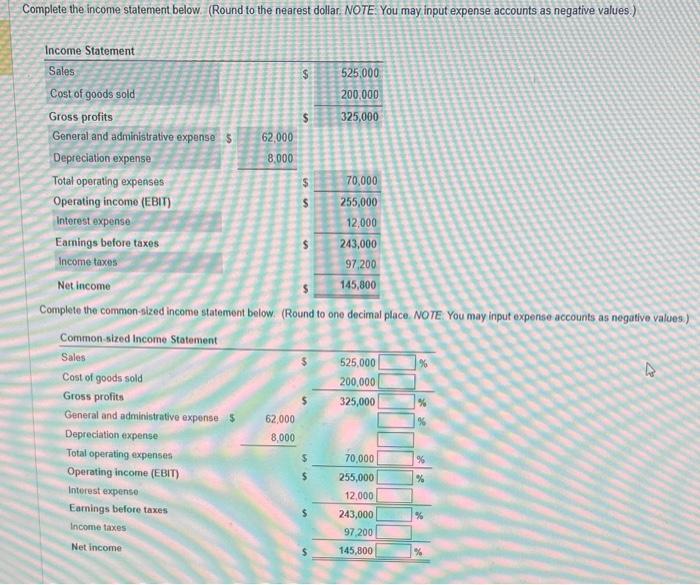

Complete the income statement below. (Round to the nearest dollar. NOTE: You may input expense accounts as negative values.) Income Statement Sales Cost of goods sold Gross profits General and administrative expense $ Depreciation expense Total operating expenses Operating income (EBIT) Interest expense Earnings before taxes Income taxes 60,891 8,231 Total operating expenses Operating Income (EBIT) Interest expense Earnings before taxes Income taxes Net income 60,891 $ 8,231 $ $ $ $ Net income $ Complete the common-sized income statement below. (Round to one decimal place. NOTE: You may imput expense accounts as negative values) Common-sized Income Statement Sales Cost of goods sold Gross profits General and administrative expense S Depreciation expense $ S 525,726 199,135 326,591 $ 69.122 257.469 11.131 246,338 98,535 147,803 525,726 199.135 326,591 69,122 257,469 11,131 246,338 98,535 147,803 % % % % % Complete the income statement below. (Round to the nearest dollar. NOTE. You may input expense accounts as negative values.) Income Statement Sales Cost of goods sold Gross profits General and administrative expense S Depreciation expense Total operating expenses Operating income (EBIT) Interest expense Earnings before taxes Income taxes 62,000 8,000 Total operating expenses Operating income (EBIT) Interest expense Earnings before taxes Income taxes Net income S 62,000 8,000 $ $ S $ Net income Complete the common-sized income statement below. (Round to one decimal place. NOTE: You may input expense accounts as negative values.) Common-sized Income Statement Sales Cost of goods sold Gross profits General and administrative expense S Depreciation expense $ $ $ 525,000 200,000 325,000 $ 70,000 255,000 12,000 243,000 97,200 145,800 525,000 200,000 325,000 70,000 255,000 12,000 243,000 97,200 145,800 % % % % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Completed Income Statements Income Statement 1 Line Item Amount Sales 525726 Cost of goods sold 199135 Gross profit 326591 General and administrative expense 60891 Depreciation expense 8231 Total oper...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started