Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please find the year 2 data. You have to prepare the cash flow statement. You can do it your way, or you can follow the

Please find the year 2 data.

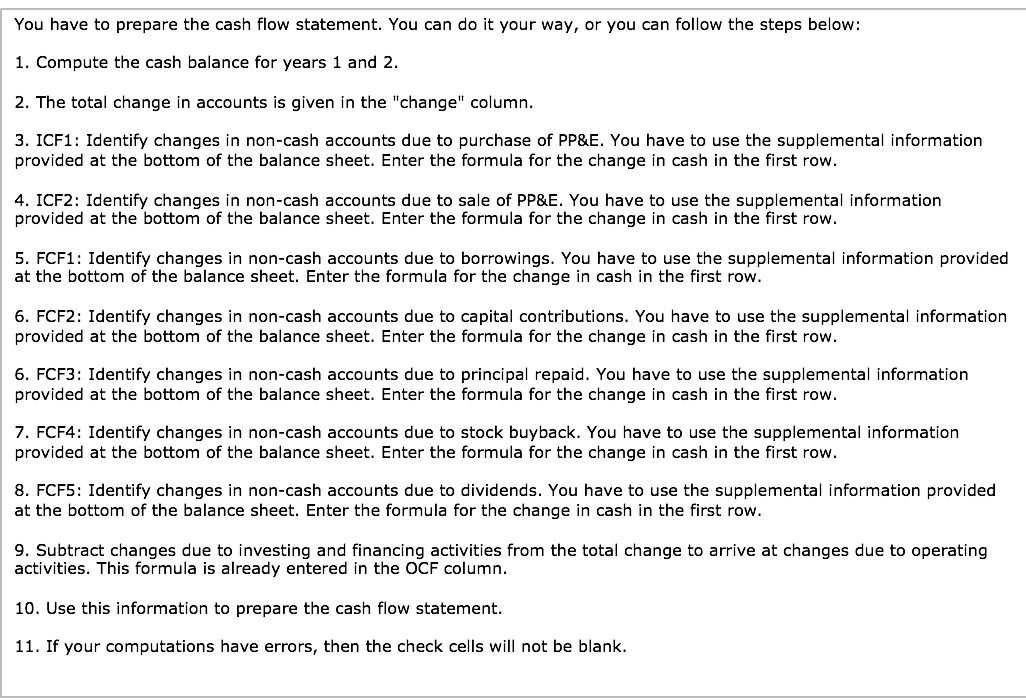

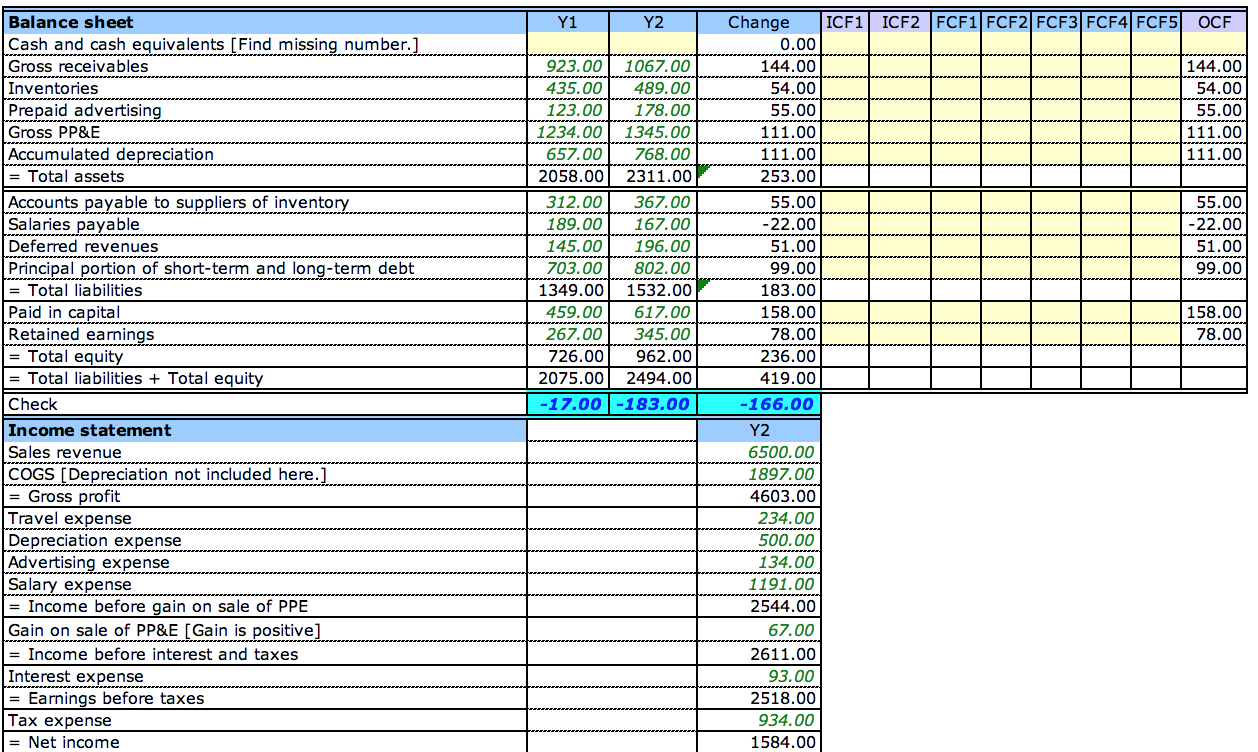

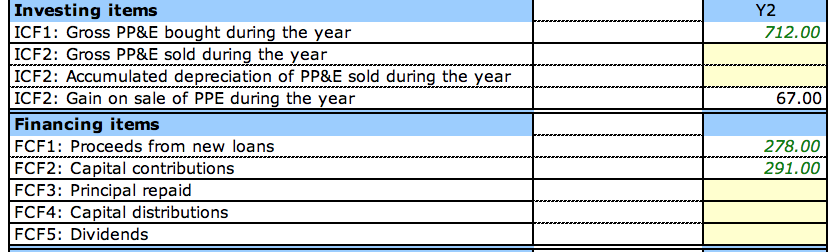

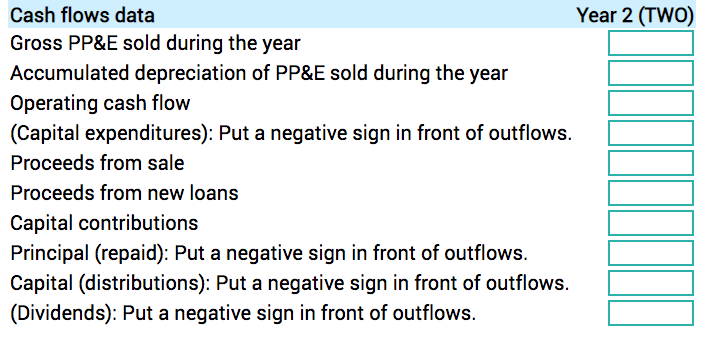

You have to prepare the cash flow statement. You can do it your way, or you can follow the steps below: 1. Compute the cash balance for years 1 and 2. 2. The total change in accounts is given in the "change" column. 3. ICF1: Identify changes in non-cash accounts due to purchase of PP&E. You have to use the supplemental information provided at the bottom of the balance sheet. Enter the formula for the change in cash in the first row. 4. ICF2: Identify changes in non-cash accounts due to sale of PP&E. You have to use the supplemental information provided at the bottom of the balance sheet. Enter the formula for the change in cash in the first row. 5. FCF1: Identify changes in non-cash accounts due to borrowings. You have to use the supplemental information provided at the bottom of the balance sheet. Enter the formula for the change in cash in the first row. 6. FCF2: Identify changes in non-cash accounts due to capital contributions. You have to use the supplemental information provided at the bottom of the balance sheet. Enter the formula for the change in cash in the first row. 6. FCF3: Identify changes in non-cash accounts due to principal repaid. You have to use the supplemental information provided at the bottom of the balance sheet. Enter the formula for the change in cash in the first row. 7. FCF4: Identify changes in non-cash accounts due to stock buyback. You have to use the supplemental information provided at the bottom of the balance sheet. Enter the formula for the change in cash in the first row. 8. FCF5: Identify changes in non-cash accounts due to dividends. You have to use the supplemental information provided at the bottom of the balance sheet. Enter the formula for the change in cash in the first row. 9. Subtract changes due to investing and financing activities from the total change to arrive at changes due to operating activities. This formula is already entered in the OCF column. 10. Use this information to prepare the cash flow statement. 11. If your computations have errors, then the check cells will not be blank. Y1 Y2 OCF RRRRRRR mamman 144.00 54.00 55.00 111.00 111.00 ***** 923.00 1067.00 435.00 489.00 123.00 178.00 1234.00 1345.00 657.00 768.00 2058.00 2311.00 312.00 367.00 189.00 167.00 145.00 196.00 703.00 802.00 1349.00 1532.00 459.00 617.00 267.00 345.00 726.00 962.00 2075.00 2494.00 -17.00-183.00 55.00 -22.00 51.00 99.00 Balance sheet Cash and cash equivalents [Find missing number.] Gross receivables Inventories Prepaid advertising Gross PP&E Accumulated depreciation = Total assets Accounts payable to suppliers of inventory Salaries payable Deferred revenues Principal portion of short-term and long-term debt = Total liabilities Paid in capital Retained earnings = Total equity = Total liabilities + Total equity Check Income statement Sales revenue COGS [Depreciation not included here.] = Gross profit Travel expense Depreciation expense Advertising expense Salary expense = Income before gain on sale of PPE Gain on sale of PP&E [Gain is positive] = Income before interest and taxes Interest expense = Earnings before taxes Tax expense = Net income 158.00 78.00 Change ICF1) ICF2 FCF1 FCF2 FCF3 FCF4 FCF5 0.00 144.00 54.00 55.00 111.00 111.00 253.00 55.00 -22.00 51.00 99.00 183.00 158.00 78.00 236.00 419.00 -166.00 Y2 6500.00 1897.00 4603.00 234.00 500.00 134.00 1191.00 2544.00 67.00 2611.00 93.00 2518.00 934.00 1584.00 Y2 712.00 67.00 Investing items ICF1: Gross PP&E bought during the year ICF2: Gross PP&E sold during the year ICF2: Accumulated depreciation of PP&E sold during the year ICF2: Gain on sale of PPE during the year Financing items FCF1: Proceeds from new loans FCF2: Capital contributions FCF3: Principal repaid FCF4: Capital distributions FCF5: Dividends 278.00 291.00 Cash flows data Year 2 (TWO) Gross PP&E sold during the year Accumulated depreciation of PP&E sold during the year Operating cash flow (Capital expenditures): Put a negative sign in front of outflows. Proceeds from sale Proceeds from new loans Capital contributions Principal (repaid): Put a negative sign in front of outflows. Capital (distributions): Put a negative sign in front of outflows. (Dividends): Put a negative sign in front of outflowsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started