Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please finish all the questions and use excel to do it 2. Sipia's balance sheet for 30 November 2019 follows. Use it and the following

Please finish all the questions and use excel to do it

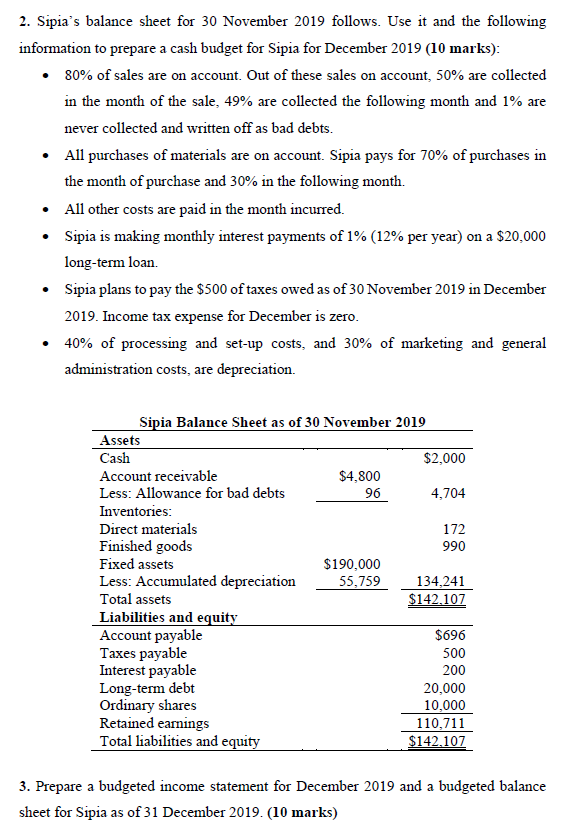

2. Sipia's balance sheet for 30 November 2019 follows. Use it and the following information to prepare a cash budget for Sipia for December 2019 (10 marks): 80% of sales are on account. Out of these sales on account, 50% are collected in the month of the sale, 49% are collected the following month and 1% are never collected and written off as bad debts All purchases of materials are on account. Sipia pays for 70% of purchases in the month of purchase and 30% in the following month All other costs are paid in the month incurred Sipia is making monthly interest payments of 1% (12% per year) on a $20,000 long-term loan Sipia plans to pay the $500 of taxes owed as of 30 November 2019 in December 2019. Income tax expense for December is zero 40% of processing and set-up costs, and 30% of marketing and general administration costs, are depreciation Sipia Balance Sheet as of 30 November 2019 Assets Cash $2,000 Account receivable Less: Allowance for bad debts $4,800 4,704 96 Inventories: Direct materials 172 Finished goods Fixed assets 990 $190,000 55,759 Less: Accumulated depreciation Total assets 134,241 $142,107 Liabilities and equity Account payable Taxes payable Interest payable Long-term debt Ordinary shares Retained eamings Total liabilities and equity $696 500 200 20,000 10,000 110,711 $142.107 3. Prepare a budgeted income statement for December 2019 and a budgeted balance sheet for Sipia as of 31 December 2019. (10 marks) 2. Sipia's balance sheet for 30 November 2019 follows. Use it and the following information to prepare a cash budget for Sipia for December 2019 (10 marks): 80% of sales are on account. Out of these sales on account, 50% are collected in the month of the sale, 49% are collected the following month and 1% are never collected and written off as bad debts All purchases of materials are on account. Sipia pays for 70% of purchases in the month of purchase and 30% in the following month All other costs are paid in the month incurred Sipia is making monthly interest payments of 1% (12% per year) on a $20,000 long-term loan Sipia plans to pay the $500 of taxes owed as of 30 November 2019 in December 2019. Income tax expense for December is zero 40% of processing and set-up costs, and 30% of marketing and general administration costs, are depreciation Sipia Balance Sheet as of 30 November 2019 Assets Cash $2,000 Account receivable Less: Allowance for bad debts $4,800 4,704 96 Inventories: Direct materials 172 Finished goods Fixed assets 990 $190,000 55,759 Less: Accumulated depreciation Total assets 134,241 $142,107 Liabilities and equity Account payable Taxes payable Interest payable Long-term debt Ordinary shares Retained eamings Total liabilities and equity $696 500 200 20,000 10,000 110,711 $142.107 3. Prepare a budgeted income statement for December 2019 and a budgeted balance sheet for Sipia as of 31 December 2019. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started