Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please finish asap. I just need help on these questions. Grawburg Incorporated maintains a call center to take orders, answer questions, and handle complaints. The

please finish asap. I just need help on these questions.

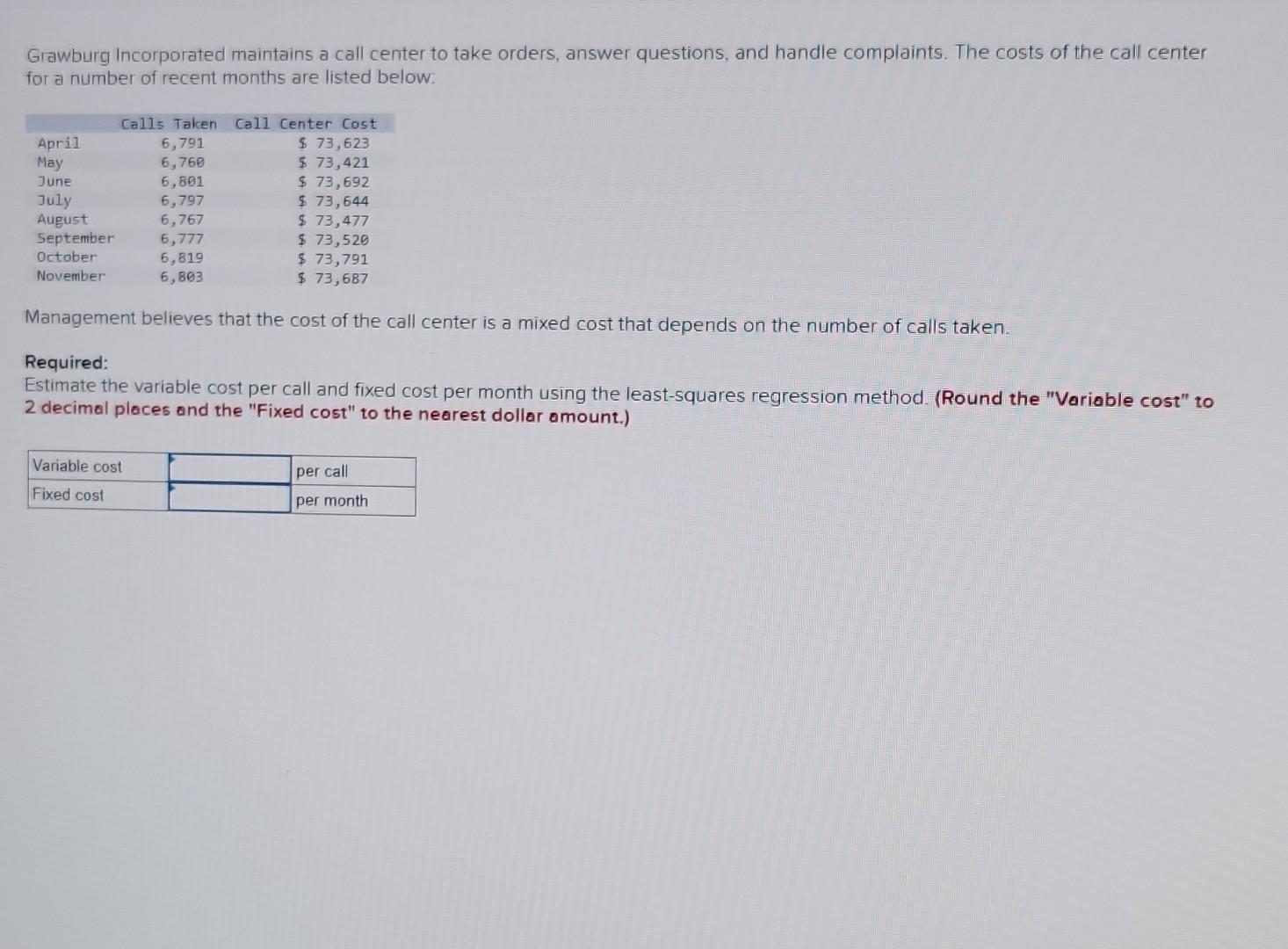

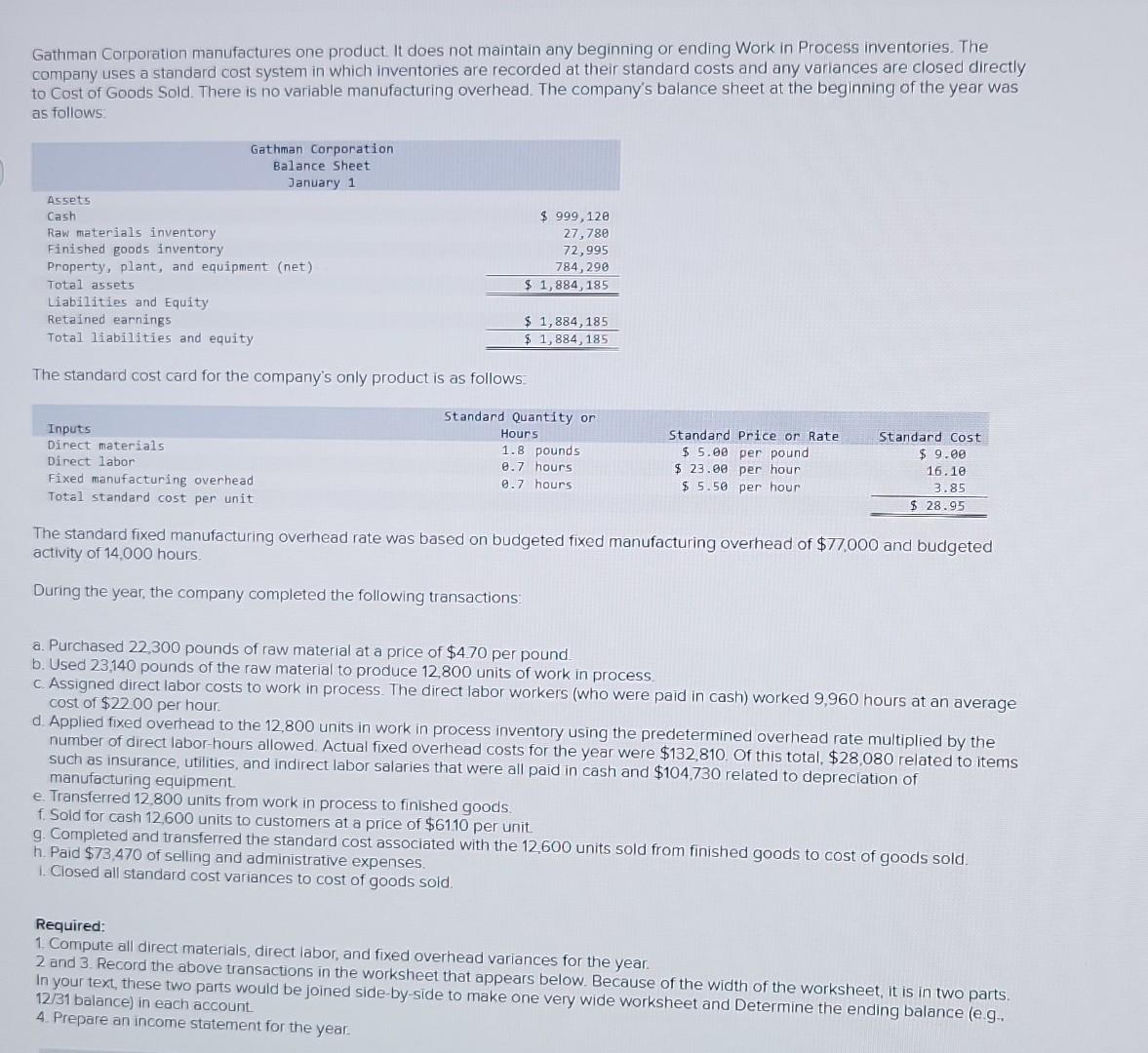

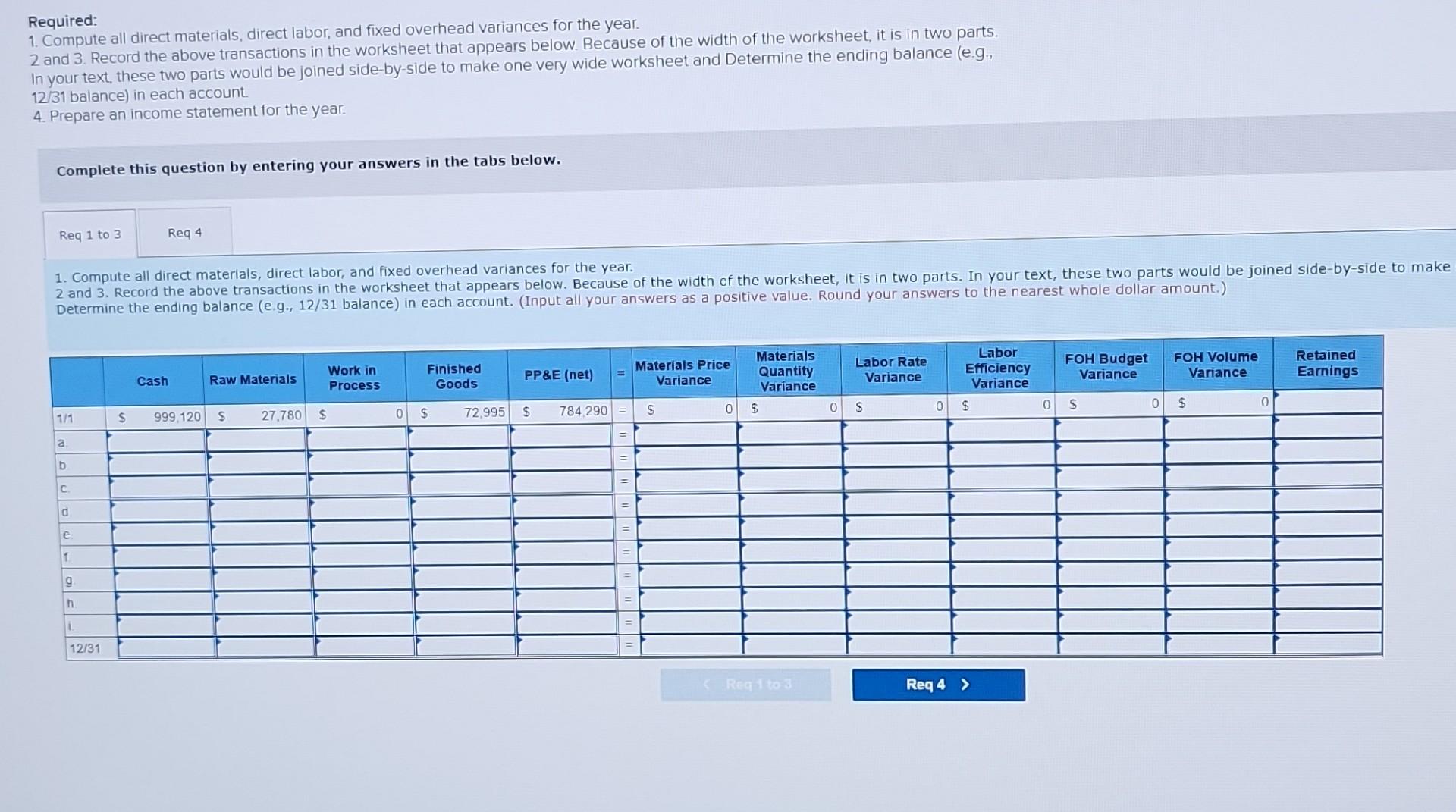

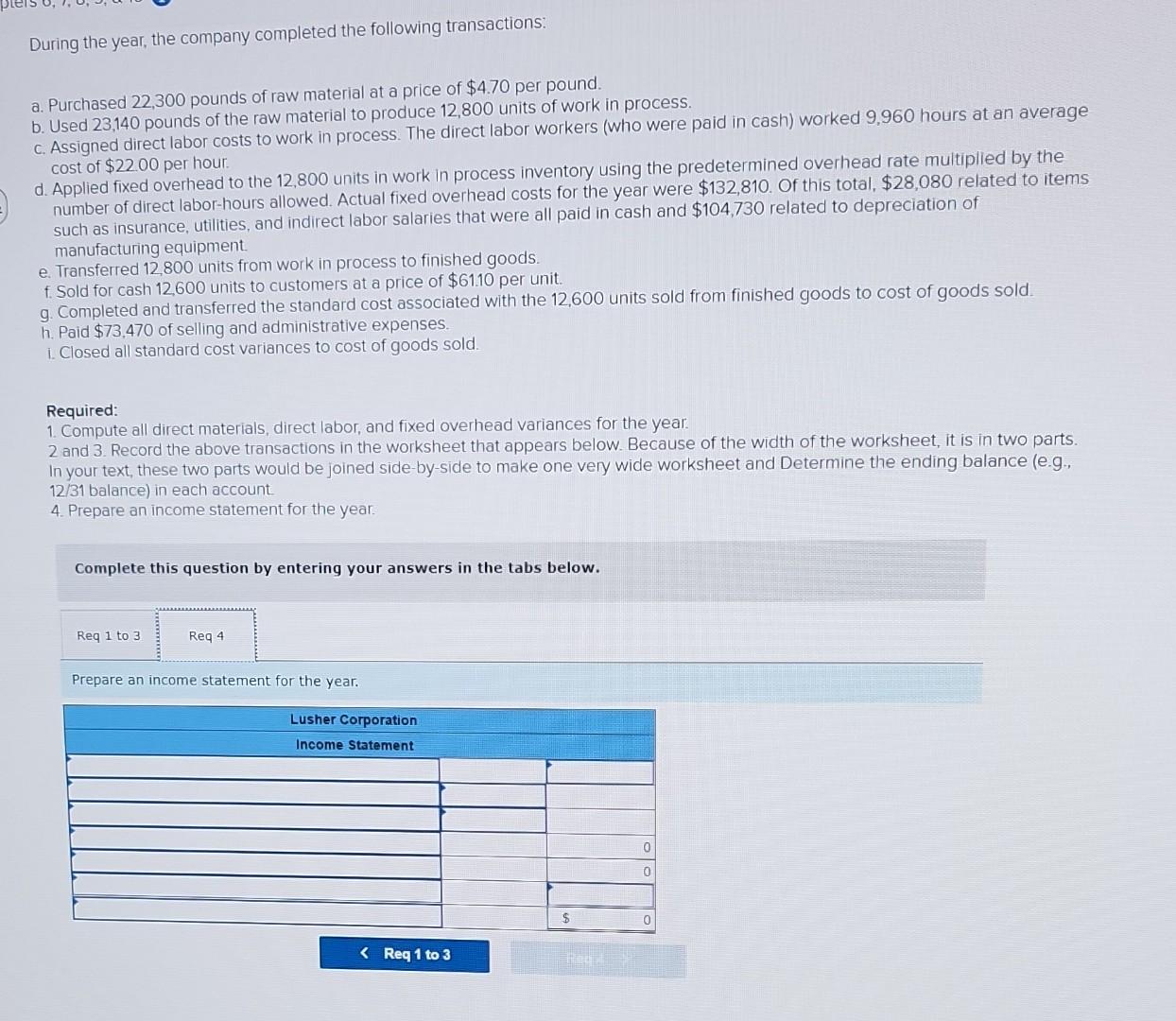

Grawburg Incorporated maintains a call center to take orders, answer questions, and handle complaints. The costs of the call center for a number of recent months are listed below: April May June July August September October November Calls Taken Call Center Cost $ 73,623 $ 73,421 $ 73,692 $ 73,644 $ 73,477 $ 73,520 $ 73,791 $73,687 6,791 6,760 6,801 6,797 6,767 6,777 6,819 6,803 Management believes that the cost of the call center is a mixed cost that depends on the number of calls taken. Required: Estimate the variable cost per call and fixed cost per month using the least-squares regression method. (Round the "Variable cost" to 2 decimal places and the "Fixed cost" to the nearest dollar amount.) Variable cost Fixed cost per call per month Gathman Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The company's balance sheet at the beginning of the year was as follows: Assets Cashi Gathman Corporation Balance Sheet January 1 Raw materials inventory Finished goods inventory. Property, plant, and equipment (net) Total assets Inputs Direct materials Direct labor Liabilities and Equity Retained earnings Total liabilities and equity The standard cost card for the company's only product is as follows: $999,120 27,780 72,995 784,290 $1,884, 185 Fixed manufacturing overhead Total standard cost per unit $ 1,884, 185 $ 1,884, 185 Standard Quantity or Hours 1.8 pounds 8.7 hours 0.7 hours Standard Price or Rate $ 5.00 per pound $ 23.00 per hour $5.50 per hour Standard Cost $9.00 16.10 3.85 $28.95 The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $77,000 and budgeted activity of 14,000 hours. During the year, the company completed the following transactions: a. Purchased 22,300 pounds of raw material at a price of $4.70 per pound. b. Used 23,140 pounds of the raw material to produce 12,800 units of work in process. c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 9,960 hours at an average cost of $22.00 per hour. d. Applied fixed overhead to the 12,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $132,810. Of this total, $28,080 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $104,730 related to depreciation of manufacturing equipment. e. Transferred 12,800 units from work in process to finished goods. f. Sold for cash 12,600 units to customers at a price of $61.10 per unit. g. Completed and transferred the standard cost associated with the 12,600 units sold from finished goods to cost of goods sold. h. Paid $73,470 of selling and administrative expenses. 1. Closed all standard cost variances to cost of goods sold. Required: 1. Compute all direct materials, direct labor, and fixed overhead variances for the year. 2 and 3. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet and Determine the ending balance (e.g... 12/31 balance) in each account. 4. Prepare an income statement for the year. Required: 1. Compute all direct materials, direct labor, and fixed overhead variances for the year. 2 and 3. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet and Determine the ending balance (e.g., 12/31 balance) in each account. 4. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. Req 1 to 3 1. Compute all direct materials, direct labor, and fixed overhead variances for the year. 2 and 3. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make Determine the ending balance (e.g., 12/31 balance) in each account. (Input all your answers as a positive value. Round your answers to the nearest whole dollar amount.) 1/1 a b C d e 1 9 h 1. 12/31 Req 4 $ Cash 999,120 Raw Materials S 27,780 Work in Process $ 0 Finished Goods $ 72,995 PP&E (net) $ 784,290 = = = Materials Price Variance S 0 Materials Quantity Variance $ 0 FOH Budget Variance S 0 FOH Volume Variance $ 0 Retained Earnings During the year, the company completed the following transactions: a. Purchased 22,300 pounds of raw material at a price of $4.70 per pound. b. Used 23,140 pounds of the raw material to produce 12,800 units of work in process. c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 9,960 hours at an average cost of $22.00 per hour. d. Applied fixed overhead to the 12,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $132,810. Of this total, $28,080 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $104,730 related to depreciation of manufacturing equipment. e. Transferred 12,800 units from work in process to finished goods. f. Sold for cash 12,600 units to customers at a price of $61.10 per unit. g. Completed and transferred the standard cost associated with the 12,600 units sold from finished goods to cost of goods sold. h. Paid $73,470 of selling and administrative expenses. 1. Closed all standard cost variances to cost of goods sold. Required: 1. Compute all direct materials, direct labor, and fixed overhead variances for the year. 2 and 3. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet and Determine the ending balance (e.g., 12/31 balance) in each account. 4. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. Req 1 to 3 Req 4 Prepare an income statement for the year. Lusher Corporation Income StatementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started