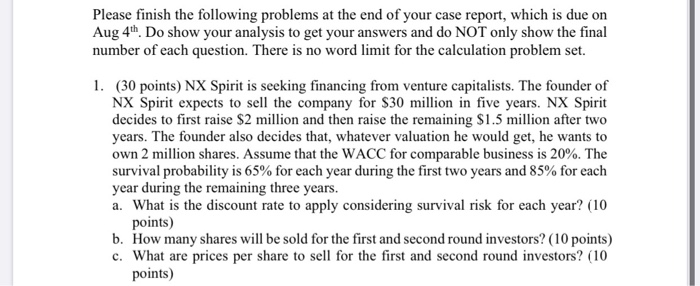

Please finish the following problems at the end of your case report, which is due on Aug 4th. Do show your analysis to get your answers and do NOT only show the final number of each question. There is no word limit for the calculation problem set. 1. (30 points) NX Spirit is seeking financing from venture capitalists. The founder of NX Spirit expects to sell the company for $30 million in five years. NX Spirit decides to first raise $2 million and then raise the remaining $1.5 million after two years. The founder also decides that, whatever valuation he would get, he wants to own 2 million shares. Assume that the WACC for comparable business is 20%. The survival probability is 65% for each year during the first two years and 85% for each year during the remaining three years. a. What is the discount rate to apply considering survival risk for each year? (10 points) b. How many shares will be sold for the first and second round investors? (10 points) c. What are prices per share to sell for the first and second round investors? (10 points) Please finish the following problems at the end of your case report, which is due on Aug 4th. Do show your analysis to get your answers and do NOT only show the final number of each question. There is no word limit for the calculation problem set. 1. (30 points) NX Spirit is seeking financing from venture capitalists. The founder of NX Spirit expects to sell the company for $30 million in five years. NX Spirit decides to first raise $2 million and then raise the remaining $1.5 million after two years. The founder also decides that, whatever valuation he would get, he wants to own 2 million shares. Assume that the WACC for comparable business is 20%. The survival probability is 65% for each year during the first two years and 85% for each year during the remaining three years. a. What is the discount rate to apply considering survival risk for each year? (10 points) b. How many shares will be sold for the first and second round investors? (10 points) c. What are prices per share to sell for the first and second round investors? (10 points)